Summary

Key takeaways

1. 2024 Beyond Feelings

The responsible investment market normalization continues, in a year marked by additional transparency requirements and continued companies’ commitments

- In 2024, responsible investment funds AUM growth was generally subdued, totaling €57 billion in the first 3 quarters, compared to over €98 billion in the broader non-ESG market in Europe 1. RI funds’ market shares, generally stabilized across regions, with Article 8 and Article 9 funds maintaining an asset market share of c. 59% in Q3 ’24 vs. 56% in Q3 ‘232. Global RI fund launch cooldown continued, such a shift indicating a maturing market facing increased scrutiny, driven by stricter regulatory developments such as ESMA’s guidelines and France’s ISR label, aimed at enhancing transparency and preventing greenwashing.

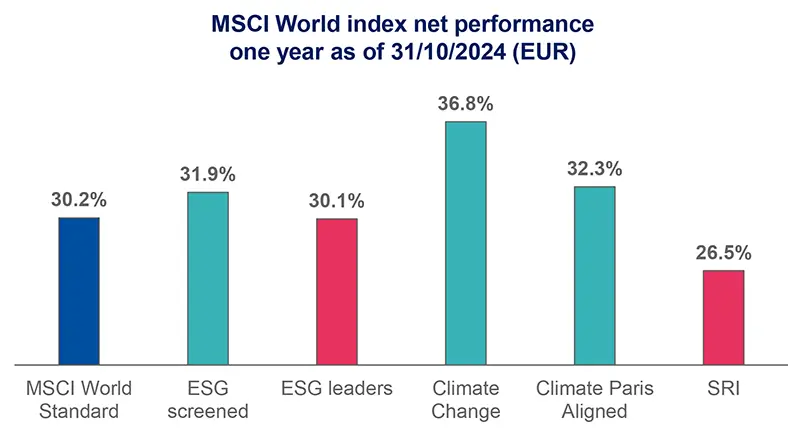

- The performance of responsible investment funds have been globally supportive, noticing more granularly diverse behavior depending on ESG integration’s modalities and regions. There is no more one unique ESG performance behavior. As an illustration, over the past year the MSCI World SRI and MSCI World Climate Change indices showed a 10-point difference in performance3. This variation emphasizes the need to understand the specific investment strategies, portfolio construction and sector exposures of different funds, as these factors can lead to significant differences in performance.

Source: MSCI Index factsheet as of October 2024

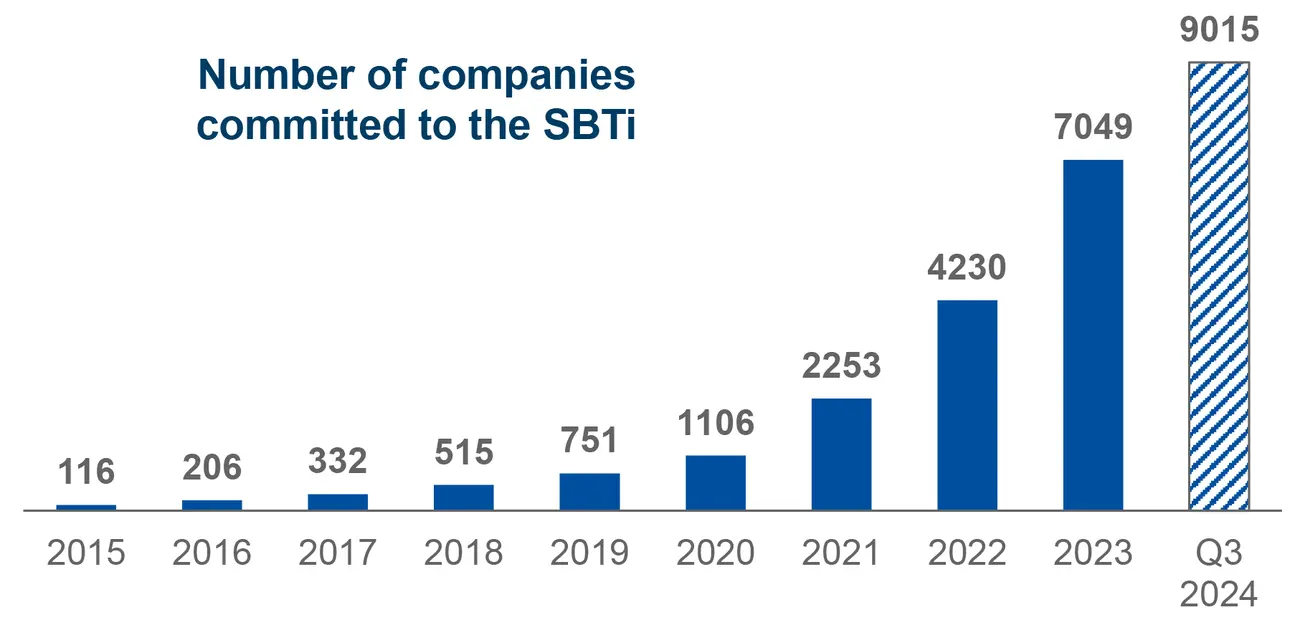

- Large corporates are more and more including climate and nature-related risks in their long-term strategy planning, with an increase of 30% in first three quarters of 2024 of companies committed to the SBTi4, after a record increase of 67% in 2023. This trend, supported by accelerating policy measures, reflects a growing awareness of the impacts of climate change and the slow energy transition on companies’ value chains.

Source: Science-Based Target initiative, as of end of September 2024

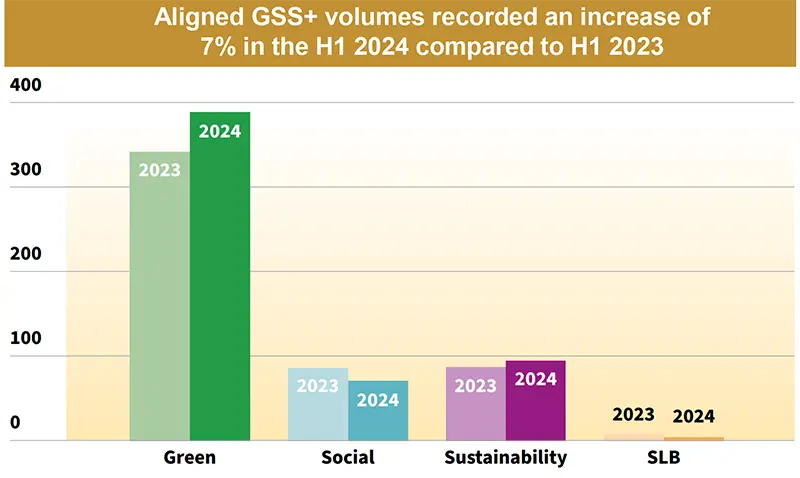

- The sustainable debt market continues to thrive, at H1 2024 the Green, Social, Sustainability (GSS+)5 bond market has surpassed the $5tn mark in cumulative issuances. Regionally, Europe was the largest source of sustainable debt volume, but Africa has shown the strongest growth and significant development in sustainable structured debt (impact outcome bonds, debt for nature swaps, etc.). Looking forward, sustainable debt market players have signaled the need for transition-themed guidance in hard to abate sectors, emphasizing a shift towards the development of tools and frameworks that consider decarbonisation pathways and roadmaps.

Source : Climate Bond Initiative – Debt Market Summary H1 2024 / June 2024

- Regarding responsible investment data, the sector is advancing with stringent European regulations, driving consolidation among major players and the emergence of advanced and more polished biodiversity metrics. This trend emphasizes a shift towards more tailored, sector-specific and specialised indicators that address the complexities of a maturing market, as firms seek to align with evolving investor expectations and regulatory demands.

2. Energy Transition at Global Crossroad

Maintaining the exponential momentum amidst geopolitical shifts

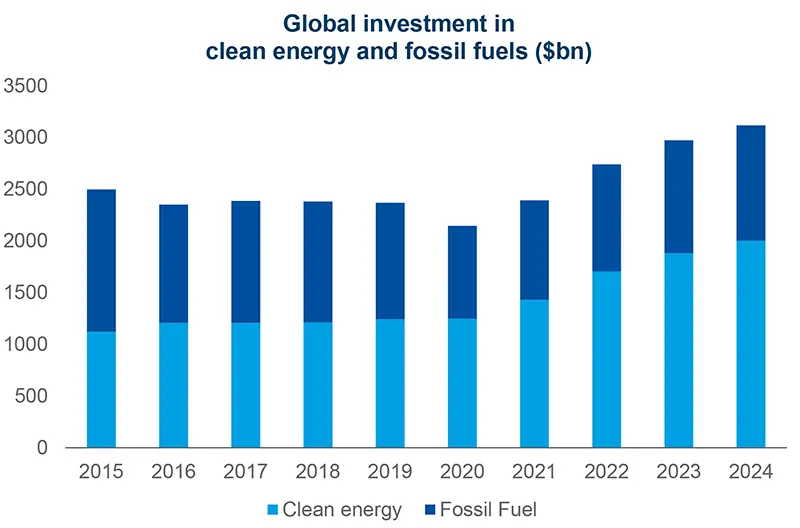

- The energy transition ecosystem is witnessing a significant surge in investments, particularly in renewable sectors such as solar and wind, with clean energy spending now outpacing fossil fuel investments at a ratio close to 2:1. Key government policies, including the U.S. Inflation Reduction Act, the EU green deal and China’s “Made in China” initiative, are driving this momentum, with clean energy adding $320bn to the world economy in 2023, 10% of global GDP growth. Clean energy also drove total investment acceleration, contributing to 50% of investment growth in China and 20% in the US6. 2024 also saw the implementation of Japan green transformation strategy (GX), another key green industrial policy program to watch in 2025.

Source : IEA, World Energy Investment report, May 2024

Source : IEA, World Energy Investment report, May 2024

- Geopolitical shifts in Europe and the U.S., particularly with Trump's recent reelection, present both challenges and opportunities for sustainability efforts. While Trump's emphasis on "cheapest energy" may boost fossil fuel production, if one accepts the prior that clean energy has become the most competitive option in many key applications, it could also provide a foundation for an acceleration in the development of green energy assets. This election also serves as a critical reminder for Europe, which has historically shown resilience and adaptability under pressure, of the critical need to combine a pro-green and pro-competitiveness agenda.

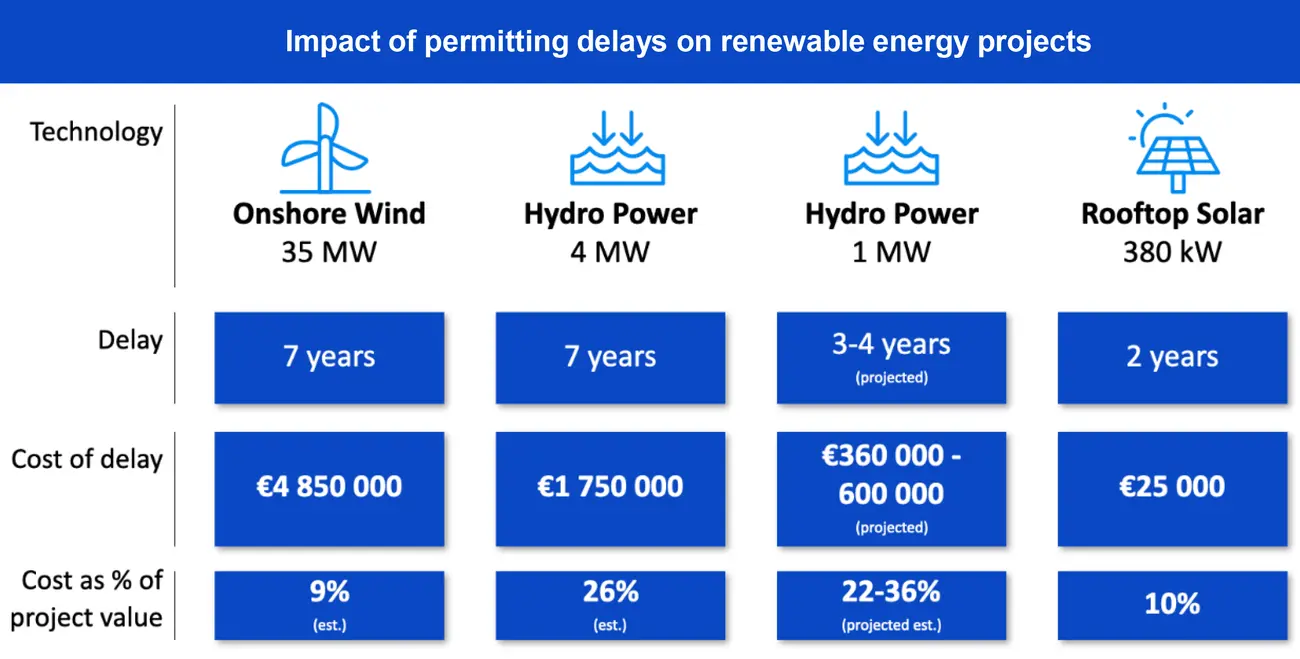

- Despite the positive momentum in clean energy investments, significant hurdles remain, particularly in infrastructure development. In the U.S., like in Europe, laborious administrative procedure for renewable energy projects can delay implementation, with both regions facing significant challenges in upgrading their energy grid to accommodate a higher share of renewables, highlighting the need for streamlined regulatory frameworks.

Source: Accenture analysis in WEF Energy Transition article « How permitting processes are hampering Europe’s energy transition, September 2024

- Emerging and developing economies (EMDEs) are poised to play a pivotal role in global climate change mitigation, as they bear the lion share in potential CO2 increase over the next decades, but are also expected to drive the future clean energy investments. With their rapid urbanization and economic growth creating substantial demand for renewable energy infrastructure, EMDEs could attract up to $5 trillion in investments7, particularly in solar and wind projects. However, realizing this potential will require proactive measures, including the establishment of robust financial frameworks, enhanced risk-sharing mechanisms, and strengthened international partnerships. 2024 saw an achievement of highly significant importance for JETPs8 with Indonesia’s plan to phase out all fossil fuel-based power plants within the next 15 years.

- The physical impacts of climate change are intensifying, with projections indicating that direct and indirect damages from physical risks could reach $1.8 trillion by the end of the century with a $300bn cost that already impact the economy9. Additionally, it is crucial to recognize that nature is becoming increasingly important in this context, as the degradation of natural ecosystems directly impacts climate risks, further complicating the challenges society faces.

- Advancement and scale-up of clean technology innovation in batteries and power grid optimisation has benefitted from the continued rapid pace of electrification. Other solutions, such as green steel, remain technically feasible but economically non-viable under current policies. Research connects this impact with global investment efforts to curb climate change.

3. The Net Zero Countdown

Pursuing innovation to meet decarbonisation targets

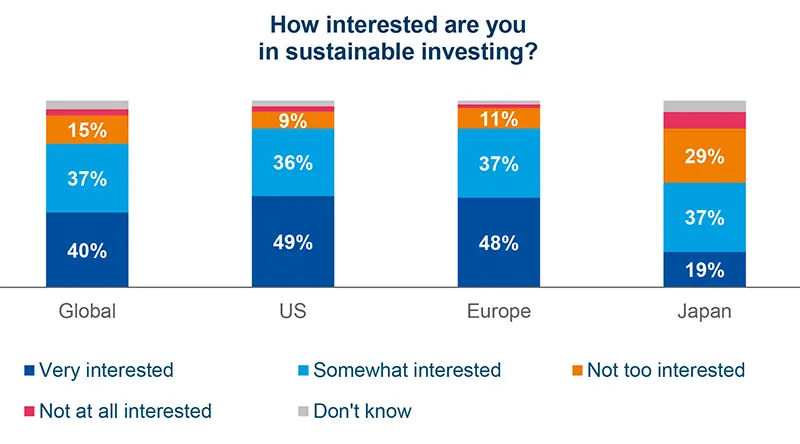

- Global demand for ESG investments is expected to remain robust, with 54% of investors likely to increase the percentage in their portfolio allocated to sustainable investment (vs. 26% decreasing)10, indicating resilience in the face of political headwinds.

Source: Morgan Stanley Institute, Sustainable Signales, October 2023 based on 1002 investors in the US, 1025 in Europe and 793 in Japan

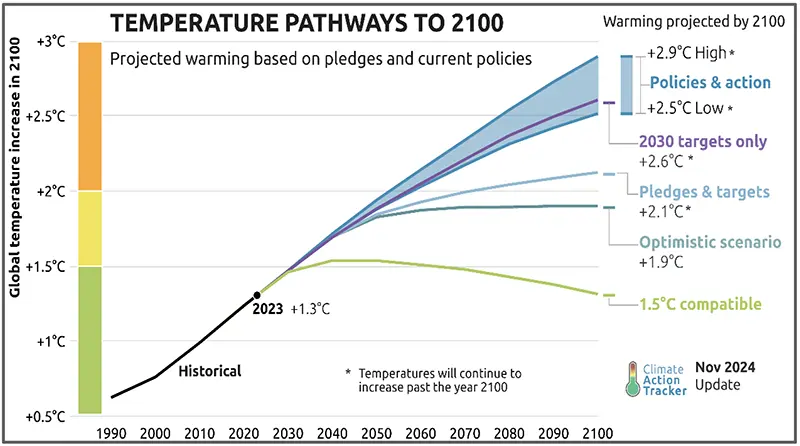

- Net Zero investors face a critical five-year period with more ambitious decarbonisation objectives to be reached by 2030. To support this ambition, the NZAOA11 and the IIGCC12 released significant updates of their respective frameworks in 2024, providing essential guidance for integrating climate risks across asset classes and emphasizing the importance of transition finance and organic decarbonization.

Source: Climate Action Tracker, temperature pathawys as of November 2024

- The financial ecosystem is increasingly integrating natural capital considerations into Net Zero frameworks, recognizing the vital interconnection between climate and biodiversity. This shift is crucial for developing comprehensive strategies that effectively address both climate change and environmental sustainability, with first guidance provided by GFANZ13 in a consultation paper.

- Investment needs to achieve Net Zero by 2050 significantly exceed the levels required by the Paris Agreement, a financing gap that cannot be met with public sector financing alone. Blended finance is standing out as a key lever to mobilize private sector capital, with initiatives like the Multilateral Development Bank Reform Tracker or the launch of an NGO-led coalition to scale conservation outcome through the use of sovereign debt conversions14, indicating a global recognition of the necessary steps to support blended finance.

- Strategies oriented towards real-world impacts are driving the development of innovative financial products, with increased investors demand for outcome-based bonds, financial product with coupon linked to project success, and impact investments, which have seen respective annual growth rates of 6% 15 and 21%16 in total volume in recent years.

- Financial tools are expanding to support the development of responsible investment and the enhancement of investors knowledge, including (i) climate stress tests to evaluate financial institutions' vulnerability to climate-related risks, (ii) transition scores that provide insights into the environmental impact of investments, and (iii) a growing focus on social and human topics from data providers.

4. Bridging Regulatory Divergence

Can client-centric approaches and increasing alignment between global players accelerate sustainable finance?

- In 2024, the EU pursued its quest for transparency, first key stone for development of sustainability frameworks, with the development of CS3D and especially CSRD covering over 50,000 companies of which 10,000 outside Europe17. While these regulations aim to improve transparency and stakeholder engagement, it also brings a new set of challenges such as technological investments and steep implementation costs, particularly for SMEs18, to meet mandatory disclosure requirements. However, transparency alone is not sufficient for reallocating capital effectively; there remains a significant gap within EU sustainability frameworks to support the development of investor knowledge and international adoption.

- Revised standards, such as France’s ISR19 label and the ESMA fund-naming guidelines, were introduced in 2024 to counter greenwashing, with a focus on fossil-fuel exclusion, with ESMA also requiring 80%20 of investments to meet environmental and/or social characteristics or sustainable investment objectives. These measures are pushing financial market participants to reorganise their offerings based on fossil fuel exclusion versus broad sector exposure. Investors are facing trade-offs between strict compliance and portfolio diversification, with RI fund performance increasingly getting tied to concentrated sector exposures. As product ranges become more polarised, it is essential for market participants to be pedagogical and transparent about the potential biases associated with investing in labeled funds, as this choice may results to divergences from benchmarks and reference indices.

- This year observed a growing regulatory divergence worldwide. The EU's leadership in sustainable finance set benchmarks globally, but divergent approaches, like the SEC in the US and other tailored taxonomies differentiated in each Asian countries, risk creating a fractured regulatory landscape. Despite international alignment efforts such as the G20 Sustainable Finance Roadmap, limited enforcement and lack of global coordination continues causing inconsistencies and compliance complexities for multinational corporates and financial institutions alike. As global climate risks escalate, momentum should build towards regulatory convergence, incorporating interoperability and building investor’s ability to implement alignment with international taxonomies.

- There is an urgent need to adopt a more client-centric approach in sustainable finance, placing the end client at the heart of the regulatory framework. Current regulations, while aiming to clarify the landscape for investors, often use complex language and concepts that hinder clients' ability to express their preferences. The policy developments need to effectively enhance consumer protection and align with the needs of retail investors, thereby reducing the knowledge gap and fostering greater accessibility to sustainable investment solutions.

- Embracing the principle of double materiality ensures that investment strategies address systemic risks and opportunities. For smaller companies and EMDEs21, these requirements pose significant compliance challenges, highlighting the need for advancements in technology and sector-specific standards to enable firms of all sizes to implement double materiality assessments. Amundi believes that this is a key mechanism to achieve sustainable returns that are both reliable and long-term.

5. Our 2025 Views in a Video

Watch the video where Elodie Laugel, Chief Responsible Investment Officer, is interviewed by Aaron McDougall, Head of Climate for ESG Research, Engagement & Voting, as they unveil our main views for 2025:

Sources

1. Amundi business intelligence based on Broadridge data as of August

2. Morningstar SFDR Article 8 and Article 9 funds reports for Q3 2023 and Q3 2024

3. All figures based on MSCI data as of 31 Oct. 2024, net results, in EUR

4. Science-Based Target initiative

5. Sustainable Debt Market Summary H1 2024, Cimate Bonds Initiative

6. IEA article “Clean energy is boosting economic growth” April 2024

7. BloombergNEF Emerging Markets Energy Investment Outlook 2024

8. Just Energy Transition Partnerships

9. Amundi analysis on direct and indirect climate-related physical risks

10. Morgan Stanley Institute analysis

11. Net Zero Asset Owners Alliance

12. The Institutional Investors Group on Climate Change

13. Glasgow Financial Alliance for Net Zero

14. The Nature Conservency press article, October 29 2024

15. All figures based on Brookings Global Impact Bonds Database as of November 2024

16. Sizing the Impact Investing Market Report, GIIN 2024

17. As per the Corporate Sustainability Reporting Directive mandate

18. Small and Medium Enterprises

19. L’investissement socialement responsable

20. European Securities and Markets Authority Guidelines

21. Emerging Market and Developing Economies