Summary

Executive summary

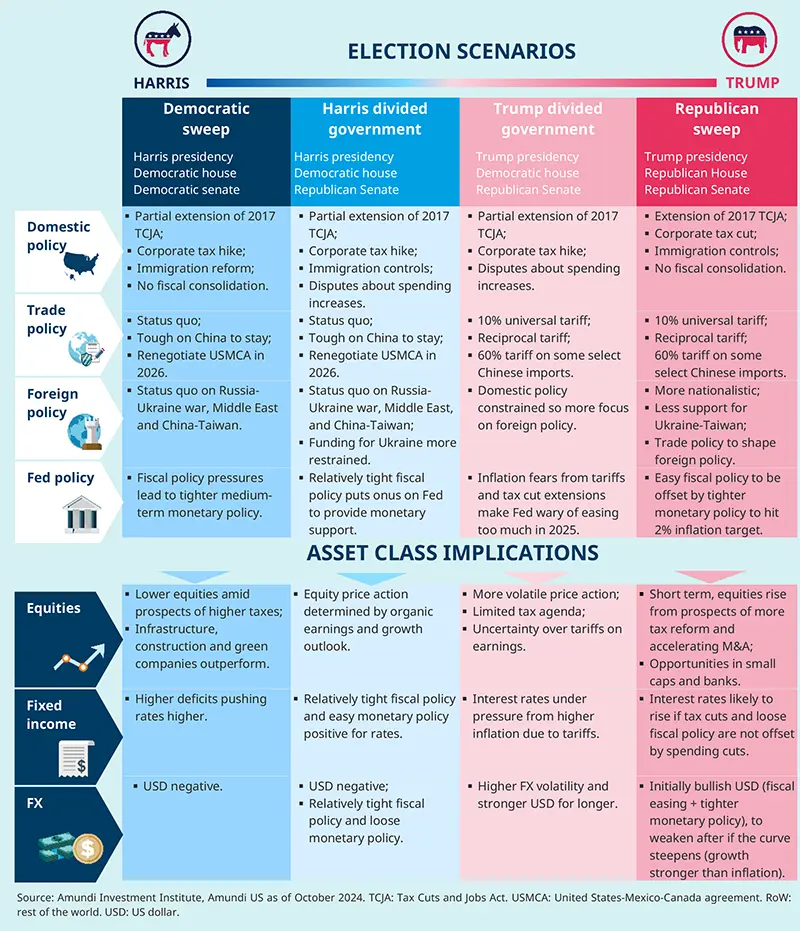

As the US elections approach, markets are increasingly focusing on the candidates' platforms and their implications for the economy and markets. Taxation, foreign trade, immigration and fiscal policy are at the forefront of the candidates' agendas. Harris advocates for higher taxes on corporations and the wealthy to fund social initiatives and green policies, while Trump promotes tax cuts, deregulation and an increase in oil production.

The tariff agenda is particularly relevant for geopolitical, economic and investment perspectives. A Trump administration pursuing the proposals outlined in his campaign would pose higher risks of economic disruption and could strain alliances. The consequences of these actions are challenging to predict, especially in a world undergoing geopolitical shifts, where any action may provoke reactions from other global powers. For instance, China is likely to respond to tariffs and may adjust its stimulus measures based on the election results. On the other hand, a Harris administration may be seen as less disruptive and could see adversarial powers align more closely.

Most importantly, it will not be clear until after the elections which policies will be implemented – beyond the election rhetoric – or whether Congress would agree to enact them, depending on whether they hold sufficient majorities. That would also impact the timing of effective implementation.

Investors should navigate the US elections by balancing short-term sector opportunities with long-term inflation risks, while keeping an eye on geopolitical shifts that could reshape market dynamics.

For investors, we see five main takeaways:

- In the short term, market sentiment is likely to be driven by Trump’s proposed lower corporate tax regime versus the risk of adverse supply and the inflation consequences of tariffs, and his pledge to deport undocumented immigrants. Meanwhile, Harris should be seen as a continuity administration, especially if the Democrats do not have a majority in the House, which will allay fears of wealth taxes and possibly also higher corporate tax.

- The "Make America Great Again" agenda may shape opportunities in US equities, with varying implications at the sector level driven by differing policies. The rally should broaden further, benefitting small caps and sectors such as banks under Trump. A Harris scenario could be more mixed for equities, with infrastructure, construction and green companies favoured.

- Geopolitical reordering will shape market opportunities, particularly for emerging markets in the context of supply-chain relocations driven by tariffs and the competition for technological supremacy. Asia may be more under pressure in a Trump administration, but China may also consider the US elections outcome in assessing its stimulus. Other EM may benefit from relocation, such as Mexico.

- Higher fiscal spending is likely to become a significant theme, with potential implications for inflation expectations. We may witness a further steepening of the yield curve and an increased probability of higher inflation regimes, prompting investors to factor inflation as a key component of their asset allocation. EM bonds could face challenges in an environment of higher inflation volatility under a Trump scenario. With inflation still on the radar, commodities and inflation-linked assets should be favoured as sources of diversification.

- We think the dollar may have entered a structural downward trend, which only a tough trade policy or a strong reacceleration of US price inflation may be able to delay or even invert. In this respect, a Trump scenario is likely to offer a better opportunity for a stronger dollar, given the potential for policy divergence in favour of the Fed and a rise in the risk premium.

Infographic: US election scenarios and market implications

Domestic policy and macroeconomic implications: Harris vs Trump

The broad outlines of the candidates’ respective platforms are coming into focus, though still lacking any clarity on costs related to their specific proposals. More importantly, it will not be clear until after the election which policies they want to implement – absent election rhetoric – or whether Congress will agree to implement them (that depends on whether they command sufficient majorities).

Policy differences in brief:

- Taxation: Harris favours higher taxation on corporates and wealthier households to finance higher social spending, more support for low-income housing, and for continuing the green agenda. By contrast, candidate Trump would reduce tax on corporates, cut government spending, pursue more deregulation and increase oil production.

- Foreign trade: This is where their platforms diverge significantly. Harris would continue with the current administration’s policy of strategic tariffs, largely directed at China. Trump seeks more wholesale protectionism: a blanket 60% tariff on all imports from China and a 10-20% tariff on imports from all other countries. In practice, many suspect that faced with possible retaliation and negotiation with trading partners, effective tariffs under a Trump presidency would be much lower.

- Immigration: If Trump is serious about deporting undocumented immigrants – over 10 million of the US workforce – alongside his tariff proposals, this would constitute a material supply shock, leading to lower growth and higher inflation. Even stricter controls on immigration would reduce the US labour supply.

- Debt and deficits: Neither candidate shows much concern about debt and deficits, a significant medium-term concern for the United States (and the world). Consensus seems aligned in expecting that under Harris, the deficit would rise by about $2-3tn over ten years, and by $6-7tn under the Trump platform. This will be a material concern for investors given that US government debt is projected to increase to about $50tn by 2034 from the current level of $35tn.I

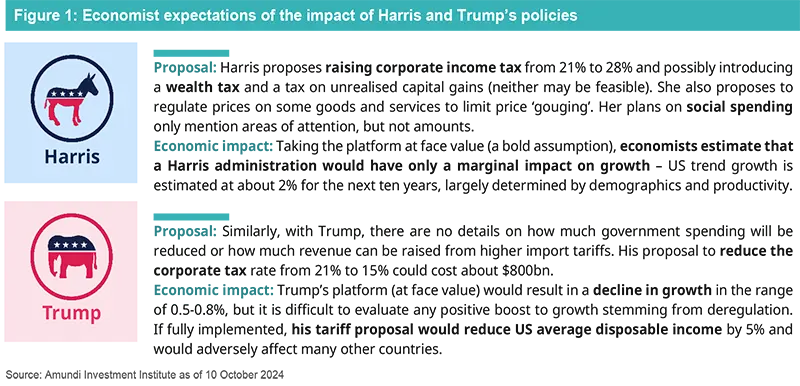

The economic impact of their respective policies can only be gauged from their broad outlines.

In the short term, US market sentiment will be driven by Trump’s lower corporate tax regime against the risk of adverse supply and inflation consequences of tariffs and deporting undocumented immigrants.

Meanwhile, Harris should be seen as a continuity administration, especially if the Democrats do not command a majority in the House, which will allay fears of wealth taxes and also a possible higher corporate tax rate.

Our assessment of the economic impact of the two platforms

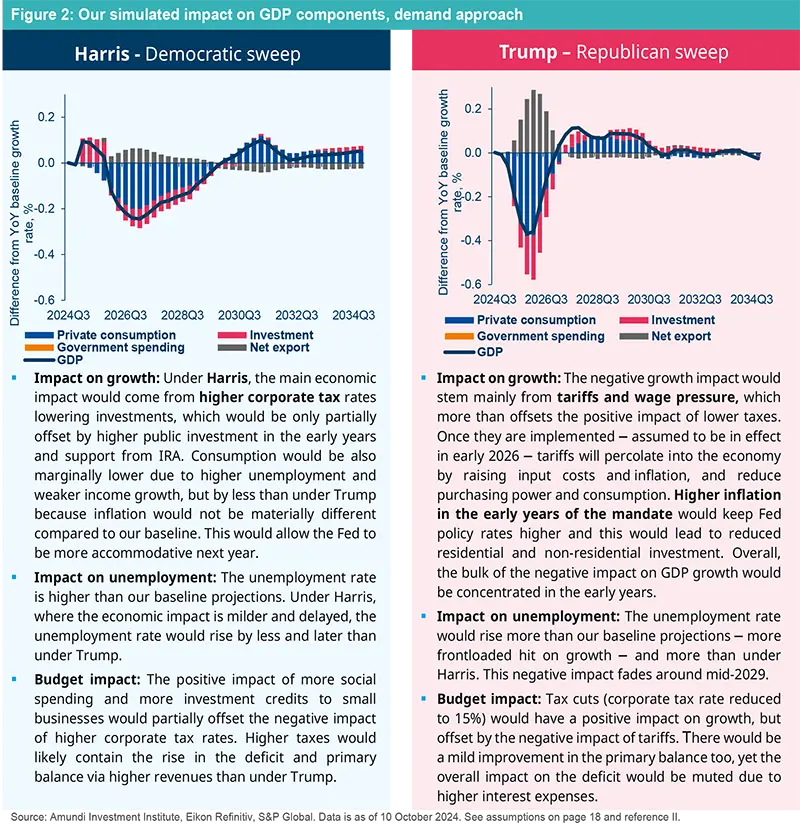

We simulated the short-term macroeconomic impact of both platforms, as currently outlined, which is a bold assumption (see page 18 for details). Aware of the fact that they would likely end up being watered-down if, as is possible, they meet with constraints.

Over a full presidential term, both platforms may lower YoY GDP growth by 0.1-0.2% on average. Yet, as per the charts below, the timing and channels of this impact differ and may be more negative, pronounced and visible under the Trump scenario – if fully implemented – than under Harris. The negative impact of Trump’s package stems mainly from inflationary pressures (tariff-related), whereas under Harris it stems from lower business investment (due to higher taxes).

Key drivers of the race

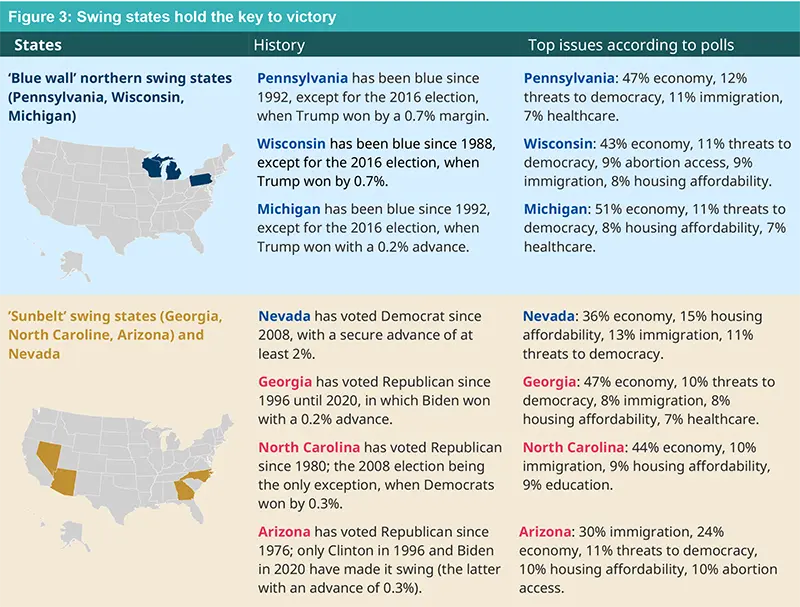

Harris has benefited from momentum since her nomination as Democratic candidate and she currently leads in national polling. However, presidential elections are decided by the Electoral Colleges, a weighted voting system, not by the popular vote. As a result, swing states are critical as each US state has a certain number of electoral college votes in relation to its population. There are many combinations of states that could put either Harris or Trump over the threshold of the 270 electoral college votes needed to win.

Assuming current national polling holds true, neither Harris nor Trump need to win all seven battleground states.

Polls show a tossup in all swing states in the 2024 election.

Source: Amundi Investment Institute, Emerson College Polling. Data as of 10 October 2024.

The polls are inconclusive and at times contradictory. About 43% of respondents identified Trump as the most trustworthy candidate to handle the US economy compared to Harris’ 41% in the Associated Press and NORC Center for Public Affairs Research poll (conducted on 12-16 September). A similar survey conducted for The Financial Times and the University of Michigan’s Ross School of Business found 44% of Americans favoured Harris to shepherd the economy compared to Trump. Another, more recent poll focusing on the swing states placed Donald Trump as the most trusted candidate on economic (except Arizona) and immigration issues (except Wisconsin), while Harris is the most trusted candidate on election integrity issues in all swing states.

Foreign policy and trade

Broadly, both administrations would overlap in some foreign policy areas, such as in their attitudes towards the Middle East and China. Both sides have isolationist tendencies and pursue ‘Make America Great Again’ policies that aim to re-industrialise the United States. They also believe that Europe should step up in defence matters.

The largest divergence in their views related to foreign affairs is their attitudes towards trade, climate change and fossil fuels, the Russia-Ukraine war, US allies and multilateralism. There is a tendency to assume that Harris would provide a more stable geopolitical outlook than Trump.

While US allies are likely to feel more secure under Harris, it is Trump who is more likely to dial down some of today’s sources of geopolitical tensions, at least in the short term.

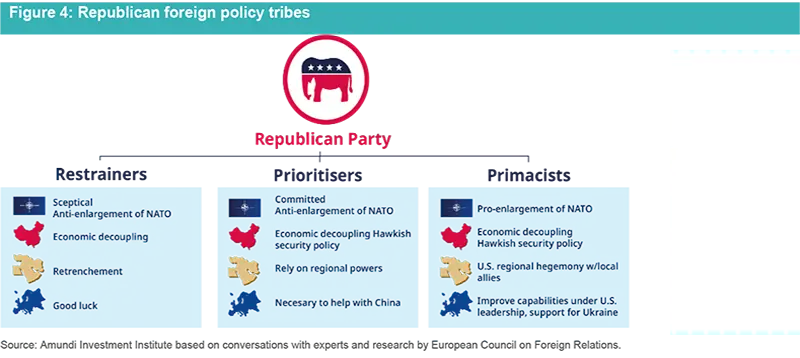

It is often said that Trump ‘1.0’ was prevented from implementing many of his policy ideas because pragmatists in his administration blocked them and that Trump ‘2.0’ would face fewer constraints. This is most likely incorrect because a second Trump term will be influenced by various factors: the different ‘foreign policy tribes’ in the Republican party (see Figure 4), the real-life experiences Trump witnessed in his first term, the personnel he appoints to key positions, and his appetite to cut deals. All these inputs will shape his foreign policy.

For example, in his first term, Trump hoped to achieve a peace plan and two-state solution between Israelis and Palestinians, which ultimately failed and led to a breakdown of trust between Israel’s Prime Minister Benjamin Netanyahu and Trump. These experiences will inform how he deals with current tensions in the Middle East.

The different foreign policy tribes in today’s Republican party will influence US foreign policy in a second Trump term.

In short, a second Trump administration is likely to face constraints in implementing the policy ideas Trump is formulating as part of the presidential campaign. Therefore, a Trump 2.0 presidency would likely face a combination of ideological and pragmatic influences.

Trump's tariff plan estimated impact

According to our analysis of the Trump tariff plan, full implementation of tariffs could wipe out the growth gain from tax reductions, shaving a cumulated 1.7% off GDP over ten years, not far from estimates by The Tax Foundation InstituteIII, where about 0.8% would stem from increases in tariffs on China to 60% and 10% on all other countries; another 0.5% if tariffs on all other countries were raised to 20%. All these estimates are subject to how other countries react. Retaliation (estimated to potentially shave 0.4% from GDP over the same ten-year horizon) could reduce US growth if sufficiently strong or lead the Trump administration to water down the scale and scope of what is currently proposed.

Harris vs Trump foreign policy comparison

After considering the different influences, we summarise below Trump’s foreign policy and trade stances, and the likely positions of Kamala Harris by looking at her political track record to date and the personnel advising her. Let’s take a look at the likely individual policy implications:

Key insights on Trump vs Harris foreign policy and trade

In summary, both Trump and Harris present upside and downside risks for geopolitical stability. The downside from a Trump administration would be economic disruption, as tariffs against allies and foes alike will become a more important tool, leading to retaliatory measures. The Western alliance and transatlantic relations are likely to suffer. On the upside, a ceasefire in Ukraine is somewhat more likely under a Trump administration, which in turn could lower the geopolitical risk stemming from growing Russia, Iran, North Korea, and China ties.

A Harris administration is likely to keep the status quo, where the United States manages the transition as hegemon to a multipolar world with the least disruption possible. The upside is that this approach will focus on maintaining the current world order and keep the international system as open as possible. The downside is that Russia/Iran/North Korea and China geopolitical goals are more likely to overlap.

How the US elections could shape emerging market economies

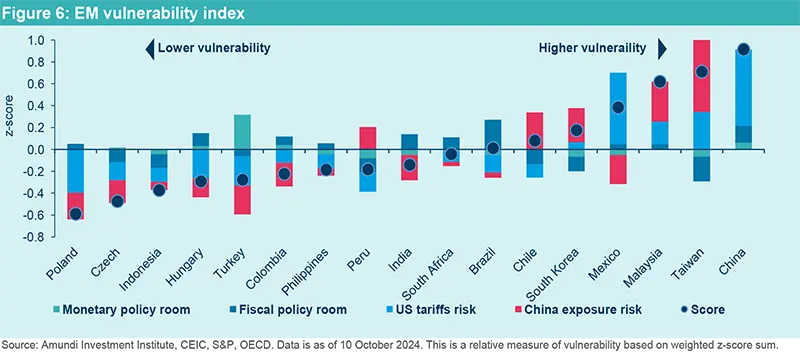

When evaluating the potential impact of the US elections on EM macro and financial markets, the most direct angle comes from their contrasting approaches to tariffs. Trump advocates for a more aggressive stance on tariffs, while Harris leans towards a more moderate or status-quo approach.

Both candidates' platforms share a common thread in the lack of fiscal adjustment, implying a possible medium-term risk of rising core yields and term premia, with consequences on EM monetary policy and EM asset class valuations, without any significant differentiation between the two candidates. From a theoretical standpoint, Trump's radical tariffs are expected to have broad implications on growth, inflation and monetary policy globally, with ripple effects on EM macro and asset classes.

Harris' policies are generally more favourable to EM growth, with EM GDP growth projected to outpace that under Trump between late 2025 and 2028.

Growth is expected to peak around mid-2026 before converging with Trump's trajectory by end-28. The driving force behind this outperformance is China's economic resilience under Harris, while Trump's policies may initially suppress EM growth, particularly in Asia, before rebounding in later years. In contrast, Mexico should benefit from Trump's trade policies.

Under Trump, the impact would be particularly negative for Asian EM, such as Taiwan, Thailand and especially China. Malaysia and India would also face adverse effects, albeit to a lesser degree. Mexico and Hungary could emerge as relative winners. Mexico, in particular, could take advantage of supply-chain shifts from China towards North America. In contrast, under a Harris administration, growth and inflation volatility should be lower, driven by multilateralism, green energy investments and infrastructure development.

Inflation dynamics

In a Trump-led US, EM inflation would experience a temporary spike, rising by over 0.5pp at end-2025 and remaining elevated for most of 2026. This inflationary shock is expected to normalise over time, eventually reverting to the slightly lower levels seen under Harris. Asia would be the most impacted region, with China, Taiwan, Malaysia and Thailand seeing the most significant inflationary pressures. Mexico should experience a disinflationary effect. One of the key concerns is whether EM central banks will need to intervene to curb inflation at the expense of growth or if inflation will naturally settle due to anchored inflation expectations.

Harris’s policies are expected to foster a more stable inflationary environment, with less volatility across EM, mainly due to a more collaborative global trade stance and emphasis on economic stability. In contrast, Trump's protectionist trade policies, combined with unpredictable foreign policy, are likely to introduce higher inflation volatility, especially in Asian markets. Furthermore, currency depreciation under Trump could exacerbate inflationary pressures, as currencies serve as both shock absorbers and competitive tools.

Investment implications

What could be the impact on fixed income markets?

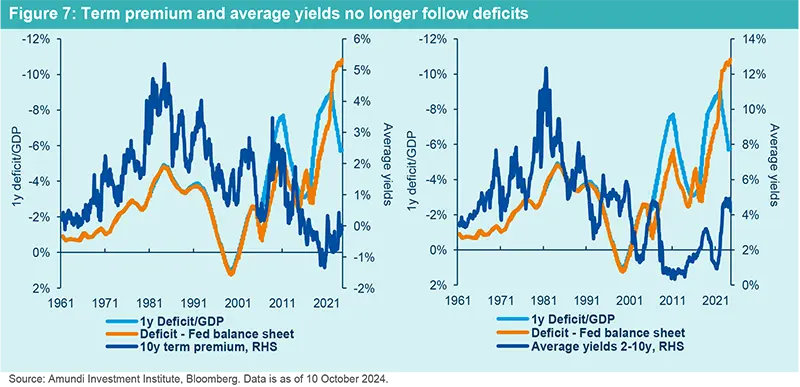

Fixed income investors will focus on how the next President’s policies affect the outlook for growth and inflation, but also on how those policies affect the deficit. James Carville famously said that he wanted to be reincarnated as the bond market, because then he could intimidate everyone. In the 1990s, when Carville said this, it made sense, because at that time yields rose and the curve steepened when deficits increased.

The right-hand chart below shows the one-year average of the federal deficit-to-GDP ratio, plotted against the average level of yields in the 2-10-year area of the Treasury curve. The left-hand chart shows the same deficit plotted against the New York Fed’s estimate of the 10-year term premium. Higher deficits in the 1970s and 1980s tended to coincide with rising bond yields and a steeper curve. Yet, this relationship broke down after President Clinton (and his strategist James Carville) left government. The deficits of the 2008-09 period and the 2020-21 period did not either steepen the curve or drive yields higher.

Several factors may have contributed to the breakdown in this relationship, including quantitative easing (even though debt grew faster than the Fed’s balance sheet, as the orange line in Figure 7 shows). Given the unprecedented increase in the size of the debt, however, with Federal Debt projected to get into unchartered territory, there is a significant risk that we may go back to the relationship of the 80s rather than the relationship of the recent past.

Moreover, an expansionary fiscal deficit risks kindling fears of inflation.

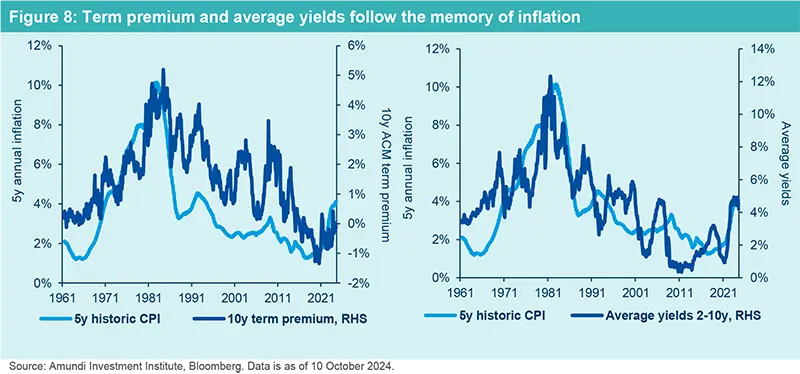

Yet James Carville’s quote still makes sense if we consider inflation. The period between the entry of China into the WTO and the Covid-19 crisis saw very low inflation rates, which may have reduced the impact of federal deficits on bond yields. The charts on the next page show average yields and the ten-year term premium against the five-year historic rate of inflation, as a proxy for inflation expectations. In both periods – the 1960s-2000s and the 2000s-2019s – the impact of inflation on the level and slope of the curve has been considerable.

The key question for bond investors, then, is not just whether the federal deficit will rise or fall, but what impact that deficit will have on inflation.

Our economists argue that if either the Democrats or Republicans sweep both the White House and both houses of Congress, the deficit will rise (more so under Trump), and lead to a more worrisome rise in inflation under Trump. A second Donald Trump term, even with a Democratic house will likely kindle inflation, because the president would be able to impose tariffs, at least on China. Fixed income investors will want to be particularly alert to this risk.

What are the implications for the US dollar?

With the upcoming US elections, a broad set of trade, fiscal and regulatory policy choices are likely to affect the market perception of economic growth, inflation and monetary policy. This reflects investors’ anxiety over the direction the dollar can take, particularly given the battle between policy continuity and policy uncertainty the two candidates’ proposals point to. In our view, regardless of the US election outcome, we may need a substantial spike in risk premium to support the dollar from current levels.

We think the greenback has entered a structural downward trend, which only a tough trade policy or a strong reacceleration of US price inflation may be able to delay or even invert.

For now, both Trump and Harris scenarios do not offer convincing elements for too diverging reaction functions of the Fed, given the threat to financial stability a “high-rates regime” puts on public finances. With a dovish Fed, aligned with other major CBs, the dollar’s recent strength may not be sustained for too long. Yet things may rapidly change should the new administration opt for imprudent fiscal policies and more protectionism.

A Trump scenario will likely offer a better opportunity for a stronger USD, relative to our baseline.

Aside from a Republican sweep scenario, we would expect higher FX volatility in a divided government scenario. The challenge Trump may face on domestic policy should make him tough on trade, and the United States would be more insulated, given the nature of its economy (more closed compared to the rest of the world).

Should Republicans win the Congress, we would expect the USD to strengthen initially on expectations for easier fiscal and tighter monetary response. Yet, we would argue, that growth/early cycle trading and positive risk sentiment may eventually dominate (historically USD negative), unless inflation rises markedly. Meanwhile, in a Harris scenario, we find little bad news to support the greenback. Fiscal consolidation and a less hostile approach towards trade and tariffs make a dovish Fed the link towards dollar depreciation.

What are the expectations for equities?

One of the starkest differences between the Trump and Harris platforms is on taxes. President Trump would cut corporate taxes and make the 2017 income tax cuts permanent, while President Harris would increase corporate taxes.

Equity markets are likely to prefer President Trump to President Harris. There are also likely to be important differences for sectors and geographies, particularly under a second Trump presidency.

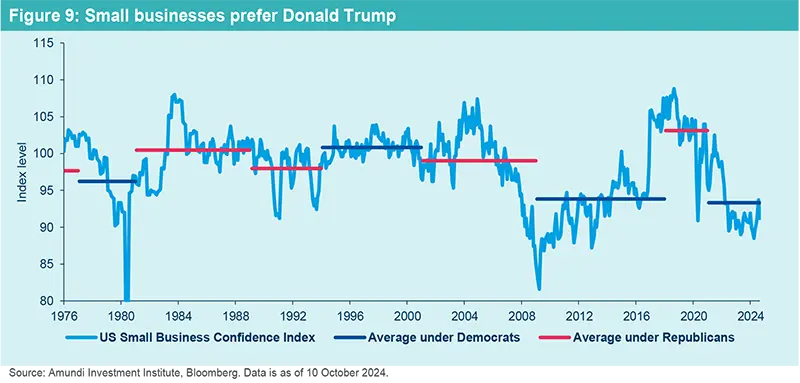

Also, small businesses prefer Donald Trump. That, at least, is the message from the National Federation of Independent Business’s optimism survey. The chart below shows the survey, which has been taken since the mid-1970s, and shows that the preference for a Republican president is relatively recent. In the mid-1970s, Gerald Ford generated slightly more optimism than Jimmy Carter, but small businesses were more optimistic under Bill Clinton than under either of the Bushes or even under Ronald Regan. The sea change took place under Barack Obama, when optimism fell to its lowest level ever (though it has since dipped even lower under Joe Biden). By contrast, small business optimism hit its highest average ever under Donald Trump.

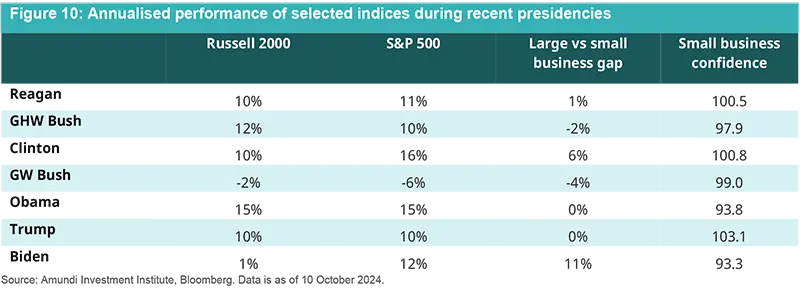

Stock market performances have started to reflect shifts in confidence. The table below shows the annualised performances of the 2,000 smallest companies in the Russell Index, which are a proxy for small businesses, and the performance of the big companies in the S&P 500. For most presidencies, the performance of small and big companies is larger, and the annualised performance gap in the Clinton era did not affect confidence. However, the gap has been noticeably large under Joe Biden. A lack of confidence may now be affecting stock market performance.

It is difficult to tell why small businesses have lacked confidence under the last two Democratic presidents. Fears of regulation – or hopes of deregulation – may be one issue, with small businesses suffering more from regulatory costs. In any case, whatever the reason, it seems likely that a return of Donald Trump would allow small business confidence to rise and narrow the recent gap in small business performance against large businesses. At the sector level, Trump’s deregulation could be supportive of banks and boost M&A activity, while positive market sentiment could help consumer sectors. Harris could favour clean energy and EVs, as well as healthcare.

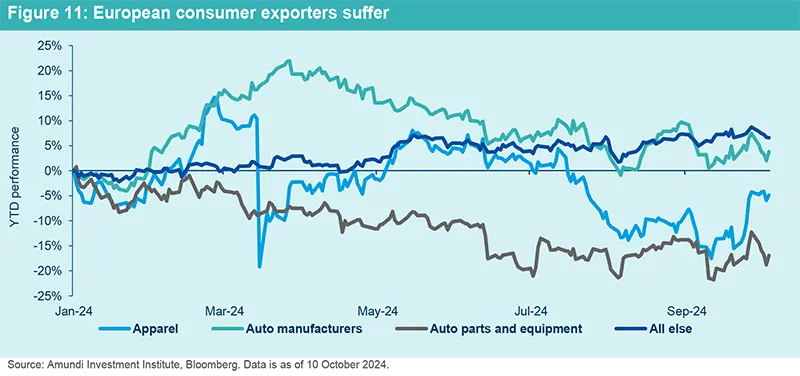

European stock markets have seen a recent underperformance of businesses that export to consumers.

The chart below shows the performance of equally-weighted sub-indices of autos, auto parts and apparel against an equally weighted index of all other companies in the Eurostoxx 600. Auto parts and equipment are leading losses, apparel is negative for the year, and auto manufacturers have given up their early gains. This weakness is due to concerns about China, but it could intensify – and spread to industrial exporters – if Donald Trump enacts his tariff policies.

If Donald Trump becomes the next President, equity investors may find it prudent to adopt a cautious approach towards European exporters, while looking for opportunities in small US companies.

What are the implications for emerging market assets?

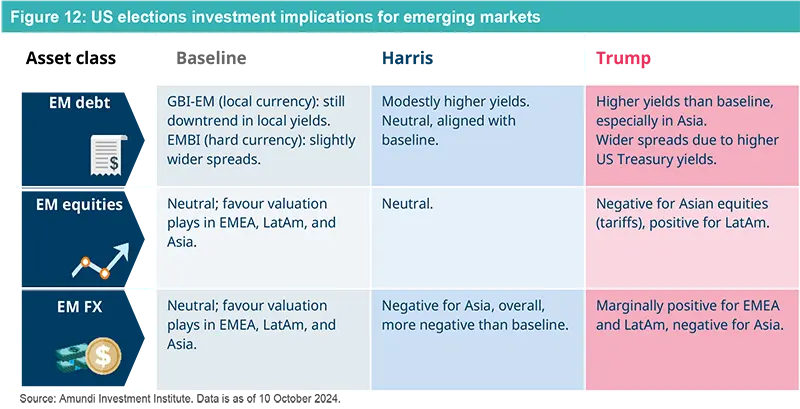

Under Harris, US growth is expected to be moderately higher, while Trump’s policies would lead to significantly higher inflation, resulting in persistently more restrictive monetary policy expectations. Higher core yields will result in higher EM local-currency bond yields (GBI-EM), particularly in the second half of 2025, slightly above the base case under Harris. Under Trump, yields would remain contained in H1 2025, but rise sharply in H2, creating a challenging environment for EM debt.

Spreads are expected to widen under Trump due to rising US Treasury yields and weaker EM growth. Harris' policies should keep spreads relatively neutral, with little deviation from the baseline.

Under Harris, EM equities are expected to perform moderately, with valuation-based strategies remaining favourable across regions like EMEA (Poland), Latin America (Brazil) and EM Asia (Korea). Under Trump, equities face more downside risks in Asia due to tariffs and trade tensions. Domestic equities in China (A shares) may benefit from incremental stimulus compared to H shares, which are likely to be negatively impacted by intensifying external risks.

In FX markets, the baseline outlook is selectively positive for currencies like the Brazilian Real (BRL), Chinese Yuan (CNY), South Korean Won (KRW), Indonesian Rupiah (IDR), and South African Rand (ZAR). Under Trump, EMEA and Latin American currencies could see marginal gains, while Asian currencies may come under pressure due to trade tensions. In a Harris scenario, Asian currencies face headwinds, but to a lesser extent than under Trump.

What are the main implications for multi-asset investors?

If Trump is elected as the next US president, we can differentiate potential trades between the short and medium term. In the short term, the partial or total implementation of his proposed policies may attract investor interest in several sectors, including energy, banks and consumer discretionary. Specifically, for banks, the delay in further waves of bank regulation could be an appealing prospect for investors. Another sector that may generate interest is healthcare, primarily due to a potential shift in leadership between larger and smaller-cap stocks. As mentioned previously, US mid and small caps could continue to close the performance gap with large caps. It is realistic to expect that some of these trades may persist for three to six months.

The scenario could become mildly stagflationary moving ahead, characterised by increased bond issuance and higher long-term inflation due to tariffs, leading to more curve steepening. Consequently, long-term TIPS (Treasury Inflation-Protected Securities) may become more attractive.

Conversely, a Harris victory may result in a more muted market response in the short term, with equities potentially impacted by the prospect of higher taxes. Sectors such as infrastructure, construction and green companies may outperform due to the candidate's increased focus on these areas.