Summary

- FOMC statement and press conference: On 14 December, the Federal Reserve (Fed) hiked the Fed Funds Rate by 50bp to 4.25-4.50%, a step down after four consecutive 75bp rate hikes. This takes the Fed Funds Rate further into restrictive territory. The slowing in the pace of the rate hike was widely expected. The Fed believes in a soft landing and sees the terminal level for rates at slightly above 5%. Overall, the dot plot and Chair Powell’s press conference were hawkish, with Powell maintaining full commitment to inflation.

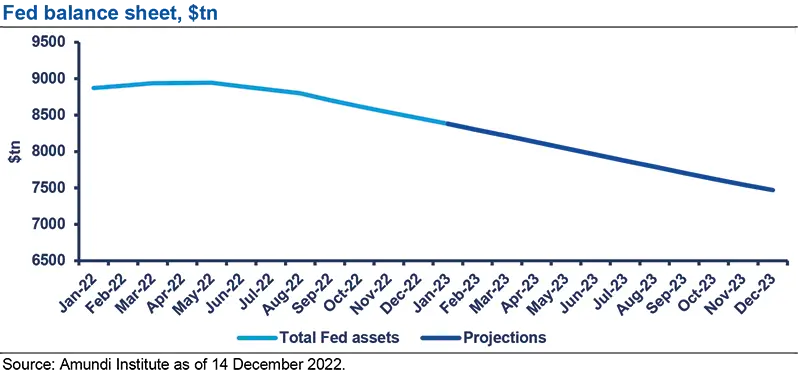

- View on the Fed balance sheet: The reduction in the size of the Fed balance sheet should continue, with shrinking expected to be around $1tn in 2023. A premature end to Quantitative Tightening (QT) could come from (1) a strong recession (not our scenario) or (2) from a strong impairment of market functioning (market liquidity remains a key element to watch), or (3) reserve scarcity (which ended QT last time).

- Market reaction and investment implications: The market reaction was mixed with risk assets selling off due to a hawkish Fed, while the USD and US Treasuries seemed to react more to the possibility of a 25bp rate hike at the February meeting. We remain cautious and anticipate market volatility since the Fed’s task of bringing inflation down to 2% is a long way off and uncertainty over the peak in the Fed Funds Rate remains, as does uncertainty about how long rates will need to remain restrictive. This environment continues to call for an active duration stance, as the journey to price stability is still long.

Key takeaways

- The Fed slowed the pace of rate hikes from 75bp to 50bp taking the Fed Funds Rate to 4.25-4.50%.

- The dot plot lurched even higher: 5.125% in December vs 4.625% in September for year-end 2023; 4.125% vs 3.875% for year-end 2024; and 3.125% vs 2.875% for year-end 2025.

- Summary of Economic Projections (SEP): Sharply lower GDP forecasts, higher unemployment rate and PCE Core projections.

- Press conference: Powell maintains full commitment on inflation.

FOMC statement: No significant changes to the statement

There was little change to the statement. There was a small tweak downgrading the impact of the Russia-Ukraine war on inflation from “creating additional” to “contributing to” – perhaps a sign that the Fed no longer expects that specific geopolitical risk to be adding to inflationary pressures going forward. There was no change to the forward guidance since it had been changed at the November FOMC when the Fed signalled a need to tighten monetary policy that is sufficiently restrictive to hit its 2% inflation target over time.

Summary of Economic Projections and the ‘Dots’: Fed believes in a soft landing

The most striking takeaway from the FOMC is the near uniformity among FOMC members that the terminal level for rates will exceed 5%. It appears the lower than expected October and November CPI inflation data was not enough to change members’ views. The December SEP saw some sharp revisions to GDP, unemployment and Core PCE. Despite the Fed revising GDP forecasts downward significantly in 2023, the Core PCE estimates were revised higher in 2023 and 2024. The unemployment projections for the forecasting period were revised higher, suggesting the committee sees inflation persisting a little higher over the forecast period, necessitating a softer real economy.

- The Fed revised its GDP forecast sharply lower from 1.2% to 0.5% in 2023 and a small downward revision to 1.6% from 1.7% in 2024. There was no change to the 2025 GDP forecast of 1.8%, in line with the Fed’s longer run GDP.

- At the same time, the Fed marked up its forecasts for year-end unemployment rates from 4.4% to 4.6% in 2023, from 4.4% to 4.6% in 2024 and from 4.3% to 4.5% in 2025.

- The Fed’s Core PCE projection was revised up significantly from 3.1% to 3.5% in 2023, from 2.3% to 2.5% in 2024 while the 2025 forecast remains unchanged at 2.1%

Specific to the Fed Fund’s rate ‘Dot Plot’

- Year-end 2023: The median dot rose a little more than expected from 4.625% to 5.125%.

- Year-end 2024: The median dot jumped again from 3.875% to 4.125%.

- Year-end 2025: The median dot increased from 2.875% to 3.125%.

- Long term: The median dot remained unchanged at 2.50%. Note: this is commonly referred to as the “neutral rate”.

Press conference: Powell maintained a hawkish tone

Chair Powell maintained a hawkish tone, warning that, despite the recent reduction in the pace of inflation rise, it will take substantially more evidence to instil confidence that inflation is on a sustained downward path.

Overall, Chair Powell maintained a hawkish tone but there were some comments that can be interpreted on the dovish side, although these were fewer than in his recent press conferences. While he acknowledged the inflation data in October and November was a “welcome reduction” in the monthly pace of price increases, he warned that it will take substantially more evidence to instil confidence that inflation is on a sustained downward path. He stated that the Fed does not expect to cut rates in 2023 and referred to the December SEP. In a direct reference to the recent easing in financial conditions, Chair Powell stated, “financial conditions fluctuate in the short term in response to many factors. But it is important that over time, they reflect the policy restraint that we are putting in place to return inflation to 2%”. During the press conference, he left the door ajar to the prospect of a 25bp rate hike at the February FOMC and stated that it is appropriate to move at a slower pace. Chair Powell also said that the Fed is getting close to a sufficiently restrictive rates level.

View of the Fed’s Quantitative Tightening (QT) path in 2023

The reduction of the size of the Fed balance sheet should continue, with shrinking expected to be around $1tn in 2023.

In June 2022, the Fed began the process of reducing the size of its balance sheet. For the first three months of run-off, from June to August, caps allowed for the run-off were up to $30bn in Treasury securities and up to $17.5bn in MBS and agency debt each month. Starting in September, the caps increased to $60bn and $35bn, respectively. In 2023, the QT programme should continue in its current form. In total, the Fed balance sheet should shrink by around $1tn in 2023 approaching $7.5tn at end-2023.

A premature end to QT could come from three different sources:

- Strong recession. This is not our central scenario as we foresee US growth slowing to 0% in the second half of 2023.

- Strong impairment of market functionality. 2022 has been a challenging year for Treasury market liquidity. Market depth has declined sharply during the last year and has reached levels only seen in 2008-09 during the GFC and in 2020 during the Covid-19 lockdown. QT could mean the functioning of the market remains impaired, but lower volatility in bonds and the implementation of Treasury buybacks, if needed, should alleviate Treasury market dislocations. Indeed, Treasury market liquidity is sensitive to uncertainty, with liquidity deteriorating when volatility rises. Bond volatility has surged in 2022 as a result of strong uncertainty related to the monetary policy path. It should decline in 2023 as the Fed ends its tightening cycle, which should partly alleviate concerns regarding liquidity.

- Reserve scarcity – which ended QT last time. The Fed is now operating in an ample reserve framework which ensures the smooth transmission of its monetary policy, and safe and efficient bank funding and repo markets. Debt ceiling considerations are likely to make the cash balance that the Treasury holds at the Fed very volatile, leading to reserve volatility. If it leads to money market disruptions, it would be a sign that the supply of reserves in the system is approaching scarcity and could halt the balance sheet run-off.

Market reaction and investment implications

We remain cautious and anticipate further market volatility since the Fed’s task of bringing inflation down to 2% is a long way off.

Market reaction was bifurcated with equity markets selling off following a more hawkish dot plot, while US Treasuries and USD reversed an initial selloff on the prospect of a 25bp rate hike at the February FOMC. We remain cautious and anticipate further market volatility since the Fed’s task of bringing inflation down to 2% is a long way off and uncertainty over the peak in the Fed funds rate remains, as does uncertainty around how long rates will need to remain restrictive. Key market takeaways from the FOMC:

- Powell pushed back on the recent easing of financial conditions.

- Powell highlighted the Fed is not expecting rate cuts in 2023, according to the Dec SEP.

- Price stability has a long way to go.

- Therefore, rates are likely to move higher and stay higher for longer.