Summary

US banking sector in brief

The recent banking stress has been a real test of capital and liquidity regulations enacted after the 2008 crisis. While the banking system has been able to absorb the failure of three regional banks without creating systemic issues, banks have also been active in trying to enhance their liquidity positions by parking maturing securities in cash and accessing the Federal Home Loan facility. They are also more aggressively competing with certificates of deposit and engaging in deposit splitting. On the deposits front, the banking industry has witnessed large outflows, more significantly in the case of smaller banks, whereas money market funds seem to have benefitted.

Regional banks performance

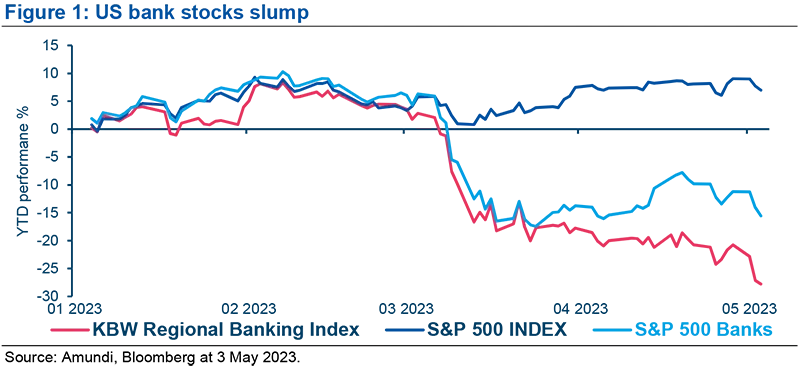

Regional bank stocks are down by approximately 28% year-to-date (YTD) (Figure 1), reflecting deep concerns among bank equity investors that the US banking system remains vulnerable to deposit runs, given that there is still $8tn of uninsured deposits.

Impact of the regional bank turmoil on

- Broader banking system: Banks subject to Fed stress testing include a wide range of banks with different tiers of capital, liquidity and testing requirements, with a lower probability of failure as a result when compared to banks that are not subject to such requirements. In general, we are convinced that while there are concerns and stress around the regional banks, large banks and the banking system overall remain robust.

- Fed policy and Treasuries: We believe the impact of banking stress has probably led to a lower terminal fed funds rate. If volatility in financial markets increases due to the banking stress, we expect US Treasuries to rally on a flight-to-quality.

FOMC May meeting review

Regional bank stocks have been affected more by investor concerns around deposits.

The FOMC raised the federal fund rate by 25bp but dropped future guidance. Chair Powell toed a hawkish line, saying that the Fed is far away from hitting its inflation target but acknowledged that the tighter credit conditions for households and businesses could affect economic growth. We think that the Fed is setting the table for a conditional pause in monetary policy. While the financial markets may become excited about the prospect of the Fed moving to or near a pause, we would advise caution regarding any near-term course reversal by the Fed since the incoming inflation and economic data are not likely to support rate cuts.

To find more, download the full paper.

With contribution from:

Gabriel Kim, Senior Equity

Analyst - Financials