Summary

Key takeaways

- Interconnected Issues Demand Integrated Action: Biodiversity, climate change, and land degradation are deeply intertwined challenges requiring cohesive solutions that simultaneously mitigate climate impacts, adapt to their effects, and preserve biodiversity. Stakeholders — governments, businesses, and investors — are also increasingly recognizing the value of integrated approaches across the biodiversity and climate agendas.

- Separate Frameworks, Growing Synergies: Since the 1992 Earth Summit, three environmental issues (climate, biodiversity and land degradation) have been addressed through distinct UN Conventions, known as COPs. However the recent COPs, have seen greater alignment among these issues, reflecting a recognition that their solutions are mutually reinforcing. This trend offers investors a clearer pathway to contribute across multiple sustainability goals.

- Strong Implementation Mechanisms put to the Test: The Paris Agreement included a strong implementation mechanism to progressively raise the ambition of national commitments until the world is on the path of a global warming limited well-below 2°C. Even though the target is still far from reach, there has been a first inflection with new implemented climate policies putting the world on a path towards +3,1°C by the end of the century vs. +4,2°C when the Paris Agreement was adopted. The Global biodiversity framework included a similar mechanism to meet the target of stopping and reversing the trend of biodiversity loss. The efficiency of these two mechanisms is currently being tested by the geopolitical context and the difficulty to reach international agreements.

- Financing Gaps Highlight Opportunities for Innovation: Disappointing negotiations around the new collective quantified goal (NCQG), show that challenges persist in ensuring an equitable North-South financial transfers. While public financial flows remain limited, mechanisms like the «Cali Fund» for biodiversity and indigenous payments and the USD 2.5 billion committed by the Green Climate Fund (GCF), signal progress. However there are still significant financing gaps, highlighting a growing demand for innovative private-sector financing solutions.

- Innovative Finance Models Gain Momentum: Innovative financing mechanisms such as blended finance vehicles, climate bonds, climate and biodiversity credits, debt-for-nature swaps are pioneering ways to involve private capital in environmental goals. These mechanisms are increasingly attractive for investors seeking long-term returns that align with biodiversity and climate objectives, offering scalable solutions for bridging the financing gap.

- Real-Economy Progress and Corporate Momentum Acceleration: Contrasting with the heightened policy and political uncertainties highlighted during the COPs, 2024 saw a record growth in clean energy markets, as well as an overall expansion and adoption of transition plans, with many businesses and financial institutions across the world committed to, or with the intention to set, net-zero goals. The sustainability momentum is also on the rise with a growing movement towards a better understanding of companies of their impacts

Introduction

The year 2024 marked a significant moment for global environmental discussions, with the convening of three major conferences, with two having already occurred – COP 16 for the Convention on Biological Diversity (CBD) in October in Cali, Colombia; and COP29 for the United Nations Framework Convention on Climate Change (UNFCCC) in November in Baku, Azerbaijan – and a last one scheduled to take place December, also called COP16, but for the United Nations Convention to Combat Desertification (UNCCD) in Riyadh, Saudi Arabia.

While these conferences focus on distinct environmental issues, they share a growing recognition of interconnected environmental challenges. For instance, climate change is one of the primary drivers of biodiversity loss, with rising global temperatures and extreme weather events disrupting ecosystems and threatening species survival, while healthy biodiversity and soils are essential for mitigating climate change and adapting to its effects. These relationships make it clear that solving one issue in isolation is no longer enough.

The close timing of COP16 and COP29 has initiated the dialogue that these environmental issues are linked. The interconnected-ness of dynamics have highlighted the need for stakeholders to build integrated solutions that address multiple environmental challenges simultaneously.

The private sector is especially getting more involved on biodiversity and climate, as this year’s COP16 for biodiversity saw the highest attendance in the history of CBD COPs. While attention to land degradation is still lagging, the goal of reaching land degradation neutrality is still reaffirmed. Furthermore, more stakeholders, especially financial market players, are beginning to recognize that preserving biodiversity and maintaining healthy soils are essential for both mitigating and adapting to climate change.

The stakes for investors are high, with urgency to act on climate and biodiversity which is both a moral and economic imperative. As momentum builds toward the next climate milestone, COP30 in Belem, Brazil, innovative financial instruments and private sector investments are emerging to support sustainable initiatives, but their effectiveness hinges on robust government actions and policies. To fully harness the potential of these financing mechanisms, governments must create an enabling environment that incentivizes investment in climate and biodiversity projects. Businesses and investors alike have a role to play in shaping a sustainable future whether it is mitigating risks, seizing opportunities in nature-based solutions, or complying with evolving regulations.

1. Every COP counts

COP16 and COP29 as key milestones to secure ambition for biodiversity and climate

COP16 and COP29 were what some observers call “implementation COPs”. Unlike Climate COP21 in 2015 or Biodiversity COP15 in 2022, they are not organized to negotiate major frameworks or agreements; but to discuss key mechanisms that are necessary to implement them. However, that does not mean they should be underrated!

COP16 - First COP after the adoption of the Global biodiversity Framework: the rather unmet challenge of implementation

COP16 for biodiversity represented a collaborative moment for the world to set the tools in order to reach the 23 targets of the Global Biodiversity Framework (also called the Kunming-Montreal Framework). As the first COP after the adoption of the Framework in 2022, the negotiators in Cali had the mission to finalize the difficult part of the negotiation, especially agreeing on the monitoring framework and its indicators, and the hairy topic of financing that remained unresolved.

On the positive side, one of the key achievements was the creation of a global fund, called the Cali Fund, to support benefit-sharing from digital sequence information (DSI), a critical step toward ensuring that companies profiting from genetic resources contribute to biodiversity conservation. The fund also aimed to direct significant resources to Indigenous Peoples and local communities, which was seen as a crucial step in recognizing their role in conservation efforts.

However, the conference ended in disappointment with unresolved questions, as parties could not reach an agreement on the much-anticipated decisions of the monitoring framework and financing due to a lack of time to finalize negotiations. Very late on the last night, the Colombian COP President Susana Muhamad, Minister of Environment and Sustainable Development, had to stop the discussion because too many delegates had already left the conference.

COP29 – Last COP before new NDCs: the missed opportunity of showcasing ambition

COP29 in Baku was another critical milestone in the global fight against climate change negotiations, with observers having expressed divergent reactions, with some acknowledging certain achievements with notable announcements and discussions, while others that emphasized the significant gaps remaining in the implementation of key climate strategies. From contentious negotiations on carbon markets to renewed but uneven climate pledges, the outcomes reflected both progress and persistent challenges.

The negotiations began with a bold announcement of consensus on Article 6.41, (removals and methodological requirements), criticized for bypassing the usual process2. On a positive note, the updates do realistically address downward adjustment of baseline assumptions, and indicate the avoidance of projects which lead to fossil-fuel lock-in. However, guidance on removals and permanence is critically lacking. Additionally, Article 6.2 (defining credit trading) was the subject of complex negotiations3, resulting in better transparency. It is now also required that countries publish approvals of Internationally Traded Mitigation Outcomes (ITMOs), but with no timeframe this could be after the credits are used. Largely, progress was made, and it is likely that global carbon markets will grow as a result. However, the rules fall short of guaranteeing that Article 6-compliant credits will deliver real-world climate mitigations.

Several countries unveiled updates to their Nationally Determined Contributions (NDCs) during COP29, highlighting both ambition and inadequacy. The UK raised its interim 2035 emissions reduction target from 78% to 81% compared to 1990 levels4, earning praise from climate experts. Brazil, the host of next year’s critical COP30, announced a 2035 target to cut emissions by 59%-67% from 2005 levels5. Yet, even its upper threshold falls short of the 1.5°C pathway. Meanwhile, the UAE faced widespread criticism for its 47% reduction target compared to 2019, as its oil and gas production is projected to rise by one-third by 20356. These announcements underscore the uneven progress among nations.

COP29 was championed as the finance COP, meaning that the focus on determining the New Collective Quantified Goal (NCQG) on climate finance was strong, but yielded poor results. At COP29 a $300bn new finance deal for developing nations was agreed upon, under the NCQG. The initial demand for mobilization of finance with a north to south transfer of $1 trillion annually, signalling not only that the demands were not met of some of the poorest and most vulnerable countries to fight climate change, but also an ever increasing financing gap with high stakes of inaction7. Since making the climate finance pledge in 2009, developed countries have failed to deliver the (comparatively modest) original $100bn/year, which brings the plausibility of an increase into question8.

Building on the outcomes of COP28’s first-ever global stocktake, COP29 was supposed to be the occasion for parties to show their willingness to achieve the goals of the Paris Agreement and transition away from fossil fuels, under the broader banner of ‘implementing the global stocktake outcomes’. However, this sparked sharp divisions among nations – with members of the Like-Minded Group of Developing Countries (LMDCs), including India and China, arguing for a singular focus on climate finance, while others pushed for the broader original agenda. These debates reflect the persistent tension between developing and developed nations over responsibility, financing, and timelines for transitioning energy systems.

2. Implementation Mechanisms put to the Test

Meeting global climate and biodiversity targets through robust implementation mechanisms

As for every strategy, the key is in the indicators and processes set up to make sure to meet the agreed targets. In this regard, the mechanism to raise ambition created in the Paris Agreement has been pioneer and is now inspiring other negotiation tracks such as CBD.

The efficiency of the mechanism to raise ambition

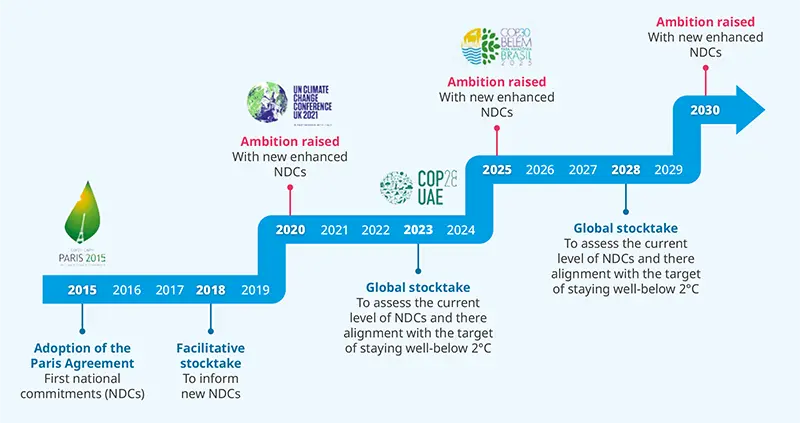

Figure 1: Timeline of Global Environmental Discussions

For climate, the first global stocktake took place at the last COP in Dubaï. As stated in the Paris Agreement, they should then take place every 5 years thereafter, assessing collective progress toward achieving the purpose of the Agreement. Its outcome informs Parties for them to update and enhance their actions to mitigate climate change. When the Paris Agreement was adopted, the world was on a path towards +4.2°C global warming. According to UNEP9, it is now on a path towards +3.1°C with the continuity of current policies and +2.6°C if the NDCs are implemented. This inflection is a good sign, but it is still far from the target of the Paris Agreement to stay well below 2°C and pursuing efforts to limit global warming to 1.5°C. That is why, as organized by the Paris Agreement, new enhanced NDCs are supposed to follow before COP30 in Belem, in order to bring the world closer to its target.

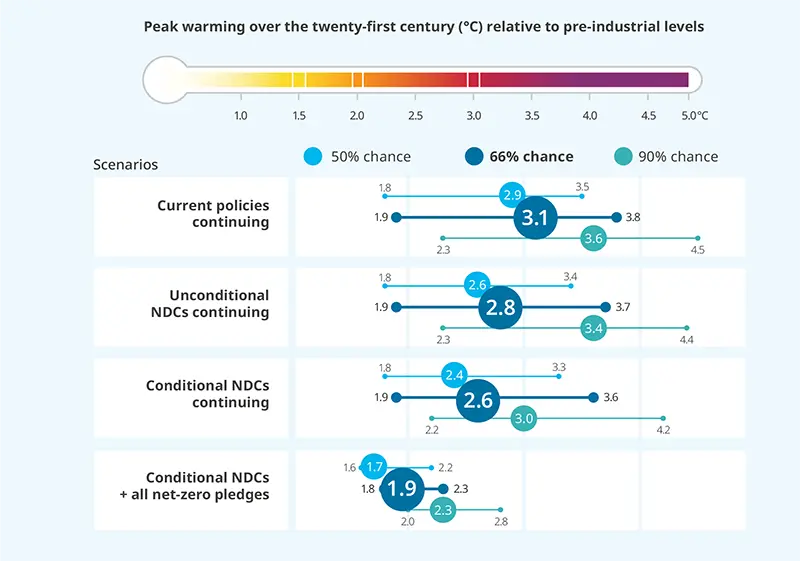

Figure 2: Projections of global warming under the pledge-based scenarios assessed

A continuation of the mitigation effort implied by current policies is estimated to limit global warming to a maximum of 3.1°C (range: 1.9–3.8) over the course of the century, however the Nationally Determined Contributions (NDCs) scenarios lower these projections to 2.8°C (range: 1.9–3.7) and 2.6°C (range: 1.9–3.6), all with at least a 66% chance.

Source: UNEP Emission Gap Report 202410

That is the strength of the ratchet mechanism agreed at Paris in 2015: it is designed to constantly iterate between international target and national commitments; with the goal of continuously enhancing ambition until the world is on the right path.

COP16 delayed the setting up of a robust implementation mechanism

On the biodiversity side, the former decennial framework adopted in COP10 - the Strategic Plan for Biodiversity for 2011-2020, also called “Aïchi targets” – failed to be implemented. As per an official assessment, out of the 20 “Aïchi targets” only 6 out of 20 were partially achieved. The reasons for this failure are multiple and include a fairly absence of metrics and reporting process – making the targets aspirational but hardly achievable.

That is why negotiators of the post-2020 Global Biodiversity Framework took the Paris Agreement as an inspiration and agreed on a similar implementation mechanism, based on national commitments and regular global reviews. These reviews can therefore lead to recommendations for parties to enhance their national targets.

Negotiators in Cali had to agree on the monitoring framework and the global review which is supposed to be conducted for the next COP. This point was key as it also includes the important question of the indicators to assess the achievement of the GBF targets. Unfortunately, the delay of other negotiation tracks led to the absence of agreement, not because indicators were not consensual but because the COP has been suspended before getting to that agenda point.

To ensure the mobilization of all stakeholders on the complex issue of biodiversity loss, these indicators will still be essential, however the delay of their adoption, probably until the next COP in 2026, is no good news but should not mean that we should stop acting for biodiversity.

As investors, our role is indeed major to fund the technologies and projects that contribute to achieve the goals of both climate and biodiversity.

IMPLICATIONS FOR INVESTORS

Facing the risk of disorderly and delayed policy action

- While uncertainties on ambitions and implementation come out as major takeaways of the two COPs, investors are increasingly aware of the risks which may be brought about from the gradual momentum on nature and climate transition, not without the risk that countries hold back on their transition – at least temporarily.

- The delay of agreeing on metrics and indicators for the Global biodiversity framework could be seen as a set back for finance actors who want to invest in biodiversity. However, many frameworks and metrics already exist and can be used by governments, corporates and investors. Amundi developed a bespoke biodiversity investment framework that put forward the Mean Species Abundance (MSA) metric using a vast data-set to assess biodiversity footprint11.

- In a resulting scenario where the pace of transition across the world will greatly vary, introducing higher flexibility in overall asset allocation may allow investors flexibility and new opportunities in allocating towards the transition. Additionally, although the change brought about by the transition may be exponential in nature, these trends are likely to play out over the medium and long term.

- Reconciling long term horizons with the pace of the transition means gradually breaking away from a short-termism mindset and shifting focus toward long term forward-looking approaches. The short-term financial cost of integrating climate or net zero considerations into investors’ asset allocation should be offset over the long run as corporates gradually transition towards low-carbon models12 13.

3. Breaking the ‘finance mobilization’ bottleneck with private sector momentum

Public finance remains the stumbling block of negotiations but private sector stays mobilized

Achieving global climate and biodiversity goals demands urgent financial scaling, with net-zero pathways requiring $4.5 trillion annually in clean energy investments by 203014 and a $700 billion annual biodiversity financing gap15, highlighting a dire need for increased public and private capital flows. Yet, COP 16 and COP 29 fell short of securing decisive public commitments like the NCQG and new biodiversity fund. Despite this, momentum in the private sector is soaring, driving sustainable finance through innovative mechanism like sustainability-linked bonds, carbon markets, and biodiversity credits. Moreover, corporate momentum accelerates with record growth in clean energy markets, robust transition planning.

COP16 & COP29: agreements below expectations on North-South public financial transfer

During COP29, the New Collective Quantified Goal (NCQG) for climate finance was a pivotal agenda item, that tasked developed nations with mobilizing $1 trillion annually to help developing countries mitigate and adapt to climate change. However, negotiations began with unanimous rejection of a 9-page draft meant to guide discussions, and after two exhausting weeks of chaotic bargaining, underscored by long-standing divisions over climate finance, a new finance deal was agreed upon that commits developed nations to pay atleast $300 billion a year by 2035 to help developed countries green their economies and prepare for climate change.

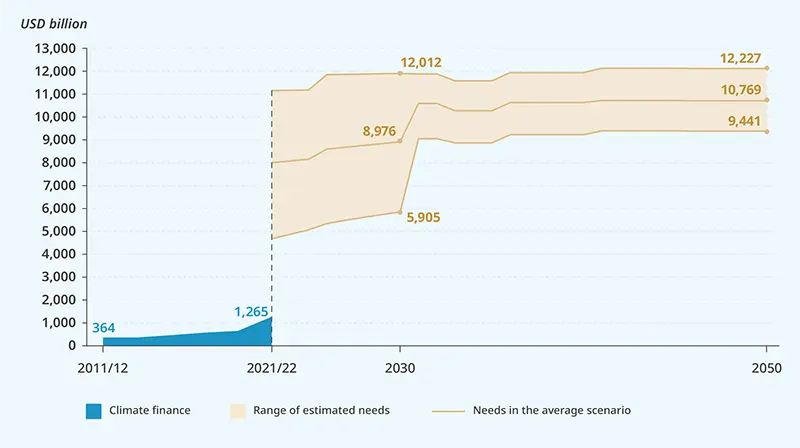

With only a fraction of the initial demands met, developing nations are kicking off a firestorm of criticism fueled by an erosion of trust from previous failures to deliver in the agreed timeline the original USD 100 billion annual pledge since 2009. Geopolitical disagreements are expected to persist over how much is needed, who should contribute, and how contributions are calculated, alongside contentious issues around funding sources, eligible activities, and progress tracking. Meanwhile, estimates underscore the scale of the challenge, that climate finance needs must increase five-fold annually, as shown in Figure 3.

On the bright side of public finance commitments, announcements like the USD 2.5 billion commitment by the Green Climate Fund (GCF) and the additional pledge by Sweden of USD 19 million to the Loss and Damage Fund signals incremental progress, the operationalization of Funds will be critical, as these financing mechanisms are not just a source of finance but also as a demonstration of developed nations’ recognition of their responsibility to repair damage caused by environmental catastrophes.

Figure 3: Global tracked climate finance and average estimated annual needs through 2050

In the average scenario, the annual climate finance needed through 2030 increases steadily from $8.1 to $9 trillion. Then, estimated needs jump to over $10 trillion each year from 2031 to 2050. This means that climate finance must increase by at least five-fold annually, as quickly as possible, to avoid the worst impacts of climate change.

Source: Climate Policy Initiative, Global Landscape of Climate Finance 202316

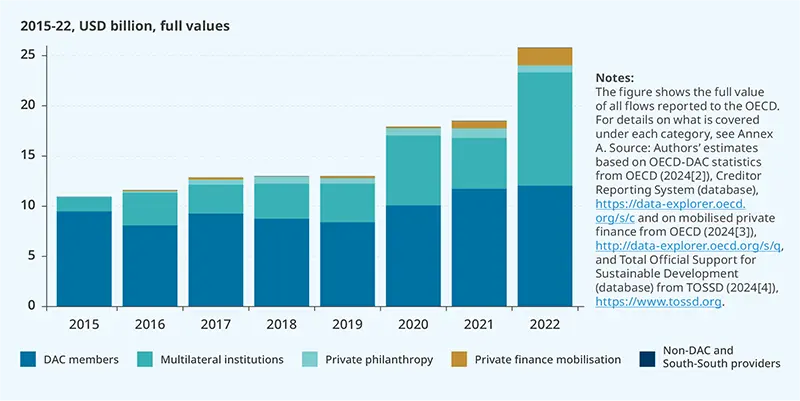

On biodiversity, the Global Biodiversity Framework aims to mobilize at least $200 billion annually by 2030 from public and private sources, putting forth a dedicated goal of $30 billion per year in international public finance by 2030 and an intermediate goal of $20 billion by 2025. At COP16, negotiations faltered due to sharp divides: developing countries demanded a new global fund with distinct governance, while developed countries opposed it. Currently, the Global Biodiversity Framework Fund—established at COP15 and managed by the Global Environment Facility— remains the primary mechanism for supporting GBF targets in developing countries. However, with contributions totaling just $400 million (including $163 million pledged at COP16), it is far from the $20 billion 2025 target, with only 23% of the goal currently met, according to the OECD.

Figure 4: Overall Biodiversity-related development finance

Source: OECD Biodiversity and Development Finance 2015 - 2022 (2024)

Fortunately, these were not the only funding mechanisms discussed at the COPs.

The growth of innovative financing, signaling a new era of sustainable finance

Private sector momentum during and around the COPs break with the slow progress and overall disappointing outcomes of the negotiations. This is underpinned by the now unmistakable energy transition revolution, the world now investing more than twice as much in renewables as in fossil fuels and 2024 having been a year of real-world progress. Financial institutions have responded with innovative products, such as sustainability-linked bonds, carbon markets, and biodiversity credits. These instruments aim to channel resources toward conservation and decarbonization. Frameworks like the TCFD, TNFD and international regulatory frameworks such as the EU Taxonomy have improved transparency.

Bridging the financing gap through innovative financing mechanisms for biodiversity & climate

The International Advisory Panel on Biodiversity Credits (IAPB), led by Sylvie Goulard and Dame Amelia Fawcett, released a Framework for high-integrity biodiversity credit markets, a key step in channeling private investment into nature conservation and restoration. Though in its early stages, this framework offers a new mechanism to help meet the $200 billion annual target for biodiversity. Alongside this, carbon credit markets – both voluntary and regulated – are gaining significant traction by companies and individuals to offset their emissions by purchasing credits that fund projects like reforestation, renewable energy, and methane capture.

Despite this growth critical gaps standardization, monitoring mechanisms, and verification processes are needed to ensure that credits meet global quality standards. Furthermore, there is also a pressing need for better alignment between biodiversity and carbon markets, so that projects can be designed to address these issues simultaneously, creating more comprehensive solutions.

Other innovative mechanisms like green bonds or debt-for-nature swaps also contribute to the funding landscape. Debt-for-nature swaps – a mechanism where creditors provide debt relief in return for a government commitment to protect and restore its biodiversity, is gaining new momentum with the potential to provide $100 billion for nature restoration in nearly 50 countries. This mechanism, where creditors provide debt relief in exchange for biodiversity protection commitments, is increasingly seen as a vital funding option for tropical forests and endangered ecosystems.

The share of green bonds financing biodiversity conservation has grown from 5% in 2020 to 16% in 202317. Though still below target, green bonds for sustainable water management, circular economy, and sustainable agriculture also help reduce biodiversity loss drivers. There’s rising demand for nature-related financing from issuers and investors alike.

Mobilizing finance for emerging markets: overcoming growing challenges and unlocking disruption

Emerging markets and developing countries (EMDEs) bear the brunt of a complex patchwork of regulations that exacerbate barriers to accessing green finance, as most funds are concentrated in advanced economies. Blended finance vehicles have demonstrated success in overcoming these barriers, increasingly playing a transformational role in bridging public and private capital to foster a conducive investment environment tailored to EMDEs’ specific circumstances. For instance, the Sustainable Development Investment Partnership (SDIP), mobilizes public and philanthropic resources to de-risk investments and unlock private capital for sustainable infrastructure projects in developing economies. SDIP’s role in supporting energy infrastructure in sub-Saharan Africa demonstrates its capacity to reduce perceived risks and crowd in institutional investors. However, despite these successes, scaling such initiatives remains challenging, with a greater need for collaboration and innovative financing mechanisms.

Strong market forces in motion: a growing corporate momentum for sustainability, in a record year for clean energy markets

Following the First Global Stocktake at COP28, last year, where stakeholders had pledged to triple the installed renewable power capacity and double the rate of energy efficiency, 2023 saw record deployment of new installed renewable power capacity and the highest ever annual increase in solar photovoltaic (PV). In 2023, renewable power capacity grew by 473 gigawatts (GW) (of which 347 GW was solar PV), compared to the 298 GW of renewables (146 GW of solar PV) added in 202218. China, European Union and United States accounted for 85% of the additions in 2023. The leading role played by solar PV is expected to continue for the rest of the decade, thanks to its sustained cost- competitiveness, manufacturing overcapacity and flexible scalability.

In terms of corporate momentum, there is an overall expansion and adoption of transition plans, with many businesses and financial institutions across the world committed to, or with the intention to set, net-zero goals. More than one-third of publicly traded companies already have net-zero targets in place, which are increasingly validated by the Science Based Targets initiative (SBTi), with the number of companies with an SBTi target doubled in 2023, amounting to 4,204 companies globally19. Additionally, + 6,500 organizations have also reported to CDP that they are planning to develop transition plans within the next two years20.

This proliferation of transition plans can be partly explained by a regulatory push, but not only, as in the US where there are no rules requiring corporates to report GHG emissions, 95% of companies in the S&P 500 index report Scope 1 and 2 emissions, 73% report all or a portion of their Scope 3 emissions, 87% have emission reduction goals in place, and 33% have goals verified by the SBTi. Moving forward, efforts will be needed to ensure global readiness to ensure that corporate impetus for action is aligned with the regulatory push to back transition plans with credible and implementable actions.

Following suit on climate targets, Nature Action 100 presented the inaugural benchmark assessments, that found that most of the engaged companies are still at an early stage regarding their knowledge and action on impacts and dependencies on nature. Investors involved in this initiative will stay committed to accompany companies on their journey towards a better understanding of their relation to biodiversity and the actions to put in place in order to mitigate their impacts.

The Taskforce on Nature-related Financial Disclosures (TNFD) also announced a 57% increase in their membership, with over 500 organizations, including 129 financial institutions representing $17.7 trillion of asset under management committed to TNFDaligned risk management and corporate reporting. This exponential growth also showcases a strong movement towards a better reporting of companies of their impacts and dependencies to biodiversity.

IMPLICATIONS FOR INVESTORS

Focusing on investments that drive transformative change

- Embrace the Private Sector Momentum: The slow progress at COP, especially in terms of climate finance negotiations, contrasts sharply with the private sector momentum driving real-world progress. Investors should recognize the transformative potential of innovations like sustainability-linked bonds, carbon markets, and biodiversity credits. The energy transition is accelerating, with renewables now outpacing fossil fuel investments, and investors should remain committed to seizing opportunities in this rapidly evolving space.

- Focus on Real-World Impact: Transition finance, biodiversity solutions and engagement activities are in the spotlight, well placed to respond to the rising demand for investment solutions aimed at real-world impact. Whether for financial institutions or the companies in which they invest or lend to, climate transition plans should set out a theory of change for the real economy.

- Advocate for Standardized and Granular Data: However, the absence of granular and standardized data still hampers efforts to assess and manage risks effectively. Even when data is available, fragmentation across standards and platforms reduces its utility for investors, and increases operational and financial burden. Financial innovations like biodiversity credits could address some of these gaps but require more robust policy frameworks and investor incentives to thrive.

Conclusion

Finding the path between delayed policy action and strong market forces in motion

The results of the COPs were not as good as expected even thought there were still some steps forward on gender inclusion, better recognition of indigenous communities or corporate engagement for instance. The $300bn new finance deal for developing nations agreed upon at COP29, far from the $1tn initially expected, signals an ever increasing financing gap, which highlights the tension on the international system when addressing environmental issues, with the Paris Agreement and the Global Biodiversity Framework being put to the test.

However, these negative signals should be seen from a bigger perspective. They are indeed balanced by the growing momentum of the climate-biodiversity nexus. As the effects of climate change become more and more tangible in our everyday life, the need for a resilient environment in order to adapt cannot be ignored. Nature-based solutions are more and more understood by companies and investors as a way to enhance resilience against climate change and secure value chains through nature restoration. In 2022, around $35 billion were invested by the private sector in those nature-based solutions, representing a +10% growth in one year19. And by 2030, they could reach up to $100 billion a year for private sector and about $450bn for the public sector.

To ensure continuity in global climate and biodiversity efforts, financial institutions, policymakers, and civil society must strengthen collaboration. This includes harmonizing global ESG standards, creating targeted incentives for biodiversity investments, and expanding public-private partnerships to de-risk green projects. As political shifts, such as the U.S. election outcomes, may test global commitments, it is vital for market players to remain steadfast in advancing sustainability goals; and therefore send positive signals to encourage a more ambitious outcome in the next COPs, especially COP30 in Belem where countries should bring the world closer to the goal of staying well below 2°C.

The road ahead demands collective resilience and steadfast commitment. A unified approach, combining public-private partnerships and robust regulatory frameworks, will be essential to close financing gaps and build resilience against climate and biodiversity crises. Greater synergy can accelerate the adoption of clean technologies, improve data availability, and expand finance accessibility to underserved regions.

The time for decisive, coordinated action is now, as financial players, staying aligned with science-based targets and prioritizing equity across the transition will ensure a just and sustainable future for all.

Sources

1. COP29. COP29 Opens in Baku with Breakthrough on Global Carbon Markets

2. Drilled Media. https://drilled.media/news/COP29

3. Carbon Market Watch. https://carbonmarketwatch.org/2024/11/06/faq-fixing-article-6-carbon-ma…

4. BBC. New UK target for 81% emissions cut by 2035

5. Brazil’s NDC falls short of true ambition

6. Climate Change News. UAE kicks off new global round of UN climate plans

7. Carbon Brief. COP29 DeBriefed 15 November 2024: Azerbaijan’s shaky start; Finance and fossil fuels dominate negotiations; Free webinar today

8. Centre for Global Development. https://www.cgdev.org/blog/how-much-climate-finance-inconvenient-truth

9. https://www.unep.org/resources/emissions-gap-report-2024

10. UNEP. Emissions Gap Report 2024. https://www.unep.org/resources/emissions-gap-report-2024

11. Amundi. Integrating biodiversity into portfolios: a bespoke framework. 2023. https://research-center.amundi.com/article/integrating-biodiversity-por…-

framework

12. Source: https://research-center.amundi.com/article/net-zero-investing-and-its-i…

13. CFA institute estimates that addressing short-termism could result in an increase in shareholder value of some $200 billion (https://www.cfainstitute.org/-/media/documents/article/position-paper/C…). While this is a large figure it is dwarfed by the potential costs of poor ESG decisions.

14. IEA, Net Zero Roadmap: A Global Pathway to Keep the 1.5 °C Goal in Reach, 2023. https://www.iea.org/reports/net-zero-roadmap-a-global-pathway-to-keep-t…

15. Nature Conservancy, A New Deal to Close the Nature Finance Gap, 2021. https://www.nature.org/en-us/what-we-do/our-insights/perspectives/closi…

16. Climate Policy Initiative, Global Landscape of Climate Finance 2023. https://www.climatepolicyinitiative.org/wpcontent/uploads/2023/11/Globa…- Finance-2023.pdf

17. https://www.sustainablefitch.com/corporate-finance/biodiversity-in-esg-…

18. IRENA. World Energy Transitions Outlook 2024. https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2024/Nov/I…

Summary.pdf

19. Net Zero Tracker, 2022,

20. CDP. Are companies developing credible climate transition plans? 2023.

With the support of Marine BRAUD - Founding Partner at Alameda Sustainability Advisory