Summary

Structural headwinds are strong for the yen, setting a fundamental background for the currency to stay weak. Yet a recessionary environment is a cyclical blessing – peaking growth and rates prove that the JPY is among the cleanest diversifiers – and officials may have lost their appetite for currency devaluation.

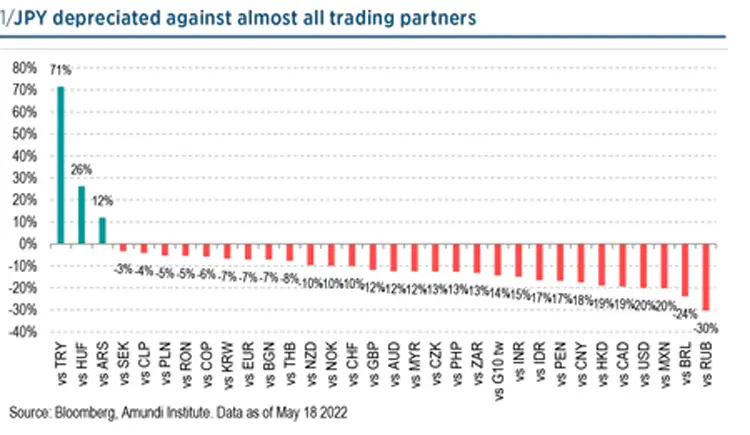

Two years after the first Covid-19 outbreak in developed markets, the JPY is among the clear losers globally. With respect to December 2020 – when the new US administration was coming into power – the currency has weakened against all major trading partners with few exceptions, including the TRY, HUF and ARS.

The movement, which has been extreme compared to the USD, RUB, BRL and MXN (where the JPY’s depreciation goes from -20% to -30%), has been strong and broadbased, with both cyclical and fundamental reasons backing the trend.

At this stage, and given the huge increase in prices of commodities and raw materials globally, Japanese officials have started questioning whether the positive externalities of a weaker currency are materialising or, rather, whether the time has come to intervene in the FX market.1

The goal of this paper is to assess whether conditions supporting a weaker JPY are still with us. We will go into JPY fundamentals in detail (weak and far from pre-pandemic levels), leverage our own expectations on the global economic cycle (and its impact on the currency), assess the net effect of a weaker JPY on the domestic economy and, finally, explain why intra-Asia competition may additionally prevent further depreciation going forward.

with us. We will go into JPY fundamentals in detail (weak and far from pre-pandemic levels), leverage our own expectations on the global economic cycle (and its impact on the currency), assess the net effect of a weaker JPY on the domestic economy and, finally, explain why intra-Asia competition may additionally prevent further depreciation going forward.

Fundamental headwinds are strong for yen…

Covid and CB and government intervention in response have created huge distortions at the global level. Yet Japan is among the places where fundamentals weakened the most across developed markets, creating structural support for its currency to weaken.

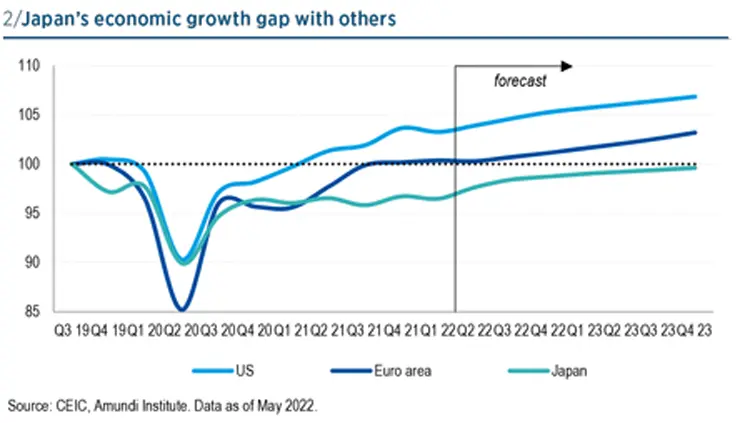

Whilst most trading partners have recovered pre-pandemic patterns, Japan has lagged behind, with a deep output gap that is not expected to close before 2024. Its postpandemic recovery lacks the same level of momentum as in the US or the Eurozone.

On top of chronically deficient demand, the Japanese economy had already been hit once before Covid by the consumption hike in October 2019. Consumer inflation had stayed subdued until lately.

Against this backdrop, BoJ has repeatedly stated that the cost-driven increase in inflation is not sustainable. It has maintained its ultra-loose monetary policy and defended its YCC target range by committing to buy unlimited amount of JGBs, making JGB the most attractive solution for funding carry strategies.2

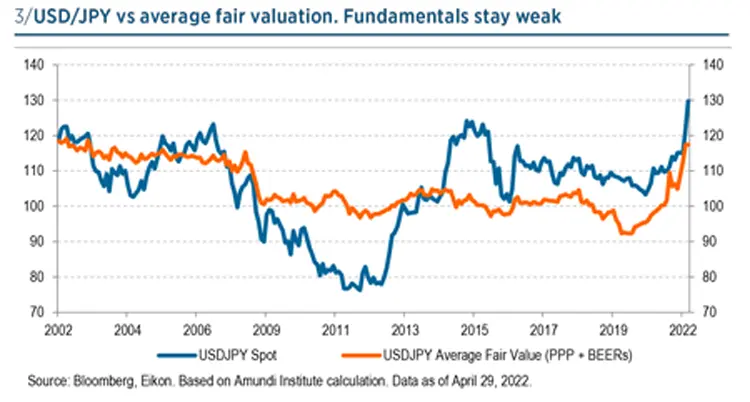

Moreover, as a commodity importer, Japan is particularly sensitive to the global supply chain shock and to rising commodity prices. The deterioration in terms of trades has been unprecedented. From the beginning of 2021 to April 2022, Japan’s import prices rose 63%, a much steeper rise than export prices (25%). Despite its relatively muted inflation versus the rest of the world – which, in turn, made the currency more and more attractive from a PPP perspective – USD/JPY’s fair value has collapsed in the last two years. According to our own calculation3, USD/JPY’s fair value has moved consistently with spot, thus providing a fundamental background for a weaker currency. From this perspective, it will be hard to go back soon to old levels.

Should the global economic cycle enter a recessionary environment, the JPY would be among the cleanest diversifiers

…but a recessionary environment is a cyclical blessing

Not all moves in JPY crosses have been based on fundamentals, though. With a global recovery in progress and with global yields strongly outpacing Japan’s, JPY weakness has simply worsened, consistent with historical patterns. Needless to say, the recovery has entered its mature phase and stagflation probability has increased substantially in recent months.

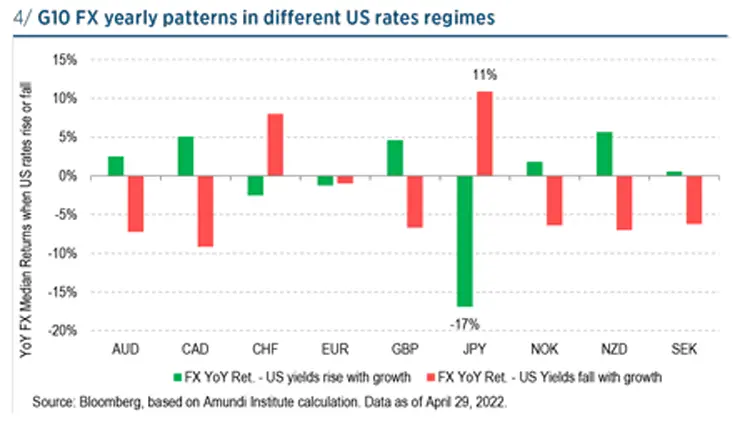

Should the global economic cycle enter a recessionary environment, long-term rates would have to react and disconnect with short-term monetary policy decisions. At that time – and till the peak in Fed hawkishness4 – the JPY would be among the cleanest diversifiers and make up part of its recent losses. We report below the historical simulation of G10 FX yearly returns when US rates – our global proxy – rise or fall, based on growth.

Policymakers lose appetite for currency devaluation

While a weak currency is usually a boost for external demand – exported products are cheaper for foreigners – empirical evidence suggests Japan is no longer a beneficiary. The “J” curve, which links exchange rate dynamics to the balance of payments, has disappeared in Japan since the Abenomics era. The reason is that Japan now produces high-value-added products – where prices are unable to be used to gain market share – whilst cheap products are left to other Asian countries. The real activity benefiting from a weaker currency rely only on the income effect, but, at a juncture where production costs are rising globally, the net effects on growth are questionable, to say the least.

Nonetheless to say, the Japanese government has to maintain a fine balance between its geopolitical interests and the economic benefits from a weaker yen (if that happens). In this respect, we have to distinguish between mechanical vs competitive factors.

Some currencies (e.g., CNY and SGD) have the JPY within their pegging mechanisms: they will have to let their currencies weaken vs the USD, the more JPY weakens. Korea, Taiwan and others, on the other hand, would find a competitive incentive in lowering their exchange rates, thus keeping Japan from getting most of the external demand on their same offering.

Summing up, whilst 2021 saw both structural and cyclical forces in support of a weaker JPY, we see a regime shift for 2022 onwards. Fundamentals still justify a weak currency, and we see no imminent risks that the BoJ will change its dovish stance. Yet cyclical forces and competition challenges suggest most of the movement should be behind us. We see limited depreciation from current levels and expect a reversal of some of the recent losses over the next 12 months.

The “J” curve, which links exchange rate dynamics to the balance of payments, has disappeared in Japan since the Abenomics era