Summary

Key Takeaways

- Despite the sectors' inherent reliance on nature, companies in the food sector are in the very early days of understanding and addressing the issue

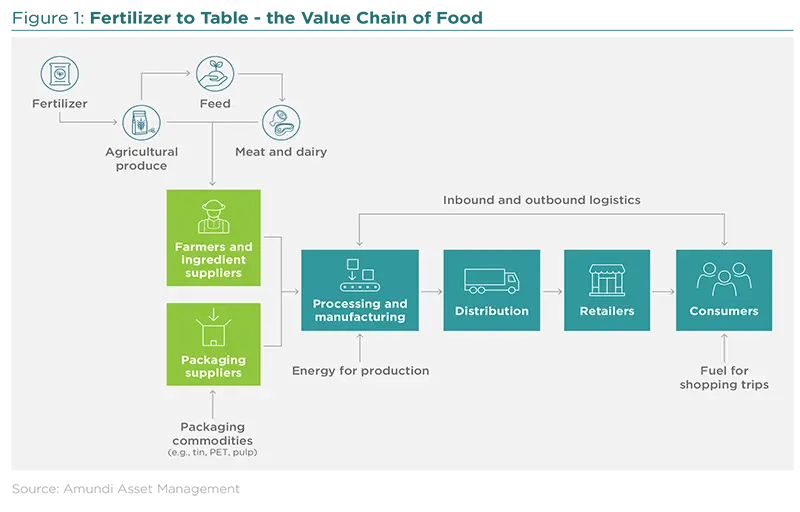

- Addressing the impacts (and associated risks) linked to biodiversity will require an entire review of food systems from agriculture to end user

- Most impacts are indirect in nature, adding to the complexity of addressing the issue

- Restaurants and catering services have an additional layer of complexity as they are often franchised and sourcing decisions are conducted at a regional level

- Many companies have focused on addressing a few key commodities or biodiversity impact drivers but this can leave major impacts in impact management and mitigation

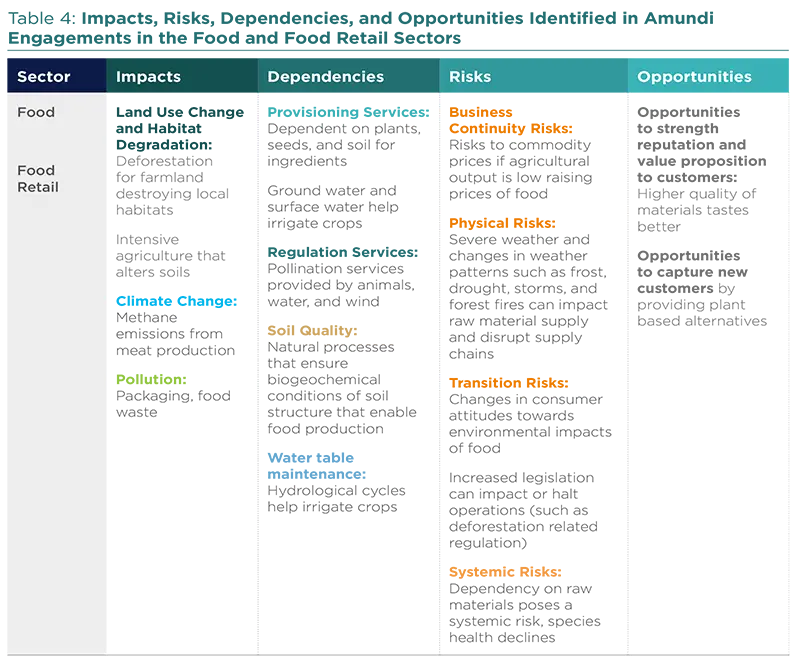

The global food sector is often cited as one of the primary sectors driving biodiversity loss globally1. While the sector heavily exacerbates biodiversity loss2, it is also heavily dependent on biodiversity and faces significant associated risks. The impacts to biodiversity are often indirect, primarily through the sourcing of raw materials, making the topic difficult to manage and measure in part due to the sheer scale of global supply chains.

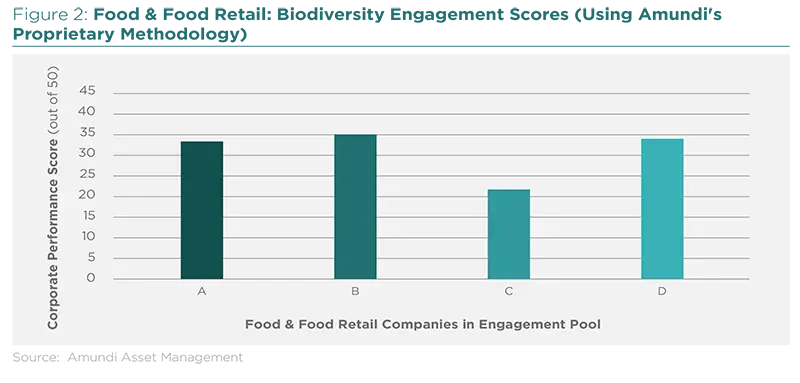

Overall, most companies in our study were in the early days of addressing the topic of biodiversity as a specific strategic topic, with some companies having almost no awareness of the subject altogether. However, they did demonstrate some awareness and action through commodity specific strategies (i.e. coffee, cattle, palm oil, etc.) or specific impact drivers (such as deforestation, climate change, and packaging). Consequently, biodiversity at the board level is often addressed through these other issues, but not as a specific strategic topic that requires board oversight. The one exception was for European companies who performed better, likely due to existing pressure from regulation.

It is of little surprise that very few companies within the food sector have started to identify biodiversity as a strategic topic. The food industry is a “perfect storm” of low margins, volatile commodity prices, and price sensitive consumers. Supply chains have been built on maximizing efficiencies to lower costs, but cost to nature and society is not factored in. The sheer scale of global food supply chains also means that consumers are relatively disconnected from the impacts of their food purchases3. Furthermore, food is an essential human need so price increases can have social implications as well. Food prices were increasing before Covid-19 but the pandemic has exacerbated this trend with a roughly 30% year on year according to the FAO Food Price Index45. The energy crisis and other supply shocks have exacerbated this trend even more with food price inflation in the EU alone being 18.2% in December 20226. Thus, proactively addressing biodiversity loss could be taking a back seat in favor of more shortterm concerns.

Many companies have been addressing biodiversity loss with commodity or focused efforts around a specific activity, but are susceptible to leave gaps in their strategies. Mapping supply chains and addressing biodiversity impacts is arguably a huge undertaking for a single commodity, let alone an entire menu of ingredients. However, inaction on certain commodities or other biodiversity loss drivers remains a major risk for companies.

At the same time, companies within the food sector should more clearly evaluate the business opportunities associated with addressing biodiversity loss. While there will be costs associated with addressing the impacts of global food supply chains, there are also business opportunities to be seized in the transition. There is a growing consumer focus on the environmental impacts of food (such as for organic products and plant based alternatives). It is estimated that the market for plant based meat and milk could be worth more than $80 billion by 2030. If food companies better develop their biodiversity strategies, they may be able to react more quickly to growing consumer interests around environmental preservation.

In this section, we will dive deeper into these three sectors to understand the impacts they can have on biodiversity, the risks they face from biodiversity loss, and how the sectors are managing and moving forward on the issue.

Addressing Biodiversity Loss in Food & Food Retail

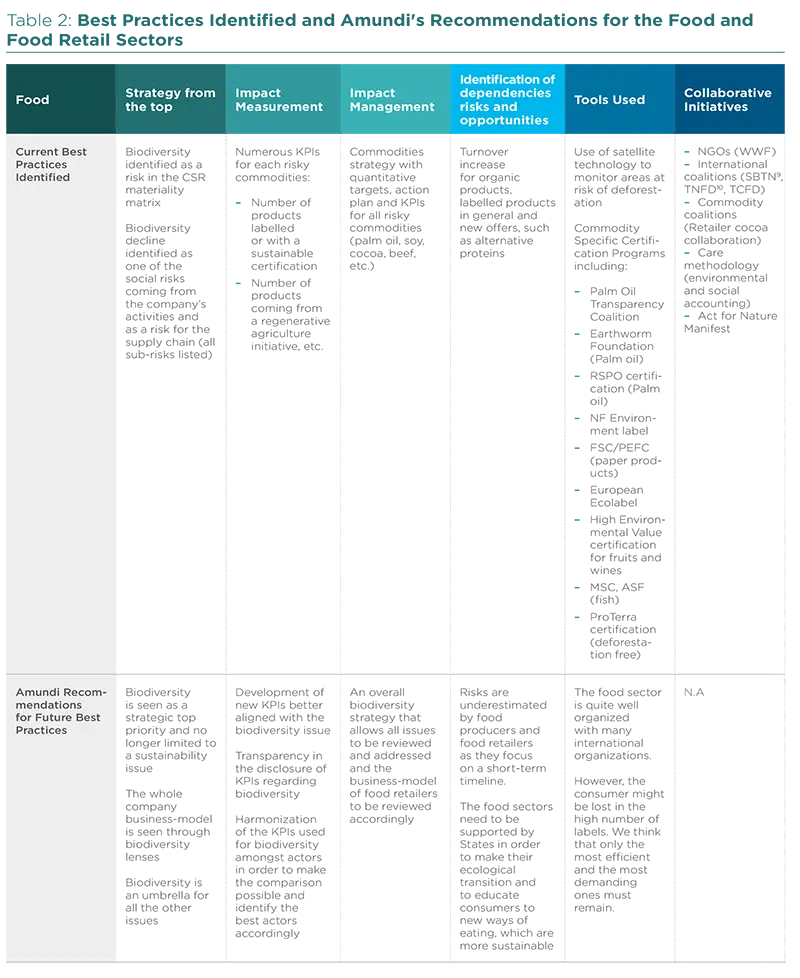

Historically, companies in the sector have initiated their work on biodiversity through deforestation due to the expansion of agriculture for certain commodities, such as palm oil or soy. Companies then extended this work to other commodities (cocoa, beef, etc.). For all the companies interviewed, biodiversity is an emerging issue on which they are beginning to think holistically and no longer in silos according to raw materials. Although there is no global strategy yet, companies have set up strategies by raw material with objectives (often quantitative), an action plan and indicators. There is a difference in the level of communication between French and American companies on biodiversity related issues. French companies, probably in part to meet the regulatory obligations of extra-financial reporting, are more verbose on the subject and communicate more transparently and exhaustively than American companies.

Managing Biodiversity from the Top Down

Companies are only just beginning to identify biodiversity as a cross-cutting issue, like climate. However, this is not yet reflected in their CSR strategy. The focus is still on risk management for commodities (soy, cocoa, etc.) and their environmental impacts (deforestation, pollution, etc.). Commodity strategies are defined by the holding company but the subsidiaries are quite autonomous according to their exposure to them (beef in Brazil, palm oil in Indonesia, etc.). While companies may have targets such as zero deforestation or 100% certified palm oil, there is no quantified target for biodiversity due to the lack of initial data on which to build a quantitative strategy.

Biodiversity Impact measurement & management in the food and food retail sectors

Biodiversity as a whole is a recent topic. Until a few years ago, it was only perceived by food companies through other issues that were in the spotlight, such as the use of pesticides, risky commodities, CO2 emissions, etc.

These issues have led to specific policies. It is therefore difficult today that the subject of biodiversity is arriving in force to review the entire CSR strategy that has been made to make biodiversity a central subject that would link a number of subjects and would organize them. It would require to review everything, which is even more complicated as the issue is very complex and still poorly understood.

However, companies are aware of this complexity and we are seeing more and more companies hiring biodiversity specialists. Moreover, if companies have strategies decided by the holding company, it is important that these strategies are consistent with local specificities. Indeed, as an example, risks due to cattle breeding are not the same in France (increasingly intensive breeding) as in the United States (intensive breeding) or in Brazil (risk of deforestation). Biodiversity must remain a local issue with a centralized strategy.

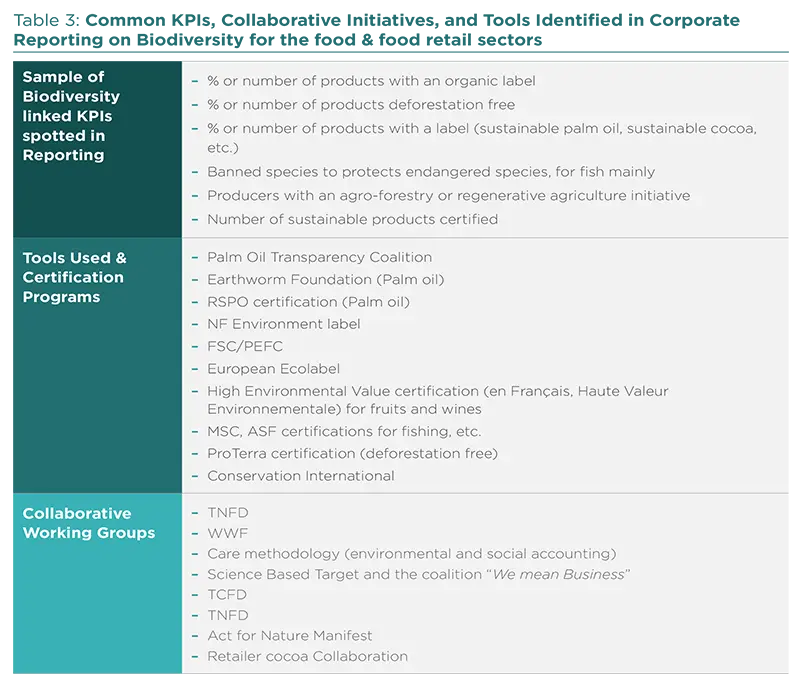

Reporting on the subject of biodiversity is still in its infancy for the simple reason that thinking is also in its infancy and the extremely complex subject does not allow the use of a single indicator, such as the CO2 emissions KPIs for the fight against climate change, which could summarize the subject quite extensively.

All companies are working together to find a way to better evaluate and report on biodiversity and make it quite easy to understand. However, as of today, this matter remains a challenge.

Identification of Dependencies, Risks and Opportunities

The food sector faces a multitude of issues that it needs to address on the subject of biodiversity. Moreover, in recent years, the issues on which it is expected to act have multiplied, making their treatment even more complicated because they require large investments, both financial and human, in a sector where margins are already reduced. As a result, the sector has focused on issues that are in the news, such as commodities like palm oil, cocoa, coffee, etc. However, this is only the tip of the iceberg. For the sector to make a real ecological transition, the entire system must be reviewed: reducing the use of pesticides, changing the diet to reduce meat consumption and increase that of vegetables, promoting short circuits, etc. The food sector is trying to implement a transition but is faced with a difficult situation, particularly for distributors, where they are caught between a rock and a hard place: on the one hand, they are dependent on food producers who are told to increase volumes, and on the other, on consumers whose eating consumption habits are changing very slowly.

The extent of the risks is generally underestimated by the food industry, even if they are fairly well identified.

As for the opportunities like organic products, they are still limited and are aimed at a niche group of consumers. Food producers and food retailers are trying to mainstream these products but this takes time and remains a small part of their turnover, even if the margin on these products is interesting.

Tools & Collaboration

Due to the particularly complex nature of the food topic, companies are faced with the difficulty that there is no consolidated indicator that could assess the level, either positive or negative, of a product's impact on biodiversity. Moreover, since biodiversity is so diverse, companies must deal with a complex subject, which is still poorly understood and has poorly defined issues that require experts.

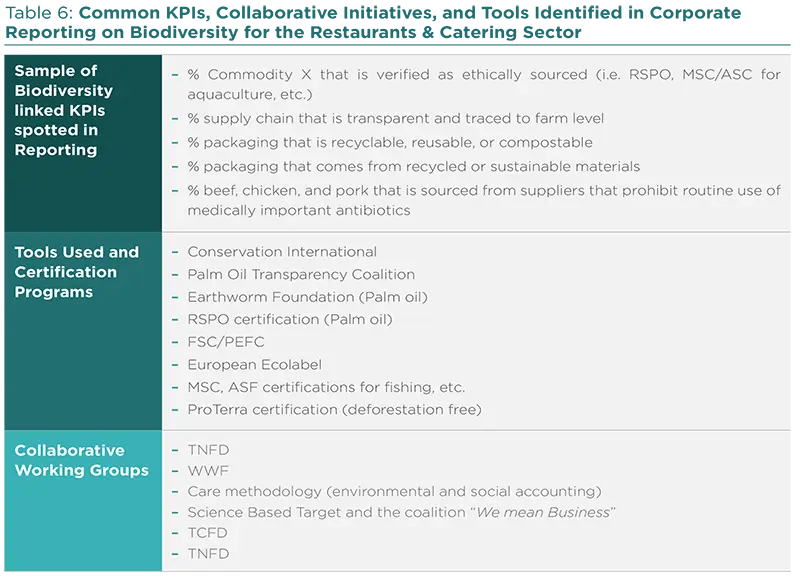

Thus, to address these complexities, companies in the food sector have had the intelligence to come together in a collective for certain biodiversity-related issues such as commodity linked deforestation for certain high risk commodities like RSPO. Tools used to measure biodiversity impacts are thus widely wielded through commodity specific certification programs. There is also work to develop and use certain common tools, such as the use of satellites to fight deforestation in Brazil. In addition, many labels and certifications have been developed over the past ten years to try to protect certain endangered species, particularly in the fishery sector.

However, these tools and collaborative groups are often deemed insufficient. No retailer can really guarantee 0% deforestation or “sustainable” sourcing of a product. Some labels have been tainted by scandals regarding their low standards and have been criticized as greenwashing.

We do support companies to keep collaborating in order to find collaborative solutions and an international harmonized framework that could help compare companies and identify the best actors. We also support targets in terms of percentage of raw materials certified to specific standards but there are limits to certifications, and clearly certifications today have not yet concretely stemmed biodiversity loss in their respective topics. Thus, while we support these certifications, there is also clearly a need for companies to stop hiding behind vague certifications and show us what is in their own “secret sourcing sauce”. Finally, on collaboration, companies need to be transparent on where the weak links are in the collaborative work and what are the steps to address and improve on the current certification programs.

Conclusion

Biodiversity is still a recent topic for companies. Therefore, they find it difficult to apply the concept to their activities, and to make it intelligible to the general public.

The top management of companies underestimates and has too little knowledge of the subject, which is still relegated to a sub-topic of CSR, whereas it is essential for the sector and should therefore be identified as a strategic priority. Indeed, the sector's business model is based on the protection of biodiversity so that Nature can continue to provide what we eat. We therefore recommend that top management be trained in this area to raise awareness.

At the management teams’ level, we recommend that this subject be integrated into the strategic priorities, and that experts be hired to define a coherent strategy in order to integrate risks and opportunities in the new business-model of the company.

Risks need to be better defined, assessed and better taken into account by companies. Besides, opportunities must be promoted by companies who have a role to play in educating consumers so that they change the eating habit consumptions (more vegetables, less meat, etc.).

The food sector also needs to keep collaborating in order to develop a tool or a KPI that would allow to assess the biodiversity score of a product or of a company.

Case Study with Carrefour: Interview with Lorna Lucet, ESG Analyst, Food Retail

Q: What was one company in your engagement study that you want to highlight? What are they doing on biodiversity currently?

A: Food retailers have a lot to do in terms of biodiversity as issues are increasing. Carrefour started working on biodiversity-related issues years ago, such as commodities at risks (cocoa, coffee, beef, palm oil, etc.). If the company has not yet issued a very structured strategy on biodiversity, it has addressed some of the issues with structured and specific policies, action plans and KPIs that are followed yearly. This is a first good step.

Q: What was particularly interesting about Carrefour?

A: The company is well aware of the progress that needs to be done, especially a structured strategy on biodiversity. The company is trying to have a pragmatic way of doing it by addressing the main issues, hiring experts, collaborating with peers and other stakeholders to better assess risks and opportunities to then build a coherent strategy.

Besides, the company has been implementing for a few years a CSR and food transition score on four thematics - sustainable supply chain, shopping activities and logistics, client satisfaction and employee commitment – that is integrated into the top managers’ remuneration. If this kind of index needs to be more focused on biodiversity, it helps into the integration of CSR issues into the business strategy.

Q: Any recommendations for improved practices?

A: The company needs to identify all the facets of the biodiversity issue in order to better assess them and then to address them. We think that it is time for biodiversity to be seen as an issue per se and not only through other issues. Consequently, a biodiversity strategy needs to be written and to integrate top business priorities. However, we think the company is going in the right direction as a member of many working-groups, in particular on how to find KPIs to better assess the impact of its activities on biodiversity.

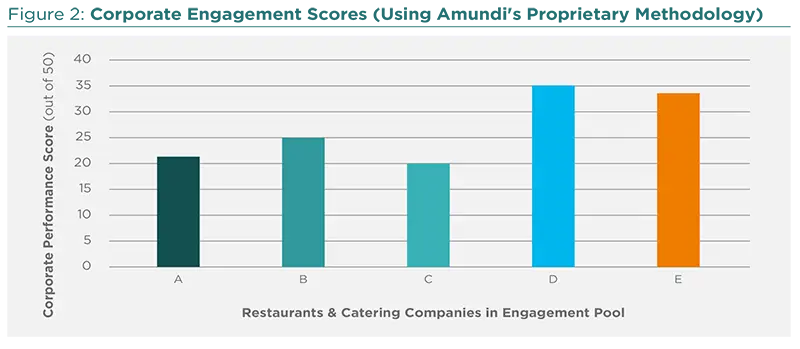

Restaurants & Catering

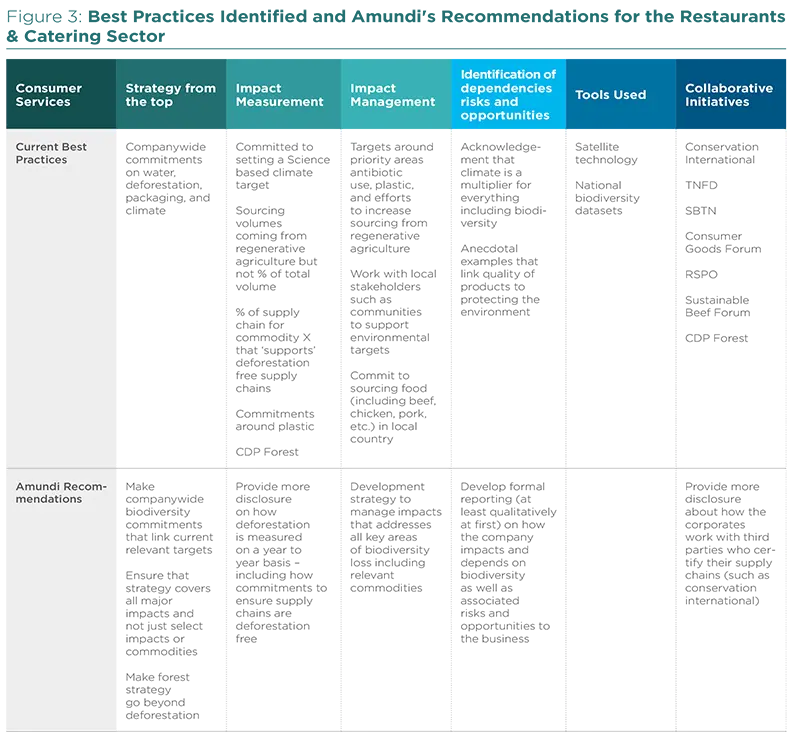

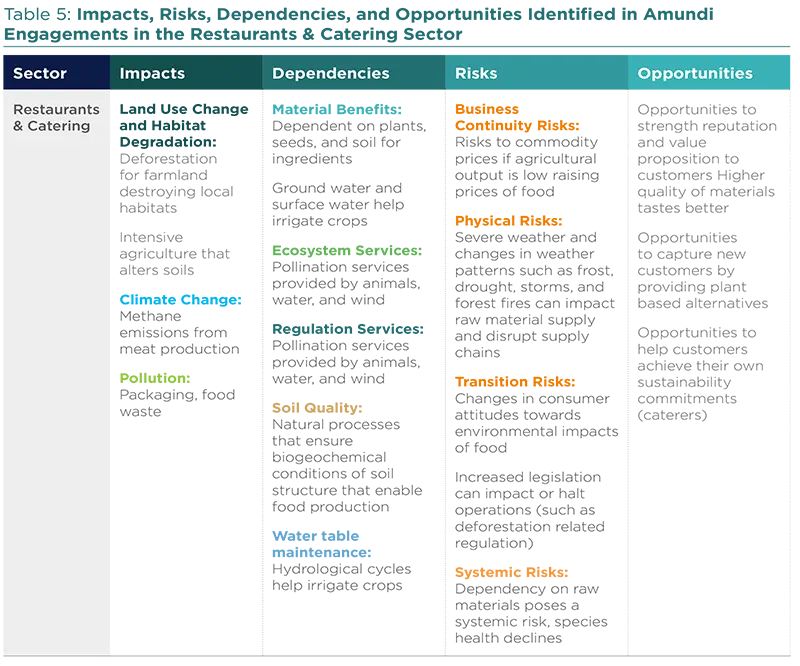

The consumer sector demonstrates limited understanding of the topic of biodiversity. Companies within the sector may have specific efforts on biodiversity-linked subjects such as responsible sourcing, packaging, water consumption or antimicrobial resistance. However, overall biodiversity strategies that connect their specific policies and processes on biodiversity related topics remained limited and almost non-existent. The strongest companies did demonstrate awareness of the issue but had not yet developed formalized strategies. Other companies had almost no understanding of the topic. Efforts were generally focused on one or two specific commodities or one or two specific issues. Some companies demonstrated very strong sourcing targets on a few key ingredients but the overall exercise to assess how the company is exposed to biodiversity loss was missing.

Top Down Strategy on Biodiversity

In this sector, there is a high degree of independence among various operations, geographies, branches, and stores. For example in catering, sourcing decisions are made often at the country level and for restaurants, many restaurants are franchised, so many decisions are made at the branch and local level. This means that top down oversight on strategy is difficult and there is a whole other level of decision making that separates companies from the impacts of their operations.

Not one company within the study had specifically highlighted biodiversity as a strategic ESG priority. Leading companies mentioned climate change, deforestation, supply chain transparency, and packaging but the overall link was missing. Some companies within the study were in the beginning stages of developing their ESG strategy in general and thus it is understandable that biodiversity was not yet a key subject. However, we see this as an opportunity to encourage companies to incorporate the topic early on so they effectively incorporate biodiversity into ESG from the beginning.

One interesting observation was that, some companies that scored lower already had biodiversity linked topics embedded into their business models. For example, two US companies cited that high quality meat was key to their value proposition. Their meat was sourced only in the United States and on antibiotics one company was antibiotic free from its inception while the other had leading commitments on reducing/eliminating antibiotics from their meat. Furthermore, strategies around sourcing meat coming from regenerative agriculture were also apparent. They recognized the benefits of regenerative agriculture but had not quite incorporated the concept into a holistic strategy. Encouraging these companies to connect their existing efforts to biodiversity will hopefully be the possible next step on their ESG journey.

Impact measurement & management

There is a long way to go in the sector in terms of effective reporting. Leading companies had clear statements and targets around deforestation free supply chains but the data to back up those claims remained vague. Conversely, companies who are still in the beginning stages of ESG had sourcing targets in terms of volumes sourced but not around the percentage of the commodity sourced responsibly.

Management of biodiversity risks within their supply chains was still often at the level of mapping supply chains but not supporting biodiversity management at the local level. Leading companies had targets to achieve 100% transparency in their supply chains but while they collaborated with a third party on this, indicators on how they actually measured this and assessed it were missing.

Furthermore, for companies that were nearing their transparency targets, there is a way to go to make sure that biodiversity management is officially measured at the commodity level. This includes examining on the ground impacts including pesticide/fertilizer use, water consumption, and the impacts of intensive agriculture. There was some evidence of ad-hoc pilot projects that addressed on the ground impacts. Ad-hoc pilot projects are an important first step but no company demonstrated any early efforts to try and holistically expand these initiatives on a more global scale.

Identification of dependencies risks and opportunities

The restaurants and catering services were not very far in identifying risks, impacts, dependencies, and opportunities associated with their business. Some had anecdotal examples (i.e. plant-based alternatives can help capture new markets) but a more formal exercise was not conducted. We think further analysis will help address gaps in their environmental strategies overall. For example, only one company did identify water risks and watershed management as a strategic priority for their key commodity. If this is a risk for one company it is likely a risk for others.

Tools & Collaboration

Tools and collaboration take the form of primarily certification and programs and working groups. Working groups can be either on a commodity level such as the roundtable for sustainable beef or impact driver level such as the Ellen MacArthur Plastic pact. There are also a few risking working groups that look at the topic biodiversity holistically such as Science Based Targets for Nature.

Conclusion

Restaurants and catering have an additional layer of complexity to the already complex topic of managing nature related risks and impacts for the food sector. As sourcing decisions are often not conducted centrally, there are difficulties to implement systematically, companywide targets. Despite these difficulties there is ample evidence of promising initiatives strategies to address this sector’s impact on nature. The root solution ultimately though to effectively manage biodiversity related impacts and risks is transparent sourcing of all products and ingredients. While there is still a long way to go, working with well-established suppliers who share the same goals and ambitions will ultimately help deliver improvements to nature and very likely value to the business in terms of quality of products and management of sourcing risks.

Case Study with Sodexo: Interview with Molly Minton, ESG Analyst, Consumer Discretionary

Q: What was one company in your engagement study that you want to highlight? What are they doing on biodiversity currently?

A: I think Sodexo is an interesting case to highlight because the nature of the catering business model makes addressing biodiversity loss a particularly tough subject. However, that is not stopping Sodexo from having a strong awareness of the topic and actively working on the issue! For catering, a lot of the sourcing decisions are done locally and not centrally, thus to manage their biodiversity impacts, the central strategies have to be translated into local level policies and processes. For example, Sodexo has a zero deforestation commitment as one of their priority topics but with 30,000 sites in over 50 countries, effectively implementing that at the local level takes time and effort. Menus change every day locally and most purchasing decisions happen at the local level. In addition, Sodexo has set a science based target commitment to align with the 1.5°C scenario. This ambition will lead to profound changes within their business. At the time of the engagement they stated they were the only one in their sector who had published a Scope 3 target which is where 99% of their carbon emissions come from.

Q: What was particularly interesting about Sodexo?

A: While still early on their biodiversity journey, Sodexo really demonstrated a strong awareness regarding the business benefits of addressing biodiversity loss and climate change. For example, they acknowledge the rise in demand from their customers for vegetarian and plant based options worldwide. To support its commitment to propose 33% plant-based dishes in their menus by 2025, Sodexo has launched the Future Food Collective; a collaborative research initiative bringing its chefs together with industry experts and key suppliers to reshape consumption habits. More interestingly, they have identified a business opportunity in the sense that their clients often have their own climate and environmental commitments. As a catering service, they can sell their catering services as a way to help their clients achieve their own climate targets in terms of service offerings. While they are seeing this so far more on the climate side, as awareness around biodiversity loss increases this is an additional value add.

Q: Any recommendations for improved practices?

A: The complexities of the global food supply chains does not make it an easy task to address quickly and holistically. Thus, like for practically every food company, Sodexo’s first priority needs to be effectively mapping their supply chains which will support both their climate and biodiversity related goals. Though as sourcing decisions are done locally, global policy needs to be translated to the local level (and then re-aggregated for top down reporting). We hope that Sodexo can begin making sourcing commitments at a more local level with (accompanying indicators) to help measure the progress towards their wider goals.

Furthermore, we understand that the complexity of the business means that the focus must start with a few key commodities and impact drivers (i.e. soy, seafood, food waste, plastic, etc.) and that each commodity needs its own approach. This is a very common approach for the sector and while an important first step, it could mean other commodities or impacts slip through the cracks with no company taking a proactive effort to address them. Like many companies in the engagement, we urge Sodexo do the exercise of assessing how they impact biodiversity more holistically so they can begin to understand (and manage) these other impacts.

Since our last engagement Sodexo joined Act4nature initiative reinforcing their ambition to develop responsible agriculture based on the preservation of natural resources and respect for biodiversity, social justice and economic viability.

Conclusion

Food based sectors have significant impacts on the biodiversity including risks around deforestation, intensive agriculture, and pollution. Conversely, these sectors are heavily dependent on a healthy and biodiverse environment to function. While, biodiversity is starting to become a more prominent topic, especially in Europe with emerging regulation, it is clear that many companies are still in the early days of understanding and addressing the issue. Addressing these issues for the sector is complex. Most of the impacts on nature are indirect (in the upstream and downstream of the product’s life cycle) making them hard to understand and manage at scale. The sector and consumers are so sensitive to price differences that it becomes hard to justify the cost of addressing biodiversity impacts, especially if the impacts are not yet concretely felt at the consumer level. However, there are high risks of inaction. Regulation is emerging which will help encourage quicker action, but investors will have a huge role to play to encourage corporates to adopt best practices and continue to push the envelope to address these issues comprehensively.

For more insights

This article is part of the series “Biodiversity: it’s time to Protect our Only Home”. To learn more about this theme, please click below on the following article.

Biodiversity : It’s Time to Protect Our...

Sources

1 https://www.unep.org/news-and-stories/press-release/our-global-food-system-primary-driver-biodiversity-loss

2 The Encore Tool identified Consumer Staples as having “very high materiality rating” for terrestrial ecosystem use, water use, freshwater ecosystem use, marine Ecosystem use and “high materiality rating” for GHG emissions, non-GHG air pollutants, water pollutants, soil pollutants, solid waste, and other disturbances https://encore.naturalcapital.finance/en/explore?tab=impacts

3 https://www.just-food.com/features/biodiversity-loss-why-food-companies-should-say-something/

4 https://devpolicy.org/the-covid-19-crisis-and-rising-food-prices-a-year-on-20210928/

5 https://www2.deloitte.com/content/dam/insights/us/articles/the-profit-margin-squeeze-structural-strategies-forconsumer-product-companies/DUP104-Profit-Margin-Squeeze.pdf

6 https://www.euronews.com/next/2023/01/26/inflation-in-europe-is-falling-but-food-prices-are-rising-who-is-payingthe-most-and-what-

7 Observation is based off of sources including ENCORE, BCG, engagement calls, and analyst assessments.

https://encore.naturalcapital.finance/en

https://www.bcg.com/fr-fr/publications/2021/biodiversity-loss-business-implications-responses

8 Impacts both in supply chain and in end-of-life but minimal impacts in direct operations

9 Science Based Targets Network

10 Taskforce Nature Related Disclosures