Summary

Setting the scene

The proliferation of crypto-currencies (CCs) and the popularity of these assets among investors has led us to question their nature, function, valuation and potential development. CCs are at the crossroads of technological innovation, finance and monetary policy.

While this innovation promises the development of a more inclusive form of finance, it cannot challenge the monopoly of central banks (CBs) in terms of monetary policy without putting the entire financial system at risk. It is up to regulators to find an appropriate regulatory framework to take advantage of the development of these assets without putting macro-financial stability at risk.

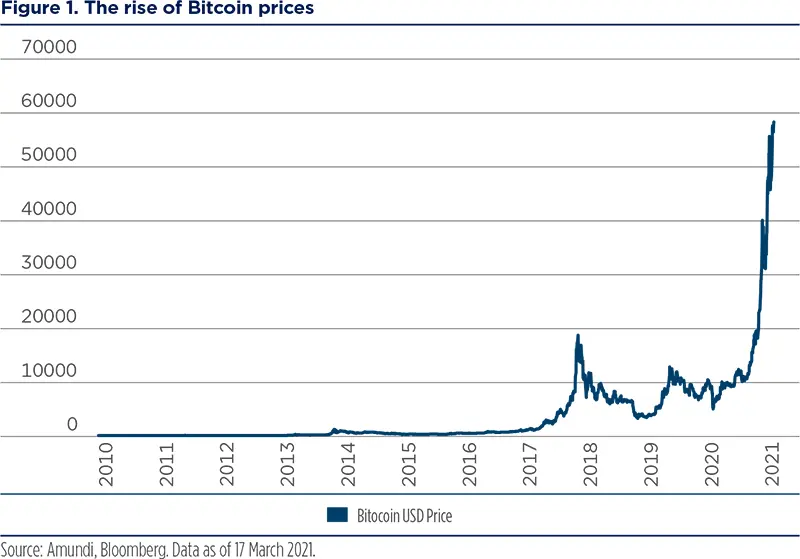

The development of CCs (and all digital financial assets) has been the subject of many reports in recent years. Interest in these assets is not new. While the first CCs were developed after the GFC in 2008, the Covid-19 crisis gave them a spectacular boost (bitcoin saw its value multiply by more than seven times in one year).

This development, most certainly speculative in nature, raises questions about the nature of these assets, their function and their valuation. What are the reasons for this craze? Is it just another form of excess linked to recent financial innovation? Or are we witnessing the emergence of a new paradigm in decentralised finance and a profound break in the transaction systems linked to technological disruption (blockchain)? Can CCs really "compete" with official currencies in their traditional functions? And if so, is this a risk to global financial stability?

There are several distinct issues here: technological disruption and the search for decentralised and inclusive finance (made possible by blockchains); the increasing digitalisation of our economies (with an appetite for a digital currency); and also the search for new safe havens in an environment where public debt tends to be increasingly monetised in the major advanced economies, where inflation expectations are rising and where mistrust of the traditional financial system is taking hold. In the end, the valuation of CCs crystallises all these dimensions without it being possible to distinguish between them.

There is already an abundant amount of literature on CCs. This note does not aim to cover all the debates and controversies, often technical in nature, but to enlighten investors about the issues related to their development, as well as the advantages and disadvantages of owning them.

A brief typology

A semantic problem. From the outset, it should be noted that the usual terminology is a source of confusion: the generic term crypto-currency (CC) maintains the idea that it is a form of money. This is certainly a characteristic that its promoters would like to give it. However, CCs do not possess the three qualities that have characterised money since Aristotle (as a unit of account, a store of value and a medium of exchange): in fact, to date, it is neither a proven store of value, nor a recognised unit of account and even less a universal means of payment. Its volatility is much higher than that of traditional currencies. Its liquidity is not always assured, nor is its convertibility (no CC is legal tender). It would ultimately be more accurate to speak of a crypto-asset.

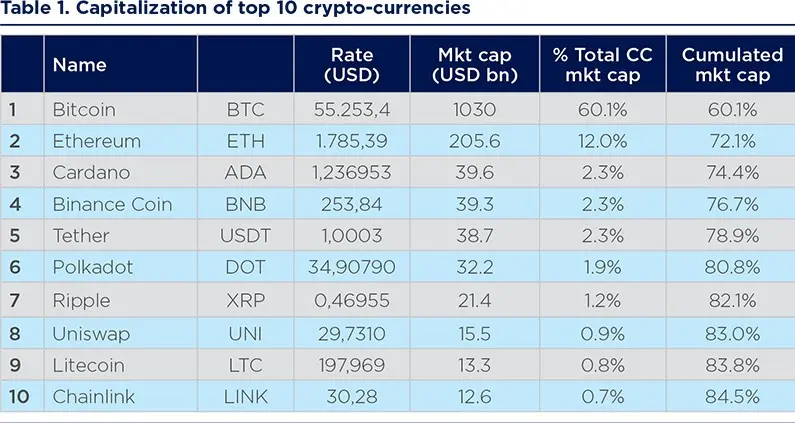

Moreover, behind the term CC lie very different realities. If Bitcoin represents about 60% of the total capitalisation of crypto-currencies (more than USD 1,700 billion in March 2021), the remaining 40% is made up of a very large number of very heterogeneous products.

As of today cryptocurrencies (CCs) cannot be considered a form of money as they are neither a proven store of value, nor a recognised unit of account and even less a universal means of payment.

Source: Amundi Research, https://coinmarketcap.com/all/views/all/

Some of them, direct competitors of Bitcoin, have, like Bitcoin, an "official vocation" to serve as a currency, while serving above all as a store of value: this is notably the case of Litecoin (the 9th largest crypto-currency by capitalisation, at around USD 13 billion).

Other CCs, very numerous, are comparable to High Tech assets, allowing the execution of smart contracts (automatic execution in the blockchains of agreements previously formalised between the members of a network). Their applications are very diverse: the rapidly developing "decentralised finance" market (the lending and borrowing of cryptocurrency, the generation of derivatives similar to those traded on traditional markets, etc.), video games, online betting, as well as uses more in line with the real economy, such as the certification of supply chains or green energy trading. The most important medium in this category is Ethereum, the 2nd largest crypto-currency with a market capitalisation of USD 206 billion.

Finally, a third category of CCs are "stablecoins" (SCs), digital assets that maintain a fixed value relative to traditional currencies.

SCs are widely used for transactions on other CCs or for international transfers. While the largest of these SCs, Tether, has a market capitalisation of only USD 39 billion, it is frequently in first place in terms of daily volumes traded (ahead of Bitcoin).

Most CCs are comparable to High Tech assets, allowing the execution of smart contracts.

In some respects, these SCs are the most direct competitors for official currencies. Their rapid growth is beginning to draw attention to the risks they could pose to the financial system, particularly if one of them suddenly ceases to be able to maintain its fixed value (see Box 1).

BOX 1: A guide to stablecoins (SCs)

- SCs are different from CCs such as bitcoin. While SCs are not new (the most widely traded SC currently dates back to 2014) recent initiatives have attempted to change the paradigm. In particular, Facebook's announcement in June 2019 of its proposed SC, Libra (renamed Diem in January 2021), triggered a coordinated G7 response in 2019. Since then, the G20 and the Financial Stability Board have also undertaken efforts to address potential risks while harnessing the potential of technological innovation.

- SCs are digital units of value that differ from existing forms of money (bank deposits, e-money etc.) and rely on a set of stabilisation tools to minimise fluctuations in their price against a currency or a basket of currencies.

- To maintain a stable price, some SCs commit to holding funds and/or other assets ("collateral") against which the SCs held can be redeemed or exchanged. SC agreements serve multiple functions: from stabilising the value of SCs to transferring value and interacting with users.

- As a crypto asset, SCs do not pose problems for the financial sector and/or central banks' missions.

- However, their development as a means of payment or store of value poses risks to financial stability. The development of SCs may increase the demand for safe assets and may have a negative impact on price formation, collateral valuation, the functioning of money markets and thus affect monetary policy. The intermediation capacity of banks could also be challenged.

- Under these conditions, regulators will not remain inactive. For example, banks may be required to have an appropriate risk management framework to address the risks arising from their potential participation in SC schemes.

- Like all CCs, SCs pose legal, regulatory and supervisory challenges: legal security, money laundering, terrorist financing (and other forms of illicit financing) and cyber security.

- In addition, SCs that become global may pose challenges and risks for monetary policy, financial stability and the international monetary system (substitution of existing currencies).

- The G7 believes that no global SC project (such as libra) should be implemented until the legal, regulatory and supervisory challenges and risks are adequately addressed. These risks are systemic in nature, particularly in countries with underdeveloped financial and payment systems.

Stablecoins are digital units of value that differ from existing forms of money (bank deposits, e-money etc.) and rely on a set of stabilisation tools to minimise fluctuations in their price against a currency or a basket of currencies.

An increasingly diverse investor base

Demand is no longer coming exclusively from retail. More and more companies, institutional investors and investment funds are interested in bitcoin in particular (but not only). The most emblematic example was Tesla's decision to acquire USD 1.5 billion bitcoins in early February. Payment platforms (Paypal) are now also accepting bitcoin as a means of payment.

These developments have naturally led to expectations of a strong increase in demand. Companies, particularly in the technology sector, see CCs as an opportunity to strengthen their position by preparing to accept new digital payment methods. It is estimated that S&P 500 companies have USD 1 trillion in cash (including over USD 200 billion in the tech sector alone). The demand from these players will undoubtedly support the valuation of CCs. But to what extent? Bitcoin has no intrinsic return and there is no natural protection

against capital loss. This naturally raises the question of its fair value.

An asset without intrinsic value?

CCs do not have the usual characteristics of assets. Unlike other assets (stocks, bonds, currencies, real estate, commodities), CCs have no real economic underlying asset. As a result, there is no valuation model. Demand and supply do not depend, most of the time, on trade volumes of goods and services. On the one hand, supply is limited (and not controlled by a central authority) and on the other hand, the determinants of demand can vary over time and between buyers. At best, we can identify different motives for ownership, but we cannot rank them.

It is therefore not possible to estimate the potential demand for these 'assets', unless assumptions are made about the precise role they will play in the future. It is very likely that the demand for CCs will be negatively impacted by the level of regulation1 to which they are subject to. If the equilibrium price is undetermined, it is impossible to anchor investors' ex ante expectations on any metric. Regulation is an exogenous risk factor for the buyer.

Over the recent period, the anticipation of a further rise (driven by new categories of investors) seems to have been the main reason for buying (bitcoin). If this is the case, bitcoin would be the archetype of a "rational bubble". That said, this speculative dimension alone does not rule out the hypothesis that the expectation of a rise is well-founded.

CCs have no real economic underlying asset and therefore there is no valuation model.

Neither "real money" nor "true assets", what are they?

A safe haven?

CCs developed in the wake of the GFC, as CBs resorted to quantitative easing (QE) policies. They are beyond the control of CBs and thus appeal to investors who are concerned about the long-term inflationary consequences of QE policies and rising debt. Distrust of centralised institutions is a powerful engine of development.

It is a medium that can compete with gold in some of its functions. In this instance, the diversification of assets held in gold could give CCs very significant upside potential. For bitcoin, some estimate that its price could double or even triple from current levels (to a target price of between USD 100k and USD 150k).

For investors, gold offers a hedge against extreme risk and inflation. Given its low correlation to other asset classes, holding a portion of assets in gold is generally considered to diversify a portfolio (this portion is estimated between 5 and 15%). Gold has these properties because of its symbolic status acquired over centuries (linked to its rarity). Gold also played a key role in the international monetary system in the 20th century, to the extent that it’s still held in the vaults of central banks.

CCs, on the other hand, have not proven themselves. They soared during the Covid-19 economic crisis but haven’t been through an episode of financial stress. Their correlation with other asset classes is unknown. Giving them the same status as gold, ex ante, when estimating their upside potential is questionable.

However, it cannot be ruled out that CCs will end up playing the role of "digital gold", especially for younger generations. CCs are more divisible and their storage is no riskier. Their volatility is not necessarily an obstacle, as gold itself is more volatile than most major currencies. But this reference to digital gold is, at best, conjecture that needs to be verified and, at worst, an illusion.

CC is a medium that can compete with gold in some of its functions. In this instance, the diversification of assets held in gold could give CCs very significant upside potential.

A vehicle for decentralised finance?

It is clear that blockchains are a major technological innovation that are transforming the supply of financial services and products. Indeed, crypto-assets were originally designed to lower transaction costs and expand access to financial services. The Bank for International Settlements (BIS) estimates that 1.7 billion people worldwide are unbanked or underserved when it comes to financial services.

A fully decentralised and disintermediated CC system could address this by enabling the development of global payment systems that are faster, cheaper and more inclusive than current payment systems.

The advantages put forward by the promoters of CCs are of various kinds: facilitating transactions and asset transfers on a decentralised and secure network, while guaranteeing the confidentiality of transactions; reducing transaction/transfer costs compared to the traditional financial system; allowing free access for anyone with internet access; limiting knowledge of a transaction (or transfer) to the parties involved; giving full ownership of the assets to the owner, guaranteed by a tamper-proof key system of which he is the sole holder; finally, security based on an unbreakable encryption system2 .

A fully decentralised and disintermediated CC system could enable the development of global payment systems that are faster, cheaper and more inclusive than current payment systems.

The nature of the disadvantages can be better understood when the advantages are stated:

- For the authorities, the lack of regulation and anonymity facilitates cybercrime in all its forms (black market, money laundering and tax evasion).

- For users, decentralisation entails new risks: loss of data; inaccessibility of data if a server is physically damaged; being subject to cyber-attacks or permanently disconnected from Internet (a risk in non-democratic countries or countries at war); non-convertibility (absence of an equal exchange rate)3; irreversibility of transactions4; volatility. Not to mention the risk of hacking.

Furthermore, the environmental impact is very negative. The exploitation of CCs is indeed very energy-intensive. It is estimated that mining bitcoins consumes more electricity than the entire Belgian economy. The solution of using low-carbon energy sources, which are sometimes put forward, are still far from being operational. However, less energy-intensive protocols may be found in the future.

But the main obstacle for the authorities is the risk of financial instability. The proliferation of CCs is indeed reminiscent of the "free banking" experience in the US in the 19th century: banking and financial crises were rife for a century until the creation of the Federal Reserve in 1913 (see Box 2).

CBs obviously have no intention of abandoning their role as lender of last resort: history has shown that only they can maintain financial stability and prevent deflationary crises. They will not let "CC means of payment" multiply without supervision.

However, properly regulated crypto-assets could coexist with the digital currencies CBs intend to issue in the coming decade. What remains to be done is to find the right link between these crypto-assets, which support more inclusive decentralised finance, and national CBs, which are the only ones capable of guaranteeing financial stability.

The exploitation of CCs is very energy-intensive. It is estimated that mining bitcoins consumes more electricity than the entire Belgian economy.

Box 2: The proliferation of CCs reminds us of the competition between private currencies in the 19th century in the United States)

- The proliferation of CCs is reminiscent of the free banking experiment in the US (1837-1862). At that time, banks were allowed to issue their own currency, all called "dollars", sometimes (but not always) with a counterpart in gold or silver. The coexistence of several currencies was a source of great financial instability.

- In 1837, there were 712 banks. The life span of these banks was often short. About half of the banks went bankrupt and 30% of them ceased to operate because they could not redeem their notes. The conversion of currencies between them was not assured, which made transactions difficult. Clearing houses were created to remedy this.

- The National Banking Act of 1863 ended the period of free banking, but not financial instability. A system of national banks, which were more regulated, was created. Most of the state banks were converted into national banks (there were over 1,500 by 1865!). To finance the civil war effort, all national banks were then forced to hold Treasury securities as a counterpart to the currency issued. Banks were then required to accept each other's currency at face value, thus eliminating the risk of loss in the event of a bank failure.

- Backing to the federal debt solved the convertibility problems, but not the liquidity issues. The absence of a lender of last resort led to recurrent liquidity crises and bank runs, the most severe of which was the financial panic of 1907. It was not until the creation of the Federal Reserve in 1913 that the financial system was stabilised.

Conclusion: Separating the wheat from the chaff

Promoting faster, more reliable and cheaper payment systems, both nationally and between nations, is a common goal of most governments and central banks. It is clear that blockchains offer an opportunity to improve financial inclusion.

But while CCs have the power to change global finance for the better, their use as a means of payment is potentially destabilising, with systemic risk:

- Because they are likely to challenge the monopoly of the CBs on money production and monetary policy in the medium and long term;

- And because the operational resilience of decentralised systems is still in question.

Total anonymity and legal immunity seem to have been central to the development of these assets, at least initially. G7 regulators are therefore determined to regulate the CC ecosystem. With what impact? It is likely that such regulation will initially lead to an adjustment of their price, possibly brutal (buyers do not seem to be discounting any regulatory risk)5.

But once the regulatory environment is clarified and the main risks are addressed, CCs are likely to flourish again, this time based on the needs of a more inclusive economy and financial system. Against such a backdrop, we believe companies, institutional investors and investment funds would be keen to obtain more digital assets.

Capturing the benefits of innovation while controlling its excesses is the challenge facing regulators/CBs in the 21st century. Only once the regulatory environment has stabilised, and the relationship with CB digital currencies has been clarified, will asset managers be able to recommend digital assets as safe investment vehicles. At the end of the day, investments in CCs may be promising, but they are still speculative in nature.

Definitions

1https://www.esma.europa.eu/press-news/esma-news/esma-sees-high-risk-investors-in-non-regulated-crypto-assets

2At least in the current state of computing knowledge. Quantum computing could change that.

3There is generally no public guarantee. Only the most popular CCs - those with the highest market capitalisation, in terms of dollars – tend to have dedicated online exchanges that allow direct exchange for cash. This is not always the case for the others, which makes them less attractive.

4In the event of an error, the user does not have the option to cancel a transaction (get a refund). However, payment platforms and traditional credit card networks (Visa, MasterCard, PayPal) can resolve disputes that arise in transactions. Their policies are specifically designed to prevent fraud.

5An analogy is that carbon-emitting companies may be subject to rules (or taxes) that reduce their market value.