Summary

Emerging markets outlook for the second half of 2024

Emerging Markets, particularly India, are playing a crucial role in driving the global economic recovery in 2024 due to their resilience, adaptability and sound policy frameworks.

Emerging Markets (EM) are playing a crucial role in driving the global economic recovery in 2024. We see three themes playing out:

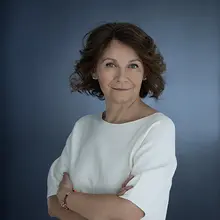

1. Resilient, but not robust Emerging Market economic cycle: The weak macroeconomic momentum in the second half of 2023 has become positive in 2024 and is expected to improve moderately throughout the year. The recovery, driven by the export cycle, has also started to impact domestic demand due to a less restrictive policy mix.

2. Fed's impact on Emerging Market Central Banks: If the Fed makes even a marginal pivot or stays on hold, the environment for Emerging Market Central Banks would remain favourable, as several have already begun their easing cycle. Domestic economic conditions, particularly inflation, have influenced the current monetary policy cycle in Emerging Markets. While disinflation is expected to continue gradually, it may fall short of inflation targets in Latin America and Eastern Europe in the second half of 2024. This means that the easing path may not be as pronounced as the hiking path. In most cases, the Fed's actions should not dictate a directional change for most Emerging Market Central Banks. However, in some cases in Asia, the first Fed rate cut could signal the start of easing, allowing Central Banks to be more patient.

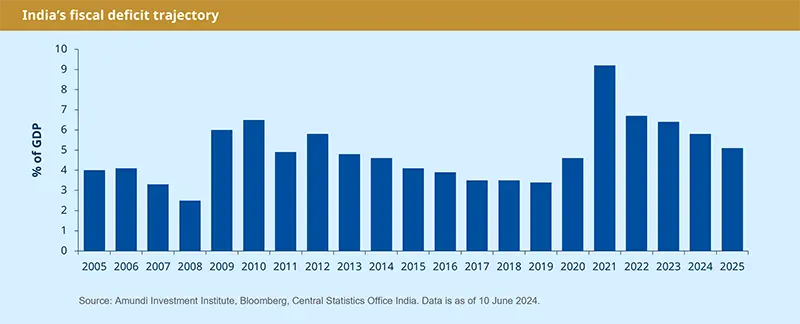

3. Prudent fiscal approach: Fiscal authorities in Emerging Markets have adopted a prudent approach to address excessive fiscal imbalances accumulated since the recent crisis. However, fiscal adjustments remain challenging. While 2024 is expected to end without further debt ballooning, some countries, such as Mexico, Thailand and China, are at a higher risk of a significant deterioration in their fiscal accounts. On the other hand, countries like Hungary, Poland, Colombia and, to some extent, India are making decent improvements towards a more sustainable debt trajectory.

Focus on China and India

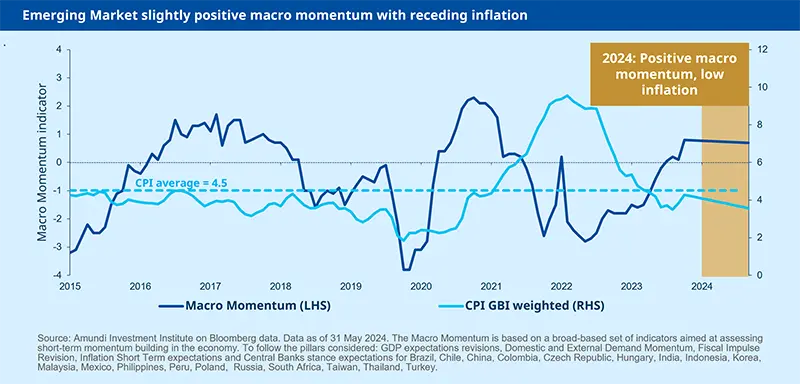

China's economic growth in Q1 outpaced expectations, growing 5.3% YoY. The recovery has been uneven, with net exports contributing significantly more to GDP in Q1 compared to 2023 (+1.4 percentage points), while the boost from investment and consumption declined (-1.3pp).

Domestically, there has been no significant resurgence in demand. Despite recent policy announcements, sales of new homes have continued to decline through May and early June. Additionally, consumer confidence and consumption are recovering at a slower pace, hindered by a bleak labour market outlook.

However, exports have continued to exceed expectations. Despite concerns about excess capacity, a rebound in the global semiconductor cycle, coupled with increased shipments to ASEAN and Belt & Road countries, has supported overall production growth. This has led us to revise our growth forecasts upward. Looking ahead to the second half of the year, we anticipate that this dual-track recovery will persist, with external demand expected to be the primary driver of growth.

India's economic growth performance continues to be well sustained. Domestic demand is the driver and investments should remain robust even in the second half of the year. A more broadly constructive outlook for consumption is likely to come on the back of some marginally larger support for households. Thanks to the generous RBI dividend, the government has been able to meet and even reduce the last fiscal year deficit and it has some buffer to use in the current fiscal year (around 0.3% of GDP). Therefore, the increase in social expenditure should impair neither the fiscal consolidation path (5.1% fiscal year 2025 fiscal deficit target from 5.8% in FY24), nor revert the focus towards capex.

The aforementioned fiscal support results from the disappointing election outcome for the incumbent coalition and the need to devolve more resources to the neglected parts of the economy. Headline inflation is expected to remain well anchored in the upper band of the RBI’s target range for the rest of the year, while core inflation continues to be more benign. Vibrant growth dynamics and inflation not exceeding the target, together with the Federal Reserve starting its easing cycle, should allow the RBI to keep a prudent approach to its monetary policy and start easing by the end of 2024.

EM directions for the second half of 2024

Equities

EM equities are favoured amid the recovering earnings growth in the second half of the year.

We are positive on EM equities driven by the strong demand and economic growth.

Country-wise we like:

- India benefits from supply chain relocation and internal policies and its capex cycle

- Indonesia benefits from structural tailwinds such as exposure to critical minerals and favourable demographics

- South Korea favoured by improving corporate governance

- Brazil benefits from being first to cut rates, attractive valuations and growth supported by agriculture

- Regarding China, recent supportive policies are encouraging, but we remain neutral overall.

Bonds

EM bonds offer attractive yields. Overall, we are positive across the board.

The higher-for-longer rates narrative from the Fed is putting some pressure on EM debt, but we remain positive with a selective mindset.

- EM hard currency debt: we are positive amid a supportive macro backdrop. Valuations and carry are attractive in HY vs IG and thus we maintain our preference for the former.

- EM local currency debt: we are selective and exploring high-yielding countries such as those in Latin America.

- EM corporate: we are positive favouring HY over IG given the former’s attractive valuations.

Currencies

While a Fed move to cut rates will evenutally support EM currencies, for the time being we remain more neutal, as the higher-for-longer environment is supportive for the USD. We favour ultra-high yielding currencies such as Brazilian Real, Peruvian Sol, Indonesian Rupee and Indian Rupee.