Summary

EXECUTIVE SUMMARY

The European economy is emerging from its worst economic slump since the Great Depression. As the vaccine rollout progresses quickly across the continent, mitigation measures and travel bans are being lifted, allowing growth to revive. As the European economy recovers, the real estate sector should join the rebound after a tough year, although the pace of this recovery will be uneven across sectors and subsectors.

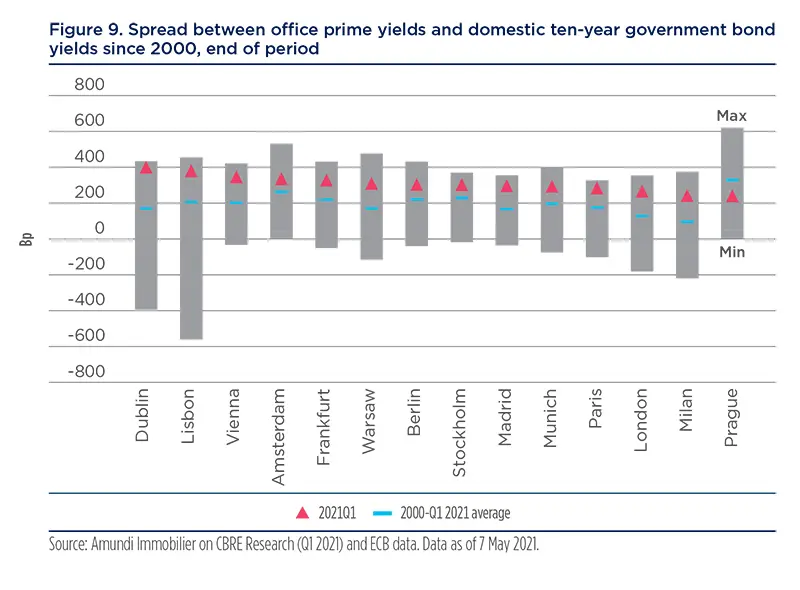

Beyond cyclical consideration, European commercial real estate could play a key role in investor portfolios for different reasons. Firstly, monetary policy is likely to stay accommodative for a long time, especially in Europe. While the Federal Reserve (Fed) is “talking about talking” about tapering plans, at its June meeting the ECB confirmed its dovish stance. Its asset purchase programmes should help keep government bond yields low, prompting investors to look beyond traditional sources of income. As such, real estate offers an appealing yield pick-up, with the gap between prime real estate yields and government bond yields above its long-term average.

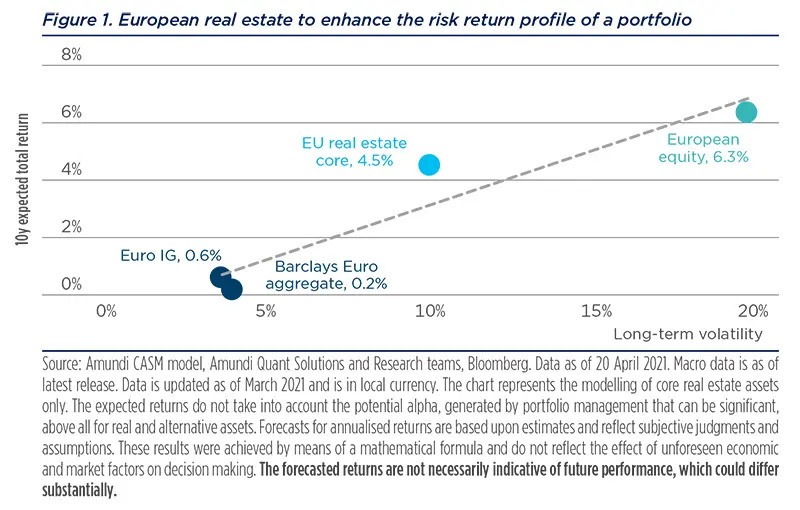

Secondly, a rising concern among investors is the acceleration of inflation. Eurozone inflation is currently at 2.2% and may increase in the second half of 2021. Accelerating inflation trends are a feature shared by advanced and emerging economies, due to a combination of factors, including the cyclical recovery – empowered by the huge fiscal stimulus – as well as pent-up demand and savings, supply-chain bottlenecks and upward wage pressures. These trends will join forces with more structural trends to form a likely regime shift towards higher inflation as a way out of the crisis, as highlighted in the paper “Don’t give up on fundamental valuations”. As inflation fears rise across the investment community, one advantage offered by real estate investment to long-term investors is the opportunity to hedge their income return against inflation when the asset is leased, as rents are generally indexed. Moreover, at a total portfolio level, investors should look at the European real estate as an additional source of diversification, as the asset class may provide attractive risk-return adjusted returns on a ten-year horizon for investors with the appropriate time horizon.

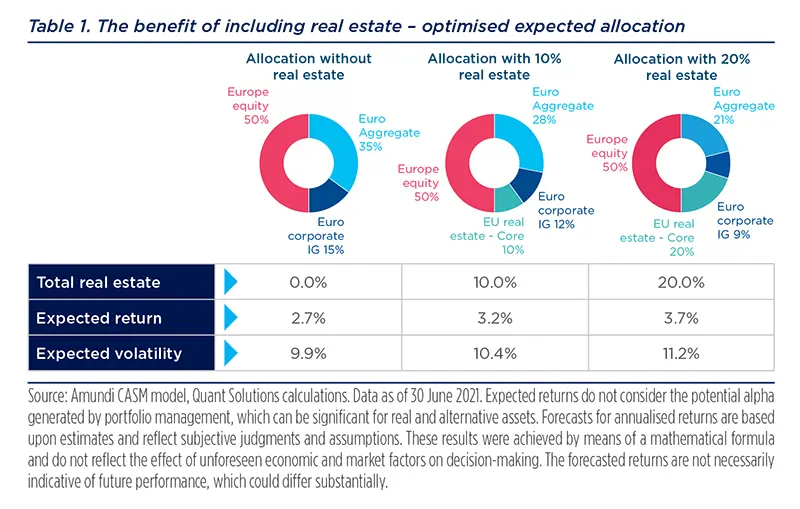

The inclusion of an allocation into European real estate could boost the overall expected return of a European investment portfolio and improve its risk-return trade-off.

The inclusion of real estate into a European diversified portfolio could boost the overall expected portfolio return, alongside an improving risk-return trade-off.

In light of the above features of real estate investing, investors should still maintain high levels of scrutiny and selection when picking assets. This will be paramount as, post-Covid-19, the European real estate market will be fragmented, given the pandemic has hit different countries and segments to differing degrees and a post-crisis repricing process is ongoing, with the overall number of transactions remaining down as are a wide range of prices and rents. Such short-term considerations could somewhat temper the upbeat long-term outlook for the asset class. Picking the most resilient assets will be key to taking advantage of the post-Covid-19 rebound, focusing on those real estate assets with the best recovery opportunities and those that enjoy structural growth trends.

Finally, as ESG investing becomes more mainstream, real estate will take centre stage due to its impact on environmental and social issues. It is one of the most energy-consuming and greenhouse-gas (GHG)-producing sectors, so it will play a key role in the green transition. As part of human life, real estate has also significant linkages with the social pillar (e.g., wellbeing and sustainability). With rising sensitivity to these topics, it will be paramount for responsible investors to implement a rigorous ESG policy, encompassing our three pillars and to integrate it fully into the investment process.

Dominique CARREL-BILLIARD |

Real estate and Covid-19: resilience but growing fragmentation

It has been almost one and a half years since the European economy and capital markets were hit by Covid-19, in an environment marked by waves of the pandemic, uncertainty, and lockdowns. Eurozone GDP dropped by 6.7% in 2020 and the crisis has increased economic fragmentation within the single-currency area: Germany, Austria and the Netherlands have experienced a less severe recession, with GDP dropping 5.1% in Germany compared with 8.0% in France. The huge monetary and fiscal stimulus has mitigated the economic fallout of the pandemic, limiting the rise in unemployment and shaping the economic and financial environment that companies and investors make decisions around. This environment has shaped real estate trends, with capital values holding up relatively well on average. However, discrepancies have emerged across both asset classes and countries, with markets becoming increasingly fragmented, as Covid-19 has hit European commercial real estate markets to a different extent. Hotels and non-food retail assets were most affected, with temporary closures, as well as a significant decline in tourism. On average, European real estate activity dropped in 2020 compared to the previous year and remained subdued in Q1 2021 compared to its ten-year average. Overall, rental values on the retail market were revised down.

Leasing markets: impact on logistics mitigated by booming e-commerce

Leasing activity in logistics markets has been resilient due to the surge of online commerce, which is a driver of leasing demand. Prime headline rents in Europe were roughly stable in 2020, with some scattered increases. Logistics is also partially tied to physical retail, which means the dynamics are uneven.

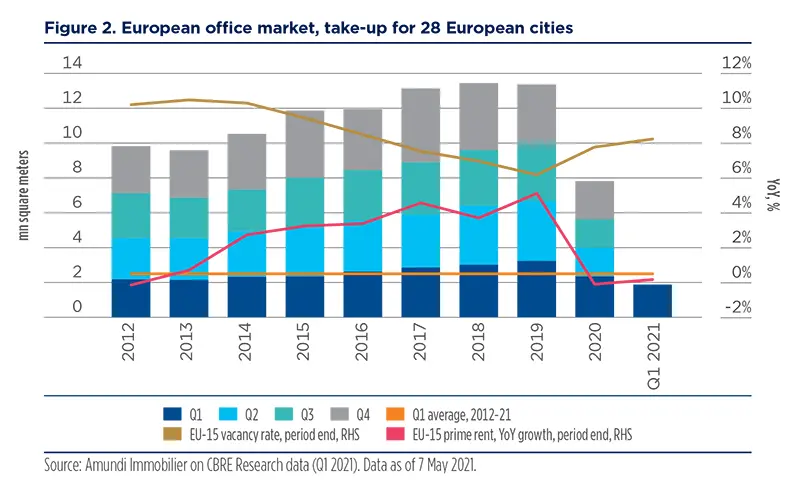

Leasing activity of office space was down sharply in 2020, by around 40% YoY on average with reference to a sample of 28 European markets. After several years of high take-up, the economic and pandemic reined in leasing activity sharply. First, the lockdowns and travel restrictions limited visits and shifted companies’ attention to maintaining business continuity during the lockdowns. The lack of visibility on health and economic issues made companies less open to making real estate decisions, while issues related to work set-ups increased. As a result, many companies took a ‘wait-and-see’ stance on their real estate decisions. Some of them cancelled or postponed projects and renegotiated or extended their leases.

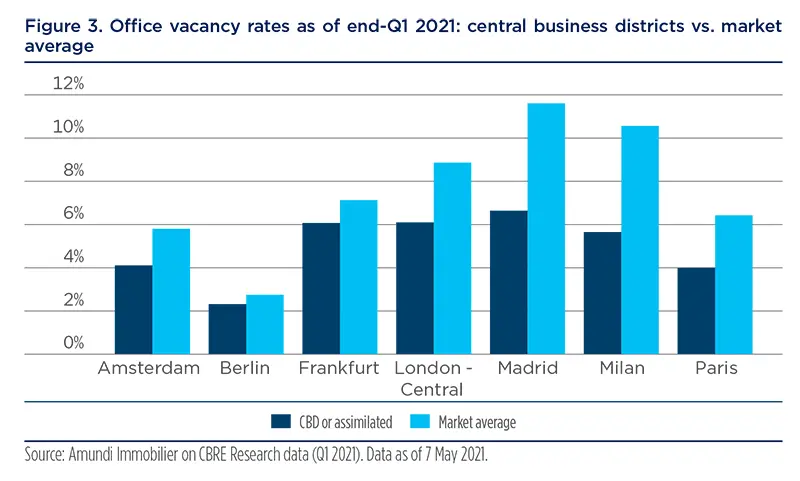

In Q1 2021 – still impacted by lockdowns in many European countries – the average office take-up decreased in YoY terms with reference to a sample of 28 European markets, but remained stronger than the levels experienced in Q2 and Q3 2020. The vacancy rate – which before the Covid-19 crisis was nearly 100 bp lower than its level prior to the 2008 Great Financial Crisis (GFC) – increased in 2020 in many markets due to the sharp slowdown in leasing activity. This upward move continued in Q1 2021, with the vacancy rate rising to 8.2% in the EU-15 area, as measured by CBRE Research, for an overall rise worth 200 bp in 15 months. It remains below its ten-year high and close to rates observed in early 2017.

Rent dynamics have been significantly affected by Covid-19 and its fallout, playing as a sudden stop in average rental growth. However, no major decrease has been recorded thus far.

The situation varies across markets and submarkets, as the vacancy rate remains relatively low compared to its average in some central business districts (CBD). This can explain the resilience of headline prime rents in 2020 and Q1 2021. Nevertheless, rent dynamics have been affected significantly by Covid-19 and its fallout, playing as a sudden stop in average rental growth. However, no major decrease has been recorded thus far. Covid-19 increased the bargaining power of tenants when negotiating new leases, which is reflected by higher commercial incentives, although with geographical disparities.

Investment markets: growing segmentation requires rigorous analysis

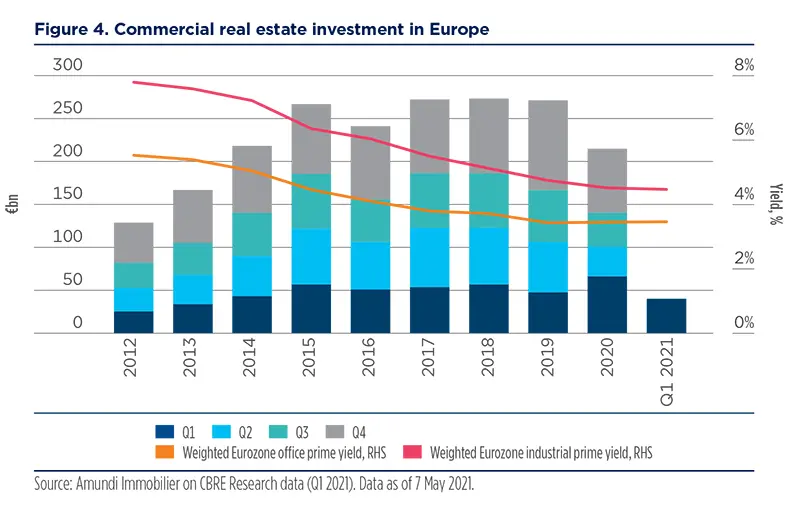

The European commercial real estate investment market has proved to be more resilient than the leasing market, with a decline of around 20% in 2020 compared to 2019. With over €210bn invested in 2020, the real estate investment turnover was close to its ten-year average. This shows that investor demand for commercial real estate has not dried up despite the crisis, unlike during the 2008 GFC. In Q1 2021, investment volumes dropped significantly, but the situation is not as critical as in 2009, as the volumes currently invested in commercial real estate are around three times those invested in Q1 2009. Germany has kept its leading role in the continental European market in terms of investment volumes in commercial real estate, followed by France.

The European commercial real estate investment market has proved to be more resilient than the leasing market.

Although down around 30% YoY, offices remain the leading asset class on the real estate investment market and the deepest one in terms of investment turnover, despite rising investor appetite for residential and logistic assets (demand for logistic assets has been driven by the double-digit growth experienced by e-commerce). Despite the acceleration of remote working, we believe offices will still be needed in a post-Covid-19 world as a collaborative tool and as a mean to attract talent. In the likely new hybrid work model – where in-presence and remote work options coexist – office space should evolve from a place where employees sit at their desk to a space where connecting and sharing ideas is made easier. This evolution should depend on companies and jobs. The current persistence of low prime yields for offices may signal confidence in prime office space by long-term investors.

The current persistence of low prime yields for offices may signal confidence in prime office space by long-term investors.

Hotels were hit strongly. The Covid-19 related travel restrictions have affected hotels primarily in gateway cities and global tourist destinations, which have also faced indirect competition from ‘staycations’, including non-hotel lodging solutions. Despite predictions that travel will not return to its pre-pandemic level until 2023 at the earliest, the hospitality industry could undertake actions to mitigate the impact and emerge stronger. According to the World Economic Forum, hotels may reduce emissions, reinvent the hotel experience around tailor-made services, hybrid work models, health and wellness.

Shopping malls and brick-and-mortar retail have been hit hard by the pandemic and the rise of e-commerce, but trends towards omnichannel shopping could offer some resilience to both sectors. Retailers should manage their store network as a dynamic asset that compounds physical and digital channels to fulfil customer needs by building dynamic store formats that create a fruitful customer experience. Given the multi-store nature of many retail real estate footprints, the adoption of a comprehensive strategy to tackle decarbonisation will be paramount.

Demand for high-quality ESG residential buildings in smart cities remains strong, but supply is still out of balance.

More generally, the greater focus on quality assets – with long lease terms and strong tenants – has helped keep prime yields low, leading to resilient prices. However, assets with vacancies, short-term leases or fragile tenants often saw their yields rise, resulting in decreasing values. Another significant development last year was the rise of risk aversion. An emphasis on the visibility of rental payments favoured rigorous analysis of tenants’ financial strength and some divergence in terms of market yield, both across asset classes and among assets within the same category. To sum up, in 2020 the investment market became segmented after several years of yield convergence.

In 2020 the investment market became segmented after several years of yield convergence.

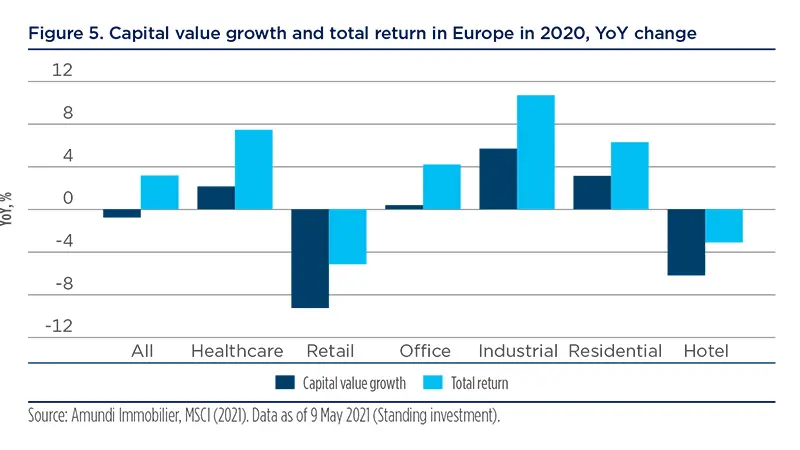

Divergences in market values

In light of the above developments in both leasing and investment markets, a divergence in values was recorded in 2020 across assets, depending on the asset class and the quality of location. The segmentation by asset class is showcased by discrepancies in capital value growth: the asset classes most impacted were European hotels and retail assets, with drops in capital values worth 6% and more in 2020. At the same time, residential and industrial/logistic assets recorded capital value growth above 3% last year. Such opposing trends highlights different investor behaviour, as well as the different features of leasing markets. In terms of portfolio management, these results highlight:

- the advantage of a diversified portfolio to limit idiosyncratic shocks; and

- the role of income return, which can help limit the adverse impact of capital value drawdowns on the total return performance or enhance the positive impact of positive capital value growth.

Higher fragmentation reflected in greater performance divergences. Highly diversified and income focus portfolios are key.

An edge on the real estate industry

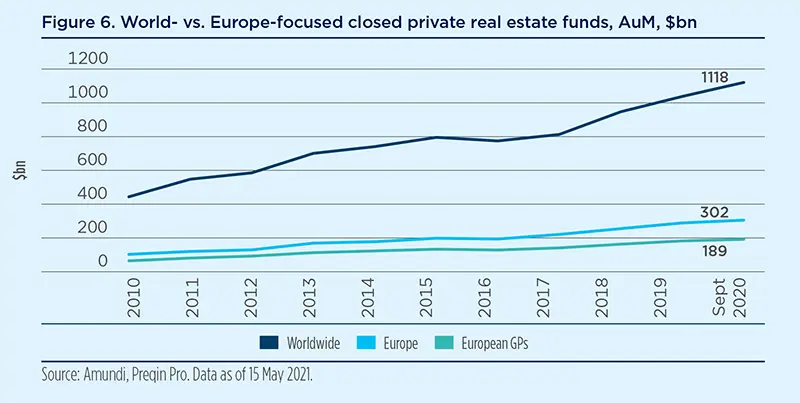

Since in-presence due diligence has been virtually impossible in many countries during the early phase of the pandemic, investors and fund managers had to postpone the closure of their deals and projects to the second half of 2020 and 2021. Despite this, the private real estate sector hit a record $1.1tn in assets under management (AuM) as of September 2020. Europe accounts for 27% of those assets, worth $300bn.

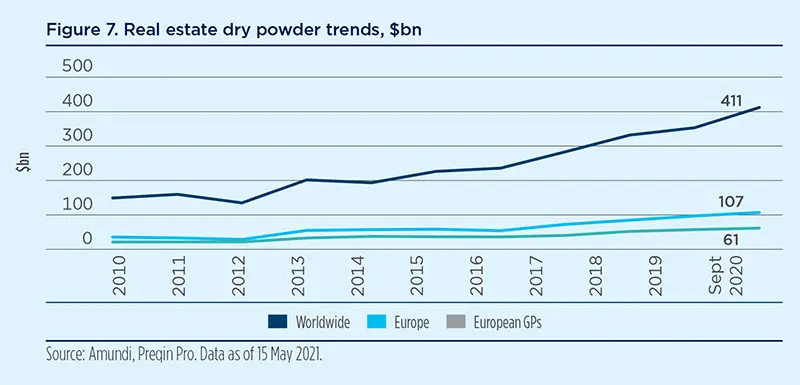

In 2020, dry powder exceeded $400bn, of which $100bn was in Europe and $61bn was in the hands of Europe-based general partners (GPs). In addition, Covid-19-related restrictions have hit trading activity, which – coupled with high uncertainty – has prompted fund managers to adopt a wait-and-see approach. When market activity restarts, there might be appealing opportunities at competitive prices, especially in the retail and hotel segments, which have been hit hard.

Despite the ongoing economic turmoil, the private real estate sector hit a record $1.1tn in AuM as of September 2021.

Real estate fundraising decreased globally in 2020, with a 20% YoY plunge to $146bn. European fund managers captured about 50% of European flows, but lost ground compared to American and Asian players. The decline in fundraising has affected countries to a different extent, with France, Germany and the United Kingdom suffering the most, while GPs domiciled in the Nordics and Central and Eastern Europe grew further. According to INREV, private real estate funds accounted for the largest share of flows in Europe, while separate accounts captured around one quarter of the flows and club deals, funds of funds and other vehicles were about one third.

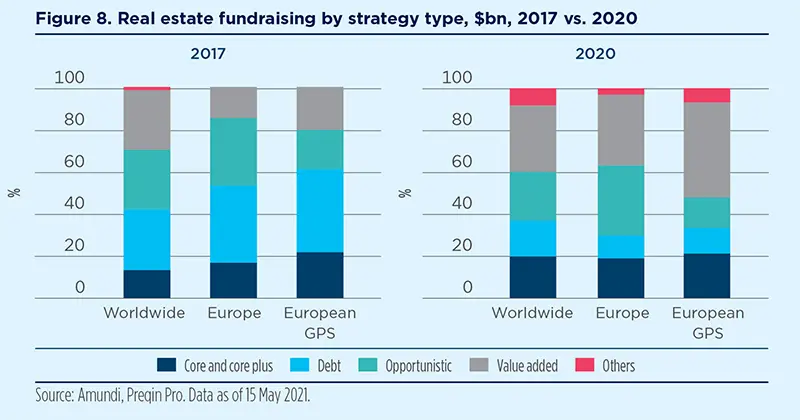

With reference to strategies, value added has proved the winning strategy for fundraising in 2020, both globally and at a European level, with European GPs doubling their fundraising on this strategy on an annual basis. Opportunistic was the second strategy in terms of capital raised. It was mainly pursued by American and Asian GPs who invest in Europe and seek higher returns. Debt has been losing momentum after its 2017 peak. Finally, core and core plus strategies grew globally, up 6% YoY.

Real estate fundraising decreased globally in 2020, with a 20% YoY plunge to $146bn. European fund managers captured about half of the European flows, but lost ground compared to American and Asian players.

The number of funds in the private market and their aggregate capital have been growing rapidly, both globally and in Europe. As of May 2021, there were 1,184 real estate funds in the market with an aggregate target capital worth €348bn. Some 60% of those funds have an European focus. European GPs control only 20% of the funds, worth about 50% of the target size of European assets. Such a trend confirms that fund managers see Covid-19 as a short-term hurdle to their real estate investment and commitment. In 2020, the pandemic, coupled with high competition and the limited availability of high-quality assets, affected the number of transactions – down 30%, with reference to closed-end private real estate funds – and their aggregate value, down 40%. Europe has proved more resilient than other regions.

Despite the pandemic and the decline in short-term performance, the yield and net internal rate of return (IRR) target of real estate strategies has remained appealing. According to INREV, core and core plus strategies investing in Europe set an average target distribution yield of 4-5% and a net IRR target of 6-8% per year. A stable income stream could be achieved by targeting assets in resilient sectors that offer enough liquidity. Such strong returns could be available to fund managers who are willing to hold assets for the long term and undertake a hands-on approach to managing both the asset and its tenant. Opportunistic and value-added strategies with a European focus tend to set a more aggressive IRR target, at 9-11% or even more.

Real estate fees depend on the vehicle structure and size and on the strategy type. According to INREV 2021, the average total expense ratio (TER) for real estate openended funds is lower than that of closed-ended funds. On average, closed-ended funds are more leveraged than their open-ended peers and the latter tend to be more diversified. In addition, larger-sized vehicles tend to have lower TERs than smaller-sized ones. To sum up, despite the adverse fallout of the Covid-19 crisis, European real estate remains attractive due to the size of the market, the expected medium-term growth of AuM, and good target returns. The outlook is for cautious optimism.

Real estate: attractive as inflation hedge, but selectivity is key

Our central economic scenario for the next 12-18 months is one of a multi-speed recovery. While economic activity rebounded strongly in the third quarter of 2020, as countries reopened and travel restrictions were lifted, the recovery had a set back at end-2020/ early-2021, as renewed restrictions were introduced across Europe to contain the second wave of the virus. Economic growth is likely to rebound over the summer of 2021, as the vaccine rollout accelerates across the continent. Governments will maintain their fiscal support until the recovery is fully on track, while the ECB should remain accommodative. Inflation has been accelerating amid higher volatility due to transitory factors, while most likely remaining below the ECB target at the end of the forecasting horizon. The economic improvement expected from the summer may encourage the decision-making process. However, the lack of visibility or pandemic-linked events could weigh on the decisionmaking process and favour a ‘wait-and-see’ attitude.

In this new hybrid work model, office space must evolve from a place where employees sit at their desk to a space for connecting and sharing ideas.

Against such backdrop, the European private real estate market is expected to grow at 3.0-3.4% over the next five years, according to Preqin. There is strong growth potential among European private banks and family offices, as the largest amount of untapped capital remains in the hands of private investors and high-net-worth individuals, who are under-exposed to real estate. To take advantage of these flows, most fund managers are planning to buy a minority stake in primary insurance or are partnering with private banks and wealth managers. Some fund managers are expanding their private market platforms, while others – affiliated with retail banks – are considering raising capital outside of the traditional channels in other European countries.

In 2021, investor appetite for real estate should prove to be strong, driven by the gap between prime real estate yields and government bond yields. The latter should remain low throughout the year, with ten-year German government bond yields expected to remain in negative territory through to end-2021.

We expect the take-up of office space to rise this year compared to a particularly slow 2020, although probably not back to its pre-Covid-19 level.

A growing concern among investors is the acceleration of inflation. As pointed out in a recent paper, asset classes may react differently. One advantage of real estate investing for long-term investors is a way to hedge their income return against inflation when an asset is leased, since rents are generally indexed.

All in all, the key words in real estate investing in 2021 should be segmentation and selectivity.

Market fundamentals and conditions remain key, as market rents and capital values may vary, and income return may change upon a renewal or a new lease. All in all, the key words in real estate investing in 2021 should be segmentation and selectivity. At the sector level, 2020 trends should be confirmed this year, with some risk aversion and segmentation in terms of asset classes and asset features. Those with demographic fundamentals, such as residential or healthcare, should continue to attract investors as a defensive tool in an environment negatively affected by Covid-19.

Prime yields should remain low, with possible margins of compression for logistics in locations that are deemed more resilient and of higher quality. Risk aversion should favour price differences between secure assets and other ones, creating opportunities for those investors that are willing to take on risk. The above expectations highlight that segmentation between assets may remain in the coming quarters and that, in the longer run, asset picking will remain key as the gap between assets responding to tenant expectations and the others might increase.

We expect office take-up to rise this year, although not back to its pre-Covid-19 level. Corporates will be dealing with greater requirements for cost controls and some will seek out central locations close to transportation facilities and quality spaces. This trend could make central areas more resilient. Completion of office space should be significant in 2021 and lead to an increase in vacant spaces. Any rent negotiation should depend on supplydemand dynamics, promoting some heterogeneity across cities and geographic subsectors. Commercial incentives should increase and prime headline rents should prove more resilient in the under-supplied sectors than in the over-supplied ones, where decreases are likely in 2021. Logistics should continue to benefit from e-commerce growth and increases in market rent are likely in 2021 in under-supplied sectors. Hotels and non-food retail assets could be impacted by any possible virus resurgence.

ESG trends in real estate

ESG trends will affect the real estate market, due to its direct impact on environmental and social issues. Regarding the environment, real estate is one of the most energyconsuming industries. This feature relates to the quality of buildings, their location and their set-up. Sensitivity to ESG topics has been rising among both investors and tenants, as well as through regulation.

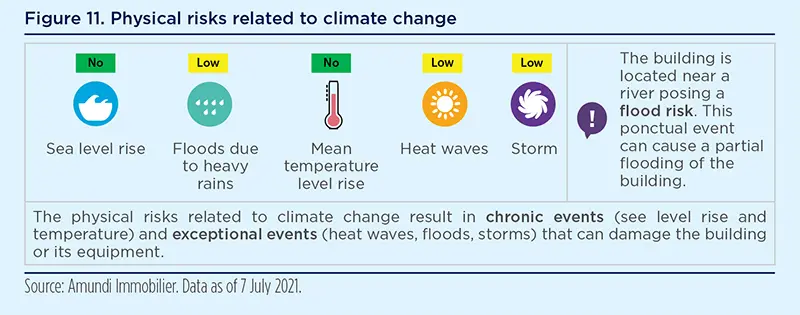

The implementation of ESG strategies in the real estate market involves both asset picking and fund strategy. From an asset perspective, ESG strategies start early in the investment process and are active during the asset management phase. One issue often raised by investors concerning the environmental pillar is the cost of this policy. In this respect, a close daily relationship with the tenant and accurate monitoring could combine efficiency and performance. The use of specific tools for the implementation of such strategies is also key. For instance, CO2 emissions per square metre might be screened. The climate risk issue can also be integrated during the asset-picking phase with the analysis of the potential impact on the asset of risks such as rising sea levels, heat waves, flooding or storms.

Such concerns about ESG strategies are echoed by regulation, such as the EU Sustainable Finance Disclosure Regulation (SFDR) and taxonomy. On 10 March 2021, the first SFDR disclosure step took place. Such regulation requires financial market participants and advisors to disclose information about their policies on how to integrate sustainability risks into their investment decision-making process. It also requires remuneration policies to be disclosed, highlighting their consistency with the integration of sustainability risks. At a product level, financial market participants should indicate in pre-contractual information how sustainability risks are integrated into their investment decisions and should communicate how they assess the likely impact of sustainability risks on the performance of financial products. If market participants do not consider sustainability risks to be applicable, a clear and concise explanation should be provided. Articles 8 and 9 of the SFDR concern financial products which promote environmental and social features, respectively, or which have sustainable investments as their goal. For funds falling into these categories, the legislation indicates a set of additional information that needs to be included in pre-contractual documentation and periodic reports. The last step of the SFDR implementation will be completed at end-2022.

From an asset perspective, ESG strategies start early in the investment process and are active during the asset management phase.

Finally, the taxonomy initiative of the European Commission aims for the EU to become carbon neutral by 2050 and prevent any possible ‘greenwashing’, that is the practice of some companies to gain an unfair advantage based on misleading or false claims to present a financial product as environmentally friendly that does not actually meet basic environment standards. The taxonomy will rank sustainable economic activities, establishing criteria for determining whether or not an economic activity can be considered sustainable. The taxonomy identifies six environmental and climate goals: climate change mitigation, climate change adaptation, sustainable use and protection of water and marine resources, transition to a circular economy, pollution prevention and control, and the protection and restoration of biodiversity and ecosystems. These regulatory changes can offer more visibility to ESG strategies and help raise funds.

Regulatory changes can offer more visibility to ESG strategies and help raise funds.

ESG approach to real estate

We implement a responsible ESG investment policy carried out over three pillars: environment, social, and governance:

- The environmental pillar takes the environmental fallout from the operation of existing assets into account, evaluating the impact from new or renovated buildings, and the impact of building materials.

- The social pillar addresses the building’s integration with its inner surroundings and the tenant’s satisfaction level.

- The governance pillar integrates our best practices of framing the governance policy across our funds.

We have adapted our broader company-level responsible investment policy to make it consistent with the management of real assets. In doing so, we can leverage a binding responsible investment process that is compliant with the highest international standards, such as the Global ESG Benchmark for Real Assets (GRESB) and the Principles for Responsible Investment (PRI). In addition, the company policy adheres to several other initiatives, such as the French SRI label.

Environment and social pillars

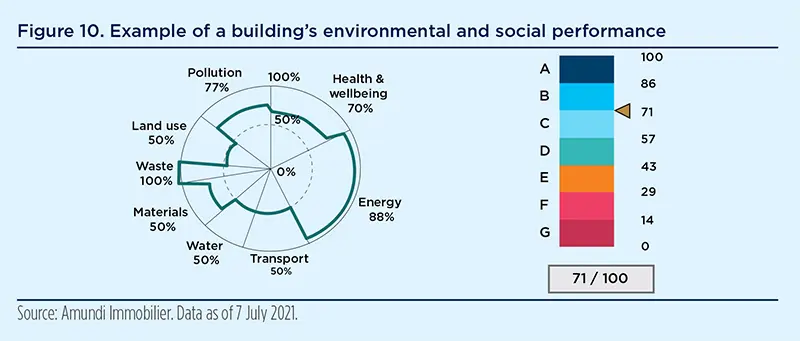

We have built a proprietary scoring methodology to measure an asset’s environmental and social performance. Such a methodology could help monitor the carbon and energy consumption of real estate assets within a portfolio and assess its compliance with the Paris Agreement. In addition, it assesses the resilience of each asset to climate change.

Our ESG team maps each asset against eight KPIs: health and wellbeing, energy, transport, water, materials, waste, land use and pollution. On the energy front it is possible to refer to the rules and regulations that were effective when a building was constructed. The weighted average of the above KPIs will measure an asset’s overall score, which can range on a scale from A to G, with A being the best possible performance. Our portfolio managers exclude F- and G-rated assets from portfolio construction. According to our framework, the ESG team measures the reduction of energy consumption for each asset against two goals:

- Energy goal: based on the reduction imposed by a French decree regulating the tertiary sector and on energy reduction recommended by the European Commission.

- Carbon goal: based on the required reduction to ensure that an asset is on a trajectory consistent with the Paris Agreement to limit global warming to 2°C.

The KPIs used relate to the reduction of energy and water consumption, carbon emissions reduction and their respective targets. According to our framework, the ESG team measures the exposure of each asset to five risks linked to climate change. Three criteria are considered to establish our evaluation:

- geolocation of an asset and the resulting predictive scenarios of climate change;

- an asset’s devices and features allowing it to resist these risks; and

- the current environment, including deteriorating factors.

Regarding the climate change scenarios, the ESG team relies on both databases from France and the EU. To measure this risk, the ESG team relies on a few KPIs, such as direct emissions linked to gas, fuel, oil and refrigerant leaks; indirect emissions linked to energy consumption (e.g., emissions stemming from electricity and water); and other indirect emissions (e.g., emissions linked to construction and renovation materials). The savings are included in a decision-making matrix that helps portfolio managers identify the risks and opportunities of each asset.

Governance pillar

Our governance is transparent and monitored closely. It includes robust internal control by both the risk management and compliance offices, as well as strong ethical framework, policies related to the conflict of interest, active anti-money laundering and anti-terrorism programmes, transparent reporting published regularly (e.g., operational reports, biannual financial reports and annual reports).

Investment process

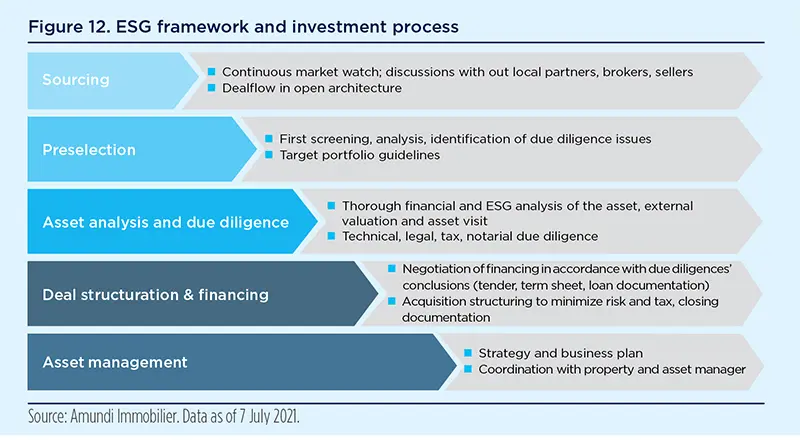

The ESG framework is fully implemented into the investment process, starting with the pre-selection phase through to the asset management phase.

DEFINITIONS

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- Closed-ended fund: In these funds, there is no internal mechanism for investors to redeem their subscriptions. Investors’ subscriptions are tied-up for the lifetime of the fund unless investors can find a buyer for their shares on the secondary market.

- ‘Core plus’ real estate investment strategy: ‘Core plus’ is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core plus property owners typically have the ability to increase cash flows through light property improvements, management efficiencies or by increasing the quality of the tenants. Similar to core properties, these properties tend to be of high quality and well occupied.

- Core real estate investment strategy: ‘Core’ is synonymous with ‘income’ in the stock market. Core property investors are conservative investors looking to generate stable income with very low risk. Core properties require very little hand-holding by their owners and are typically acquired and held as an alternative to bonds.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Dry powder: It refers to cash reserves kept on hand by a company, venture capital firm or individual to cover future obligations, purchase assets or make acquisitions. Securities considered dry powder could be Treasuries or other short-term fixed income investment that can be liquidated on short notice in order to provide emergency funding or allow an investor to purchase assets.

- GP: General partner, a fund manager that raises capital from institutional investors through open-ended or closed-ended fund structures or non-fund vehicles with fund-like economics.

- LP: Limited partner, an institutional investor that commits capital to private funds through limited partnerships.

- Office vacancy rate: Share of unoccupied office space immediately available relative to all existing office space.

- Open-ended funds: In these funds, investors have the choice of whether to partially or completely redeem their subscription on each redemption day, subject to the redemption terms specified in the fund’s offering document.

- Opportunistic real estate investment strategy: Opportunistic is the riskiest of all real estate investment strategies. It is synonymous with ‘growth’ in the stock market. Opportunistic investors take on the most complicated projects and may not see a return on their investment for three or more years. Opportunistic properties often have little to no cash flow at acquisition but have the potential to produce a large amount of cash flow once the value has been added.

- Prime rent: Rent of the most sought-after assets relative to available supply. This is the highest rent for a given asset class and geographical area.

- Prime yield: Yield provided by leasing under the market conditions of the assets – sometimes few in number – most sought-after by investors relative to available supply. This was the lowest yield for a given asset class and geographic area.

- Take-up: Spaces leased or acquired for own use. It does not include lease renewals.

- Value-added real estate investment strategy: ‘Value-added’ is synonymous with ‘growth’ in the stock market and is associated with moderate to high risk. Value-added properties often have little to no cash flow at a