- Dollar strength is causing strains, even in developed economies like Japan and Britain.

- A short-term fix could be a Plaza-style accord to weaken the dollar. Reverse FX wars, with a race to strengthen currencies, are another possibility.

- Longer-term, momentum may grow for a multi-polar currency regime that pits China against the United States.

- Higher exchange-rate volatility requires more active strategies, but there will also be more opportunities for currency diversification.

The dollar’s pre-eminence over the last three decades has had little to do whether the currency was rising or falling on the foreign exchanges. But the amount of pain that its protracted rally is currently inflicting, even on other developed economies, is a stark reminder of its entrenched dominance in financial markets and international trade. Japan has been forced to intervene in the foreign exchanges for the first time since 1998 to prop up the yen, while the British pound’s slide to record lows against the greenback is exacerbating inflation and piling pressure on the Bank of England to hike interest rates more sharply.

One short-term fix to address strains caused by the dollar’s strength could be an agreement to weaken the greenback, like the one that major economies struck at the Plaza Hotel in 1985. A reverse currency war, where countries compete to strengthen, rather than weaken their currencies, is another possibility. Japan is just showing the way.

But such options don’t address the limitations of a regime that has been stretched to the limit. Globalisation made it convenient to price all steps of integrated supply chains in the same currency, and no other rival stepped up to the task. But the emergence of a new, largely energy-driven, inflationary regime, may shake things up. Regionalisation, receding global value chains, and the reshoring of manufacturing activities will make the world less dependent on dollars. The recent ‘weaponisation’ of foreign exchange reserves in response to the conflict in Ukraine also showed non-Western central banks that access to these reserves may be contingent on maintaining good relations with the West.

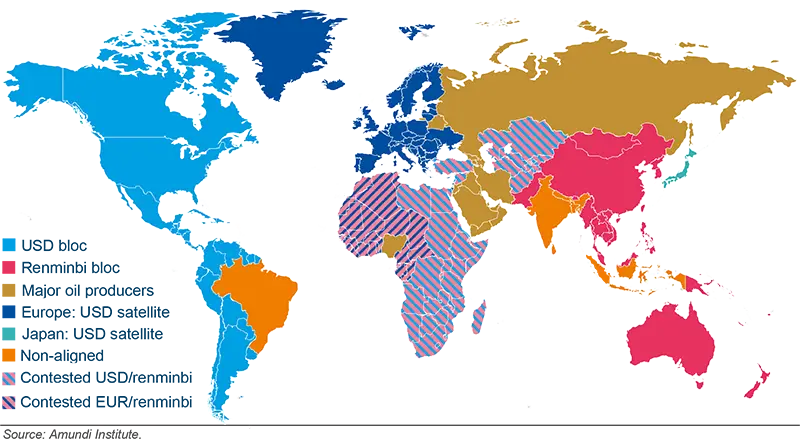

At the same time, China is evolving. In the past, Asian countries, and particularly China, made it a deliberate policy to accumulate reserves. Between 2000 and 2022, global reserves increased sevenfold, with China holding slightly more than a quarter of the total. Past episodes of renminbi strength triggered official intervention to depress the yuan against the dollar. It is not certain the same will occur today. Longer term, domestic demand will play a more important role in the Chinese economy. Doing so requires bolstering the renminbi’s international status as a credible competitor to the dollar. The emergence of a two-bloc trade system built around China and the US therefore seems a plausible evolution.

Each bloc would use the currency of its dominant country as the anchor. In this scenario, trade would not result in massive capital flows or foreign exchange reserves accumulation. Due to its strategic geopolitical importance, energy would be a determining factor. The two camps would seek to price oil and gas in their own currencies, forging closer ties in the geopolitical arena. An example of how this might work was Russia and China recently switching payments of gas supplies to roubles and yuan rather than dollars.

Other oil-exporting nations like Russia and the Middle-Eastern producers would probably continue to buy both dollars and yuan. Europe, and presumably Japan, would remain peripheral, but still related to the US bloc, while a number of larger emerging countries like Brazil, India, and Indonesia may establish a non-aligned group.

The path to a two-bloc system is not clear-cut. China would have to loosen capital controls, provide a growing number of renminbi and renminbi-denominated assets to the world, and possibly lose part of its internal political control. Moreover, the vision of an East Asian bloc dominated by China does not match existing alliances in the region, and satellite countries would have to accept some degree of subordination to the PBoC’s monetary policy. Still, there are signs that East Asian central banks are actively limiting fluctuations of their currencies against the renminbi rather than the dollar.

The yuan’s chances of becoming a second global anchor would increase in this scenario. However, it is still unclear whether the dollar will remain dominant or whether there will be a shift over decades to a multipolar world. Any such change carries both risks and opportunities. The benefits of currency diversification should increase with inflation and the desynchronisation of monetary policies and economic cycles.

Such shifts would take time to play out. In the meantime, investors have to navigate a world where higher currency volatility is back with a vengeance. Active strategies to manage exchange-rate risks will become increasingly important for portfolios.

Towards a multipolar foreign exchange system