Summary

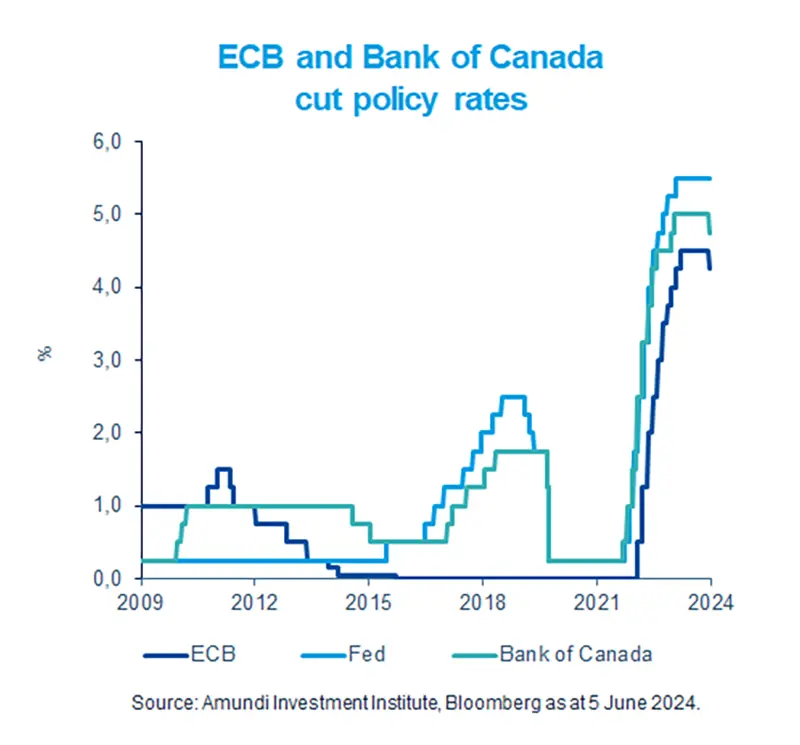

The ECB avoided any surprises for the markets as it reduced policy rates amid decelerating inflation, which could boost appetite for European fixed income.

- As expected, the ECB reduced its policy rates for the first time in the last five years.

- Slowing inflation allowed the central bank to take this step, but the ECB is likely to be vigilant on price pressures.

- Given that the ECB acted before the Fed, this temporary divergence may create opportunities in European bonds.

The ECB cut its policy rates in June for the first time in nearly five years, after a similar move by the Bank of Canada. This was in line with expectations as inflation continues to slow towards the ECB’s target. However, Christine Lagarde refrained from committing to future rate cuts and appeared in no rush. In order to decide on future policy easing, we believe the ECB will continue to monitor the trajectory of services inflation and wage growth in the eurozone.

Importantly, the ECB started its monetary easing before the Fed. We see only a limited potential for this divergence. As US inflation continues to fall and the economy slows, even the Fed could be inclined to reduce rates. This slowing inflation paints a potentially attractive picture for bonds.

Actionable ideas

- European bonds

Quality bonds of companies with strong business models may perform well in an environment of slowing inflation and rate cuts by the ECB.

- European and UK equities

A marginally improving global economic outlook is beneficial for Europe, a region more reliant on international trade. Companies with robust margins and differentiated products etc. are preferred.

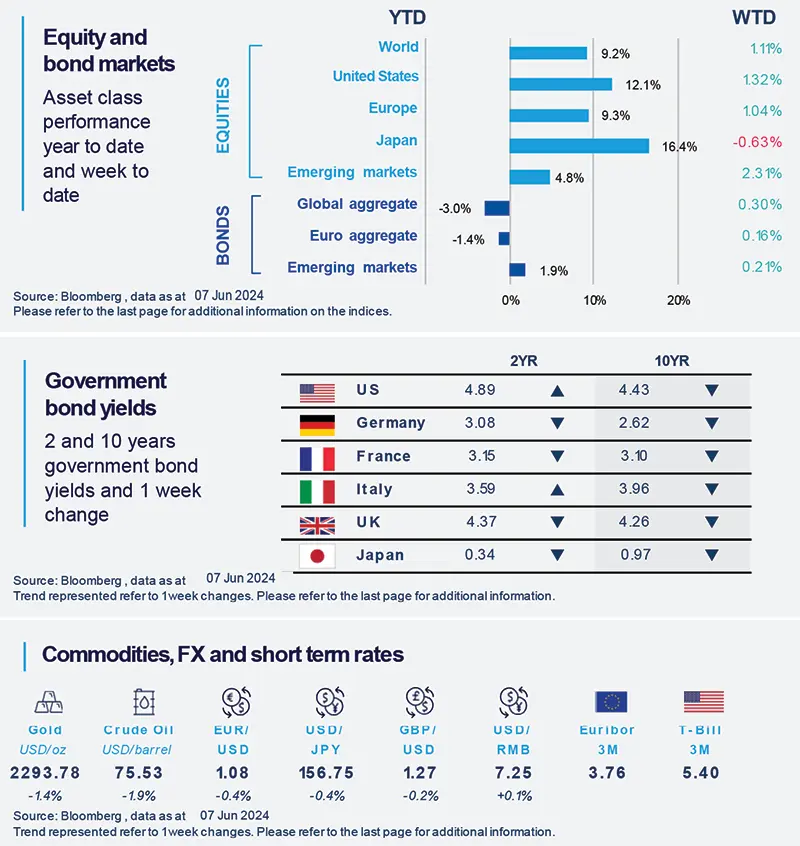

This week at a glance

Long term bond yields declined after subdued US data led the markets to reassess interest rate cuts by the Fed. Stocks were driven up by the optimism around the US tech sector. Oil prices, on the other hand, fell as OPEC and its allies decided to unwind their production cuts in near future.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 7 June 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Institute Macro Focus

Americas

United States trade deficit rose in April.

The trade deficit (excess of imports over exports) reached its widest level in nearly two years in April, driven by a surge in imports and only a mild increase in exports. Imports were boosted by robust domestic demand. However, weak export numbers were a result of subdued global backdrop and a strong dollar, which makes exports expensive. Looking ahead, international trade may continue to weigh on US GDP growth in Q2.

Europe

Latest data shows signs of recovery in Eurozone.

A survey of economic activity in Eurozone showed mild improvement in May. The Eurozone composite PMI reached a 12-month high in May at 52.2. A reading above 50 indicates expansion. But the picture is uneven across sectors and countries. While the services component of the index marginally fell, the manufacturing sub-index rose when compared with April.

Asia

India’s election outcome

On June 4, India announced the outcome of national elections that fell short of exit polls expectations for the incumbent coalition National Democratic Alliance, which is led by the Bharatiya Janta Party (BJP). Yet the BJP secured the backing of its coalition allies, to form a government for the third consecutive time. While we are optimistic on the country’s growth path, we are actively monitoring the progress on ambitious economic reforms and government finances.

Key Dates

|

10 June Japan GDP |

12 June Fed policy; CPI – US, China, India |

14 June Bank of Japan policy, EZ trade balance |