Summary

Key take away

- FOMC meeting and statement: On 2 November, the Federal Reserve hiked the Federal Funds rate by 75bp, to 3.75-4.00%. The pace of future rate hikes remains data-dependent, and Chair Jerome Powell confirmed the FOMC’s commitment to lowering inflation.

- Press conference: Chair Powell reiterated the Fed’s focus on inflation and commitment to reaching the Fed’s long-term target of 2%. Incoming data suggest that the ultimate level of Fed Funds rates will be higher than previously expected. The Fed is transitioning from how fast to get to restrictive territory to how long to remain in restrictive territory. It looks premature to be considering a pause in monetary policy. The path to a soft landing has narrowed, but the Fed remains optimistic. Powell acknowledged that inflation has not slowed as expected, with goods inflation remaining persistent and services inflation climbing.

- Market reaction and investment implications: The markets rallied strongly with regard to the dovish statement, based on the ‘peak Fed’ narrative. However, the nascent rally reversed following a hawkish press conference. Despite adjustments to the statement’s language, Chair Powell maintained that policy rates need to go higher and that it is premature to look at a policy pause. The terminal rate is likely higher than what was projected by the FOMC in September. Regardless of at which level and when the Fed stops lifting the Fed Funds rate, policy will stay in restrictive territory for a long time. Finally, the labour market remains too tight, with little evidence of meaningful loosening, and inflation remains uncomfortably high. Thus, we maintain a cautious investment bias, given that the outlook for monetary policy and its impacts on inflation and the economy remain both fluid and uncertain.

As widely expected, on 2 November, the Federal Reserve hiked the Federal Funds rate by 75bp, to 3.75-4.00%. The action marked the fourth consecutive 75bp rate hike this year. Investors initially interpreted the accompanying statement as dovish by selling the dollar and buying US Treasuries and equities. However, any question as to whether the Fed is beginning to alter its stance of monetary policy was corrected by Powell’s hawkish press conference. Consequently, investor sentiment reversed quickly during Chair Powell’s press conference, where he made a striking comment that incoming data (inflation and labour market) since the September meeting suggests that the ultimate level of interest rates will be higher than previously expected. The pace of future rate hikes remains data-dependent, and Chair Powell confirmed the FOMC’s commitment to lowering inflation.

FOMC statement: notable additions

The FOMC statement included some important changes that leave room for interpretation. The Fed signaled two points in its forward guidance. First, the Fed wants the policy to be “sufficiently restrictive” to return inflation to its 2% target over time. This confirms the Fed’s inflation-fighting focus. Second was that the committee “will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments”. This hints at the likely debate going on within the committee around balancing an eventual downshift in jumbo-sized interest rate hikes while also keeping financial conditions appropriately tight. While markets interpreted this comment as confirmation that the Fed is likely to start slowing the pace of future rate hikes soon (in December), we believe it is less clear and a good reminder that the future policy path will be guided by near-term economic data and corresponding market pricing.

Press conference: Powell was unmistakably hawkish

During the 45-minute post-meeting press conference, Chair Powell did his best to deliver a repeat performance from his Jackson Hole speech. Powell was careful not to be perceived as dovish and was certainly more hawkish than the FOMC meeting statement. Importantly, he reiterated the Fed’s laser focus on inflation and commitment to reaching the its long-term target of 2%. Other notable takeaways from the press conference are as follows:

- Incoming data since the September FOMC suggest that the ultimate level of Fed Funds rates will be higher than previously expected.

- The Fed is transitioning from how fast to get to restrictive territory to how long to remain in restrictive territory.

- It is very premature to be considering a pause in monetary policy.

- Slower wage growth is not obvious, reflecting how tight the US labour market remains.

- The path to a soft landing has narrowed, but the Fed remains optimistic. Powell acknowledged that inflation has not slowed as expected, with goods inflation remaining stubbornly persistent and services inflation climbing.

The market rallied strongly to the dovish statement, feeding into the ‘peak Fed’ narrative; however, the nascent market rally reversed following a very hawkish press conference

Market reaction: a short-lived bond and equity markets rally was snuffed out by a hawkish press conference

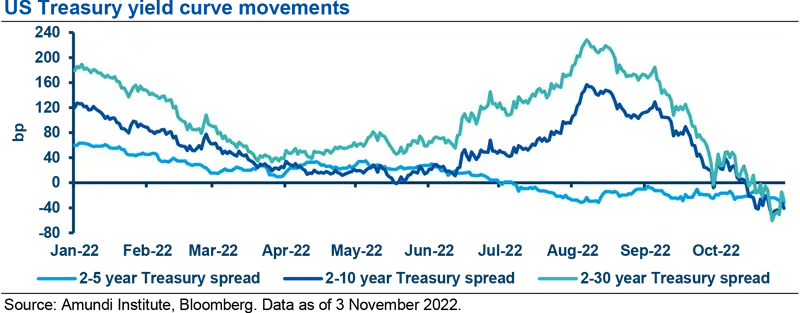

The markets rallied strongly to the dovish statement, feeding into the ‘peak Fed’ narrative. However, the nascent markets rally reversed following a very hawkish press conference. After the release of the meeting statement, regarding which markets speculated that a Fed pause may come sooner rather than later, two- and ten-year US government bond yields fell 8bp and 3bp, respectively. Interestingly, the 30-year yield rose 3bp. The 2- to 10-year and 2- to 30-year yield curves steepened by 4bp and 10bp, respectively. Equity markets rallied by 0.80-1.25%. Finally, the dollar weakened, with the Dollar index falling 0.7%. However, after the hawkish press conference, the markets completely reversed course. The bond market sold off sharply and the yield curve flattened. The equity markets sold off sharply, with the Dow Jones closing at -1.2%, the S&P 500 slipping -2.5%, and the NASDAQ plunging -3.4% on 2 November. The dollar strengthened by 0.3%.

Investment implications

We were skeptical regarding whether the initial financial market rally would be sustainable, and that proved to be the case. Despite adjustments to the FOMC meeting statement’s language, Chair Powell maintained that policy rates need to go higher and that thinking of a policy pause is premature. We make four key points here:

- The terminal rate is likely higher than what was projected by the FOMC in September.

- Regardless of to which level and when the Fed stops lifting the fed funds rate, policy will stay in restrictive territory for a long time.

- The Fed believes the risk of doing too little to tame inflation still outweighs the cost of doing too much. It has the tools necessary to clean up a ‘policy mistake’.

- Finally, the labour market remains too tight, with little evidence of meaningful loosening, and inflation remains uncomfortably high.

We keep a cautious investment bias, given that the outlook for monetary policy and its impact remain both fluid and uncertain. The path to a US soft landing has narrowed.

We maintain a cautious investment bias, given that the outlook for monetary policy and its impacts on inflation and the economy remain both fluid and uncertain; the path to a US soft landing has narrowed.

Definitions

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- Curve flattening: A flattening yield curve may be a result of long-term interest rates falling more than short-term interest rates or short-term rates increasing more than long-term rates.

- Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than short-term interest rates or short-term rates dropping more than long-term rates.

- S&P 500 index: It is a commonly used measure of the broad US stock market.