Summary

Key insights

- We believe now may be the best time in recent history to invest with an active approach in US equities.

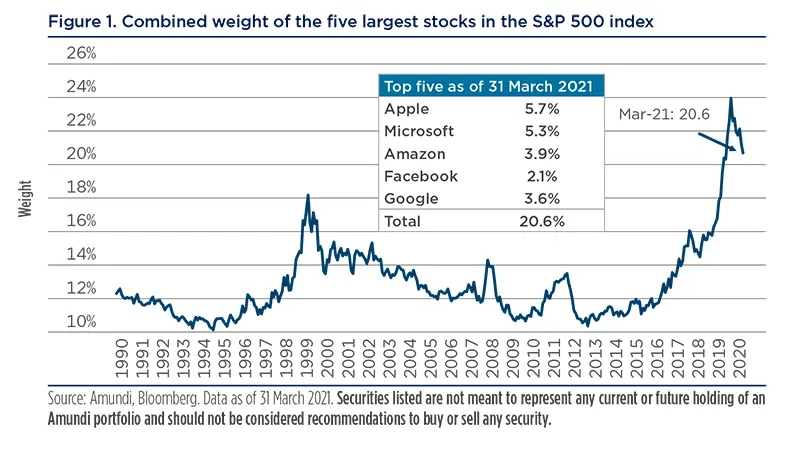

- Passive indices outperformed active managers in recent years as US equity markets became more concentrated and dispersion declined: concentration in the five largest stocks in the S&P 500 had been increasing since 2013 and it peaked at 24% in 2020, when Alphabet, Amazon, Apple, Facebook and Microsoft benefited from a stay-athome environment in which people increasingly used technology to communicate, shop and work. Returns in the five largest stocks benefitted from higher earnings, but also from falling interest rates, which reduced the cost of capital and supported higher valuations, especially for long-duration assets, such as high-growth stocks. With these five mega-cap stocks returning 55.8% in 2020, active managers struggled to keep pace, with the rest of the S&P 500 returning 10.8%.

- A reflation of the US economy -- driven by vaccine distribution, economic stimulus and dovish monetary policy -- is contributing to greater market breadth and dispersion as cyclical stocks have begun to outperform the narrow group of stocks that benefitted most from stay-at-home orders which led the equity markets higher in 2020.

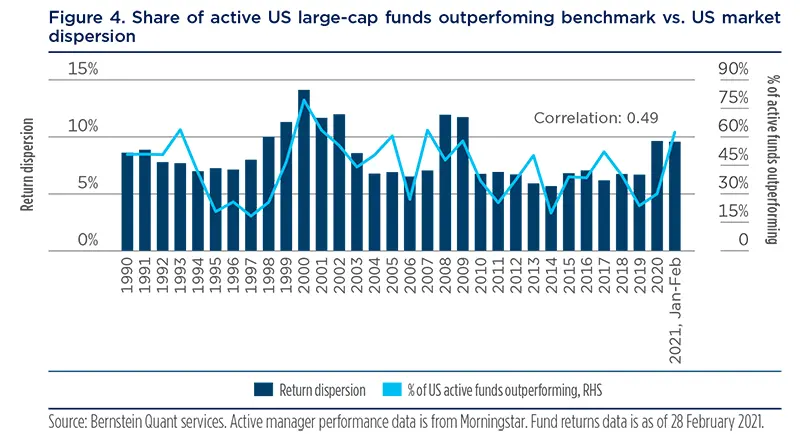

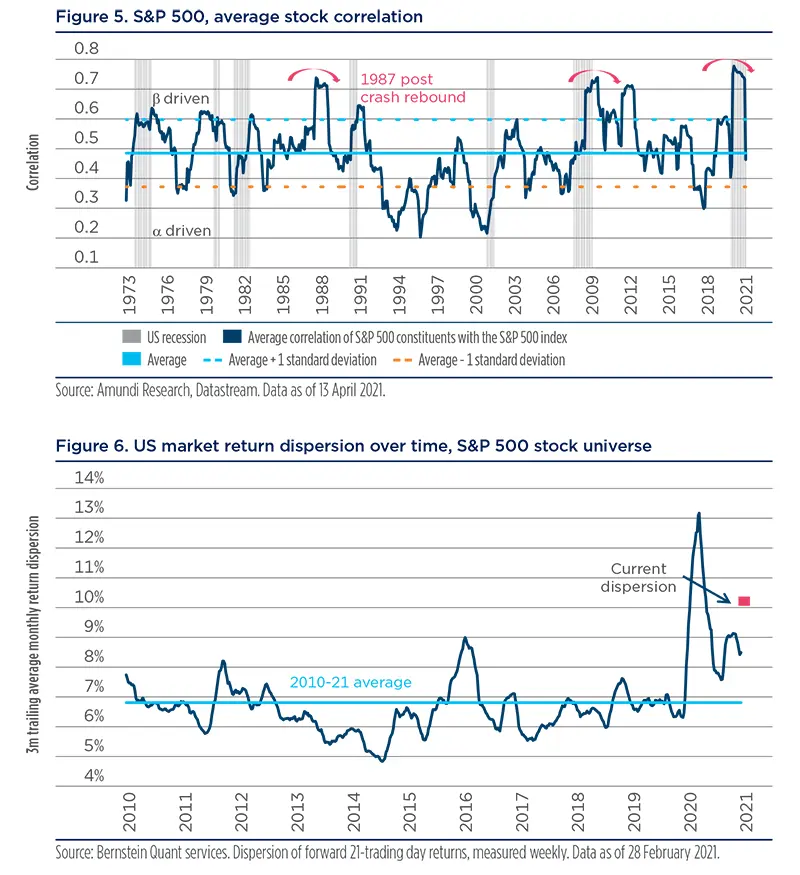

- Historically, there has been a positive correlation between the dispersion of returns and the outperformance of active managers relative to their benchmarks. This means that active managers typically outperform when dispersions are elevated while a passive approach performs better when there is a lack in return dispersions. Similarly, higher correlations among stock returns tend to favour passive investments while lower correlations tend to favour active ones. Currently, return dispersions are elevated and correlations are trending down from near-historical peaks, both of which favour active.

- The value rotation that commenced in the fourth quarter of 2020 -- characterised by strong outperformance of value and cyclical stocks -- further creates market conditions that should support an active approach in US equities.

- The prior peak in market concentration occurred in 2000. As the concentration in the S&P 500 index declined post-2000, 59% of active US large-cap funds outperformed their benchmarks from 2000 through 2005 as investors rotated out of the technology, media and telecommunications names that had driven market concentration during the 1990s. We believe this environment is similar today and may provide a tailwind for active managers for some time.

- Active managers that integrate Environmental, Social and Governance (ESG) principles into their analysis may have an additional edge in this environment as there is an increasing investor focus on ESG investment alternatives and a greater ability for active managers to assess subjectively the potential for companies to mitigate their ESG risks and improve their ESG profiles over time. These important aspects of identifying and promoting sustainable and socially responsible investing are less possible in systematically managed passive investment vehicles.

Why passive outperformed in recent years?

Passive approaches to investing tend to outperform active approaches when market concentration is rising. This is because active managers -- even those that focus on large-capitalisation stocks -- often invest across the market capitalisation spectrum for diversification purposes. When mega-cap stocks outperform, it is often difficult for an active manager to keep pace.

As shown in figure 1, concentration in the five largest stocks in the S&P 500 has been increasing since 2013. During this same period, the majority of active managers lagged the return of the S&P 500 index. Concentration in the five largest stocks in the S&P 500 -- Alphabet, Amazon, Apple, Facebook and Microsoft -- peaked at 24% in 2020 when they benefited from a stay-at-home environment in which people increasingly used technology to communicate, shop and work. With these five mega-cap stocks returning 55.8% in 2020, active managers struggled to keep pace, with the rest of the S&P 500 returning 10.8%. For instance, the Morningstar Large Blend fund universe returned 15.8% compared with 18.4% for the S&P 500 in 2020. Returns in the five largest stocks benefitted from higher earnings, but also from falling interest rates, which reduced the cost of capital and supported higher valuations, especially for long-duration assets, such as high-growth stocks.

Returns in the five largest stocks benefitted from higher earnings, but also from falling interest rates, which reduced the cost of capital and supported higher valuations, especially for longduration assets, such as high-growth stocks.

Due to position size limits and investment style considerations (i.e., valuation discipline), many active large-cap growth and core managers were underweight the largest top-five stocks relative to their respective Russell 1000 Growth and Core benchmarks. This made it difficult for active managers to outperform.

Why might now be the time to invest with an active approach?

The quick rollout of the vaccination programme, another massive round of economic stimulus, and a dovish Fed have paved the way for a strong recovery in the US economy in 2021. The yield curve has steepened as a result, with the ten-year US Treasury yield more than doubling off its low. This has caused investors to begin to pivot away from some of the largest stocks in the S&P 500 as well as other hyper-growth stocks -- as cost of capital is up -- into the equities of companies that are likely to see a significant recovery in earnings tied to the economic recovery this year.

The performances and valuations for these mega-companies and other large-cap growth stocks may have peaked. Large-cap growth stocks have strongly outperformed their value counterparts for almost 15 years, reaching historic levels in 2020. Additionally, growth stock valuations reached historic extremes relative to value stocks last year. This performance and valuation trend started changing in 2020, when investors began rotating to long-neglected value and cyclical stocks based on improving economic growth forecasts and appreciating commodity prices. Active managers have been outperforming during this value rotation, due to their positions in value and cyclicals, and we believe that trend should continue.

Active managers have been outperforming during this value rotation due to their positions in value and cyclicals, and we expect that trend to continue.

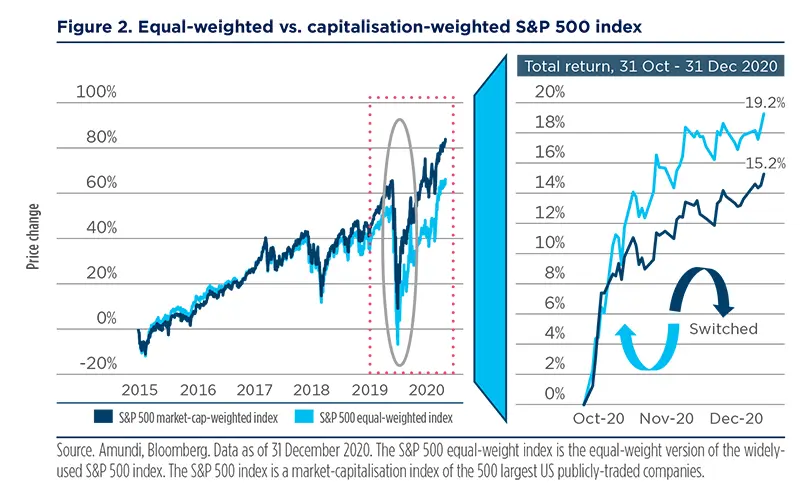

As shown in figure 2, the rotation out of the five largest stocks has contributed to the equal-weighted S&P 500 index outperforming the capitalisation-weighted S&P 500 index, which is dominated by the largest five stocks.

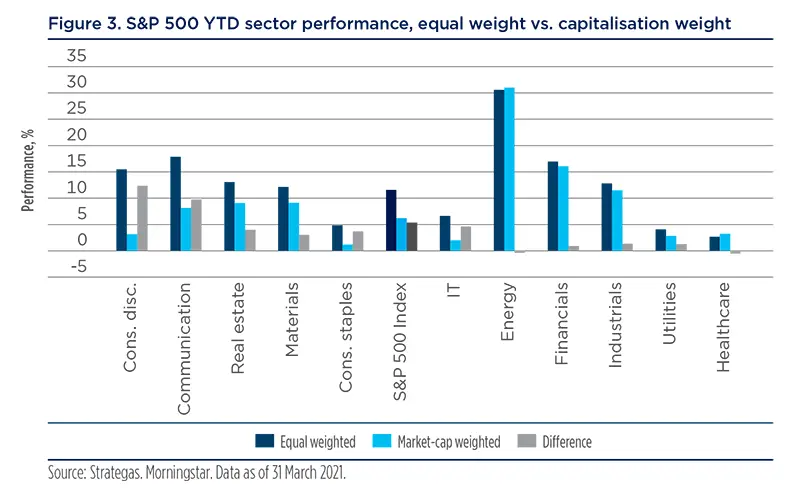

In addition to the S&P 500 equal-weighted index starting to outperform the capweighted index in aggregate since late-2020, additional research results show that the equal-weighted version of ten of the S&P 500 sectors outperformed their cap-weighted counterparts so far in 2021, while the degree of cap-weighted outperformance in energy and healthcare -- the two exceptions -- was very minor (see figure 3). This suggests that we are in the initial phase of a broad-based value rotation spanning the sector spectrum.

We are in the initial phase of a broad-based value rotation spanning the sector spectrum.

Is history repeating itself?

As the concentration in the S&P 500 index has begun to decline, active managers have started to outperform. On 24 February 2021, Bloomberg reported that a recent Goldman Sachs study of 507 actively managed mutual funds focused on US stocks -- representing approximately $2.7tn of assets under management -- determined that roughly 57% of large-cap mutual funds have outpaced their benchmarks in 2021 thus far. This marks the strongest start to a year for active managers in almost a decade. We believe that the current rotation could continue without a disruption, similar to what investors experienced following the dot.com bubble.

We believe that the current rotation could continue without a disruption, similar to what investors experienced following the dot.com bubble.

This is similar to the performance of active managers leading up to, as well as after, the previous peak in concentration of the S&P 500 index in 2000. The S&P 500 capitalisationweighted index outperformed the equal-weighted S&P 500 index from 1995 through 1999, as the index became more concentrated. After the dot.com bubble burst and index concentration plummeted, 59% of active US large-cap funds outperformed their benchmarks from 2000 through 2005 as investors rotated out of the technology, media and telecommunications names that had driven market concentration during the 1990s. Not only did the equal-weighted S&P 500 index outperform the capitalisation-weighted index over the period, but it also outperformed each year. During the same five-year period, the capitalisation-weighted index return was consistently below the median return of the Morningstar Large-Cap Blend universe. Today, even if we are not in a correction akin to the bursting of the dot.com bubble, the potential for a secular rise in interest rates should persuade investors to rotate away from longer-duration assets, such as mega-caps stocks, towards shorter-duration stocks like value and cyclicals.

We believe active managers may have the ability to continue to outperform for the following reasons:

- The economic recovery is likely to be sustained by pent-up consumer demand, further increases in government spending on infrastructure and healthcare, and accommodative monetary policy. This should result in a broad-based and durable earnings recovery, which should contribute to increased market breadth.

- The S&P 500 index is more concentrated than it was at the previous peak in 2000. As of end-2020, the top-five stocks accounted for 22% of the S&P 500 compared with just over 18% in 2000. This means the index should have further to go compared to 2000 in reaching a more normal level of concentration.

- The Biden administration is focused on environmental and social policy, which, we believe, will make it increasingly important to distinguish between companies that are addressing ESG risks and those that are not. Active managers who integrate ESG into their investment processes can make this distinction.

- Finally, astute active managers are able to make allocation decisions across sectors, industries and other portfolio characteristics in anticipation of potential macro opportunities, such as a value rotation or cyclical recovery. These managers can target areas of the market most likely to generate above-benchmark performances in different market environments.

In light of the Biden administration’s focus on ESG, it increasingly important to distinguish between companies that are addressing ESG risks and those that are not.

Dispersion is increasing

Dispersion of stock returns and the correlation of those returns are further important indicators of the opportunity for active managers to outperform. Historically, there has been a positive correlation between the dispersion of returns and the outperformance of active managers relative to their benchmarks. This means that active managers typically outperform when dispersions are elevated while a passive approach performs better when there is a lack in return dispersions. Similarly, higher correlations among stock returns tend to favour passive investments while lower correlations tend to favour active ones. Currently, return dispersions are elevated and correlations are trending down from near-historical peaks, both of which are favourable for active.

We believe ESG is another critical consideration for today’s asset owners. As such, investing with an active manager who are able to research fundamentally and assess qualitatively company managements’ socially responsible behaviour and can interact with company management to improve ESG principles is critical in today’s world. With a strong economic recovery in sight, we believe that the market should continue the rotation out of the narrow cohort of mega-cap market leaders and that we are entering a market environment that offers opportunities for managers employing an active approach, as evidenced by the greater market breadth, elevated dispersions and lower correlations. We believe that active managers may continue to benefit for some time as excessive concentration levels in US equities unwind. In this environment, and at a time when there is increasing pressure on investors to act more responsibly (ESG), we believe that asset owners should consider allocating to managers actively investing into US equities.

We believe that the market is set to continue the rotation out of the narrow cohort of mega-cap market leaders and that we are entering a market environment which is more constructive for managers employing an active approach, as evidenced by the aforementioned greater market breadth, elevated dispersions and lower correlations.

DEFINITIONS

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than short-term interest rates or short-term rates dropping more than long-term rates.

- Growth style: It aims at investing in the growth potential of a company. It is defined by five variables: 1. long-term forward EPS growth rate; 2. short-term forward EPS growth rate; 3. current internal growth rate; 4. long-term historical EPS growth trend; and 5. long-term historical sales per share growth trend. Sectors with a dominance of growth style: consumer staples, healthcare, IT.

- Market depth: It is the market’s ability to sustain relatively large market orders without impacting the price of the security.

- S&P 500 index: It is a commonly used measure of the broad US stock market.

- Value style: It refers to purchasing stocks at relatively low prices, as indicated by low priceto- earnings, price-to-book, and price-to-sales ratios, and high dividend yields. Sectors with dominance of value style: energy, financials, telecom, utilities, real estate.