Summary

bust consumer resilience supports stocks in the short term, but a more complex inflation scenario ahead may bring volatility.

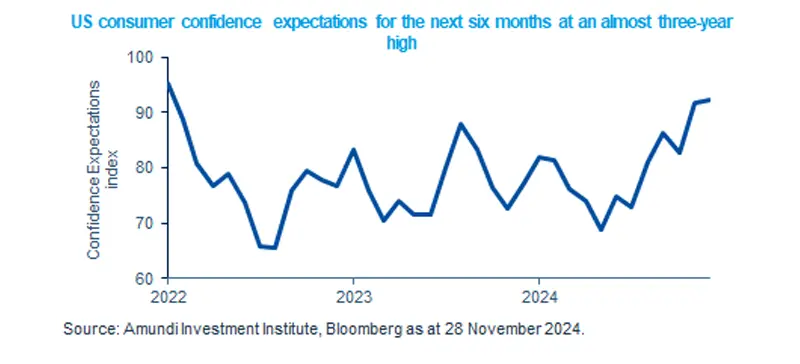

- Rising consumer confidence bodes well for the upcoming holiday season.

- Trump’s announced policies are boosting market sentiment, but they may add inflationary pressures later on.

- Uncertainty on the inflation path will make the Fed increasingly data-dependent.

In November, US consumer confidence hit its highest point in over a year. Notably, expectations for the next six months (as shown in the chart) are at their highest level in nearly three years, which is promising for the upcoming holiday season. The increase in political discussions among survey participants indicates that the political climate following Donald Trump’s election may have influenced consumer attitudes. Additionally, a more positive view of job availability and equity markets at new record highs have further fuelled this optimism. With expected resilience in consumption, the key theme to monitor in the coming months will be inflation, as the new administration's economic policies could potentially heighten inflationary pressures. In this context, investors should explore potential opportunities across different markets and regions.

Actionable ideas

- Global equities

Global divergences and still positive economic outlooks may unleash potential opportunities across different regions.

- Multi-asset investing

A multi-asset approach may allow investors to stay flexible and potentially benefit from growth opportunities while adjusting to the evolution of the economic cycle.

This week at a glance

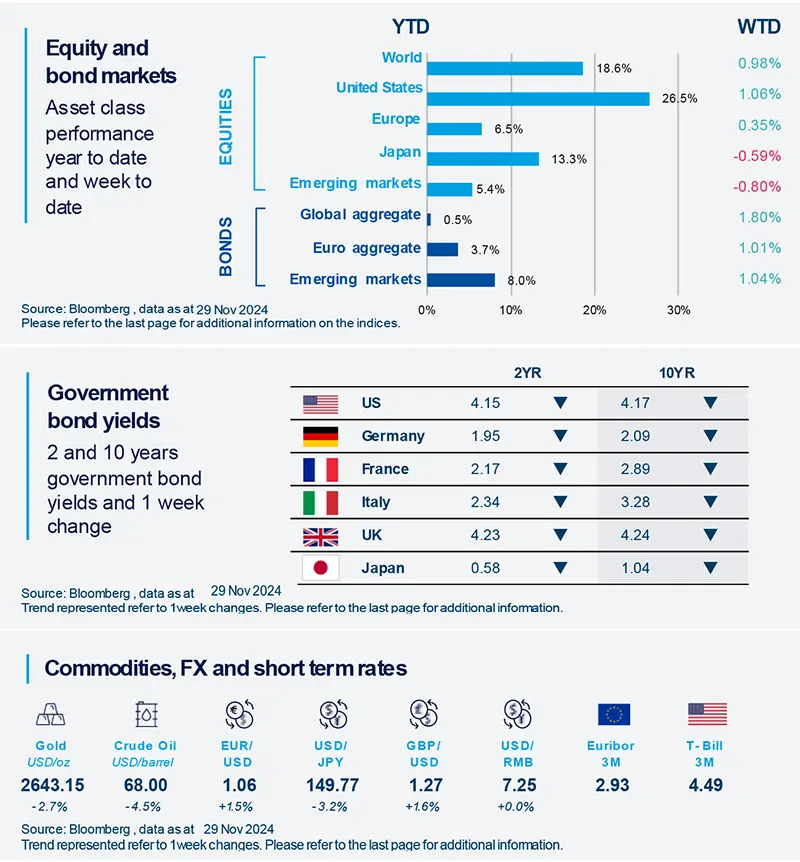

US equity markets reached record highs before Thanksgiving, while European markets were mixed and Chinese stocks rose on stimulus speculation. Bond yields fell, with the US 10-year yield at a month-low of 4.2%, and the dollar weakened against major currencies.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as 29 November 2024.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US core PCE price index picks up

October core PCE price index accelerated to 2.8% YoY, mostly owing to a rise in service prices, reflecting a surge in portfolio management fees due to rising stock prices. This data supports recent comments by Fed officials saying that there is no rush to cut interest rates as long as the labour market stays healthy and economic growth proves resilient.

Europe

Eurozone inflation came in as expected

Eurozone inflation for November came in aligned to expectations at 2.3% YoY from 2.0% in October. The rise was mostly due to base effects in fuel prices, while core inflation was unchanged. The broad picture remains one of generalised disinflation and weak growth. As such, the ECB is likely to keep on cutting rates. The only area of concern remains services inflation which reflects domestic cost pressure.

Asia

Pre-emptive cut may be a singular event in East Asia

The Bank of Korea surprised the market by cutting its policy rate back-to-back by 25bp in November. Concerns over growth have exceeded concerns over inflation, against the backdrop of an increase of US trade policy uncertainties. We do not expect China, Taiwan, or Vietnam to follow Korea’s path of pre-emptive cuts by the end of the year.

Key dates

|

02 Dec China Caixin 4 Dec 6 Dec |

04 Dec US ISM Services, Fed |

06 Dec US: Non-Farm Payrolls, |