Summary

CIO letter

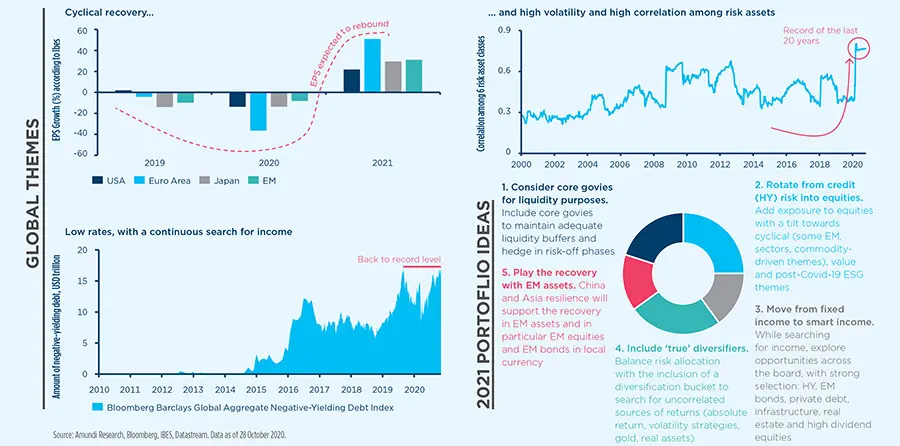

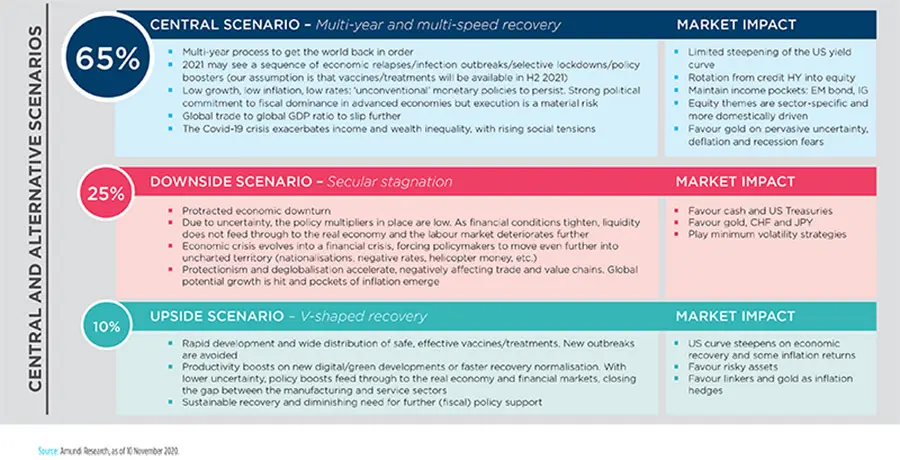

The Covid-19 pandemic drove an unprecedented collapse in economic activity in H1, which was followed by a desynchronized rebound. The recovery phase has been uneven, with the virus cycle dictating the sequence of it. We believe that the damage to the global economy will last well beyond 2021. Output and personal income losses, the rise of inequality and the disruption in some sectors will be the legacies of the pandemic. Expecting that a vaccine will cause these to dissipate within a few months is too optimistic. Expectations of additional fiscal and monetary measures will continue to mount in the coming months amid possible virus relapses. This will drive sentiment in financial markets, in line with the ‘bad news for the economy, good news for the markets’ narrative that saved the day for investors in the dramatic year of 2020. The performances of risk assets rebounded strongly amid the policy support. However, investors in a traditional balanced portfolio experienced a doubling of volatility compared with the previous decade, a nasty drying up of market liquidity and an increased correlation among risk assets. These features will affect portfolio construction in 2021 and beyond. We see five investment themes to play in 2021 at portfolio level. From a cross-asset perspective, a rotation from credit (HY) into equities. Equities will likely have a better risk-return profile than high yield in a phase of mild recovery and earnings re-acceleration in 2021. Investors should add exposure to cyclicals stocks, quality value and post-Covid-19 ESG themes. We believe old-fashioned geographical diversification will come back into focus, thanks to global trade no longer driving global growth, the repatriation of value chains and the desynchronization of cycles. At the same time, sector discrimination will become even more evident, providing additional diversification opportunities. Move from fixed income to smart income. With the amount of negative yielding debt close to historical highs and interest rates expected to remain low in the short term, investors should build an income engine by searching for opportunities across the board, including emerging market bonds, private debt, loans, real assets (infrastructure, real estate) and high-income equities. Opportunities in credit markets remain, but the big theme for 2021 is what we call ‘the great discrimination’. What is sound and expensive will become even more expensive. Some areas of the market will likely deteriorate further, as the abundant liquidity injected by central banks is hiding weakening fundamentals. Selection will be key in 2021. Consider govies for liquidity. Investors should consider allocating a portion of their portfolio to core government bonds, regardless of their valuations, primarily for liquidity reasons in case there are phases of liquidity shortages. Play the recovery through emerging markets assets. In a still highly uncertain virus and economic cycle, the Chinese and Asian economies are emerging as the most resilient, having been able to effectively manage their outbreaks. So far, China has been the only country to recover to its pre-crisis GDP level. The outlook of EM countries in LatAm should also improve through 2021 as the virus cycle is improving in this area. These trends should support EM regional themes and EM bonds in local currency. Include ‘true’ diversifiers. In a world of high correlation among risk assets, adding uncorrelated sources of returns may help balance the allocation. Absolute returns approaches, volatility, hedging strategies and gold may help improve overall portfolio diversification, as well as real assets, private markets and insurance-linked securities. Those asset classes show a lower correlation to traditional asset classes, and some, like real estate and infrastructure, can provide an hedge against inflation. In the medium term, the main risk for investors will be the de-anchoring of real rates and inflation expectations due to the massive fiscal stimulus, the monetization of public deficits, the rebalancing of social and political support in favour of labour and the retreat of global trade. Markets are not pricing in this risk yet, but investors should start looking at strategies for a possible inflation comeback.

Global CIOs investment themes

Setting the scene: central and alternative scenarios

1 - Important information: Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 12 November 2020. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results. Date of first use: 18 November 2020.