Summary

Summary

One year ago, as the Covid-19 crisis had just begun, we wrote about its potential inflation implications from both a cyclical and a structural standpoint. Cyclically, the crisis was already generating a combination of demand and supply shocks that could only increase short-term inflation volatility and sectoral fragmentation. Structurally, we saw its potential to accelerate policy and institutional changes that, adding to pre-existing factors, could at some point question the continuation of the 40-yearold ‘Volcker’ disinflationary trend, although the case was very open at that time.

Today -- with the crisis still unfolding despite there being some light at the end of the tunnel -- we remain in the mid of its shortterm contradictory inflation shocks. Longer term, the way policies have unfolded during the crisis strengthens our call that -- during the rest of the decade -- inflation could be higher than during the 2010s.

Tracking inflation trends and the inflation regime that may unfold as a result of the Covid-19 crisis is extremely important from an investor standpoint, as some asset classes may prove to be more resilient and outperform during periods of higher inflation. In a regime of normal inflation -- between 2% and 3% -- credit tends to perform well, due to improving economic fundamentals, as does equity, particularly quality, value and cyclical markets.

With higher inflation, tighter financial conditions will halve equity performance to single digits and bring fixed income, with the exclusion of inflation-linked securities, into red territory. Diversifying across a broad range of asset class becomes paramount to dealing with a normal inflationary regime, with upside risks.

1. Inflation pressures building up in 2021

Oil will be the main driver of large moves in headline price indices. After ultra-low oil prices contributed 1.6 percentage points (pp) to the 2.4-pp drop in twelve-month US inflation between January and May 2020 (the corresponding figure for the Eurozone is a contribution of 1.4 pp to a 1.3-pp drop), the recovery in oil prices has accounted for 1.4pp in the 1.6-pp inflation rebound between May 2020 and February 2021 (1 pp to a 0.8-pp recovery for the Eurozone).

A number of base effects should also push inflation higher in many core sectors soon (notably, leisure, travel, accommodation and food services) that were very depressed a year ago. However, in many cases, the twelvemonth variations will not be very informative, comparing the current situation with that of lockdown periods where price measurement was hampered by the small number of transactions.

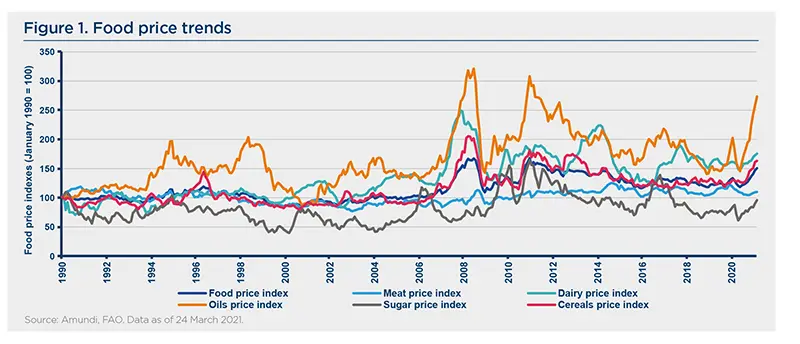

When it comes to the current strong directional movements, food prices are rising once again after a temporary inflationary episode one year ago (when the FAO food price index hit its highest level since mid-2014). While supply-chain disruptions caused a short-lived price surge in many countries during the spring of 2020, it is now upside price pressure from a number of agricultural commodities that is accelerating global food inflation. This is due to a number of factors, including:

- mediocre crop yields relating to adverse climate events;

- massive Chinese purchases overseas;

- export controls from several large producers, notably Russia and Indonesia; and

- disruptions in the cross-border movement of agricultural workers.

Additionally, a number of shortages in manufacturing and trading of goods sectors are currently pushing up prices, which could also be related to the crisis. This include semi-conductors -- where demand has been amplified by the demand for tech products related to remote working and by the global ambition to promote electric vehicles -- and shipping containers, whose supply has had a hard time responding to the sharp upside reversal in global trade.

When it comes to further potential price moves, pent-up demand from large household savings could generate a number of short-term inflationary equilibriums when some sectors re-open. This could be the case if households rush to newly-reopened leisure facilities during the summer season while the long-frozen supply is not able to respond quickly. In the United States, we have recently seen an acceleration of durable goods prices, the strongest in 25 years, as households spent a lot on these products over the last few months.

Similarly, the large fiscal stimulus recently approved by the Democratic administration – the $1.9tn ‘America Rescue Plan’ – could also drive-up US prices. While previous stimulus episodes -- notably the 2017 Trump tax cuts -- had fewer inflationary effects than expected, the magnitude and some distinctive features of the Biden plan (i.e., large cash transfers to households over a short timeframe) could make things different. Former Treasury Secretary Larry Summers and former IMF chief economist Olivier Blanchard have suggested that the bulk size of this package could cause some overheating of the US economy. On a side note, monetary aggregates are experiencing their strongest acceleration in decades: in February, US M2 money supply grew by 27.1% YoY, its strongest ever growth pace.

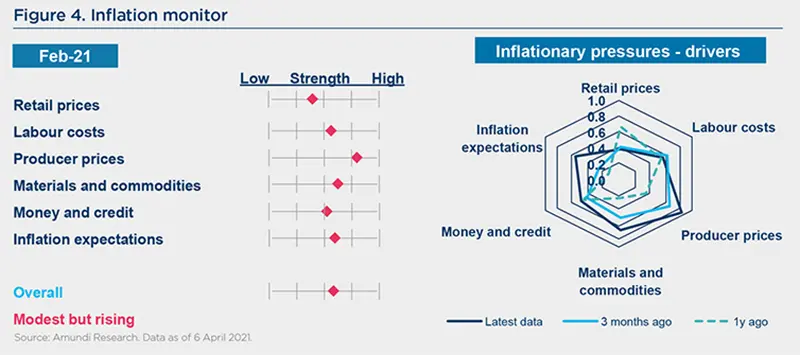

Given the above elements, the imminent direction of inflation is up, yet only for a few months. Indeed, the above-mentioned factors are one-off and temporary –or presumably so in the case of commodity and food prices – and could fade away before major advanced economies have reverted to their potential output level. Most probably these elements will not be enough to make any case for a lasting change in structural inflation regimes. Such upward price pressure has fed into higher levels of inflation expectation, as measured by a number of market-based instruments or surveys. However, this does not mean that they have caused a permanent shock to the more deeply anchored expectations that feed into the wage-setting process.

After a few months, the still negative output gap inherited from the Covid-19 crisis could mean that cyclical pressures -- notably from still damaged labour markets -- become disinflationary again rather than inflationary. This is more likely to be the case for the Eurozone -- which is not expected to recover to its pre-crisis output level until well into 2022 -- rather than the United States, where GDP growth should return to potential as early as this year.

2. Detecting long-term trends that may change policy markers’ attitudes

Regarding the potential long-term implications of the crisis on inflation, we should assess whether it has caused any permanent change to policy makers’ attitudes.

We believe there are substantial hints that this might be the case and that such changes could be enough to alter most economic participants’ long-term expectations and feed into wage-setting processes. Three factors can be identified as potential drivers of at least a moderate upside breakaway from the 40-year Volcker disinflationary trend:

- The possibility that part of the combined fiscal and monetary stimuli deployed to counter the crisis will remain until after the output gap turns positive. This would be different from what happened in the 2010s, where it is believed that the rapid withdrawal of fiscal stimulus prevented monetary expansion from yielding any inflationary effect, even though it may at least have prevented deflation.

- The possibility that the crisis leads to more social or pro-worker policies, as opposed to pro-corporation policies. The former is more likely to prop-up prolonged inflationary expectations than any observed price move in the goods and services sectors could.

- The possibility that the crisis accelerates a de-globalisation trend. Prices in advanced economies would then be more exposed to domestic wages that are higher than those of emerging economies where activities are currently offshored.

Lasting expansionary policies

Recent policy developments hint at lasting expansionary policies and monetary-fiscal combinations:

- The United States has set the tone with the Democratic administration now planning -- beyond its crisis-fighting stimulus measures amounting to almost $6tn when also considering the America Rescue Plan -- a massive and lasting infrastructure plan. The latter should be worth about $3tn at a time when the output gap should have turned positive. The infrastructure package might be financed by tax hikes, some of which could prop up inflation (possible options are hikes of federal gas taxes or the introduction of a carbon tax). It is also very unusual that a very high number of companies report difficulties in hiring skilled staff during a postrecessionary period. This is extremely different from the post-GFC thinking, when austerity measures had to be taken by local authorities. Moreover, under its new framework unveiled in August 2020, the Federal Reserve (Fed) is applying an Average Inflation Targeting (AIT) strategy, which entails more tolerance for inflation temporarily being above target and the need to improve many features of the labour market. As such, the Fed’s rate policy should remain accommodative for a long time.

- In the Eurozone, there is broad consensus that fiscal policy should not shift back to austerity as quickly as it did in the 2010s. While we are likely to see an intense debate over revamped fiscal rules, these are unlikely to be as strict -- or at least as pro-cyclical -- as they were in the past. The ECB, for its part, is expected to finance both a large part of the Next Generation EU programme, whose resources are to be spent until 2026, and single-country fiscal deficits for many more years, since, even after the end of its PEPP (Pandemic emergency purchase programme), the ECB will continue its APP (Asset purchase programme) purchases at a pace of €20bn per month. Like the Fed, the ECB is also expected to adopt an AIT strategy and the possibility of a rate hike in reaction to short-lived inflation (as happened in 2011) has been ruled out.

Social policies becoming permanent

There are signals that social policies could become permanently larger, although these are clearer in the United States than in the Eurozone:

- Social policies are high on the agenda of the US Democratic administration, with campaign measures on the minimum wage, healthcare, housing, student debt and various other social transfers, together with a favourable attitude towards unions. While it is unlikely that all of these measures will be adopted, as the Republicans may win back at least one chamber in 2022 and the Democrats currently do not have the required majority to approve some of these measures, at some point the Republican party -- be it post-Trumpian or still Trumpian -- may agree to more social policies than in the past. If sustained over time, and drive permanent expectations of higher nominal income among the less well-off segments of the population, such policies could have a tangible effect on wage-setters’ longterm inflationary expectations. A large part of the infrastructure package should consist of a heavy investment in worker skills, which could facilitate transitions in the labour market and lower structural unemployment.

- Whether European social policies will be enhanced permanently after the crisis remains to be seen. It will depend on possible social tensions that might emerge with the lifting of restrictions and emergency measures in the coming months and on the outcome of the upcoming dense political agenda (2021 federal election in Germany, 2022 France presidential election and 2023 general election in Italy). However, the crisis has helped experiment new social schemes, such as social benefits for independent workers and even a universal basic income in Spain, some of which may be difficult to remove completely.

Re-shoring and re-industrialisation

On the third point, even though the case for tangible de-globalisation remains open, advanced economies appear keen to reshore some activities:

- Both the United States -- with Biden’s ‘Buy American’ plan -- and a number of EU countries -- industrial reshoring is stated as a major priority within the French recovery plan -- have reiterated reindustrialisation goals. While such policies face many implementation obstacles (e.g., corporations may resist, the definition of priorities may be difficult, the end of the Covid-19 crisis emergency may reduce the push for supply autonomy from China), the intention to make them a reality appears widespread across the political spectrum. A possibility could be that another form of globalisation could take shape, as the signing of the Regional Comprehensive Economic Partnership (RCEP) in Asia indicates, that could be more regional or the globalisation of services could take over from the globalisation of goods.

|

Focus: US inflation monitor

|

- It should be stressed that industrial reshoring, even if successful, would probably be only a minor driver of long-lasting reflation trends compared to the two above-mentioned factors (fiscal-monetary interaction and social policies). The wage differential between DM and EM in the manufacturing sector has narrowed over the past decades, while core inflation indices are more and more dominated by services – mostly provided by domestic labour – than by manufactured goods.

Overall, while the Covid-19 crisis has certainly brought much short-term noise, the crisis appears to have advanced the case for some inflationary pick-up over a multiyear horizon. Something deep is awakening and the Volcker disinflationary paradigm may now become more challenged than it was in the 2000s-2010s.

3. Investment implications of higher inflation

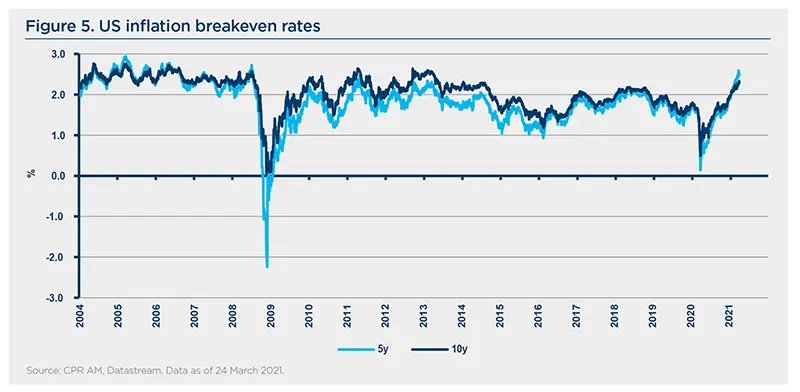

The prospects of higher inflation have been reflected in higher US inflation breakeven rates and in a steeper yield curve, amid a quick and sharp rise of US Treasury yields.

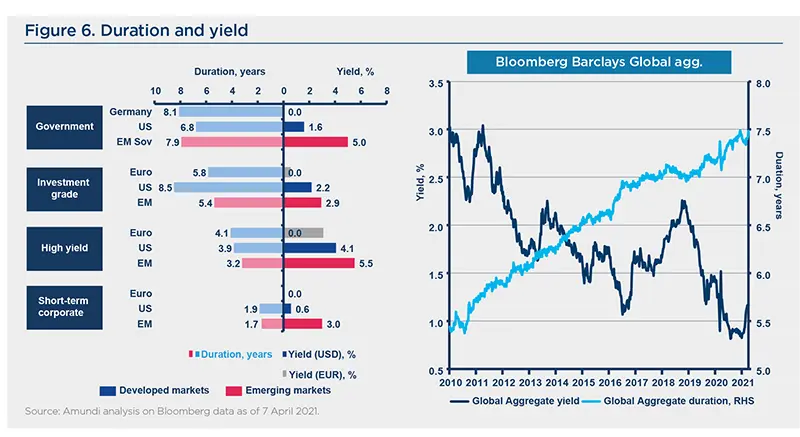

In the short term, further upside pressure to US Treasury yields will be limited, as overseas demand may prove strong -- current US Treasury yields are attractive for global investors. However, any possible upside pressure from rising inflation -- coupled with the risk that the Fed might fall behind the curve -- will warrant a cautious duration exposure.

In bonds, rising bond yields will warrant a cautious and active approach to duration, while searching for income across the entire market spectrum with a global unconstrained approach. Indeed, ten-year US Treasury yields have risen back to their pre-pandemic levels amid yield-curve steepening due to strong fiscal stimulus, the economic recovery and accelerating inflation.

Moreover, investors should adopt a flexible approach and go beyond benchmarks to search for yield. Nowadays, traditional benchmarks hold significant duration risk, with low implicit yields. For such reason, it will be paramount for investors to get exposure to different sources of return, with an unconstrained approach that may help limit the duration risk, and consider increasing their allocation to inflation-linked bonds, floating-rate notes and securitised assets, as well as exploiting relative-value opportunities. In such an environment, absolute return approaches, that can reinforce portfolios with a number of uncorrelated strategies (FX, curves, sector), may prove beneficial to protect investors from higher fixed income volatility and higher inflation.

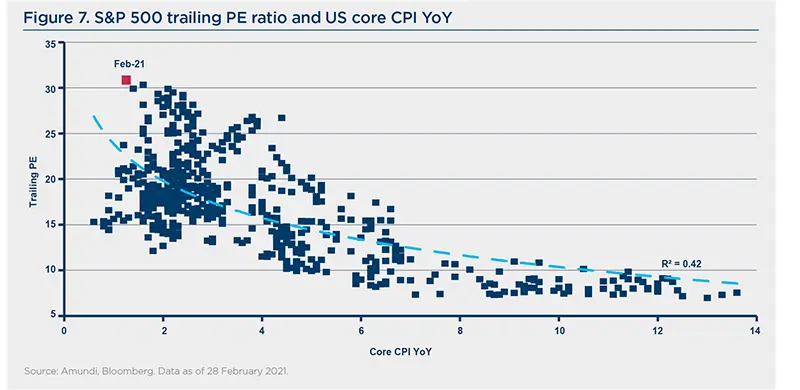

In equities, higher inflation may dent valuations, especially those at highly expensive levels. As the Fed is now targeting average inflation over a time horizon, the subsequent acceleration of inflation may prove persistent, denting equity valuations. In turn, this may favour a multi-year rotation from growth into value stocks both in the United States and Europe. This rotation is already underway and we believe could be a long-term trend.

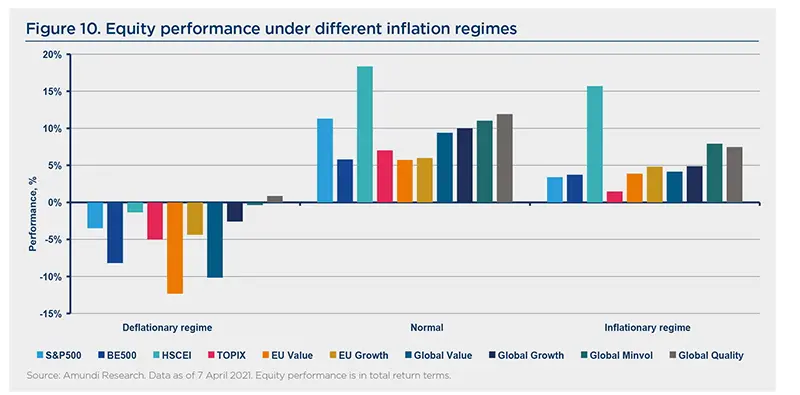

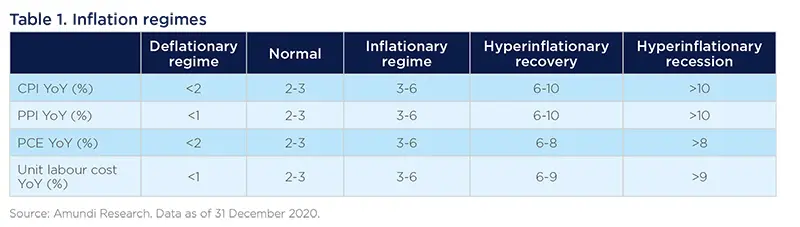

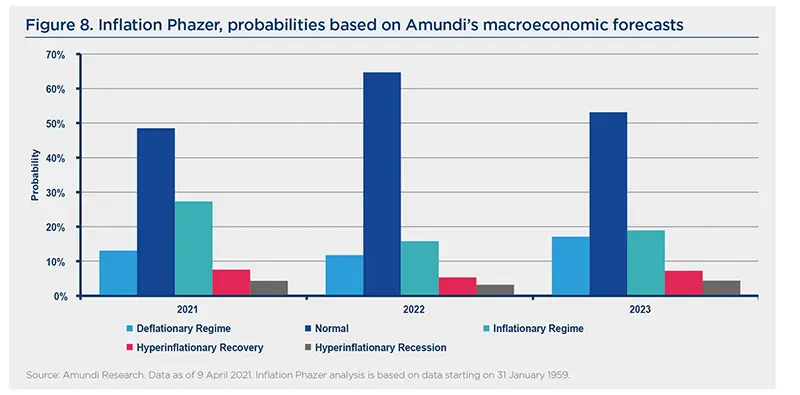

From a cross-asset perspective, it is important to monitor the different inflationary regimes to assess the asset classes that can perform better. Our Inflation Phazer identifies five different inflation regimes from 1960, analysing historical trends of the most relevant US inflation indicators, namely CPI, PPI, core PCE deflator and unit labour costs.

The Phazer gives each regime a probability based on our expectations for different inflation indicators. According to our model, there is a 60-70% chance of being on a normal inflation regime in 2021, 2022 and 2023. The other two regimes, deflationary and inflationary have similar probabilities, slightly skewed towards the inflationary one.

Asset classes tend to behave differently under various inflation regimes. In the 1970s, equities delivered poorly, while commodities were the most remunerative assets. Historically, gold proved to be strongest under an inflationary regime, while delivering positive returns under all three scenarios (deflationary regime, normal regime and inflationary regime). It is among only a handful of assets which have recorded positive returns in every scenario. For 2021, under a likely normal inflation regime, alternative assets could be attractive. Under such a scenario, with some upside risk of inflation, investors should enhance diversification by incorporating assets that would be more resilient to higher inflation.

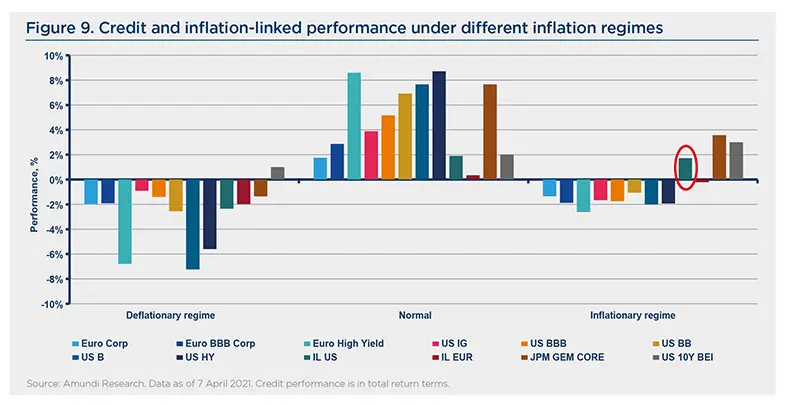

Credit indices have tended to perform at their best during periods of normal inflation (2-3%), as such a regime usually comes with economic growth and a risk-on appetite in financial markets. On the other hand, under an inflationary regime (3-6% range), monetary policy is usually in tightening mode, causing spreads to widen and credit to underperform. Unsurprisingly, inflation-linked bonds’ relative performance against credit is the most attractive under an inflationary regime.

Normal inflation has proved to be the best environment for equity as well. Equity returns have recorded their best performance throughout normal inflation regimes, as healthy economic growth and accommodative monetary policy support a risk-on stance in financial markets. As happened with credit markets, tighter monetary policy during periods of higher inflation (inflationary regime) weighs on risk asset returns, as higher interest rates result in single-digit returns for most equity indices.

Solutions that target real returns with a broad range of asset classes will be attractive in a normal inflationary regime with upside risks. This means including real assets, inflation-linked bonds, floating-rate notes, commodities and equity sectors linked to the real economy, which tend to outperform in a rising inflation environment.