The new policy pack reduces further the tail risk of a systemic crisis.

The latest support measures the Chinese government announced on housing have sought to re-establish lifelines for struggling developers, clarifying that credit forbearance would not be considered as stepping on the red lines. After sharp deleveraging over a year, stabilising the market is now the priority.

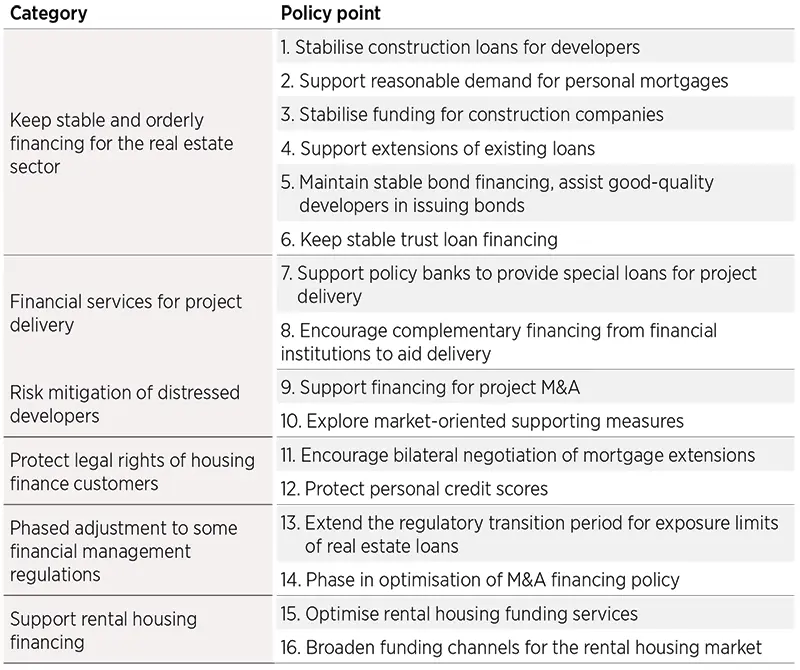

On 11 November, China’s PBoC and CBIRC (Banking and Insurance Regulatory Commission) jointly released the Notice on Implementing Current Financial Support for Stable and Healthy Development of Property Market, with 16 points of policy measures guiding financial institutions to support the property market.

This is the first high-level comprehensive policy package introduced since the outbreak of the property sector crisis. It provides unprecedented specific instructions in the banking and financial market to address various hot issues, including financing for real estate companies, supporting project delivery, solutions for distressed companies and projects, protecting mortgage borrowers, and supporting rental housing.

We found that many of the policies in the notice have already been carried out, but the notice reinforces them with more standardised and detailed guidance for implementation. Meanwhile, several policies in the notice are brand-new and provide solutions to some of the most important problems.

In our view, the notice demonstrates a strong supportive signal from the financial side that the government is changing its stance: 1) from scattered support to more comprehensive and practical measures; 2) from demand-side stimulus to also engaging supply-side support; and 3) from project-level support to also including company-level solutions. The notice tries to consolidate the policies and involve all the related stakeholders and gives more clear guidance to encouraging financial institutions to implement the old/new policies in a more pragmatic fashion. That said, what matters is implementation by financial institutions, and we still need to take a case-by-case approach in terms of single-name analysis. The notice reaffirms that the targets are the companies that “have a healthy financials in general but face short-term liquidity difficulty”.

For the overall market, the notice on 11 November further reduces the tail risk of a systemic crisis. In fact, Chinese government have been easing up on the demand side since a year ago. Household financing conditions have been relaxed significantly. Reassured by additional supports from the governments, we expect household confidence to improve and maintain the view that home sales are likely to stabilise towards year-end (see Where is China heading to?).