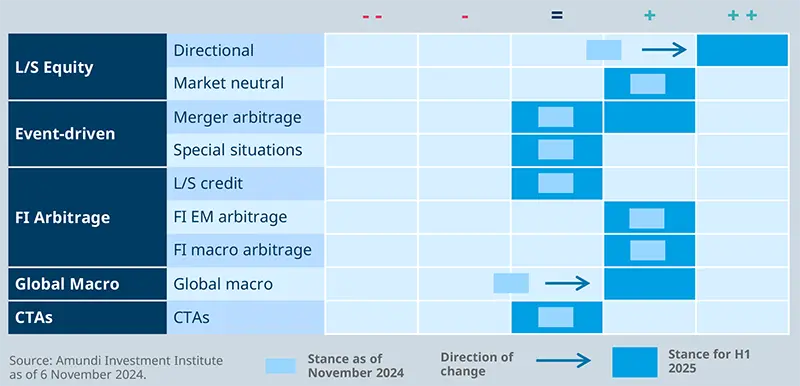

Infrastructure is favoured due to the energy transition; private equity is recovering; private debt is benefiting from strong bargaining power; the real estate market has stabilised.

Against a backdrop of mildly decelerating economic growth, weakening domestic demand, and interest rate cut expectations, the private market and real estate asset classes can offer relatively attractive investment opportunities as well as risk and return diversification.

We favour infrastructure investment due to its strong growth outlook and steady cash flow. Although volumes remain lower than a few years ago, the market is active Lower interest rate expectations are supporting activity, while the energy transition will drive growth in the years ahead. Governments are supportive of private capital, as it is needed to complement public funding in building renewable energy infrastructure, meeting transport electrification targets, and digitalising activities, as well as supply chains.

Turning to private equity volumes are progressively ticking up, helped by interest rate cuts, while pricing has stabilised. Trading is taking place in high-quality, non cyclical sectors (eg business services, healthcare, and software areas). These are profiting from strong structural growth, pricing power, and robust cash-flow generation. Meanwhile, high valuation multiples in the listed market ensure that the private market’s relative valuation levels are offering more attractive entry points than they were a year ago. As regards private debt, companies are still benefiting from strong bargaining power in negotiating lending contracts, partly due to bank financing remaining constrained albeit this constraint has eased somewhat over the last six months.

Concerning real estate, the outlook for 2025 is more attractive than it was for 2024. Although investment turnover in European commercial real estate is still low, it has increased year-on-year over H1 2024. This was helped by the repricing that had taken place In particular, we have seen signs of stabilisation in prime real estate yields and expect the year-on-year investment volume growth achieved earlier this year by this sector to persist in 2025. However, we anticipate that it will not reach the 2021 level, and the market should remain very segmented. In the leasing sector, rents should benefit from the relatively scarce supply of the most sought-after assets: conversely, the rent outlook for non prime offices is weak. Finally, ESG issues are key, and investors are factoring these into investments’ cash-flow forecasts.

FIGURE 1: Private markets views for H1 2025

Source: Amundi Investment Institute as of 6 November 2024.

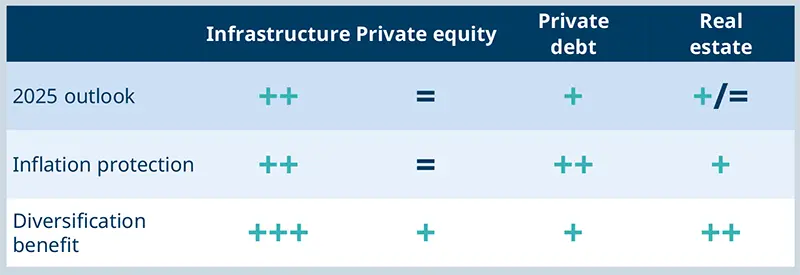

Hedge funds: rising alpha opportunities

The hedge fund (HF) industry delivered 7% year-to-date (HFRI Fund of Hedge Funds Model as of September 2024), with healthy alpha generation. HF also remain an attractive source of diversification

The current phase of the cycle, essential for identifying the sources of future alpha, will influence the preference for various hedge fund strategies. An exceptionally polarised combination of positive factors - such as robust macro liquidity and a low risk of recession - exists alongside anomalies and tail risks, including elevated valuations, fiscal challenges, and geopolitical tensions. This situation suggests a cycle phase characterised at the same time by a series of shocks, resulting in brief economic phases and some features of an early cycle.

Alpha is likely to remain abundant in Long/Short (L/S) equity, supported by a broadening in stock markets, low stock correlation, and an increased focus on companies’ fundamentals Alpha potential could be constrained by lower dispersion though. We believe investors should add directionality, rebalancing L/S neutral with a more L/S diversified bias.

The Merger Arbitrage strategy is likely to unleash greater potential under the new Trump administration. Easier regulations, more tax and business-friendly corporate policies, resulting in greater corporate activity, would provide impetus Cheaper European targets are likely to lure increased interest as well.

Amid elevated equity valuations, healthy liquidity and benign credit conditions, carry within credit remains appealing. L/S Credit HF provide an appealing gateway at affordable risk. We would move the cursor in favour of EM-focused managers at the expense of DM-focused, where valuation and dispersion now provide more limited alpha opportunities.

Multiple cycle inflections and frequent investor scenario reassessments in recent months have been challenging for Global Macro. With monetary easing having started, moderating macro uncertainties, and a focus on more traditional growth drivers, the backdrop is becoming more favourable for Global Macro, which has been revised up while staying neutral on CTAs.

As we move to the next phase of the cycle, alpha engines should turn gradually. We would make room for more directionality in L/S Equity and EM L/S Credit, with a Global Macro revival.

FIGURE 2: Hedge fund views for H1 2025