Private markets poised to benefit from new strategic landscape

Private markets are enjoying growing favour by pension plans for their potential long-term returns and diversification benefits, with a significant rise in strategic allocation expected over the next three years.

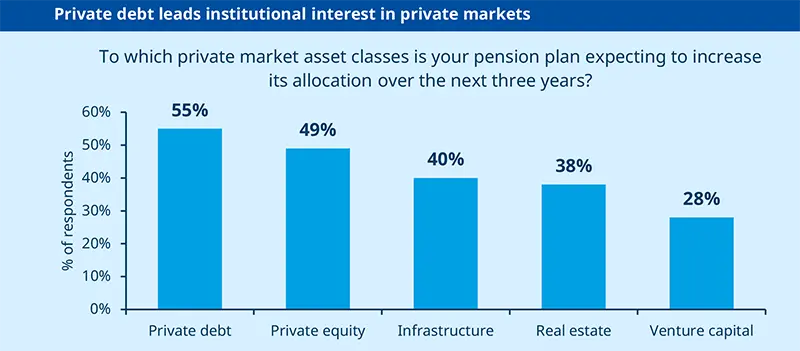

The United States leads in private market investments thanks to its robust ecosystem, followed by Europe for sustainable projects, and then Asia Pacific. Private debt is the most attractive asset class, followed by private equity, infrastructure, and real estate, with venture capital the least sought after.

Despite challenges including geopolitical risks and a rapidly changing macro landscape, private markets are seen as offering compelling opportunities, with a holistic approach needed to balance financial returns and societal impact.

Asset managers are facing growing demand from institutional investors to develop sophisticated private market strategies that balance high long-term risk-adjusted target returns, added diversification benefits, and fundamental value creation.

74% of surveyed pension plans are already strategically invested in private market assets, according to the latest Amundi / CREATE-Research global institutional survey. And this proportion is expected to rise to 86% within three years, underscoring the market’s growing importance in investors’ portfolios.

North American plans lead the way. In particular, the United States remains the gravitational centre of private market investments. Its robust ecosystem – characterised by deep pools of capital and talent, a supportive regulatory framework, and leadership in breakthrough innovations – continues to attract the majority of institutional capital.

Europe represents the second most promising destination, particularly for decarbonisation and sustainable infrastructure projects, followed by the Asia Pacific region.

The steep interest rate hikes of 2022 and 2023 have fundamentally reshaped private market dynamics, creating both challenges and opportunities.

The traditional drivers of private market investments are undergoing significant transformations. Where past strategies relied heavily on financial engineering and market valuation expansion, investors are now seeking more fundamental value creation. The focus has shifted towards identifying companies and assets that can deliver sustainable growth through operational excellence and alignment with transformative global trends.

These trends – dubbed the ‘4D Revolution’ – encompass decarbonisation, decoupling, demographics, and digitalisation. Pension plans are increasingly targeting pure-play companies within private markets that can directly address these large and complex global challenges.

The survey reveals a nuanced hierarchy of investment preferences over the next three years. Private debt emerges as the most attractive asset class, with 55% of respondents showing strong interest. Sectors like healthcare, renewables, and social infrastructure are particularly compelling, offering relatively stable returns in a volatile market environment.

Private equity follows closely, with 49% of plans looking to invest more, primarily focusing on growth equity. The prolonged private status of many innovative companies provides an attractive alternative to listed markets, which have become increasingly dominated by a handful of large technology stocks.

Pension plans are positioning themselves at the intersection of financial performance and broader societal progress, using private markets as a tool to drive value creation.

Infrastructure and real estate represent the next tier of interest. The infrastructure segment particularly is gaining prominence through its alignment with decarbonisation efforts, including renewable energy, battery storage, and green hydrogen projects.

Venture capital, while still part of the investment landscape, has seen the most significant recalibration. Only 28% of plans express strong interest, reflecting a more cautious approach after the recent market turbulence and a period of extensive unicorn creation.

Investors are not blind to the challenges. Competition between the U.S. and China, and emerging geopolitical risks like cyber threats and deglobalisation, have fundamentally changed investment strategies. Interest rate dynamics also continue to play a critical role. The prolonged higher interest rate environment has particularly impacted private equity's exit strategies, creating challenges in Initial Public Offering markets and fund maturity timelines. The traditional private equity fee structure is also under scrutiny, with investors demanding greater transparency and alignment of interests.

Nevertheless, the consensus among pension plans is clear: private markets offer compelling opportunities beyond public market alternatives. As central banks begin to normalise interest rates and inflation stabilizes, investors see potential for more predictable returns and strategic diversification.

Pension plans are increasingly relying on sophisticated asset managers to position themselves at the intersection of financial performance and broader societal progress, using private markets as a sophisticated tool to drive value creation. The new era of private market investing demands a more holistic approach, and success will be defined by the managers’ ability to identify, support, and actively guide companies driving meaningful economic and technological transformation.

Source: Amundi Investment Solutions / CREATE-Research Survey, 2024.