Summary

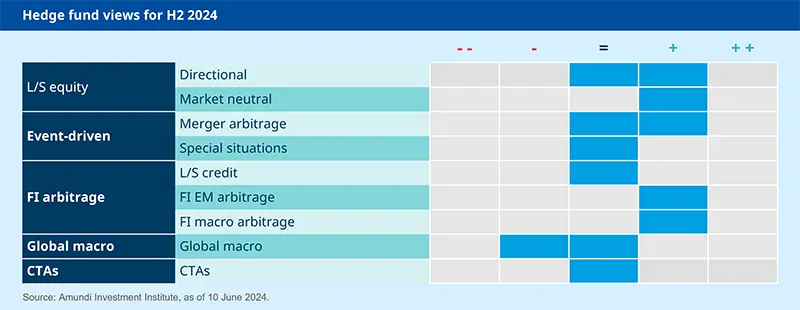

Hedge funds (HF) to benefit from abundant alpha opportunities

The current macro backdrop sees moderate growth and evidence of continued disinflation, a conviction shared by Central Banks, which judge new rate hikes as improbable. With few tail risks clouding the short-term horizon, markets see a favourable asymmetry of risk that is boosting cyclical assets. Yet, macro uncertainty remains elevated amid data dependence, rate hesitations and a stretched cyclical rally. The economic cycle is also going through frequent inflections with uneven regional dynamics.

Implications for HF. Frequent macro inflections remain a challenge for top-down styles, which face market trials and errors. We expect a more supportive backdrop when a more convincing monetary policy pivot from the Fed materialises. Until then, we favour systematic over discretionary styles. We see equity volatility staying low in the short term, also limiting market timing opportunities. On the positive side, securities’ price increasingly reflects their underlying fundamentals – a consequence of elevated rates – which is highly favourable for hedge funds. Meanwhile, greater economic fragmentation opens relative arbitrage opportunities. As a result, securities-picking is shining, amid collapsing correlations. The return of corporate activity, a source of micro catalysts, provides additional good news for event driven and long/short equity strategies.

The appeal of HF for diversification remains intact given the unreliable equity/bond correlation and the need to protect against a greater variety of risks. Given their reduced net market exposure, HF also benefit from an extra cash contribution (around 2% per year). Finally, thanks to their reduced exposures and relative style, HF provide access to riskier assets at affordable risk, particularly in the credit HY and EM segments.

For the second half of 2024, we favour L/S equity neutral and EM fixed income strategies. Merger arbitrage should also be appealing.

Private markets

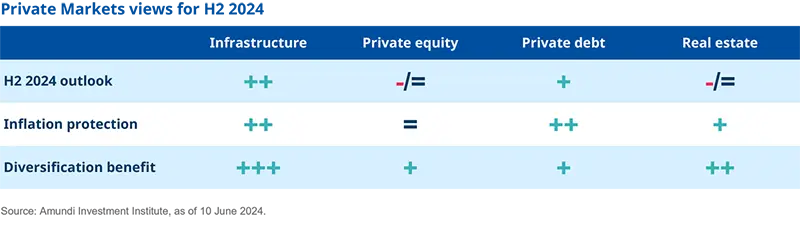

Infrastructure favoured by the energy transition, private equity improving, private debt benefiting from high interest rates while real estate set to stabilise.

In the current environment of late-cycle economic growth and changing interest rate expectations, the private market and real estate asset classes offer relatively attractive investment opportunities as well as risk and return diversification.

We favour infrastructure investment given its stable pricing, steady cash flow and strong growth outlook. Although transaction volumes are lower than a few years ago, the market is robust given the energy transition. Decarbonisation is a priority for governments, but private funding is vital to build renewable energy infrastructure, digitalise activities and redesign supply chains.

Turning to private equity, transaction volumes have slowed and a fall in pricing has occurred, although they are now recovering. Due to higher valuation multiples on the listed markets, the private equity market is more interesting now than it was six months ago. In the private debt market, the high interest rates have ensured that the asset class remains attractive.

In addition, a reduction in bank lending has resulted in private debt managers having greater bargaining power in lending negotiations.

However, the real estate sector has faced challenges due to high interest rate levels and uncertainty. This context has led to a decline in capital values compared to mid-2022. Despite this, in the leasing markets, the outlook for real estate properties in the central business districts continues to be more robust in the short term. We expect those properties to benefit from the current relatively strong demand for high-quality real estate and restricted supply. Outside of these areas, the rent outlook for offices is weaker due to oversupply while the logistics and hotel segments are doing better.

Looking forward, we expect the market values of prime real estate assets to somewhat stabilise over the second half of this year. The key factor in allowing a rebound in investment volumes, in our view, will be a much-needed convergence between buyers’ and sellers’ price expectations. Furthermore, we believe that it is vital for investors that ESG issues are factored into investments’ cash-flow forecasts. Overall, we consider that a large part of valuation repricing for prime assets has probably already happened.