Summary

- Federal Open Market Committee (FOMC) statement: This was far more hawkish than investor and market expectations. The Fed voted 8-1 to raise the target range for the fed funds rate by 25bp, to 0.25-0.50%, and signaled more rate hikes. St Louis Fed President James Bullard dissented, after voting for a 50bp rate hike.The Fed viewed the balance of risks to be skewed towards upward pressure on inflation over potential weaker economic activity. The Fed formally ended quantitative easing (QE) and signaled the beginning of a reduction in its holdings of Treasury securities, and agency debt and agency mortgage-backed securities (MBS) within the next coming meetings.

- Summary of Economic Projections (SEP): The projected path of fed funds rose higher and faster from the December SEP. The survey forecast the median fed funds rate rising 1.0% in 2022, 1.2% in 2023 and 0.7% in 2024, to 1.9%, 2.8% and 2.8%, respectively. On inflation, the Fed revised up its year-end 2022 core PCE forecast significantly, from 2.7% to 4.1%. The unemployment rate remained unchanged, at 3.5% for both 2022 and 2023. Overall, the SEP showed that Fed members are concerned about elevated risks of inflation and showed a willingness to act accordingly. Fed officials now expect the fed funds rate to rise above its long-run terminal rate.

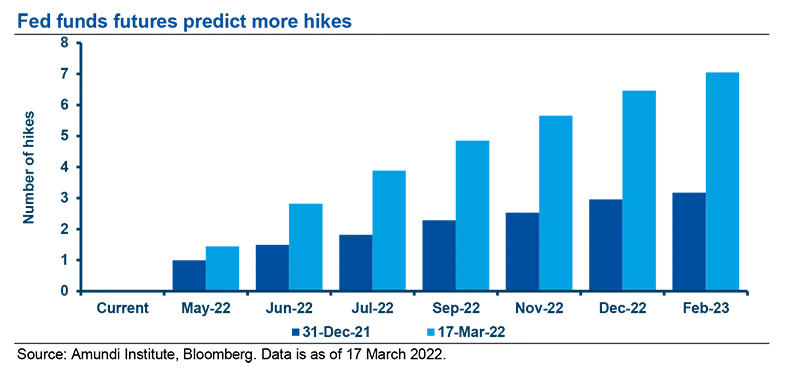

- The key takeaway is the Fed wants to preserve its flexibility: Chair Jerome Powell restated that the Fed’s ‘Dot plot’ showed seven interest rate hikes this year (inclusive of the first 25bp hike) and expressed a willingness to adjust policy as needed in the future. He stated that the probability of recession is not elevated. On balance, he expects the US economy to continue to grow over the near term, even given less accommodative monetary policy.

- Market reaction and investment implications: There was a V-shaped reaction in financial markets. Initially, markets sold off in response to a hawkish FOMC statement. They then rallied by the end of Powell’s press conference. The US yield curve flattened. Equity markets closed stronger. In currency markets, the dollar followed a similar reaction to that of equity markets, with the currency rallying following the statement, then selling off after the conference. The short end of the US yield curve is more appropriately priced now that the market has discounted a more aggressive tightening cycle. The long end of the curve will potentially be influenced by geopolitics, growth prospects and inflation expectations. Should US inflation expectations become unanchored, the Fed has expressed a willingness to adjust policy more aggressively. For risky assets, the Fed’s general affirmation of market expectations will be supportive as near-term policy uncertainty recedes.

On 16 March, the Federal Reserve hiked the fed funds rate by 25bp, to 0.25-0.50%, the first rate hike in four years. The Fed decision was widely expected and probably the most telegraphed rate hike in recent memory. However, the meeting’s statement and accompanying SEP offered some hawkish surprises. The FOMC statement signaled that yesterday’s rate hike was the start of a series of rises in coming meetings, a clear departure from the gradual tightening cycle of 2015-18. While the Fed flagged concerns about the effects of the Russia-Ukraine war on the US economy, this was not sufficient to overcome their larger concern about inflation. Within the SEP, the median rate for the fed funds rate by year-end 2024 increased from 2.125% to 2.750%, well above the Fed’s estimate of the terminal rate (2.400%) and indicative of the Fed’s willingness to take the policy rate into “restrictive territory”. While investors initially reacted by selling Treasuries and equities and flattening the US yield curve, markets eventually retraced some of the initial sell-off, as Chair Powell’s press conference offered little additional insight with regard to the meeting statement and SEP.

FOMC statement: start of the tightening cycle

There were four key changes to the FOMC statement:

- With its aforementioned criterion of an overshoot in inflation and maximum employment reached, the Fed voted 8-1 to raise the target range for the fed funds rate by 25bp, to 0.25- 0.50%, and signaled that more rate hikes appear appropriate. St Louis Fed President James Bullard dissented, after voting for a 50bp rate hike.

- The Fed warned of greater uncertainty regarding the US economic impact of the Russia-Ukraine war. Significantly, the Fed viewed the balance of risks to be skewed towards upward pressure on inflation over potential weaker economic activity.

- The Fed continued to distance itself from the “transitory” inflation view by highlighting higher energy prices and broader price pressures.

- The Fed formally ended QE and signaled that this was the beginning of a reduction in its holdings of Treasury securities, and agency debt and agency MBS at upcoming meetings.

Overall, the statement was far more hawkish than investor and market expectations.

The Fed viewed the balance of risks to be skewed towards upward pressure on inflation over potentially weaker economic activity.

Summary of economic projections and the ‘Dots’:

- Most importantly, the projected path of fed funds rose higher and faster from the December SEP, as the participants essentially ‘marked’ themselves to market pricing. Relative to the December projections, the survey forecast the median fed funds rate rising 1.0% in 2022, 1.2% in 2023 and 0.7% in 2024 to 1.9%, 2.8% and 2.8%, respectively.

- Regarding inflation, the Fed revised its year-end 2022 core PCE forecast up significantly, from 2.7% to 4.1%. Interestingly, the Fed also revised its year-end 2023 and 2024 inflation forecasts from 2.3% and 2.1% to 2.6% and 2.3%, respectively.

- Year-end 2022 GDP growth was revised down, from 4.0% to 2.8%. There was no change in the 2023 and 2024 growth forecasts.

- The unemployment rate remained unchanged, at 3.5% for both 2022 and 2023.

Overall, the SEP showed that Fed members are concerned about elevated risks of inflation and a willingness to act to combat persistently elevated inflation levels. Specific to the ‘Dot plot’:

- 2022: The median dot rose sharply, from 0.875% to 1.875%;

- 2023: The median dot jumped sharply again, from 1.625% to 2.750%;

- 2024: The median dot increased from 2.125% to 2.750%;

- Longer run: Surprisingly, the median dot declined, from 2.500% to 2.375%.

Overall, Fed officials now expect the fed funds rate to rise above its long-run terminal rate.

The key takeaway from the press conference is that the Fed wants to preserve its flexibility.

Press conference: Powell maintains hawkish tone

Given the hawkish tone at the December and January press conferences, we had expected Chair Powell to strike a balanced tone yesterday. He did not, and maintained a hawkish tone. The key takeaway from his press conference is that the Fed wants to preserve its flexibility. Some other takeaways include the following:

- Chair Powell restated the Fed’s ‘Dot plot’ showed seven interest rate hikes this year (inclusive of the first 25bp hike) and expressed a willingness to adjust policy as needed in the future.

- He stated that the probability of recession is not elevated. He cited strong aggregate demand and a strong labour market. He also stated that consumer and business balance sheets remain strong. On balance, he expects the US economy to continue to grow over the near term, even in the face of less accommodative monetary policy.

Market reaction and investment implications

There was a V-shaped reaction in financial markets to the FOMC. Initially, markets sold off in response to a hawkish FOMC statement. They then rallied by the end of Powell’s press conference. The US yield curve flattened, with two- and five-year yields rising while the long end of yields declined. Equity markets closed sharply stronger, rising between 1.5-3.7%. In currency markets, the dollar followed a similar reaction to that of equity markets, with the currency rallying following the statement, then selling off after the press conference.

For risky assets, the Fed’s general affirmation of market expectations is supportive, as near-term policy uncertainty wanes

Investment implications

The Fed delivered a hawkish hike. The short end of the US yield curve is more appropriately priced now that the market has discounted a more aggressive tightening cycle. The long end of the US yield curve will potentially be influenced by geopolitics, growth prospects and inflation expectations. Should US inflation expectations become unanchored, the Fed has expressed a willingness to adjust policy more aggressively. For risky assets, the Fed’s general affirmation of market expectations is supportive, as near-term policy uncertainty wanes.

Definitions

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association (known as GNMA or Ginnie Mae), Federal National Mortgage (FNMA or Fannie Mae), and Federal Home Loan Mortgage Corp. (Freddie Mac). Securities issued by any of these three agencies are referred to as agency MBS.

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- Curve flattening: A flattening yield curve may be a result of long-term interest rates falling more than short-term interest rates or short-term rates increasing more than long-term rates.

- Quantitative easing (QE): QE is a monetary policy instrument used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.