Summary

Key Takeways

- There is no single answer to incorporate Net Zero commitments into investment strategies. At Amundi, we have identified five main ideas that investors can implement to achieve this goal.

- Investors can start by progressively applying a Net Zero commitment to all assets and by developing an exclusion policy for companies detrimental to a Net Zero objective.

- The financial industry has plenty of room for innovation when it comes to implementing climate goals. Investors should not only look at historical carbon footprints, but also combine them with forward-looking metrics. The latter will ensure that investees are effectively reducing their carbon footprint and that the investor is actively contributing to the decarbonization objective.

- The third pillar concerns engagement and voting activities. An active stewardship policy is key to turn investment beliefs into concrete action and shows the credibility of an asset manager’s ambition to reach its Net Zero objective.

- Then, Net Zero relies on the deployment of capital-intensive technologies requiring a large amount of funding. From an asset allocation perspective, it is worth considering where capital is and where it will be needed to finance Net Zero scenarios. Amundi’s AP EGO strategy is an example of how to scale up capital across Emerging Markets.

- Finally, traditional approaches to Strategic Asset Allocation (SAA) need to be reassessed to account for climate risks. This will require the addition of more qualitative and forward-looking inputs in SAA.

Sector focus: Oil and gas

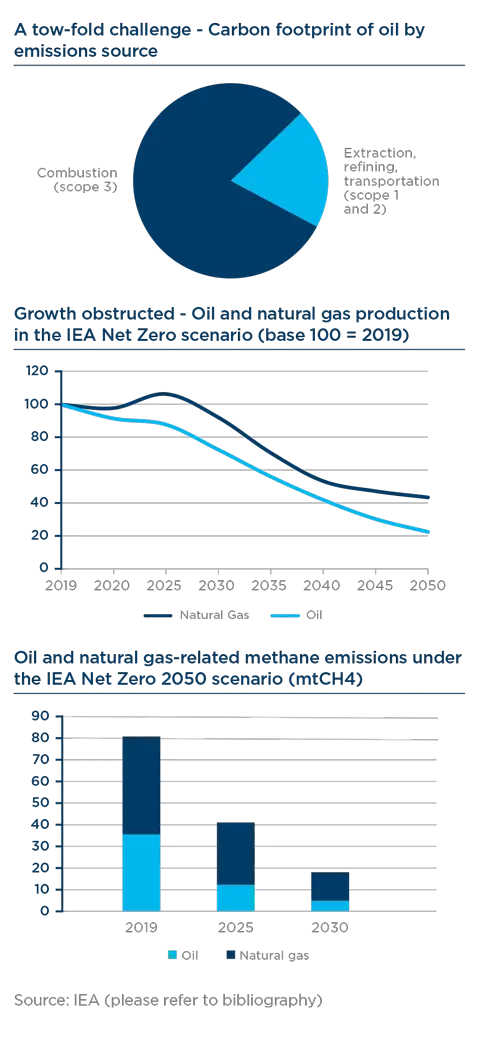

- While the bulk oil and gas products’ carbon emissions comes from their final combustion, the remaining part comes from extracting, processing, and transportation activities. The Oil & Gas sector therefore faces a challenge both at the operational and strategic level.

- According to the IEA NZE Scenario, the sector should cut CO2 emissions related to oil and natural gas by 30% over 2019-2030 and its methane footprint by 80% by 2030.

- Oil & Gas companies notably need to improve the resilience of their portfolios, mitigating economic stranding risks. Amundi expects that these companies will, on the one hand, cut the carbon footprint of their operations and, on the other hand, use more cautious planning assumptions by carrying out stress tests based on IEA NZE.

- Amundi believes that assessing the alignment of capital allocation strategy to Net Zero through KPIs is relevant, even if there is still a lack of standardization among companies. This has led Amundi to ask Oil & Gas companies for a more granular breakdown of CAPEX plans and to develop an in-house indicator to assess companies’ contribution to global Net Zero efforts.

Introduction

While carbon emissions have been increasing slowly despite efforts to bring them down, “net zero” commitments, however, have skyrocketed. Setting climate objectives used to be the appanage of public actors, but no longer. Investors are increasingly on board and net zero alliances exist for all kinds of financial institutions: asset owners, banks, asset managers. On top of that, at the COP26 in Glasgow, a net zero alliance of alliances will be launched “the Glasgow Financial Alliance for Net Zero”.

In the first ESG Thema paper, we answered the following questions: what is Net Zero, and what does it mean in practice for the economy. In this third ESG Thema, we seek to answer the following question: is the “net zero” wave a fad that will shortly pass, or a structural change that investors should study and incorporate? Hint: pick option 2.

A Net Zero Crash Course if you missed our Introduction to Net Zero

What is Net Zero? Where does it come from? When is it due? Who is it for? What does it mean? These are five questions that are worth answering again, given their strategic importance.

“Net zero” refers to the need to lower greenhouse gas emissions to “close to zero”, with residual emissions covered by activities and technologies that remove carbon from the atmosphere. Hence the “net” in front of the “zero”.

Who decided we needed to strive for net zero? In short, the United Nations. Back in 2015, the Paris Agreement enshrined the objective of limiting the global temperature rise to well below 2°C and pursuing efforts to limit it to 1.5°C, a level beyond which the impacts from climate change would be catastrophic. At the end of 2018, a special report from the Intergovernmental Panel on Climate Change (IPCC) has shown that a significant differences exist in terms of negative outcome between awell-below scenario and a 1.5°C scenario. It has also translated that objective into a target: limiting this temperature to a 1.5°C rise would require reaching carbon neutrality at a global level in 30 years, hence “net zero” in 2050.

Net Zero is, unsurprisingly, for everyone. Governments representing close to 70% of global CO2 emissions have made net zero pledges, and a growing number of corporates, banks, asset owners and asset managers have followed suit with their own pledges. This means that both public and private actors have moved on the issue.

In the economic realm, reaching net zero emissions entails massive industrial and financial shifts. One example, among countless others: it is estimated that renewable energy capacity additions should be between two to three times higher for every year until 2030 than it was in 2020. This is staggering, and does not even begin to uncover the social consequences of such shifts.

Are “net zero” commitments marketing signals? Probably. Do they limit themselves to that? Certainly not. Considering that “net zero” will be a passing trend that will disappear as soon as the Glasgow conference comes to a close would be a big mistake. As would be the decision not to prepare, plan out, and execute a net zero plan.

| Net Zero Asset Owner Alliance Key Performance Indicators |

| The 2025 Target Setting Protocol lists 4 main KPIs to monitor net-zero commitments:

1. Portfolio carbon emissions (absolute or intensity based) commitments that would only be greenwashing. |

In this paper, we will walk you through what net zero means for investors. Like in many situations, “net zero” is most likely not a one-size-fits-all affair. However, there are tools and guiding principles that can be adopted and adapted to make sure you are ready, well positioned, and well equipped for the “net zero” wave.

Incorporating Net Zero: Untangling the web

Alok Sharma, President of the Glasgow COP26, stated “There is a real advantage in getting your house in order, and early […]”. To do so requires clarity and an understanding of what net zero entails for an investor, across the entire value chain: from asset allocation, to investments, to voting and reporting.

Without a doubt, net zero will be a huge challenge for the investment world: there is no single answer, no single path to net zero, and net zero methodologies are evolving rapidly, meaning that one runs the risk of becoming outdated before one even knows it. Nevertheless, we can expect some communality between different frameworks. They will need to deliver real-world decarbonization, to demonstrate their contribution to clients and regulators and to follow guidelines already established by policy-makers.

Given the above, the objective of this section is not to provide a comprehensive “how to reach net zero” manual, but to give investors some guiding principles to prepare and implement a smart net zero strategy. This strategy will have to answer the following question: how should investors allocate capital to contribute to the net zero objective?

As we walk through the asset owner’s value chain and explore the ramifications of net zero at each step, we keep in mind five guiding ideas, that we apply throughout.

| Five ideas for Net Zero |

| Key idea 1 Investors can start by excluding corporates that are detrimental to net zero objectives. Key idea 2 Historical carbon footprints are good, but better if combined with forward looking metrics, including CAPEX plans. Key idea 3 Active engagement with corporates is crucial to turn investment beliefs into concrete action. Key idea 4 There is plenty of room for innovation when it comes to financing the transition to net zero. Key idea 5 Traditional approaches to Strategic Asset Allocation should be reassessed to account for climate risks. |

1. Do no significant harm: excluding the worst issuers from investment universes

A starting point for investors would be to progressively apply net zero commitments to all assets and to develop a comprehensive exclusion policy for companies responsible for most of greenhouse gas emissions.

Most investors have already set up exclusion policies on polluting activities such as coal mining and coal power generation. Going forward, investors should think about enlarging these policies to all corporates whose strategies are detrimental to climate change mitigation.

| Key idea 1 Investors can start by excluding corporates that are detrimental to net zero objectives. |

2. Contribution to net zero: investing in the transition and engaging with issuers

Given that all sectors and corporates need to transition, a net zero approach cannot only be about short-term exclusion. In this section, we will provide an overview of how investors can contribute to reaching carbon neutrality through innovative investment solutions and continuous dialogue with issuers to turn investment beliefs into concrete action.

Investment Strategies and Reporting: Room for innovation

Translating an investor’s net zero commitments into investment strategies is a difficult task both from a conceptual and implementation angle. Conceptually, because different approaches can be considered such as setting top-down decarbonization objectives on portfolios consistent with net zero emissions pathways, or bottom-up selection strategies. In terms of implementation, it is currently impossible to build a perfect “net zero today” product as there are too few projects and corporates that have net zero carbon emissions. In fact, there are too few corporates that have made credible commitments to ever being net zero carbon emitters at all.

Where does that leave investors? Again, there is no standard net zero product that can be designed and invested across asset classes and geographies. The most advanced product is undoubtedly to be found in the passive space, with the European Commission’s Paris Aligned Benchmarks (PABs) and Climate Transition Benchmarks (CTBs).

| A rundown of PABs and CTBs |

|

Paris Aligned and Climate Transition Benchmarks have been designed by the EU Commission to offer clients with a standard product when it comes to decarbonizing, in line with the objectives of the Paris Agreement. Their level of ambition differ by their exclusions and green requirements but they have a common ground: decarbonizing by 7% every year to be in line with a 1.5°C scenario as per the IPCC. They have become a reference for investors that want to be Paris-aligned. However, investors must keep in mind that they may evolve in the future and that knowledge on decarbonization is improving as new strategies are developing. |

The financial industry has plenty of room for innovation to develop relevant products as access to relevant indicators along with robust related data improves. In our view, a “net zero” investment strategy should feature several core elements:

Seeking carbon reductions in the real-world. Carbon emissions are the heart of net zero, and should therefore be at the heart of any “net zero” investment strategy. A carbon reduction pathway that is on track with the global objective of net-zero is a good way to orientate financing toward corporates that decarbonize. However, it should include a reality-check, to make sure that this reduction translates in the real economy and that investors do not simply avoid polluting sectors. As of today, some corporates already differentiate in their reporting what proportion in their year-on-year carbon reductions comes from sustainable real-world carbon reductions, as opposed to one-off portfolio or other activity-related effects. In order to set those carbon reduction goals, investors must also bear in mind that flexibility will be key. Indeed, as climate change accelerates and scientific knowledge improves, carbon reduction objectives will probably become more stringent.

Second, looking at trends and forward-looking indicators. The race to net zero is about transitioning and today’s carbon emitters are key in solving the net zero equation by decarbonizing their processes and products. Looking at trends can therefore be more relevant in the net zero context than absolute carbon footprints. Investors and asset managers will need to use new metrics within their investment process to measure the contribution of issuers to the net-zero objective. Some are already available and/or work-in-progress, such as Science-Based Targets (SBTs) and temperature scores to standardize a measure of corporates’ decarbonization ambitions against net zero global efforts. These metrics will ensure that investees are effectively reducing their carbon footprint and that the investor is actively contributing to the decarbonization objective. However, sector specific decarbonization pathways have yet to be designed for several key sectors. Moreover, CAPEX plans could also be a good forward-looking indicator of the investments of a corporate into the transition toward a net-zero economy.

| A rundown of forward looking indicators: SBTi targets and temperature scores |

| SBTi targets They are carbon reduction targets that are validated by the Science-Based Target initiative. The organization assesses the ambitiousness of the targets declared by corporates with respect to the Sectorial Decarbonization Approach. They compare the projected pathway of a corporate with given to a pre-determined carbon budget compliant with the International Energy Agency (IEA) Sustainable Development Scenario. Temperature scores Those scores measure the alignment of corporates ambition and past performance with respect to the carbon budget of main scenarios such as the IEA Sustainable Development Scenario. They aim at presenting the level of alignment of corporates with global climate goals. Temperature scores allow to quickly compare the commitments of a corporate with the overall goal of limiting global-warming to 1.5°C. |

Clear reporting against the ultimate global net zero goal. Investors will need to demonstrate to regulators and to the public that they are moving in the right direction, so reporting will be a key element for them. Innovation on KPIs will be key, with current tools having shown their limitations. That’s why investors will need to work closely with data providers to find the right KPIs that ensure that they deliver their commitments. In other words, net zero commitments of investors will only succeed if the world is moving toward a net-zero economy and KPIs have to reflect that.

On top of that, a comprehensive approach to net zero should feature a social dimension. Indeed, the massive transformations that a transition to a net zero world requires will definitely have large social impacts, on job security and quality, on health, on sustainable housing and transportation and so on. Workers and consumers alike will be impacted. Therefore, an inclusive transition approach is necessary: a green transition cannot be achieved without a socially inclusive approach. In our view, assessing the social acceptability of corporate carbon reduction plans is already key to evaluate the risk of setbacks in the implementation phase. In this light, the timing is right to support and finance a transition to a 2°C world, whose success rests on our collective capability to (1) embark all sectors and activities, and (2) ensure that the transition is done in a socially acceptable manner.

| Key idea 2 Historical carbon footprints are good, but better if combined with forward looking metrics, including CAPEX plans. |

Engagement and Voting: Sending the right signal

Investors should also review whether their engagement and voting policies are best fitted to contribute to net zero goals. Engaging with corporates is critical, in the short, medium and long-term. Engagement must be a key component of a net-zero strategy because it shows the credibility of an asset manager in its net-zero objective and put pressure on corporates to act. Indeed, engagement is an efficient way to translate an actor’s investment beliefs into concrete and measurable action.

The objective of net-zero emissions is global and will be reached only by mobilizing all actors. Investors have a role to play by putting pressure on corporates that lag behind and by accompanying corporates that are leading the charge. Defining a comprehensive and balanced net-zero engagement strategy is not easy as it must embody the specificities of all sectors. However, it is crucial for investors as they need corporates to move in the right direction to make sure that their investments are contributing to the net-zero objective.

| Key idea 3 Active engagement with corporates is crucial to turn investment beliefs into concrete action. |

3. The Net Zero financing challenge: tapping into new geographies and asset classes

Even though capital is abundant nowadays, the net zero financing challenge remains high as net zero scenarios rely on the deployment of capital-intensive technologies. Based on the IEA Net Zero Emissions (NZE) scenario for instance, energy investments would have to rise from an equivalent of 2.5% of global GDP up to 4.5% in 2030. Such a scenario requires a huge mobilization of private capital. From an asset allocation perspective, it is worth considering where capital is and will be needed in net zero scenarios. Investors can keep in mind several ideas when incorporating Net Zero in their Strategic Asset Allocation:

Adapt your targets to geographies. Carbon footprints and trajectories differ substantially depending on where the corporates are located, as do corporates’ capacities to reduce their emissions in the near term. A granular approach per geography – such as developed markets versus emerging markets – makes sense and is aligned with net zero trajectories. The financing challenge appears particularly high for emerging countries: clean energy investments in 2030 should reach levels three times higher than in the past five years globally, and seven times higher for emerging and developing economies.

Unlocking financing barriers. We believe there is plenty of room for innovation for strategies designed in a way that alleviates key hurdles to net zero financing needs. This can typically include strategies structured around public-private collaborations that can lower the cost of financing for clean energy developers for instance, while allowing institutional investors to allocate capital beyond their usual boundaries and to stay within their risk frameworks. For example, Amundi’s AP EGO strategy launched in partnership with the International Financial Corporation (IFC) to develop the green bond market in emerging countries aims to provide institutional investors with appropriate risk/ return profiles, while targeting emerging market debt premium. It also enables the strategy to meet the stringent investment criteria of institutional investors seeking to invest in emerging markets.

Consider new or unexplored asset classes. If we are to collectively meet the Net Zero objective by 2050, significant investments will need to be made to scale up existing climate innovations, and to develop the innovations of the future. In this light, investors can focus on green impact strategies (e.g. targeting green bonds in emerging markets where there is higher additionality), green private financing to support innovation, and renewable energy infrastructure. The specific features of clean energy projects and infrastructures also bolster the role of debt in the financing of the energy system. Counting on their own balance sheet, corporates may face limitations in financing their clean energy project pipelines as fast as needed in net zero scenarios. Off-balance sheet financing such as project finance can therefore work as a key lever to net zero efforts. Through allocation to real assets, a number of institutional investors already contribute to these efforts: IRENA found that 21% of a large sample of institutional investors already have investments in renewable energy funds or directly in renewable projects. Finally, the race to net zero requires speeding up the development of low-carbon technologies that are still under development such as solid-state batteries or green hydrogen: two thirds of incremental CO2 reductions beyond 2030 depend on technologies in the IEA NZE scenario. Investors can help those technologies by supporting R&D projects of corporates or through venture capital.

| Key idea 4 There is plenty of room for innovation when it comes to financing the transition to net zero. |

4. Net Zero Implications for Strategic Asset Allocation

Research on how to integrate net zero objectives within risk models is a key element that needs to be tackled at the industry level between both asset managers and asset owners.

Strategic asset allocation (SAA) is one of the cornerstones of investors’ portfolio construction. As the investment industry works on how to efficiently integrate ESG in SAA, climate considerations will too become a major factor for investors, trustees, and regulators. In practice, this is a tricky topic for investors to implement: while ESG approaches are often bottom-up exercises, SAA is a top-down affair.

What is clear, however, is that traditional approaches to modelling SAA should be reassessed, so as to tackle the fundamental shifts in the global economy brought about by climate change. Indeed, while standard approaches to SAA rely on historical quantitative analysis, much of the investment risk around climate change requires the addition of more qualitative and forward-looking inputs. Given the uncertainty around climate policy, investors should think about using scenario analysis to anticipate future trends and pathways resulting from climate change.

There are a few steps investors can take to improve the resilience of their portfolios. These include the development of climate risk assessments, changes in asset allocation, engagement with companies to improve climate risk disclosure, etc. On top of that, investors should think about communicating more systematically with policymakers to formulate a coordinated policy response to the climate crisis. Pushing for dialogue at the industry and policy levels could play a major role in overall portfolio risk management.

| Key idea 5 Traditional approaches to Strategic Asset Allocation should be reassessed to account for climate risks. |

Net zero 2050: an existential threat for the Oil & Gas sector

The combustion of hydrocarbons is responsible for more than half of global energy-related CO2 emissions. Because of controlled or uncontrolled gas leaks across the oil and gas value chains, oil & gas activities are also responsible for about one-quarter of global anthropogenic methane emissions, thus adding more than 2GtCO2-eq to the c.19Gt CO2 footprint.

In average, although the bulk of the carbon footprint of oil and natural gas products comes from their final combustion (scope 3 – use of sold products), 20% to 25% of the overall carbon footprint is due to extraction, processing and transportation activities, i.e. operational emissions. In the race to net zero by 2050, the sector therefore faces a significant challenge both at the operational and strategic levels.

This two-fold challenge is well highlighted by Net Zero scenarios such as the one released by the International Energy Agency in May, and according to which:

1. CO2 emissions related to oil and natural gas would have to drop by close to 30% over 2019-30. Such a low carbon diet on the demand side would leave the production of crude oil and natural gas respectively 27% and 9% below 2019 levels by 2030 and dampen hydrocarbon prices. In such a scenario, there is virtually no need for new oil and gas fields, and natural gas liquefaction units. We note still that this scenario still leaves some room for natural gas and oil production in 2050, albeit for blue hydrogen or non-energy use mostly. This sets the strategic long-term growth challenge.

2. The methane footprint of the sector should be cut by close to 80% by 2030, with significant reductions needed for operational CO2 emissions too, including the elimination of all gas flaring. This sets the challenge at the operational level.

No oil and gas activity is spared by the low-carbon challenge

How to put the company’s strategy in the race for net zero should therefore be a subject for the boards of all companies in the sector. Indeed, in the race to net zero, all the activities throughout the oil & gas value chains are concerned by economic stranding risks in our view. This ranges from exploration and production to transportation (pipelines, natural gas liquefaction) and refining activities. Although they often display lower direct carbon footprints, oil services companies specialized in providing equipment and services to this sector are equally challenged from a business growth perspective, in our opinion.

We expect oil & gas companies to build the resilience of their portfolios while contributing to global net zero efforts

With the view to improve the resilience of their oil & gas portfolios and mitigate economic stranding risks, we expect companies to:

1. Cut the carbon footprint of their operations: based on our research, we find that some oil & gas companies display upstream carbon-intensities more than 10x higher than current best-in class performers. Poor performance extends beyond energy-intensive oil sands activities and can notably be due to methane emissions left unchecked. We expect companies to improve detection and abatement of methane emissions, to strictly limit flaring to safety requirements, and to consider other solutions such as off-grid renewable electricity supply, and carbon capture and storage.

2. Use cautious planning assumptions. For instance, we compare companies’ oil and natural gas price assumptions used for new investment appraisals and impairment tests with prices assumed by climate change mitigation scenarios. While some companies mention the reference of the IEA Sustainable Development Scenario for their long-term price assumption, we now expect them to also stress test the

NPV of their portfolio based on the IEA NZE assumptions, as part of their TCFD disclosure (scenario analysis).

Net zero scenarios imply a faster shift of the global energy system towards renewable-based electricity, alternative low-carbon fuels such as advanced biofuels and low-carbon hydrogen, and CO2 sequestration solutions. The associated investment effort is tremendous and requires three time higher annual clean energy investments by 2030. In such as context, we believe that oil and gas companies (and ‘systemically important’ oil and gas companies in particular) have a key contribution to bring to global net zero goals by building the necessary low-carbon assets. At the same time, such diversification towards low-carbon solutions should improve the long-term growth profile of their portfolio.

Net zero alignment in the Oil & Gas sector: a complex equation

A growing number of oil & gas companies has adopted portfolio carbon intensity indicators that comprehensively capture low-carbon transition challenges by incorporating scope 3 emissions in their calculation. We encourage the adoption of such KPIs and of associated reduction targets. At the same time, we are cognizant that the different methodologies used limit at this stage a robust direct comparison. We therefore call for standardization within the industry. The Science-Based Target initiative has yet to come up with its methodology to certify reduction targets of oil and gas producers. On this point, we responded to their public consultation last year and the new sector pathway is due to be launched in 2021.

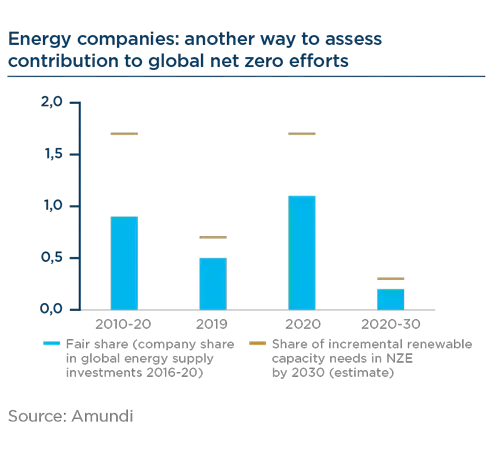

While we therefore keep relying on a multi criteria approach, we believe that assessing the alignment of the capital allocation strategy is particularly important. This led us to:

1. Ask for more granular breakdowns of CAPEX plans, as we believe it is much needed to better check the alignment with global net zero investment efforts. This is not only true on the ‘green’ side, but also on hydrocarbon side, notably when it comes to differentiating investments to sustain the production of existing fields from capex dedicated to new developments (greenfield) virtually seen as not needed in the IEA NZE.

2. Develop an in-house indicator to assess the companies’ contribution to global net zero effort by technology. We first assess the contribution of planned renewable capacity additions by the company to the global net zero scenario by 2030. For instance, a company planning to add 7GW pa would contribute to c.1% of global net zero efforts. We then compare this contribution to the company’s share in global energy supply investments, in order to derive a ‘fair share’ contribution. None of the companies assessed reach a 100% fair share contribution to net zero for now for renewable power (although some do based on ‘well-below 2°C’ scenario). However, some largely overshoot their fair contribution for the development of liquid biofuels.

| Discussion box Our view on offsetting |

| Offsetting via nature-based or industrial emission removals techniques should be left to hard-to-abate activities. We therefore generally expect companies to focus and rely on operational levers first. In the context of the oil & gas sector, we note that the IEA NZE leaves room for c.1.2Gt of unabated CO2 emissions from oil and natural gas combustion, notably from the transportation sector. This represents less than 10% of the current levels. Oil and gas companies can legitimately seek to use offsets to compensate such scope 3 emissions. In any case though, we expect the contribution of offsets to the achievement of carbon reduction targets to be quantified and marginal. Forestry offsets are temporary by nature and we encourage companies to recognize this risk by adopting conservative practices such as maintaining several years of reserves. Last but not least, carbon accounting remains a discipline in development and we are also concerned by double-counting risks such as discounting CO2 reductions enabled by products and services from the company’s carbon footprint (eg CCS). |

Other points on our engagement and voting in the sector

Interim greenhouse gas reduction targets are even more important in our view: while 2050 net zero pledges are always a good start, we expect companies to set interim targets consistent with the strategic timeframe and the long-term net zero objective. On the remuneration policy side, we ask companies to include in their long-term incentive plan energy transition-related KPIs capturing scope 3 challenges on the one hand, and to remove any incentive to strategically grow hydrocarbon production or reserves on the other hand.

_____________________________

Sources:

https://www.iea.org/reports/net-zero-by-2050

https://iea.blob.core.windows.net/assets/4315f4ed-5cb2-4264-b0ee-2054fd34c118/The_Oil_and_Gas_Industry_in_Energy_Transitions.pdf

https://www.iea.org/data-and-statistics/charts/spectrumof-the-well-to-tank-emissions-intensity-of-global-oilproduction-2019