Summary

Key Takeaways

- Biodiversity is not a new topic in mining, utilities, and paper & forest products but its importance is growing

- There are already established and relatively strong practices to address biodiversity loss including site level monitoring & impact assessments

- Reporting is still in its infancy regarding a company’s impacts, risks, dependencies, and opportunities

- More work is needed to make biodiversity reporting less qualitative and more concrete and quantitative

Addressing Biodiversity in Mining & Metals, Utilities, Paper & Forest Products

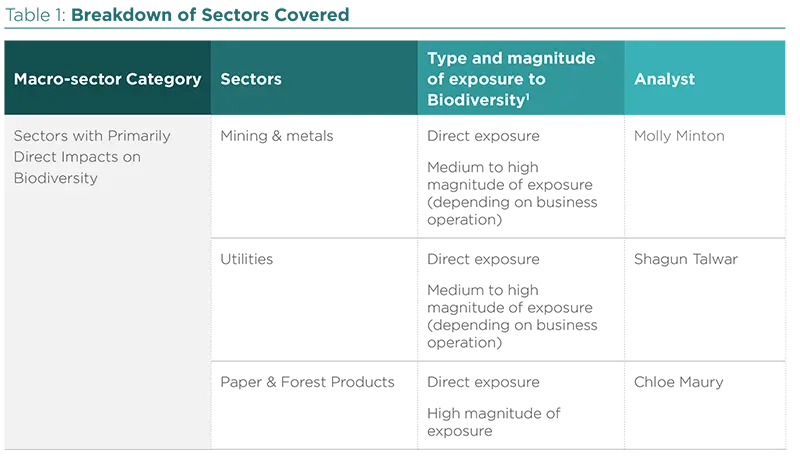

We classify utilities, mining & metals, and paper & forest products as sectors with primarily direct impacts on biodiversity as the majority of their operations happen on owned or directly managed assets.

For these sectors, there is a strong link between biodiversity and short term financial materiality. Their business models have a clear impact on the local environment and surrounding communities. Thus, business operations would not be able to continue if they did not address their impacts to local biodiversity.

Consequently, these sectors have a strong understanding of their impacts as they have a relatively clear idea of where in the world their operations primarily affects biodiversity. Where those similarities stop is regarding the current type of reporting to measure impact and progress towards biodiversity goals.

In this section, we will dive deeper into these three sectors to understand the impacts they can have on biodiversity, the risks they face from biodiversity loss, and how the sectors are managing and moving forward on the issue.

Managing Biodiversity in the Mining & Metals Sector

Biodiversity is certainly not a new topic for the mining sector, but it is beginning to have a more prominent role in its ESG strategy. The topic has always been essential to a company’s license to operate. This means that if a mining company fails to address and minimize local negative impacts, it could be subject to community protests and ultimately a shutdown of operations.

However, through our engagements, we observed that biodiversity is growing in importance with new strategies, targets, and ambitions that go beyond previously established best practices. In this section we will examine this in more detail.

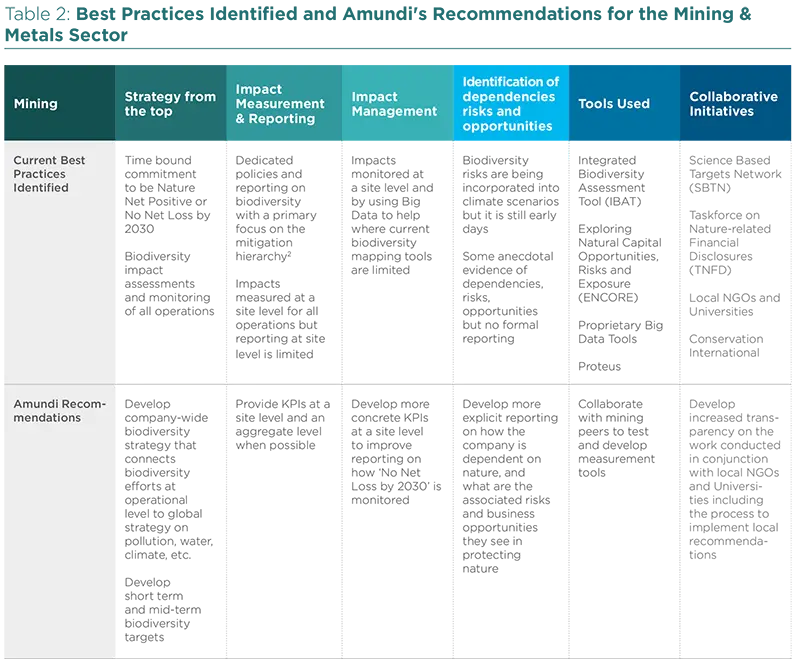

Managing Biodiversity from the Top Down

Biodiversity is a distinct subject for the sector (and not simply diffused in sustainability overall) and has strong linkages to adjacent material topics such as pollution, climate, water, and community relations. However, biodiversity strategies remain largely at the operational (asset) level including for example setting Nature Positive action plans at assets. This is understandable as large-scale mining companies have operations across the world. Every asset has a unique profile of risks and impacts based on for example, the geography, ore type, or mine type.

We observed a distinct lack of an overarching biodiversity strategy and believe that there is huge potential for this sector to develop comprehensive biodiversity strategies that go beyond individual assets and scope 1 impacts, linking to broader environmental and social strategies. Biodiversity does not operate in a silo and therefore neither should a company’s strategy.

To achieve this, board oversight on biodiversity specifically is essential. This is a best practice that we observed, but unfortunately, only one company in our study specifically identified nature as a key priority for the board alongside - and not assimilated into - other environmental topics.

Biodiversity Impact Measurement & Management in the Metals & Mining Sector

On company-wide targets, companies within the study all had some type of Net Zero/Net Positive biodiversity loss ambition (with those ambitions being translated into objectives at the asset level without any clear indication if biodiversity is being considered beyond scope 1).

It is important to note that all companies within the study were members of the International Council of Mining & Metals (ICMM). ICMM members3 must also commit to two key principles on biodiversity conservation:

- Avoid world heritage sites and respect legally designated protected areas

- Apply mitigation hierarchy with ambition of no-net-loss

Smaller non-ICMM companies may not have the same standard but net zero ambitions are clearly the benchmark for industry best practice.

We support these two principles but again encourage companies to take a more holistic view accounting for actual and potential, direct and indirect biodiversity impacts of mining. We want the strategy to be translated into biodiversity targets that link to existing environmental and social strategies including:

- Measuring the effectiveness of pollution mitigation strategies in terms of local species health

- Including biodiversity baselines into reporting on company efforts to remediate environmental spills and leaks

- Increasing reporting on the status of local biodiversity in terms of land not disturbed or land successfully rehabilitated

- Assessing and mitigating physical risks linked to climate change in terms of how it could impact local biodiversity

- Number of community grievances reported that have links to environmental degradation or biodiversity loss

We think a centralized target or strategy will also help companies to go a step further to include areas of actual or potential biodiversity impact that may not have previously had targets or fully-fledged strategies. For example, one company identified the potential biodiversity impact linked to invasive species carried via transport to ecologically sensitive regions. This is not something we have seen any mining company report on publically.

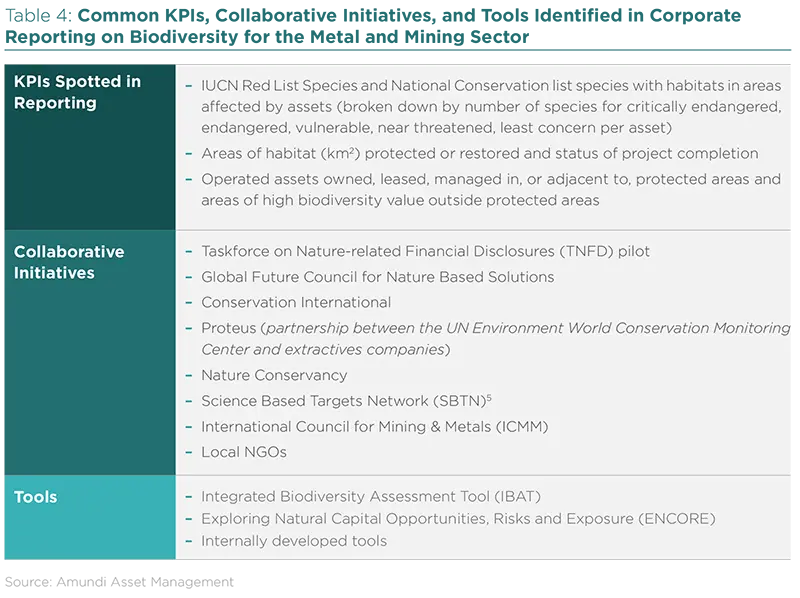

Finally, we also see room for improvement in how companies are actually tracking no net loss at an operational site. The companies within our study were already demonstrating reporting in line with the Global Reporting Initiative (GRI) such as identified IUCN4 Red List of Threatened Species and National Conservation list species at assets. However, we think that there are opportunities for companies to provide more clarity on how they actually monitor biodiversity loss comprehensively at each asset taking into account pollution control, species indexes, water tables, and climate change. For example, one mining company told us that at their mine site in North America, the best indicator of overall biodiversity health was the population of a specific species of frog. In comparison, for one of their mines in Africa, the best proxy to represent biodiversity health was the population of a type of millipede. These examples demonstrate the potential to provide investors with an interesting data point to help track biodiversity health in a high level but still insightful way.

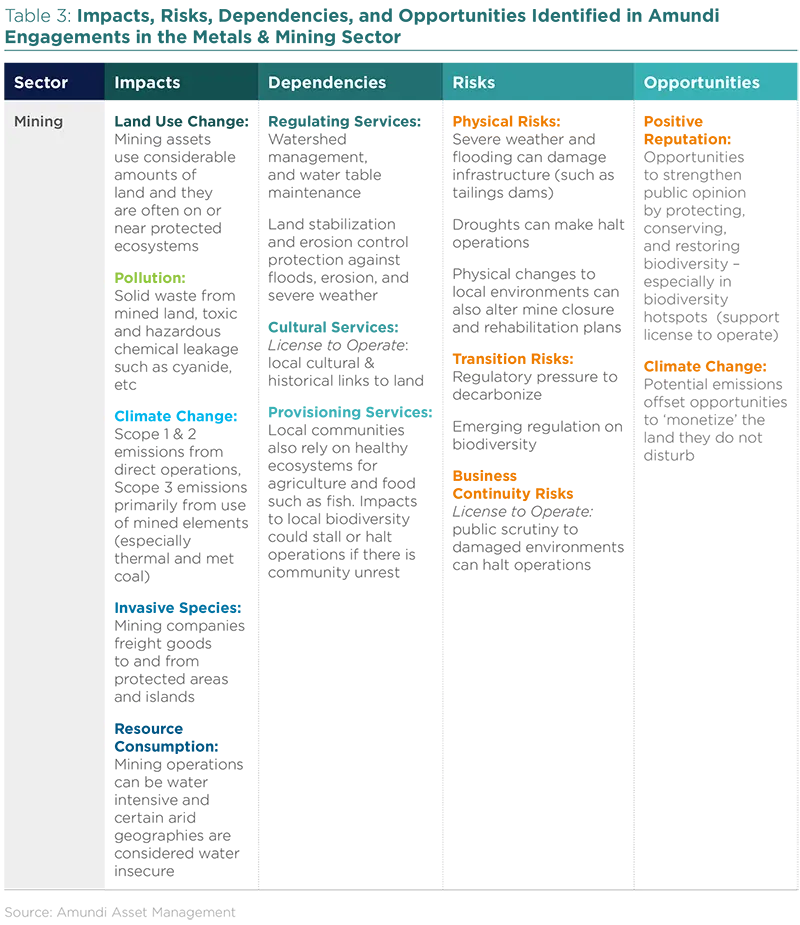

Identification of Dependencies, Risks and Opportunities

Measuring and Reporting on Risk

We see real potential for mining companies to lead the way to identify and report on risks linked to biodiversity loss. For example, one mining company mentioned that they were already trying to understand risks of biodiversity loss & climate change in terms of how it could alter mine closure and rehabilitation plans. Their plan and allocated budget today may not be sufficient in the future, if they do not take into account biodiversity risks. Thus, forward-looking risk management on biodiversity might already present significant costs savings for corporates. We encourage mining companies to develop forward-looking risk indicators and test innovative ways to account for biodiversity risk. One company even mentioned that they were in the process of looking at how to incorporate biodiversity into their climate scenario modeling. While still in early days, we see this as an exciting step in the right direction.

Capturing Opportunities

There are real opportunities for mining companies to address biodiversity loss. First, in terms of mitigation of risks as the license to operate in a region is essential to ensure consistency of operations. Thriving biodiversity will help ensure a stable local economy that likely relies on local resources such as fish, water, fertile soil for agriculture, etc.

Mining companies can play a critical role in conserving and restoring biodiversity especially if they operate near protected areas or biodiversity hotspots. We also observed companies beginning to explore the financial opportunities linked to not mining certain regions (i.e. can they ‘monetize’ the land they do not disturb). Carbon offsetting is an emerging field and presents an opportunity for certain sectors to ‘offset’ residual, hard to abate emissions. Carbon offsets have a credible role to play in meeting net zero objectives, but at Amundi we see them as a last resort option and not as a supplement to actual carbon reduction efforts.

Using Biodiversity Reporting Tools & Collaborating with Peers

To report on biodiversity, the sector overall is using a combination of established and innovative tools. For example, mining companies are using the Integrated Biodiversity Assessment Tool (IBAT), which is the ‘world’s most authoritative biodiversity data’ source that integrates three key global biodiversity datasets6. Companies are also looking into more innovative and proprietary solutions to monitoring biodiversity such as using big data. While we highly encourage this sector to lead the way by testing and developing new tools for monitoring, we also hope the sector will share resources and financial burdens with peers especially when many mining companies may operate in similar regions of the globe. This will also help ensure investors have consistent data to compare.

Conclusion

Managing biodiversity risks is an integral part of the mining sector as they can and must restore and preserve nature to keep their license to operate but also there direct operational risks to their business if they do not protect nature, such as flood protection and drought prevention. Thus, the mining sector is clearly more developed on tackling the topic of biodiversity loss overall, and there are vast opportunities for the sector to continue to lead the way on how to effectively measure, manage, and report on biodiversity. This is a way to not only better account for biodiversity risks and opportunity associated with operations, but also to help lead the way for other sectors.

Case Study: Interview with Molly Minton, ESG Analyst, Mining and Metals

Q: What was one company in your engagement study that you want to highlight?

A: Overall, our sample in the mining sector demonstrated strong management and understanding of biodiversity as a topic but a few things about BHP stood out from the rest. Like many companies in the sector, BHP has a No Net Loss strategy for biodiversity. While many companies have simply set it as an ambition, BHP has set a timeline to be net zero biodiversity loss by 2030, which is in line with the Convention of Biological Diversity’s timeline to halt biodiversity loss and restore biodiversity by 2050. Like other companies, BHP is monitoring biodiversity at the site level using tools such as IBAT. They also collaborate with both large and small groups such as local NGOs and universities and large institutions such as TNFD that are working to tackle the issue of biodiversity loss.

Q: What was particularly interesting about BHP?

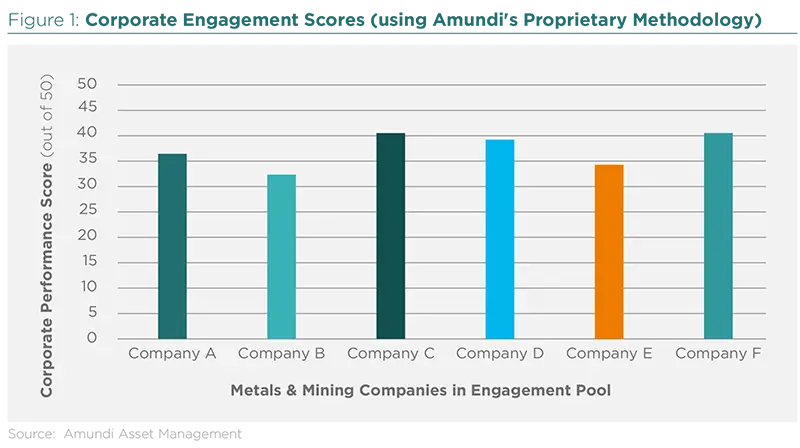

A: A few things are particularly interesting about BHP that made them stand out. First, BHP demonstrated stronger board oversight and CEO engagement on the issue of biodiversity loss. We found that companies who scored the highest have strong top down support that has led to a stronger management of the topic.

Second, as mentioned above, BHP has gone beyond an ambition of No Net Loss by setting a time bound target to 2030. This makes their biodiversity strategy more concrete and in line with emerging international standards. While we hope to see concrete KPIs soon to back up this target, we still see the 2030 timeline as a great first step.

Thirdly, BHP was the only company that mentioned some type of intention to begin incorporating biodiversity into their climate modeling scenarios. We expect companies to start understanding the risks that they could face if biodiversity loss is not managed adequately. Quantifying these risks is arguably a difficult task; however, we encourage companies to not be afraid of testing, innovating, and experimenting. It is the only way we will be able to better understand such a complex issue and hopefully, find solutions along the way.

Q: Any recommendations for improved practices?

A: Absolutely, there is long way to go to restore biodiversity and halt its loss. First, we want companies to develop an overarching strategy on biodiversity, not just No Net Loss at an asset level. This will help companies better understand how their company affects and depends on biodiversity and ensure there are no gaps in the management of the topic. The topic of biodiversity overlaps with climate, water, and pollution so an effective biodiversity strategy should not operate in isolation. Second, we want companies in this sector such as BHP to not be afraid of experimenting and testing on how they understand, manage, and report on biodiversity. What we ask for is transparency. We know this topic is complex and we support companies who report on what is possible now while building up overtime as newer tools, resources, and research become available. What is important is that companies provide us with a clear roadmap on where they are now and where they want to go.

Better understanding on how a company’s actions impact and depend on biodiversity - and the associated business opportunities - will help companies not only be more sustainable for the planet but also ensure the sustainability of the business long-term. Furthermore, this type of information is useful for us as investors to understand which companies are best prepared to manage biodiversity loss and restore biodiversity.

The above case study was based off a 2021 engagement. It is important to note that in 2022 BHP launched short-term milestones on their healthy environment goal which include publishing context-based water targets, completing biodiversity mapping for all land and water areas, and establishing “nature positive” asset plans to work towards their 2030 goal.

Utilities and Managing Biodiversity

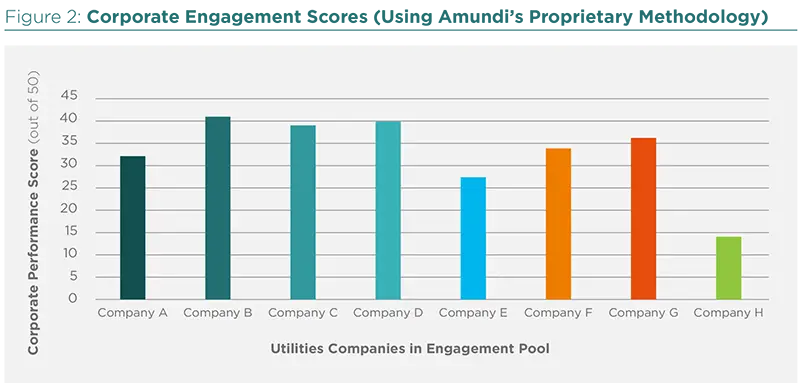

Overall, the utilities sector has strong awareness on the importance of biodiversity though there is significant heterogeneity in practices among issuers in our sample. Our set of engaged issuers varies by asset type and geography (including some with a sizeable global footprint); and European peers often perform more strongly than others based in a different geography or where regulations are weaker (reinforcing the importance of the same).

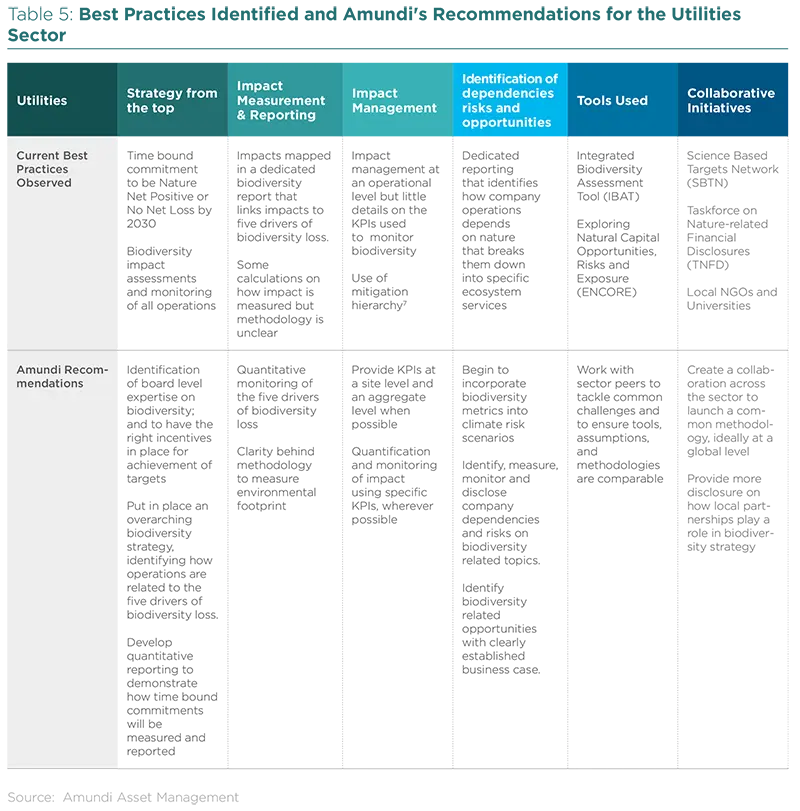

Managing Biodiversity from the Top Down

Typically, a biodiversity policy will sit within the environmental policy of an issuer, but the depth and detail of the issue varies across our sample. Heterogeneity is found across the analysis and management of biodiversity related risks, impacts, dependencies and opportunities. The strongest performers in the engaged set have dedicated policies and reporting on biodiversity that reference the mitigation hierarchy, and demonstrate an initial mapping and understanding of the five drivers8 of biodiversity loss within their strategies. These companies also have clearer identification and mitigation strategies of risks and impacts (albeit mostly qualitative in nature). The strongest practice also includes addressing the issue of biodiversity through all stages of a project lifetime and not just in one stage for example, a pre-project impact assessment. Another strong practice includes policies that are developed on basic principles for the company’s operations, but departments have the option to build on top of these policies. For example, the offshore department can develop its own policies on top of the core central policy.

A few areas of improvements that we identified were:

- Identification of expertise, and training, of the board in the matter. Subsequently, how the achievement of biodiversity related goals and targets are incentivized.

- How to integrate biodiversity related elements into the overall decision making process.

- Identification of risks, dependencies and opportunities is still in its relative infancy.

- Quantification of different elements is often missing – measurement, monitoring and disclosure of risks, opportunities, dependencies and impact.

The sector still lacks an overall systematic integration of biodiversity into company disclosure with measurable targets, when possible on key drivers.

Biodiversity Impact Measurement & Management in the Utilities Sector

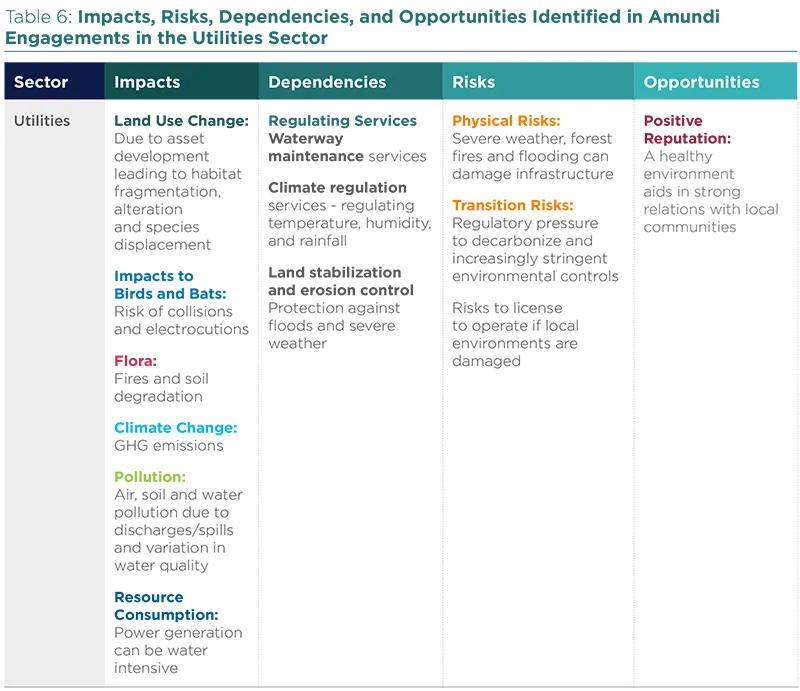

Like other sectors in this category, the utilities sector has a fairly clear idea of the impact of their operations on biodiversity, geographically, by asset type and stage of lifetime of the asset. All issuers have some kind of action plan (sometimes pretty innovative ones) in place and many have associated strategies and procedures to measure, monitor and address impacts at site level.

Impacts can be both direct and indirect in nature depending on the kind of assets and projects a company has. Biodiversity impact assessment starts at planning phase of a project during which actions are put in place to mitigate and manage the impact. As mentioned above, impacts need to be monitored and managed through the different stages of a project lifetime. Typically, we will be able to see what kind of major impacts a company has identified and what mitigation strategy they have deployed/put in place. However, what is often missing is the quantitative monitoring and results of these mitigation actions. One of the strongest practices we see is corporate analysis performed on company impacts with relation to each of the drivers of biodiversity lossi. Three main criteria identified for measurement were importance, control level and room for improvement, each ranked on a scale of low, moderate, high and very high. Further, there was extensive reporting of biodiversity projects including country of operation, main goal of project, asset concerned, description of activities, objectives and IUCN Red List species affected by project.

Consequently, we would encourage all issuers to adopt quantitative measurement, monitoring and disclosure of the company’s impact on all, or those most relevant, drivers of biodiversity loss.

Setting Biodiversity Targets and Goals

Most issuers deploy the principle of no net loss, principle of conservation and where possible, net positive/gain. However, we have a mixed bag with regard to quantification of targets, where sometimes these are missing, and sometimes companies have numerous concrete and measurable targets with associated timeframes in place. A number of companies in the sample state that they were awaiting the methodology for Science Based Targets for Nature (SBTN) to be finalised so that they could use that as a base to set appropriate and ambitious targets. It would be useful for investors like ourselves to have more clarity on the rationale behind set goals/targets, action plans, metrics/KPIs, measurement, monitoring etc. Additionally, information that would be useful is on the strategy that will be deployed to achieve the same. Disclosure and monitoring of asset level targets are also useful to give more color to the issue. For example, one of the companies we spoke to was working on furthering the company’s efforts to preserve a river mussel at an endangered dam. Other projects were the conservation of a butterfly species by relocation and plantation of the required flower as well as the conservation of a certain species of mussel by growing them in a fishery and releasing them into the river. A majority of companies in our sample have targets related to one or multiple biodiversity adjacent topics like climate change.

Identification of Dependencies, Risks and Opportunities

Often, companies view risk in a unidirectional manner i.e. the risks that company operations pose to the environment and biodiversity, which is essentially captured under impact. However, risk is a bidirectional issue, that is the company’s impact and risk towards biodiversity as well as biodiversity related risks that are material to the company. Risk assessment should happen at two levels– the first is at global/company level and the second is at site level (since each site has its unique environmental risks). The topic of risks is not as extensively or robustly understood or disclosed as that of impact.

Only a few issuers in our sample have started to identify biodiversity related risks to the company however, these are not always addressed in a robust or systematic manner. The risks identified include physical, transition, litigation, reputational, and systemic. We have one major hydro player that clearly identifies water and its associated ecosystem services, such as water provision, as the most material dependency and risk, given its business model. We also have a Transmission and Distribution (T&D) company state that they have a bidirectional risk view and that risks to the environment are identified under the risk identification and management process, and constitute a significant percentage. Within this, the risk to biodiversity is identified. However, at this stage the assessment is qualitative given lack of data around biodiversity. Another T&D player mentioned risks related to biodiversity as reputational and financial (primarily linked to community opposition leading to a delay in approvals and project implementation). Similar to impact, risk management depends on multiple factors including, but not limited to, asset type, geography and different phases of a project lifetime (construction, operation, decommissioning); and should be assessed accordingly.

The topics of dependencies and opportunities are found to be in their infancy. We have very few companies identify biodiversity related dependencies and opportunities with a clear business case. The strongest performer in this segment is a utility with large hydro operations that identifies both a dependency, and opportunities, related to water provision. Another company identifies dependencies in the form of stakeholder relations and reputational capital (albeit these are identified as ‘indirect’ and it was mentioned that there were no direct dependencies since the company does not generate revenue from biodiversity related activities). Another said circular economy, local communities, and better resource use were opportunities. However, in a majority of cases for when issuers do identify dependencies and opportunities, these are mostly qualitative in nature (and not with a clear business case as mentioned above).

A number of issuers in our sample say that they have joined hands with peers to study biodiversity related dependencies and opportunities but these projects are either a ‘work in progress’ or studies that were ready, but not publicly disclosed yet, in which case we have requested them to share the research/study once it is ready.

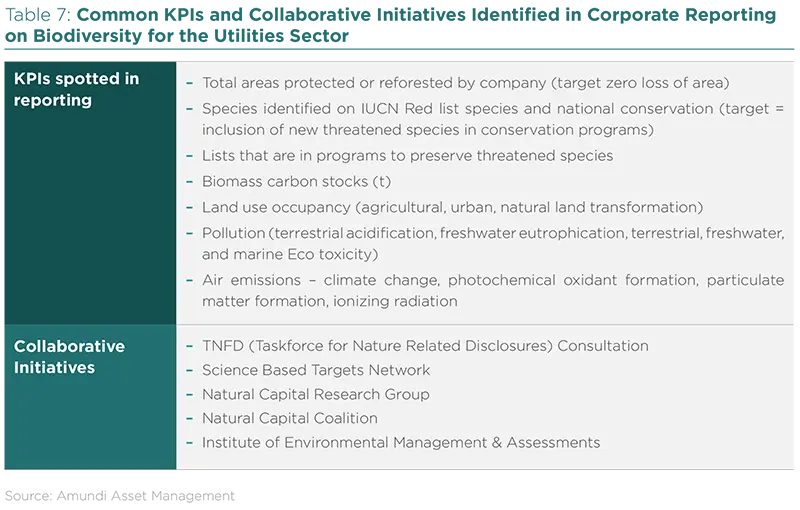

Using Biodiversity Reporting Tools & Collaborating with Peers

We observe an increasing amount collaboration between industry peers as well as with universities, associations and NGOs. Companies often use IUCN species lists and are either part of the TNFD consultation or following associated developments closely. Some companies are also considering setting Science Based Targets for Nature (SBTN). A few utilities we spoke to also have in-house tools to measure and manage their impact on biodiversity and are working on pilot projects to test various methodologies, both internal and external like STAR, GloBio etc.

Conclusion

The utilities sector is consistent in recognizing that biodiversity is a material issue and that the sector has a significant impact on it from direct operations. Risk identification is not comprehensive and primarily on the qualitative side, with most companies having received feedback to strengthen and quantify the risk modeling and establish baseline scenarios. For most companies the understanding of dependencies and opportunities is still in early stages as well. However, we observed encouraging signs that work is being done in this regard. Most issuers have the principle of no net loss or net positive in place, oftentimes within defined timeframes, but quantitative targets are missing. We are also seeing increasing collaboration on the subject with other industry peers and institutions. Overall, one big takeaway and recommendation from the campaign is that of the need for quantification. Finally, it is important to remember and reinforce that having the right policies and processes in place is critical, but implementation of these is vital as well. There were issuers in our sample that are currently facing biodiversity related controversies, including some of the stronger performers.

Case Study: Interview with Shagun Talwar, ESG Analyst, Utilities

Q: What was one company in your engagement study that you want to highlight? What are they doing on biodiversity currently?

A: Enel is positioned strongly on the topic of biodiversity and was the highest scorer in our sample. The company takes a holistic view in terms of strategy, policies, procedures and reporting. A dedicated biodiversity policy plays a central role in the overall Environment Policy and the company has established internal procedures containing detailed guidelines for different stages in a project’s lifetime. Mitigation hierarchy is deployed with respect to biodiversity and Enel works on a principle of no net loss and where applicable, net positive. However, this principle now needs to be translated into time-bound and quantitative targets. For the last two years, Enel has been working on defining goals. The company has created a matrix to measure impact and is in the process of defining KPIs in order to define targets further. However, the company has set (or already achieved) many targets on topics adjacent to biodiversity, such as climate change.

Q: What was particularly interesting about Enel?

A: Two elements that were especially interesting and useful, which I would encourage other industry peers to incorporate, are:

- Corporate analysis performed on company impacts with relation to each of the drivers of biodiversity loss. Three main criteria have been identified for measurement that include importance, control level and room for improvement, with each ranked on a scale of low, moderate, high and very high.

- Clear description of risk assessment process and the main risks for biodiversity identified.

Additionally, Enel reports extensively on biodiversity projects including country of operation, main goal of a project, asset concerned, and description of activities, objectives and IUCN Red List species affected by project. The company is one of the only two companies in our sample that was participating in the TNFD consultation. Enel aims to set Science Based Targets for Nature (SBTN) in 2022, in line with the guidelines set by the SBTN9.

Q: Any recommendations for improved practices?

A: Feedback was communicated to all companies in our sample on how to improve their practices, including Enel, who was our strongest performer. Primary feedback to the company was on further quantification of all aspects. Key recommendations we extended to Enel included:

- Quantitative monitoring and disclosure of the company’s impact on all, or those most relevant, drivers of biodiversity loss.

- Quantification of modelled risks and baseline scenario identification related to biodiversity.

- Comprehensive identification of company dependencies on biodiversity.

- Disclosure with respect to information on opportunities identified with relevant business case in place.

- Principle of preservation is already in place but quantitative targets should be set.

Update: An analysis carried out in 2021 led to the introduction of a series of new quantitative and qualitative indicators in order to measure the pressure and potential impacts generated by Enel’s activity. We further engaged with Enel in 2022 to understand if there had been any changes or improvements on the subject. The company communicated that it is now working on time-bound and measurable commitments. Furthermore, they are focusing extensively on land use (one of the five drivers of biodiversity loss). The company has mapped the Presence of Enel power generation plants in protected areas as a percentage, which stands at 2.4%. The next step for the company will be more in-depth and comprehensive habitat classification. Enel is also studying and testing to incorporate the second version of the TNFD beta framework that includes guidance on metrics.

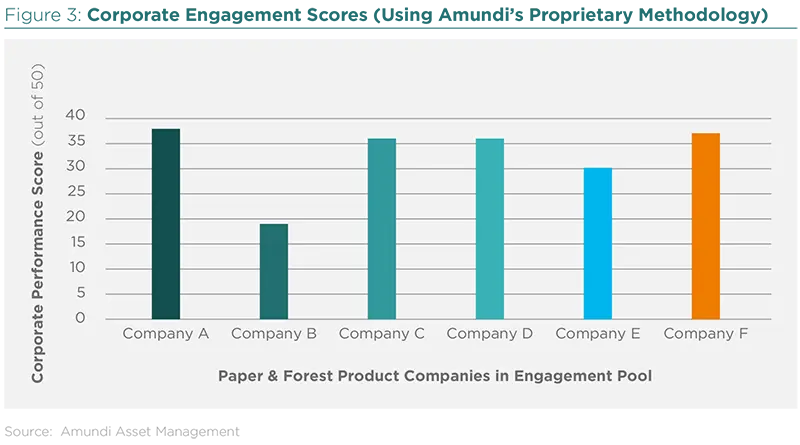

Tackling Biodiversity Loss: A Must for Maintaining a Strong and Healthy Paper & Forest Product

Considering that this sector directly pulls value from nature via the paper and forest products they produce from trees, the sector is overall advanced on understanding the subject of biodiversity. There were geographic biases within the sector, but these biases also occurred within companies. Companies who managed forests both in the northern and southern hemisphere demonstrated, in general, stronger practices for forest management in North America or Europe compared to Africa or South America due to differences in regulation. For example, the Forest Stewardship Council (FSC) certification assesses company forestry practices against local regulations meaning strength of biodiversity protections within companies can vary drastically.

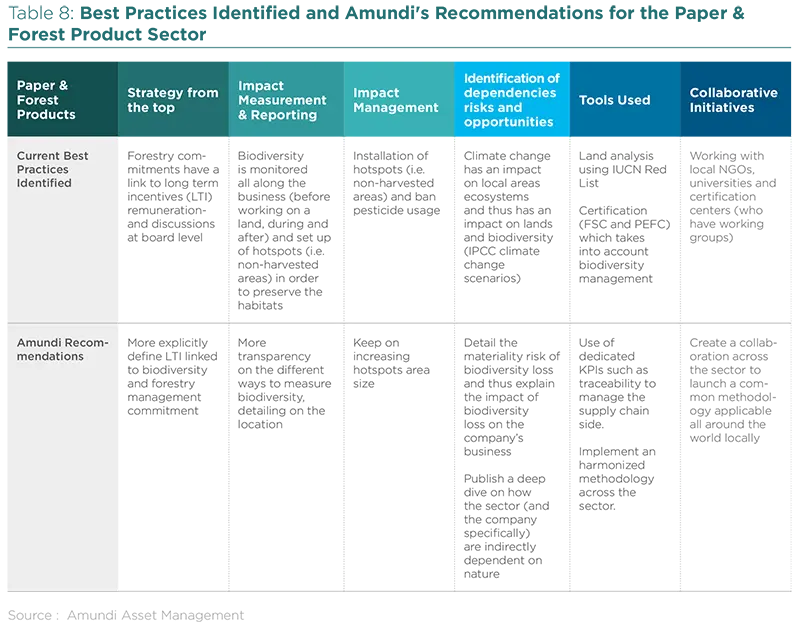

Top Down Strategy on Biodiversity

For the Paper & Forest product sector, the biodiversity strategy is largely integrated into their forest management policies and strategies. While responsible forest management is clearly the key priority topic for the sector within the biodiversity umbrella, the explicit links to biodiversity are lacking including how the company’s actions holistically impact biodiversity loss (i.e. pollution, water consumption, climate change, in addition to responsible forestry). Companies lack of public communication on their biodiversity management.

Biodiversity Impact Measurement & Management in the Paper and Forest Products Sector

Measurement and management of biodiversity is part of the day-to-day management of forests. It is something that is somehow implicit, as it is a key element of strong forest management if companies want to keep their lands in good health. To do so, biodiversity is assessed at the acquisition of new lands as a starting point and during the management of this land to better monitor the impact of the business. Besides, with the aim to preserve local ecosystems and finally biodiversity, managing forests implies the set-up of hotspots, which are non-harvested areas. This has a positive impact on the preservation of habitats, as well as the ban of pesticide usage. Moreover, we may notice a rising number of companies aiming at being net positive on biodiversity. Some are even willing to restore the some specific species and work on species preservation thanks to collaboration with third parties, for instance local universities.

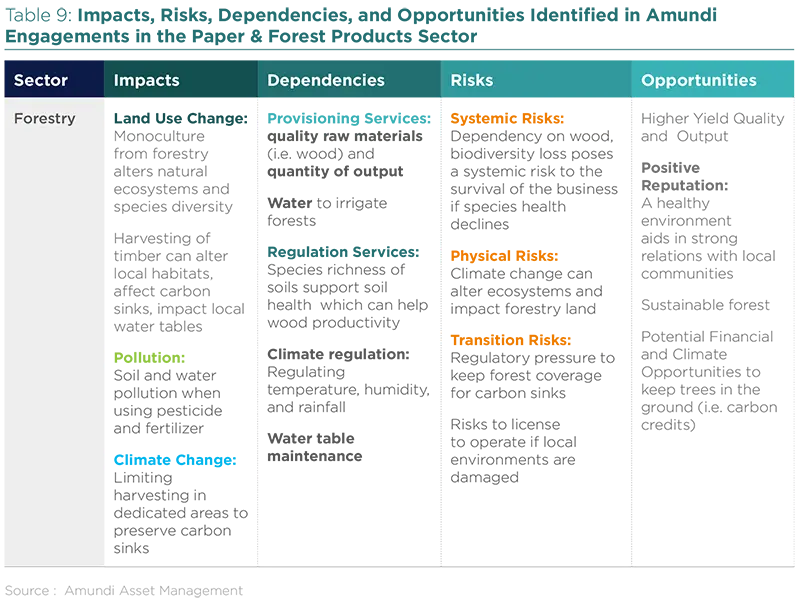

Identification of Dependencies, Risks, and Opportunities

The exposition of biodiversity loss risk is taken into account since it is part of forest management. Thus, the sector depends on biodiversity preservation if they want to continue managing their own lands. The benefits of biodiversity preservation are the good quality of raw materials (here wood and fiber) and maintaining the quantity of wood harvested. Moreover, invasive species also have the potential to cause extensive ecological impacts on trees. As a consequence, the quality of the environmental services that trees provide (water and air filtration, and oxygen production for instance) can be greatly impacted by invasive species. In the end, it remains necessary for companies to manage and prevent these threats. The good quality of forests and wood is a business opportunity in itself, which means a high connection between risks and opportunities.

Another specificity of the risks the sector is exposed to is climate change since biodiversity preservation is correlated to biodiversity. Companies are hardworking on climate scenarios and on their impact on companies land since any climate difference has an impact on biodiversity. Some species can disappear or proliferate and consequently impact negatively forests and land.

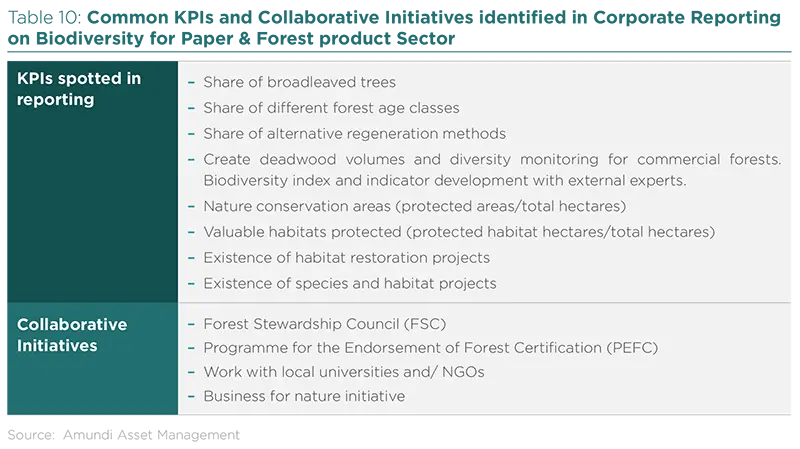

Collaborating with Peers

Most companies have their own internal methodologies to measure biodiversity and the company’s impact on their own forests. The most common tools are species assessments using IUCN Red List and the surface of non-harvested areas. There are some other tools counting the different species living on land and measuring any changes if there is any pollution on soil and water. In order to help companies to improve these tools, companies collaborate with NGOs and local universities, with WWF for instance. It is to note that suppliers are also assessed with the help of certification programs such as the one delivered by the Forest Stewardship Council (FSC) and the Program for the Endorsement of Forest Certification (PEFC) taking into account biodiversity management. Some other companies impose a dedicated policy on forest management that suppliers have to respect.

Conclusion

The Paper & Forest product sector’s dependency on biodiversity is clear and companies demonstrate a wide variety of practices to manage the impacts to local biodiversity such as measuring and monitoring biodiversity on managed lands, eliminating or reducing the use of pesticides and fertilizers, FSC certification and keeping a large percentage of managed land as protected, natural areas. Protecting biodiversity helps ensuring that forests are always regenerated. Despite this, more details are still needed on the methodologies and tools used to directly manage biodiversity. Furthermore, a uniform set of indicators amongst companies would help better indicate standards of best practice within and across certain geographies. For example, FSC certification is achieved if companies follow local forestry regulations however; those practices still differ between geographies. Clearer reporting guidelines for the sector will help ensure that all companies are meeting the same requirements. After all, systemic risks to forestry such as forest fires, invasive species, and land use change, impact all companies. Further collaboration on reporting standards will help companies ensure that they are collectively addressing impacts they can manage, and aid investors to ensure companies are reaching the same standards.

Case Study: Interview with Chloe Maury, ESG Analyst, Paper & Forest product

Q: What was one company in your engagement study that you want to highlight? What are they doing on biodiversity currently?

A: Knowing that overall the industry has a clear and dedicated approach on biodiversity management, UPM appears to be the most transparent on this matter. Their strategy is clearly defined and managed at board level, which ensures that biodiversity is part of the overall growth strategy of the company. Besides, the company provides significant granularity in their biodiversity reporting regarding how they monitor biodiversity and the concrete examples. For instance, the company measures the share of broadleaved trees in UPM-owned forests in Finland and the number of habitat restoration and biodiversity projects in UPM-owned forests in Finland.

Q: What was particularly interesting about UPM?

A: What is particularly interesting is that UPM is one of the most advanced companies on biodiversity management that we have met during the first year of engagement. They have a dedicated team in charge of biodiversity with biologists. The team is in charge of biodiversity projects and developing management practices. All field personnel is trained to differentiate the various types of managed lands such as protected forests, natural forests and managed forests. Moreover, in the process of preserving biodiversity, UPM operates forests with natural tree species in Finland and also monitor its impact on water. The ambition of the company is to be net positive on biodiversity. This is a strong commitment from the company that implies efforts from its part in terms of internal and external resources considering the surface the company has to manage. UPM has strong processes in place and is on the right path on reaching this objective.

Q: Any recommendations for improved practices?

A: Most of the company’s communication is focused on the management of Finnish forests. It would be interesting to see what the company is doing in other regions of the world since part of their activities are located in the US and in Uruguay. It would be useful to better understand how their practices differ in other geographies since biodiversity management cannot be one-size fits all as biodiversity differs from one area to another, from one tree species to another, from one legislation to another etc. This is why we recommend UPM to disclose biodiversity monitoring for all their business locations, including the United States and Uruguay, and disclose the same level of data as they do for Finnish forests. Besides, we wish to see the company sharing some of its good practices and be a leader on the matter.

Conclusion

The sectors metals & mining, utilities, and paper & forest products all demonstrate a strong understanding of nature related impacts and the materiality of the topic of biodiversity. While awareness of the issue may be relatively mature for most companies, there is still more work to be done to raise the standards of best practice including measuring, managing, and reporting on biodiversity relates risks, impacts, dependencies, and opportunities. We look forward to following their progress and expanding the engagement pool in years to come.

For more insights

This article is part of the series “Biodiversity: it’s time to Protect our Only Home”. To learn more about this theme, please click below on the following article.

Biodiversity : It’s Time to Protect Our...

Sources

1. Observation is based off of sources including ENCORE, BCG, engagement calls, and analyst assessments.

https://encore.naturalcapital.finance/en

https://www.bcg.com/fr-fr/publications/2021/biodiversity-loss-business-…

2. For key stages of the mitigation hierarchy for mining: Avoidance (avoiding critical habitat areas), minimization (reducing impacts to enable species to continue to normal behaviors in area), restoration (reduce residual impacts of a project as much as possible), and offsetting (seeking conservation gains of the same value in other areas to balance out impacts)

3. https://www.icmm.com/en-gb/our-principles/mining-principles/principle-7

4. International Union for Conservation of Nature

5. At the time of our interviews, only one mining company was involved in SBTN as they stated the mining perspective is quite different than other members

6. IUCN Red List of Threatened Species, World Database on Protected Areas, and World Database of Key Biodiversity Areas

https://www.ibat-alliance.org/the-data?locale=en

7. For key stages of the mitigation hierarchy for mining: Avoidance (avoiding critical habitat areas), minimization (reducing impacts to enable species to continue to normal behaviors in area), restoration (reduce residual impacts of a project as much as possible), and offsetting (seeking conservation gains of the same value in other areas to balance out impacts)

8. Climate change, land use change and deforestation, over consumption of resources, pollution, and invasive species (See part 1 for more details)

9. https://sciencebasedtargetsnetwork.org