Summary

China’s cyclical recovery outlook hinges critically on developments in Covid-19 policy. Housing will become less of a drag as the sector manages an L-shaped landing. In the long run, China faces multiple structural headwinds. It will be difficult for it to maintain the miraculously high growth it experienced in the past.

Cyclical rebound hinges on reopening

The just concluded Par ty Congress proved markets wrong once again. China’s reopening is not attached to any single political event, although there were extra travel restrictions before the Congress, most of which will be reversed before year-end.

The Party Congress did not directly address the issue of reopening, but, in an interview1 days before the Party Congress, public health expert Liang Wannian said there is no timeline for exiting zero-Covid-19 controls. Based on lessons from Singapore and Taiwan, high vaccination rates do not offer perfect protection against Covid-19. Deaths and strained hospitals could still be a consequence to deal with. In this regard, we have low conviction predicting when China will reopen fully.

Nonetheless, we expect China’s Covid-19 policy to remain responsive. The overarching dynamic clearing strategy aside, Chinese policymakers will take an incremental approach and some gradual relaxation of restrictions – and setbacks – are likely. Meanwhile, investors need to see an acceleration in governments’ precautionary measures. These include, but are not limited to, an acceleration of vaccinations for the elderly, the construction of extra intensity care units or general wards with oxygen support, and more effective vaccines and medicines.

Recent signals from state media and public health experts suggest the gradual reopening process could drag along over quite a long period. A full reopening must wait until all recautionary measures are put in place and the public is confident enough to live with the virus. Under this scenario, China’s economy will have to cope with various disruptions. As officials learn from constant waves of outbreaks, they accumulate experience and knowledge, which will be helpful in containing damage to the overall economy. Odds of a chaotic forced reopening scenario are low in our view, considering Wuhan and Shanghai were isolated rather quickly from the rest of the nation. Without paralysing the whole economy, the adapted zero Covid-19 policy remains a drag on growth. We expect China to grow at a much slower rate than before the pandemic, at roughly 1% QoQ in 2023.

Chinese policymakers will take an incremental approach, and some gradual relaxing of restrictions and setbacks is likely

How the housing market lands will set the tone for long-term growth

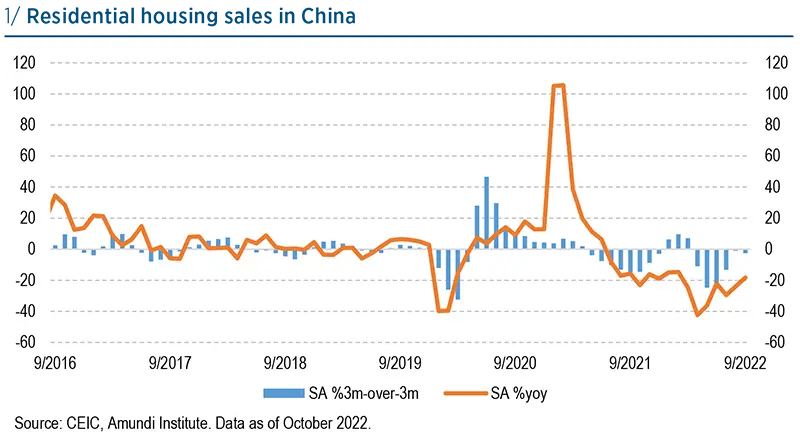

The housing market is another major concern among investors. From their Q4 2020 peak to Q3 2022, new home sales volumes fell 40%, wiping out all growth of the previous five years. Monthly sales volume dropped back to its mid-2015 level. Governments continued to step up their easing efforts. Mortgage rates declined in a year by 162bp and 109bp to 4.1% and 4.9%, respectively, for first- and second-home buyers. It now takes on average 25 days for an individual to get mortgage approval. Local purchase restrictions have relaxed to the cyclical low.

Signs of stabilisation are emerging. The Q3 PBoC survey showed the share of households planning to buy homes rising for the first time since mid-2021. Seasonally adjusted new home sales volumes increased for the second consecutive month in September. Our trend estimate indicates that the fall has slowed significantly. Meanwhile, highfrequency October data suggests the housing market has become more resilient to lockdown shocks, thanks to continuous easing efforts from PBoC and MoF.

This evidence points to a stabilisation of housing sales at end-2022. Hence, we believe that housing sales are close to their cyclical bottom. The transmission of the easing in housing policy has improved. In 2023, we expect housing sales to post a small gain and become less of a drag on growth. With the help of cyclical easing policies, new home sales may be able to return to 1.2bn square meters (sqm) in 2023. However, the market’s long-term fate has been determined by its demographic profile, including a shrinking population, slower household formation, and increasing urbanisation. A couple of conclusions an be drawn for long-term housing equilibrium:

- The urban population will expand by around 10mn per year in next decade, half the pace of the 2010s.

- Demand for new residential homes will decrease by 40% to less than 1bn sqm per year in 2031-35 from 1.54bn in 2019-21.

One case of collateral damage of the collapsing housing market is land sales, which fell by 48% YoY in Q3 2022. This reduced source of tax revenues and called into question local government fiscal positions, which were temporarily covered by increased bond issuance. Arguably, if the housing market continues its free fall in 2023, the cost will be significant and the incident has a higher chance of becoming a systemic crisis.

China’s economic priorities in 2022-27

High-quality growth:

- Raise total-factor productivity;

- Provide an enabling environment for private enterprises;

- Achieve greater self-reliance and strength in science and technology;

- Make industrial and supply chains more resilient and safe;

- Cultivate new growth engines such as next-generation information technology, artificial intelligence, biotechnology, new energy, new materials, high-end equipment, and green industry.

- New industrialisation: boost China’s strength in manufacturing, product quality, aerospace, transportation, cyberspace, and digital development; accelerate development of the Internet of Things;

- Increase investment in science and technology through diverse channels and strengthen legal protection of intellectual property rights;

- Build an efficient logistics system to help cut distribution costs;

- Build a modern infrastructure system, improve urban infrastructure, and upgrade environmental infrastructure.

Financial sector:

- Deepen structural reforms in the financial sector;

- Place all types of financial activities under regulations;

- Increase the share of direct financing;

- Modernise the central bank system.

Regulation:

- Take stronger action against monopolies and unfair competition;

- Break local protectionism and administrative monopolies;

- Advance law-based government administration.

Wages, income and wealth:

- Ensure that personal income grows in step with economic growth;

- Ensure that wages rise in tandem with increases in productivity;

- Raise the share of personal income in the distribution of national income;

- Give more weight to work remuneration in primary distribution;

- Enhance the roles of taxation, social security, and transfer payments;

- Keep the means of accumulating wealth well-regulated.

Structural headwinds still there, massive stimulus not on the agenda

In the longer run, China’s growth will converge down further to 3%

The pressing housing issue brings the market focus back to how fast China can grow in the long term. To solve this equation, there are already two well-known sources contributing to slower potential growth: a fast-aging population and a declining return on capital. There were no hints from the Party Congress that Chinese leaders will opt to inflate the problems away. While addressing the opening ceremony at the Party Congress, President Xi laid out several objectives and tasks for the next five years. His speech2 strikes a tone that is more balanced between growth, security, and sustainability.

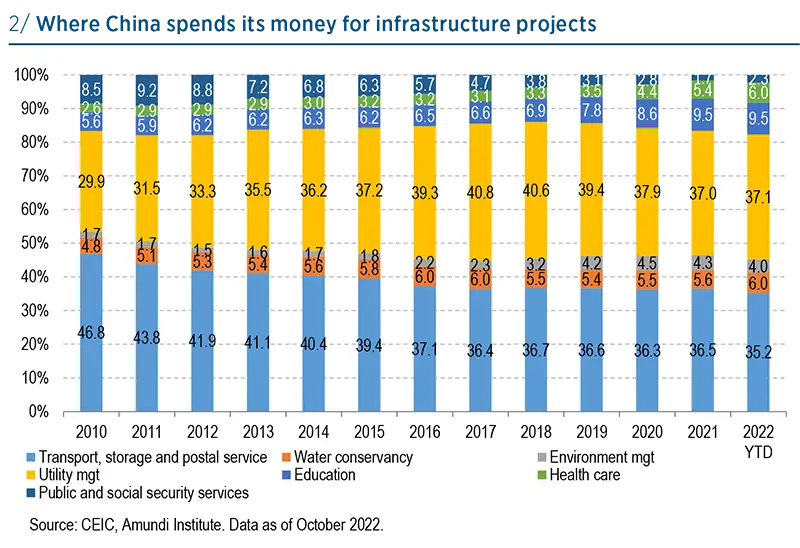

In short, China will pursue a growth model that concentrates resources on raising productivity. However, total-factor productivity is being treated as a residual in the Solow model, and a sudden technology advance or productivity breakthrough is out of predictable territory. Taking the housing sector out of the economy would reduce China growth by 2 percentage points in the long term, assuming the sector manages a soft landing. Infrastructure investment is not only smaller than housing, but also has a lower leverage effect on growth. Besides, tracking where China has spent on infrastructure projects, we found the money is increasingly directed to soft infrastructure, e.g., education, public services, and environment management, while the share of physical infrastructure investments is on a declining trend (see figure 2).

In 2022-24, we expect China to grow by about 4%. The 2022 experience shows how, without services consumption or housing, China can grow at most by 1% per quarter. In the longer run, China’s growth will converge down further to 3%.