Summary

The Federal Reserve is continuing its cut-rate path, but it will be increasingly vigilant towards any inflation risks. We expect volatility in bond markets to persist

-

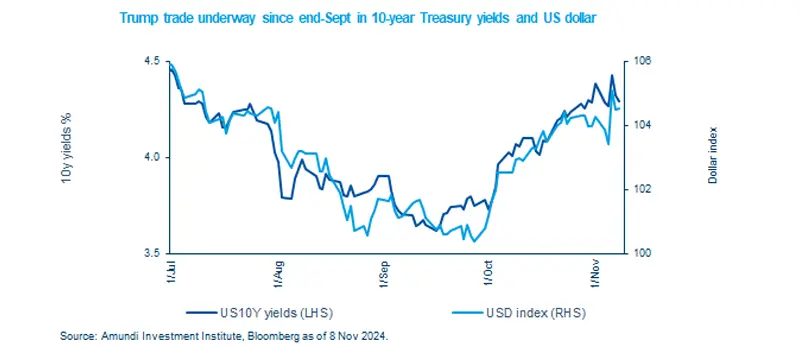

US bond yields and the dollar rose on expectations that new government’s policies could boost economic growth.

-

The Fed, on its part, reduced rates and is likely to continue to ease policy. It would, of course, monitor inflation data.

-

We maintain our no-recession scenario in US and believe consumption is the key variable.

Market expectations of Donald Trump’s victory in the US elections have driven bond yields higher since late September. This rise is partly attributed to concerns about Trump’s policies, which could have inflationary effects and exacerbate the already high fiscal deficits and government debt. Additionally, optimism regarding a positive impact on economic growth propelled the US dollar and equities higher, with the S&P 500 reaching record highs on November 6, the day the election results were announced. Looking ahead, while we see some upward risks to inflation, the overall impact on the economy could depend on the sequence of implementation of his policy agenda, in particular regarding tariffs. On the monetary policy side, the Fed has cut interest rates as expected, and it is likely to remain data-dependent, ready to adjust its approach if inflation deviates from its targets.

Actionable ideas

- Equities in a no-recession environment

Some corners of the market such as US value and equal-weighted caps are potentially attractive. European, small caps and Japanese stocks also show potential for long-term returns.

- Role of corporate credit

Corporate credit of high quality businesses, for example in Europe, with low debt should be able to withstand a mild deceleration in growth. Emerging market credit may also offer potentially appealing income.

This week at a glance

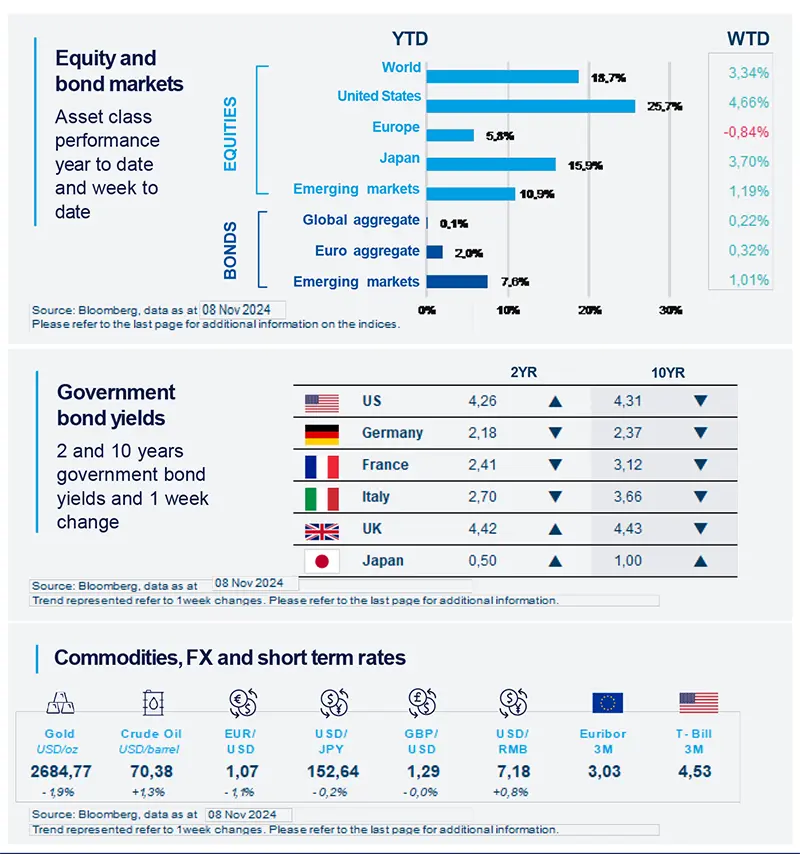

Global stocks climbed, driven by optimism that the new US administration will introduce policies aimed at stimulating economic growth, with the US market leading the charge. Bond yields saw significant fluctuations throughout the week, while gold prices closed lower.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as 8 November 2024. The chart shows the S&P 500 index and the S&P equal weighted index.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US productivity stays healthy

Q3 productivity was up 2.0% YoY, topping 2.0% for five straight quarters. The United States is benefitting from a productivity gain that may not last long and might reflect a one-time shift due to fiscal expansion and artificial intelligence adoption. In any case, such improvement has been helping the economy thus far, facilitating a disinflationary process despite the tight labour market and still healthy economic growth.

Europe

Eurozone retail sales pick up

September Eurozone retail sales were up 0.5% month-on-month, with upward revisions to past data. The improvement was broad-based at the country level. This reinforces our view that retail sales are picking up, reflecting improving real incomes, confidence, credit growth, and credit demand. We confirm our outlook of gradual recovery/stabilisation for the Eurozone economy.

Asia

China’s NPC measures disappoint expectations

China’s NPC announced a RMB6tn increase in local government debt ceiling, dedicated to local government debt swap. The announced total fell short of market expectations. The absence of increased central government fiscal resources for bank capital injections was also disappointing. However, these measures should be implemented soon, as the central government is ready to adopt housing-related tax support measures and issue special bonds for bank capital injection.

Key dates

|

13 Nov US CPI, France unemployment rate |

14 Nov UK GDP, US PPI, EZ GDP |

15 Nov Japan GDP, China industrial production, US retail sales |