Summary

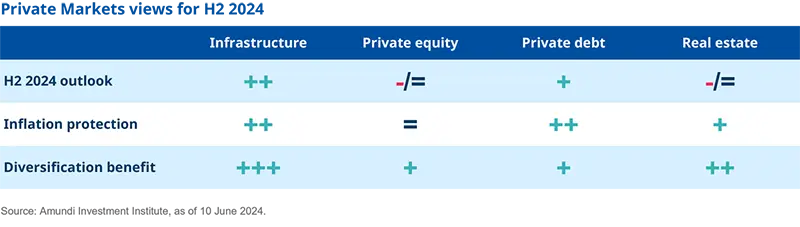

Restrictive monetary policies and fading fiscal expansion are curbing growth and inflation in major economies. Recessions look unlikely but central banks are starting on a new cycle of rate cuts at a time of divergent growth rates, sticky price pressures, constrained fiscal policy and rising geopolitical risks. Despite the uncertain outlook, markets in some regions are priced for the best outcome. We therefore favour asset allocations that can withstand different scenarios. Equities, barring US mega caps, are still attractive with those in emerging markets likely to be supported by valuations and the prospect of Fed easing. And a window of opportunity is opening in fixed income given yields are at historically appealing levels. Additional sources of diversification are on offer in commodities as well as real and alternative assets.

Key convictions for H2 2024

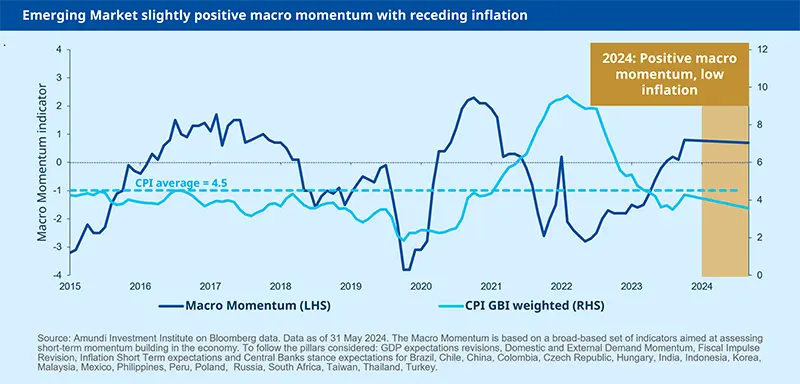

Global growth is expected to reach 3.1% in 2024. However, there are divergences in play: the US is slowing down (without a recession), the Eurozone is on a recovery path, India's strong growth continues while China is on a controlled slowdown trajectory. Inflation has been stickier than expected, but it is expected to further decelerate and reach central bank targets in 2025. This will allow central banks to initiate and continue the new cycle of cuts at different speeds.

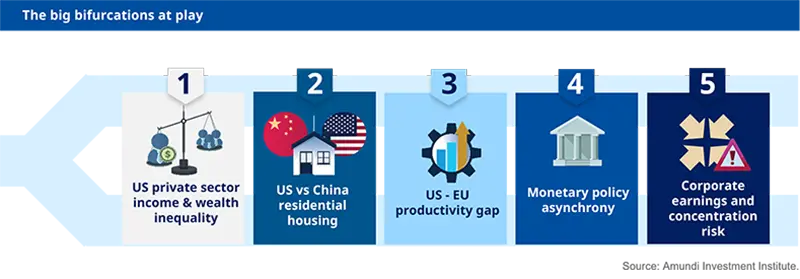

| Geopolitical risk is expected to increase in the coming years, with factors such as protectionism, sanctions, tariffs, export controls and trade wars intensifying and not all regions (notably Europe) being in a position to afford them. The outcome of the US election will be pivotal, as US foreign policy in particular (including trade) is expected to differ significantly under a Biden or a Trump presidency, although confrontation with China is expected to rise in any case. |

|

|

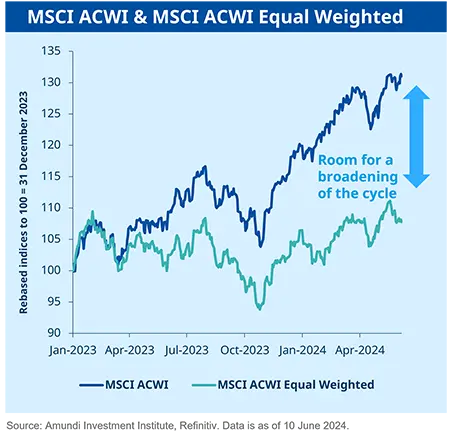

Equities are still attractive, unless we enter a recession. However, there are concerns about excessive valuations in US mega caps. Opportunities abound in US quality value and international equity. In Europe, consider small-cap stocks to capitalize on the economic cycle recovery and attractive valuations. |

After trading in a narrow range, yields are set for a new course with rate cuts approaching and curves expected to structurally steepen. With yields already at historically appealing levels this offer a window of opportunities. We favour government bonds and investment grade credit which keeps the best risk/reward profile. EM bonds also offer an attractive risk-return profile and will benefit from the Fed cuts in the second semester.

With resilient growth, supply chain rebalancing, and Fed rate cuts, Emerging Market equities offer interesting opportunities supported also by attractive valuations compared to the US. We favour Latam and Asia, with India in focus thanks to its robust growth and transformative trajectory. Bonds also will be lifted by Fed cuts, with local currencies set to become attractive.

It's time to strike a balance between opportunities from supportive earnings dynamics and appealing bond yields with risks from high uncertainty on both growth and inflation fronts. This means combining a positive equity stance with a long duration bias and searching for additional sources of diversification, such as commodities and real and alternative assets, including hedge funds. These assets will be key to enhancing the risk-return portfolio profile.

|

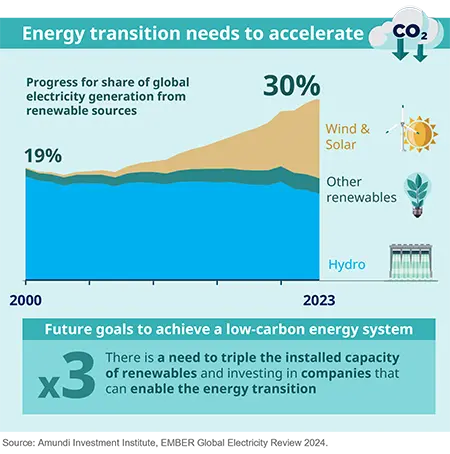

To achieve a low-carbon energy system, the world must triple renewable capacity by 2030. |

|

Mid-year Outlook 2024 It’s all about confidence

In a world with decelerating but sticky inflation and multi-speed growth, Central Banks will need to carefully assess their stance and communication. Their actions may not be synchronised, but we expect any divergences to be limited.

Macro forecasts

The economic context supports earnings and risky assets, but much of the upside potential is already priced in and finding clear catalysts for further gains is challenging.

Asset Class Views

We believe fixed income is moving into a new phase and take a positive view on duration and look for yield curves to steepen. We favour investment-grade credit over high yield and have a preference for Europe given valuations. In equities, there is some scope for the rally to broaden. In Europe, small- and mid-caps could make a comeback in the second half of the year. The dollar may weaken gradually as US growth fades and the Federal Reserve cuts rates. This US monetary policy outlook is likely to be supportive for emerging markets, where equities are benefiting from strong domestic demand and growth. Elevated uncertainty on a range of fronts makes it important to consider diversification.

To navigate the uncertain transition to the next phase of the cycle, we favour high-quality equities, a positive duration stance, and commodities to hedge against inflation risk.