Summary

- Federal Open Market Committee (FOMC) meeting and statement: On 15 June, the Fed hiked the Fed funds rate by 75bp, to 1.50-1.75%, the first 75bp rate rise since November 1994. Chair Jerome Powell confirmed that recent readings regarding consumer inflation and inflation expectations caused committee members to realise a 75bp hike was necessary. The statement was hawkish. The Fed stated that the Committee is strongly committed to returning inflation to the 2% goal, signifying it is not afraid to be hawkish until inflation falls.

- Press conference: Chair Powell remained hawkish as he described the Fed’s focus on bringing down inflation. He was careful not to dismiss the possibility of a 100bp rate hike and reiterated the Fed remained data-dependent. While he tried to keep a hawkish tone, we are concerned his message may have gotten lost. He stated the 75bp rate hike is unlikely to become regular policy. He flagged that the Fed will decide on a hike of between 50 and 75bp at the July FOMC.

- Market reaction and investment implications: After Powell left open the possibility of a 50bp rate hike in July rather than reaffirming another 75bp rate hike, the bond market rallied and the yield curve steepened. Equity markets rallied strongly. The dollar was sharply weaker across the board. Despite an understandable relief rally, it is likely too early to signal the all-clear for risky assets. The key market takeaways from the FOMC is that the Fed is highly focused on bringing down inflation and may be less worried about market reaction and volatility. As such, we maintain a cautious investment bias, given that the outlook for monetary policy and its impact on inflation and the economy remain both fluid and uncertain. The likelihood of the Fed achieving a soft landing is declining. This calls for a cautious and selective stance on corporate credit, with a focus on quality and liquidity. On duration, we have recently moved towards a neutral stance. We believe that US bonds can act as portfolio risk diversifiers in a phase of slowing growth amid more attractive valuations on the US yield curve.

On 15 June, the Fed hiked the Fed funds rate by 75bp, to 1.50-1.75%, the first 75bp rate hike since November 1994. The Fed rate hike was widely expected after earlier this week, various news agencies reported the possibility of such a move in response to last week’s strong consumer inflation and expectations data. To that point, it was quite clear in the FOMC statement, the Summary of Economic Projections (SEP), and the press conference that the Fed’s singular focus is inflation. Chair Jerome Powell confirmed that recent readings on consumer inflation and inflation expectations caused the Committee to realise that a 75bp hike was necessary. The meeting’s statement and accompanying SEP offered some hawkish surprises. The statement signaled the continuation of a series of rate hikes in the coming meetings. Within the SEP, the median rate for the Fed funds rate by year-end 2022 increased from March’s projection of 1.9% to 3.4%, well above the Fed’s estimate of the neutral rate (2.5%) and taking the policy rate into ‘restrictive territory’. Although investors initially reacted to the hawkish FOMC statement by buying the dollar and selling Treasuries and equities, sentiment reversed quickly during Chair Powell’s press conference, where he reinforced that the Fed is not on a preset course to raise the funds rate by another 75bp at July’s FOMC meeting, but rather remains data-dependent regarding the path of future policy rate adjustments.

FOMC statement: the Fed did not disappoint: tone of statement was hawkish

The FOMC statement was hawkish. The Fed stated the Committee is strongly committed to returning inflation to its 2% goal, signifying it is not afraid about being hawkish until inflation comes down. While the FOMC downgraded the impact from the Russia-Ukraine war on the US economy, it was more confident that this is exerting upward pressure on inflation.

The Fed is not on a preset course to raise the funds rate by another 75bp at July’s FOMC meeting, but rather remains data-dependent.

Summary of economic projections and the ‘dots’

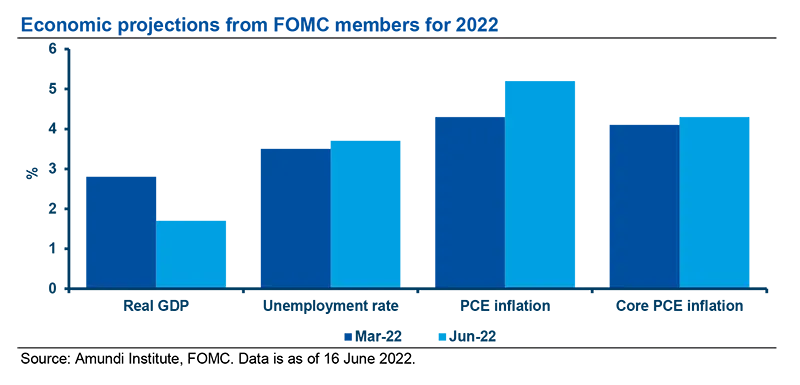

Despite forecasting a restrictive monetary policy stance, the Fed is only anticipating a slight slowing in economic growth, to just below potential. To a certain extent, this may be as negative as the Fed is willing to ever go with regard to signalling on growth.

- The Fed downgraded its GDP forecast by 1.1% for 2022 to 1.7%, by 0.5% for 2023 to 1.7%, and by 0.1% for 2024 to 1.9%.

- At the same time, the Fed marked up its forecasts for year-end unemployment rates from 3.5% to 3.7% in 2022, from 3.5% to 3.9% in 2023, and from 3.6% to 4.1% in 2024.

- There were milder upward revisions to forecast year-end core PCE, from 4.1% to 4.3% for 2022 and from 2.6% to 2.7% for 2023. No change was made regarding the 2024 forecast of 2.3%.

Specific to the Fed fund’s rate ‘dot plot’:

- Year-end 2022: the median dot rose sharply, from 1.875% to 3.375%;

- Year-end 2023: the median dot jumped sharply again, from 2.75% to 3.75%;

- Year-end 2024: the median dot increased from 2.750% to 3.375%; and

- Long term: the median dot increased from 2.375% to 2.500%. This is commonly referred to as the ‘neutral rate’.

Press conference: Powell struck a hawkish tone, but the message may have gotten lost

Chair Powell remained hawkish as he described the Fed’s focus on bringing down inflation. He talked about the rise in inflation expectations and the poor CPI data as the reasons for the 75bp rate hike. He was careful not to dismiss the possibility of a 100bp rate hike and reiterated that the Fed remained data-dependent. While he tried to keep a hawkish tone, we are concerned that his message may have gotten lost. He stated that the 75bp rate hike is unusual and will not become regular policy. He flagged that the Fed will decide between 50 and 75bp at the July FOMC meeting.

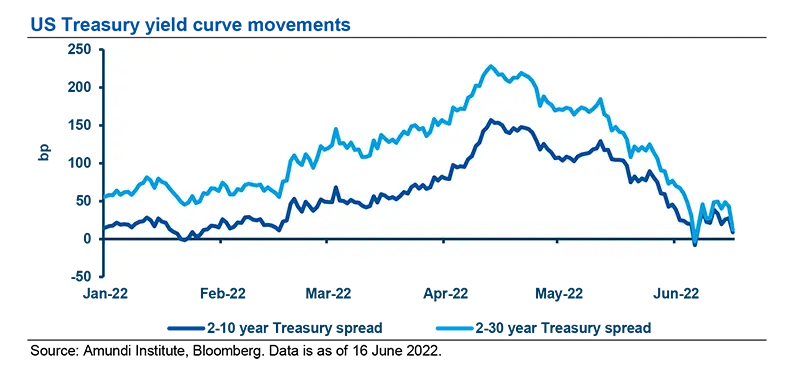

Market reaction: relief rally as markets interpreted Powell’s press conference as dovish

After Chair Powell left open the possibility of a 50bp rate hike in July rather than reaffirming another 75bp rate hike, there was a broad-based relief rally in risky assets. The bond market rallied, with two-, ten-, and thirty-year yields declining 16bp, 10bp, and 2bp, respectively, following the release of the FOMC statement. The yield curve steepened, with the two-/ten year spread steepening by 4bp and the two/thirty-year spread steepening by 8bp. Equity markets rallied strongly as well, with the Dow Jones gaining 1.3%, the S&P 500 rising by 0.5%, and the NASDAQ surging by nearly 2.0%. The dollar was sharply weaker across the board, with the dollar index declining 0.68%, while the euro and the Japanese yen both appreciated by approximately 0.7%.

Powell stated the 75bp rate hike is unusual and will not become regular policy.

Investment implications

Despite an understandable relief rally, it is likely too early to signal the all-clear for risky assets. The key market takeaways from the FOMC meeting included that the Fed is highly focused on bringing down inflation and may be less worried about market reaction and volatility. This is evidenced by three key points:

- A 75bp, rather than lower, hike;

- The Fed dropped “the labor market to remain strong” phrasing from the statement, giving less importance to employment; and

- Powell said that the FOMC would continue to raise rates until it saw “compelling evidence” that inflation is coming down.

We maintain a cautious investment bias, given that the outlook for monetary policy and its impact on inflation and the economy remain both fluid and uncertain. The likelihood of the Fed achieving a soft landing is clearly going down. This calls for a cautious and selective stance on corporate credit, with a focus on quality and liquidity. On duration, we have recently moved towards a neutral stance. We believe that US bonds can act as portfolio risk diversifiers in a phase of slowing growth amid more attractive valuations on the US yield curve.

We maintain a cautious investment bias, given that the outlook for monetary policy and its impact on inflation and the economy remain both fluid and uncertain. The likelihood of the Fed achieving a soft landing is clearly declining.

Definitions

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than short-term interest rates or short-term rates dropping more than long-term rates.

- Diversification: Diversification is a strategy that mixes a variety of investments within a portfolio, in an attempt at limiting exposure to any single asset or risk.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.