Summary

- Impact on the global economic outlook and central banks: the economic landing could be harder than initially thought. We already see a tangible deterioration of the US economy, which should fall into a recession in Q2. The credit crunch, which is already starting to materialise, will impact growth and will determine how pronounced the recession will be. Amid a weaker economic outlook, the market is reassessing central banks’ actions. We still think that, in the meeting this week, the Fed will likely raise rates by 25 basis points. But not all hikes are created equally: this measure will be needed to maintain market confidence (as the ECB did). Then possibly we may have another 25 by the end of the year but this would assume there are no further problems in the banking sector, Fed liquidity measures stabilise the banking sector, a lower credit supply, and sticky and persistent inflation. For us to confirm the 5.25 terminal rate, all these conditions would have to materialise. We are entering uncharted waters, and we expect central banks to keep an even more data-dependent approach, with little to no policy guidance, as the recent ECB meeting de facto introduced.

- Recent update on the banking sector: During the weekend Swiss regulators engineered a takeover of Credit Suisse by UBS to limit the Credit Suisse crisis from spreading. Overall the merger is a positive development, as it removes some of the large tail risks facing European banks and it was positive to see a private sector solution to this issue. However, the write-down of Additional Tier 1 (AT1) bonds, to make the deal more attractive, came as a surprise and has had a negative impact on the bank subordinated credit market. The other European regulators (EBA, SRB, ECB, BOE) have already confirmed their resolution approach and that equity instruments stand to absorb losses first before any AT1 write-downs. This should provide some assurances to investors on the European regulatory framework and support the market.

- Impact on the European banking sector: Going forward, we think that the European banking system is strong and that current repricing will generate attractive opportunities in credit for the most stable, quality retail banks. With regards to equities, the expansion in Net Interest Margins will be smaller than previously anticipated and volumes will be lower given tighter credit conditions. This will have consequences for European earnings growth as a whole as the banks were expected to be the number one driver of European EPS in the short to medium term. European banks’ earnings growth will still be positive, just less so than previously thought. Concerns about credit crunches appear excessive amid the strong liquidity profile and capital position of European banks.

- Impact on Emerging Markets: EM assets, which have been the best performers in the recent past, have not been immune to the market volatility, with some widening in hard currency debt spreads and with the MSCI EM Index giving up part of its outperformance. On the other hand, over the same period, local debt duration has outperformed on the initial repricing of the core central bank monetary policy path, as well as expectations of a more dovish stance spreading to EM central banks. We remain selective on EM looking at country-by-country areas of resilience and vulnerability. A monetary policy tightening cycle close to the peak and China’s reopening could be positive factors as soon as the situation on financial markets stabilises.

- Impact on the overall cross-asset investment stance: While we already started the year with a cautious stance in risky assets, we have become increasingly prudent in credit high yield. We have also become more constructive on US duration, as it has started to work again as a diversifier of risk in periods of turmoil. We are also positive on gold, with its safe-haven appeal in risk-off times. Regarding oil, we are tactically moving to a neutral stance, after having been positive for a while, as the negative spillover from weakening demand in the US and Europe in a tightening lending scenario more than outweighs the positive impact from China’s reopening.

How does the current turmoil in the banking sector affect your view of the economy and central bank actions?

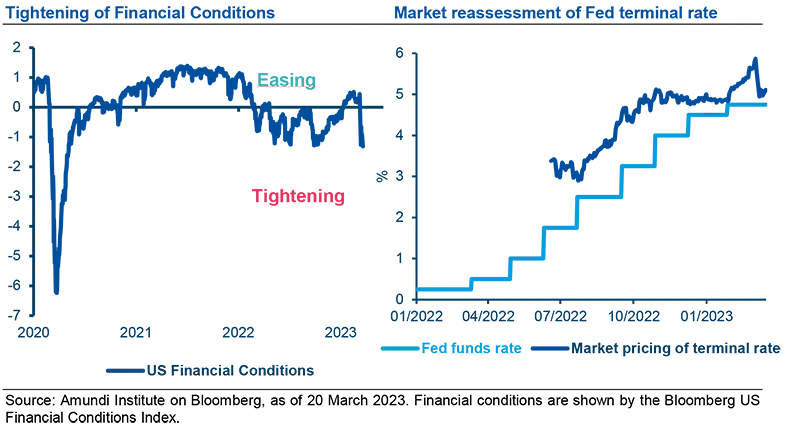

Due to tightening financial conditions, we expect a weaker US economic outlook, and a less aggressive Fed: a small increase in rates is still on the cards and then a pause.

The tightening of monetary policy arrived late, as inflation had initially been considered temporary. The acknowledgement of more persistent inflationary pressures resulted in the Fed embarking on a very rapid and strong raising of rates, which should weigh on the economy in the second part of the year and is now producing some challenges. The economic landing, in particular, could be harder than initially thought. We are already seeing a tangible deterioration in the US economy, which should move into a recession in Q2. The credit crunch will impact growth and will determine how pronounced the recession will be. While globally the Chinese reopening will help, it will not be sufficient to offset the US hard landing.

Amid this gloomier economic outlook, the market is reassessing central bank actions. If, before the crisis, the market was debating a further strong rise or small rise in Fed rates, now the discussion is centred around no rise and a small rise, at a time when Quantitative Tightening is also being questioned.

Central banks are showing a willingness to differentiate their monetary policy pathways (which aim to fight inflation) from the actions taken to deal with the banking sector storm. The fact that central banks are taking the current turmoil seriously is confirmed by the announcement during the weekend of a coordinated action to increase liquidity conditions in USD. The move is not unusual as central banks tend to act proactively to alleviate any potential funding pressures in the system before they emerge.

We are entering uncharted waters and we expect central banks to keep an even more data-dependent approach, with little to no policy guidance, as the recent ECB meeting de facto introduced. This will continue to keep volatility high in the bond markets.

During the weekend Swiss regulators engineered the takeover of Credit Suisse by UBS to limit the spread of the Credit Suisse crisis, what is your take on this deal?

UBS-Credit Suisse deal helps eliminate counterparty risks and contagion spreading.

Credit Suisse was the weakest link in the European banking sector given its idiosyncratic viability and profitability challenges (governance issues, struggling investment bank and concentrated depositor base), so a merger with UBS should restore some confidence in European banks.

While, in our view, a disorderly resolution would have been manageable (as exposure to Credit Suisse was diversified across sectors), the deal has eliminated counterparty risks and contagion spreading so far. It was also positive to see a private sector solution to this issue, without the need for a large government bailout (in contrast to the Great Financial Crisis where state support played a large role).

While the merger may prove to be an attractive, strategic longer-term deal for UBS, as the group is set to increase its market share in wealth management and Swiss banking, integration is likely to be complex and will consume management attention over the coming years. It is also somewhat surprising that UBS shareholders were not afforded the right to approve such a large transaction, although time appeared to be of the essence given the liquidity pressures facing Credit Suisse and the broader risks to financial stability if a speedy solution was not found. Overall, we believe that the problems of Credit Suisse were idiosyncratic, so we don’t see this acting as a trigger for further consolidation in the banking sector.

How do you assess the complete write-down of Credit Suisse AT1 bonds and its impact on the credit market?

The write down of Credit Suisse AT1 bonds has negative consequences for the subordinated market. The reassurance from regulators on the regulatory framework should help mitigate the pricing storm.

Notwithstanding specific viability clauses attached to Swiss AT1 bonds, the decision by the Swiss regulator FINMA to force a complete write-down of Credit Suisse’s CHF16 billion AT1s while preserving some of the equity came as a surprise as it does not appear to respect creditor hierarchy commitments.

The deal, engineered by Swiss authorities over the weekend, needed to be attractive for UBS. In addition to a low share price, one of the requirements to make the deal appealing was a total write-down of the Credit Suisse Additional Tier T1 (“AT1”). The write-down of AT1s was needed to make the deal more appealing and has not been triggered because of an insufficient amount of capital for Credit Suisse. This has been made possible through the issuance of an emergency ordinance tailored to this particular transaction.

This clearly has negative consequences for the lower capital structure of the subordinated market, namely AT1s, making them seen as the same (or even more) risky than equity. This was not the way the market was pricing AT1s and therefore it will make them more expensive for banks to issue in the future. This initially led to a strong repricing of AT1 securities, with limited impacts on other aspects of banks’ capital structures, namely Lower Tier 2 and Non Preferred bonds. We have also seen a more muted market action on non-financial corporate subordinated paper.

Though helpfully, the other European regulators (EBA, SRB, ECB, BOE) have already confirmed their resolution approach – that equity instruments stand to first absorb losses before any AT1 write-downs – this should provide some assurances to investors on the European regulatory framework and support the re-opening of the AT1 market to new primary issuance over time. This communication should partially mitigate the AT1 bond pricing storm.

Going forward, we confirm our view that the European banking system is strong and that current repricing will generate attractive opportunities for the most stable banks.

With regard to equities, how does the UBS-Credit Suisse deal affect your view on the European banking sector?

Concerns about credit crunches appear excessive amid the strong liquidity profile and capital position of European banks.

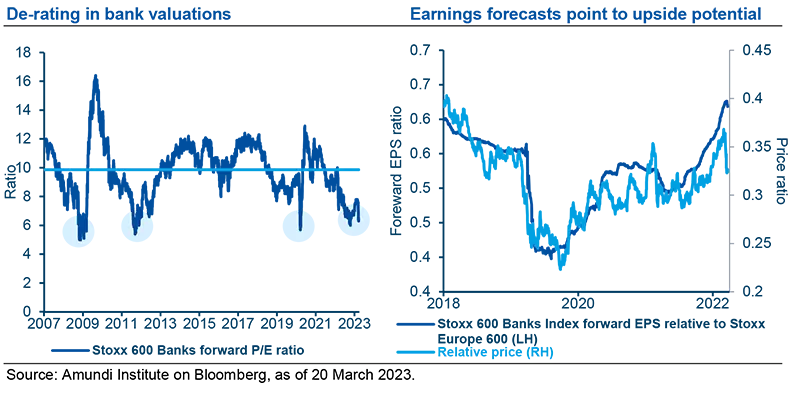

The expansion in Net Interest Margins will be smaller than previously anticipated and volumes will be lower given tighter credit conditions. This will have consequences for European earnings growth as a whole as the banks were expected to be the number one driver of European EPS in the short to medium term. European banks’ earnings growth will still be positive, just less so than previously thought.

In addition, the competition for deposits may increase for some institutions, though the liquidity profile for the sector overall in Europe still appears very robust, with less competition from money market funds than in the US, so deposit betas have remained low.

The key to sector profitability will be whether the European economy is able to avoid a recession over the coming years and if labour markets can remain robust – any deterioration in these would see asset quality become more challenged. While fears about credit crunches may increase amid higher funding costs, the strong liquidity profile and capital position of the European Banking sector should ensure that new lending facilities remain available to support the economy – so we see these concerns as currently unjustified.

With sentiment toward banks deteriorating over the last few weeks, risk premiums have moved out and the implied average cost of equity for the sector is now already at very elevated levels at c. 16%. In terms of valuations, they appear to be discounting a lot of negativity, with Price to Earnings (P/E) multiples now in the region of c. 6x 2024e, compared to the historical average of c. 10x.

European banks’ earnings growth will still be positive, just less so than previously thought.

Moving to the Emerging Markets, how do you assess the impact of the current turmoil, particularly with regard to areas of resilience and vulnerability?

Selectivity is going to increase for EM: we look at the risks and opportunities through the lens of the global economic cycle, China’s reopening and specific central bank reaction to inflation.

The risk-off sentiment triggered by the SVB failure initially and then by the Credit Suisse troubles has also impacted Emerging Markets (EM) assets. The sell-off mostly hit the best-performing EM assets from the recent past, with some widening in Hard Currency Debt spreads and with the MSCI EM Index giving up part of its outperformance.

On the other hand, over the same period, local debt duration has outperformed on the initial repricing of the core central bank monetary policy path as well as expectations of a more dovish stance spreading to EM central banks.

Moving forward, we believe that:

- Selection will be increasingly key, as a protracted risk-off phase, driven by the banking sector stress, could lead to greater challenges for corporates and sovereigns to access credit and more so for the most vulnerable names.

- Moreover, a phase of subdued oil and commodity prices, in a weak growth environment, will not benefit the hard currency debt HY component. On the contrary, the IG side looks to be more protected although more expensive. Expected performance for local currency debt is more ambiguous amid higher expected returns on the duration side while only very selective opportunities for FX.

- On EM equity, the current stress in the banking sector, resulting in tighter financing conditions and weaker economic growth, is reinforcing the view of a poor earnings season ahead, even though China’s reacceleration should partly offset the negative trend. Equity valuations across EM remain appealing (mainly in LatAm and Eastern Europe).

- The EM bank business model looks different from the DM model and certainly from the SVB model. Most EM bank assets are mostly loans rather than investment securities, with a strong retail deposit component. Wholesale deposits have increased, they normally do not represent a large proportion of funding sources. A relatively larger part is concentrated in systemic names (USD issuers). Hence, EM banks’ balance sheet sensitivity to interest rate change is not directly that high but could be indirectly impacted by economic conditions.

Finally, taking a cross-asset perspective, how do you assess the current risk-off environment and how should investors deal with it?

We remain cautious on asset allocation and we have further increased our prudent stance in areas of the market sensitive to the economic outlook, such as high yield and oil.

A more uncertain economic outlook, with a higher risk of recession and little guidance on central banks’ actions, calls for an increasingly cautious stance overall. While we have started already the year with a cautious stance in risky assets, we have become increasingly prudent in credit high yield. We have also become more constructive on US duration, as it has started to work again as a diversifier of risk in periods of turmoil. We are also positive on gold, with its safe-haven appeal in risk-off times. Regarding oil, we are tactically moving to a neutral stance after having been positive for a while, as the negative spillover from weakening demand in the US and Europe, in a tightening lending scenario, more than outweighs the positive impact from China’s reopening.