Summary

A mix of Growth and Value to navigate AI, climate change, geopolitics and deregulation

We see three themes shaping sector returns in the coming decade. Artificial intelligence (AI) will support the Information Technology (IT) sector followed by Healthcare, but it is due to extend to others as well. Regarding climate change and geopolitical dynamics, capital expenditure (Capex) will play a more important role than consumption, benefitting Industrials more than the Consumer Staples and Discretionary sectors. Finally, policies supporting deregulation should improve capital efficiency and shareholder returns, to the benefit of Financials. Sector assessment is also important in assessing regional opportunities, as the sector composition of equity markets differs from the sector composition of the economy.

|

|

| ||

The democratisation of AI and the rotation from ‘hyperscalers’ to ‘enablers’, particularly in the Software sector, is expected to boost global productivity and equity in the long run. Not all 'Magnificent 7’ sectors are at the top of our rankings. While IT remains a strong candidate, it is expensive in the US but supported by climate change initiatives and ESG scores, and is more affordable in EM. It should also deliver better returns than Communication Services and Consumer Discretionary. As AI’s benefits expand, other sectors like Healthcare are poised to benefit. | Energy, Materials and Staples are the most negatively impacted by climate change and ESG considerations. Utilities fare slightly better in this regard, but their overall expectations remain below regional market averages. Industrials are a broad group that includes the Aerospace and Defence sectors benefitting from ongoing geopolitical dynamics. While industrial emissions are high, they can also be part of the solution. Moreover, they should fare better than the Consumer Discretionary, which is also broadly neutral on climate change. Capex will be a stronger theme than consumption. | Policy changes should mostly support global Financial sectors, but in different ways across regions. Deregulation will play a key role in the US, while capital efficiency and the unbundling of cross-shareholding will be the main driver in Japan. By contrast, high shareholder returns should benefit Financials in the Eurozone. Notably, this sector represents another way to play the Capex theme, as these investments will need to be financed. Additionally, the sector should eventually enjoy higher efficiency with the adoption of AI. |

Painting a broad picture of expected returns sector

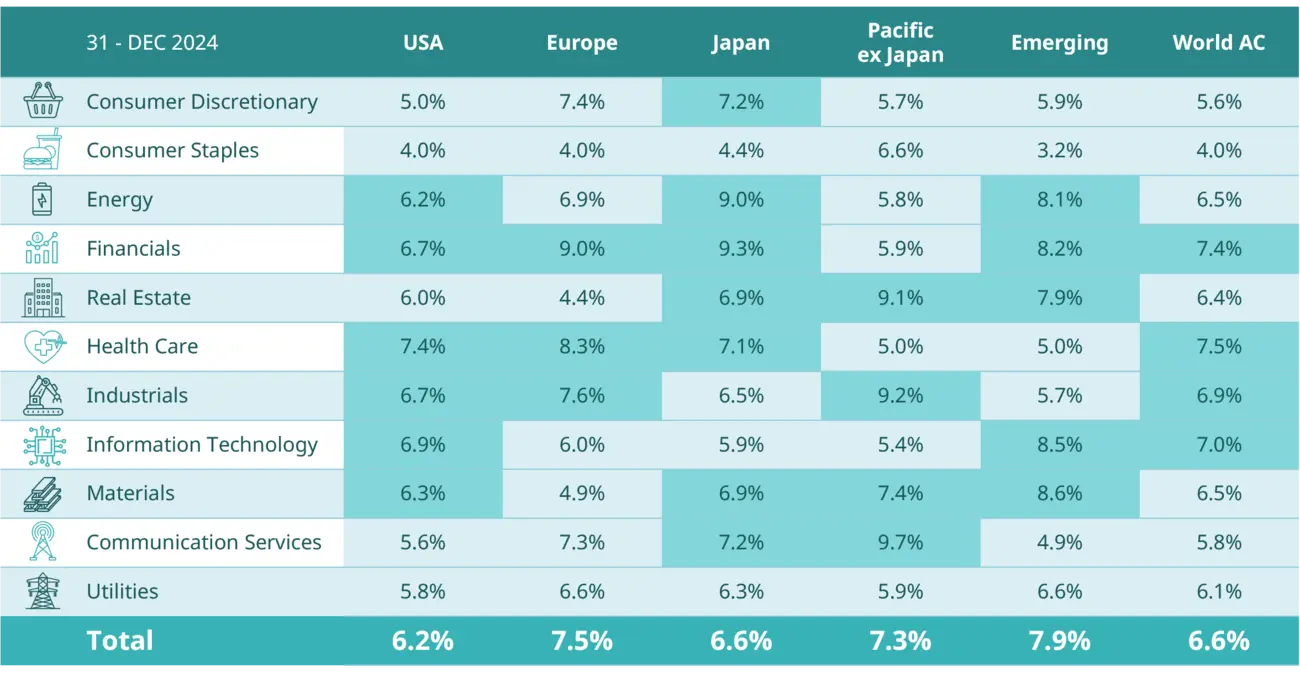

Looking at the top sectors in our ranking of the MSCI All Countries World Index (ACWI), there is a mixture of Value and Growth. Whereas Financials sit in the Value camp, IT is on the Growth side. Industrials and Healthcare vary across regions: they are considered Value in the US and Growth in Europe, for example, according to MSCI. Both the Consumer sectors (Staples and Discretionary) sit at the bottom of the ranking.

Across regions, Financials, Healthcare and Industrials consistently top the rankings. Financials, in particular, are consistently above the market average, except in Pacific ex-Japan, and have some of the highest expected returns in Europe and Japan. Industrials are also well favoured across regions with the exception of emerging markets, whereas IT is only above the market average in the US and EM.

At the bottom of the list, Staples and Utilities are consistently below average everywhere. Consumer Discretionary is only above average in Japan and Communication Services in the Pacific.

We assess sectors’ expected returns on the basis of earnings growth, valuation and dividend yield dynamics, also considering a risk premium linked to climate change, ESG and Net Zero considerations. Across regions, the most highly ranked sectors in our analysis are a mixture of Value and Growth, particularly Financials, Healthcare and Industrials.

Long term expected returns adjusted by flows

| Capital Market Assumptions 2025 Our annual Capital Market Assumptions explore the impacts of global game-changers on the long-term expected returns for more than 40 asset classes. |