Summary

- Russia and China’s agreement to switch payments of gas supplies to rubles or yuan instead of dollars is a stark reminder that the global currency regime that has prevailed for the better part of two decades is ending. While the USD was the central or ‘anchor’ currency in the past, many of the tenets underpinning its status are gradually eroding. Higher and structural inflation, increasing deglobalisation and the ‘weaponisation’ of Western currency-denominated FX reserves in response to recent geopolitical events are paving the way towards a new order.

- In the short term, the energy crisis has uncovered cracks in the prevailing currency regime. The greenback’s recent rally shows signs of stronger fundamentals, whereas the euro and yen are more exposed. Against a backdrop of rising misalignments and volatility in the FX environment, countries may have to adopt a new – cooperative or competitive – attitude.

- Longer term, we see the emergence of a two-bloc system centred around the US and China as a possible development. Each bloc would adopt the currency of its dominant country as an anchor and recycle current account imbalances internally. However, reaching such a system may take years, if not decades, and there are plausible alternative scenarios where the USD retains its role as global anchor.

- The changing FX environment carries risks but also many opportunities for investors. The opportunity of holding renminbi may increase and, more generally, so will the benefits of currency diversification. Overall, an active approach to FX strategies will become an increasingly important contributor to portfolio performance.

THE PREVIOUS REGIME: A ‘CHICKEN AND EGG’ CIRCUIT OF CURRENT ACCOUNT IMBALANCES AND FX RESERVES ACCUMULATION

The global FX regime of the last 20 years has been characterised by a distinct pattern of capital flows. At its core, Asian countries (mostly China) recycled their current account surpluses into USD-denominated FX reserves, in order to weaken their domestic currencies and preserve export-led economic models. Within this circuit of interdependence, the US – through its basic balance deficit (i.e. the part of its current account deficit financed by foreign flows into USD cash, Treasuries and other portfolio securities) – provided an essential global public good: the dollars that the rest of the world needed for trade.

This system generated large increases in money supplies and downward pressure on risk-free interest rates in most countries, thereby fuelling asset price inflation and various forms of asset and credit bubbles. However, thanks to a combination of reserve purchases, low inflation and low rates, FX volatility was generally very low as monetary policies tended to be synchronised across the world.

Despite the falling global share of US GDP, the USD has remained the regime’s ‘central’ or ‘anchor’ currency. While a purely fiat currency, the dollar retained the necessary characteristics to fit the bill: a large domestic market and current account deficit (to export the currency), free capital flows, trust defined in several ways (stability and rule of law, economic growth prospects, moderate inflation, overall geopolitical might), and deep and liquid domestic financial markets. Moreover, the globalisation of trade made it convenient to price integrated supply chains in a common numeraire, thereby benefitting the incumbent anchor. Finally, the currency has been supported by a global consensus – that is, a system of shared, self-fulfilling narratives and beliefs in the USD as a stable reference.

The gradual weakening in the US dollar’s price and status (which, according to the Triffin dilemma, is supposed to happen to a central currency) has therefore been very limited:

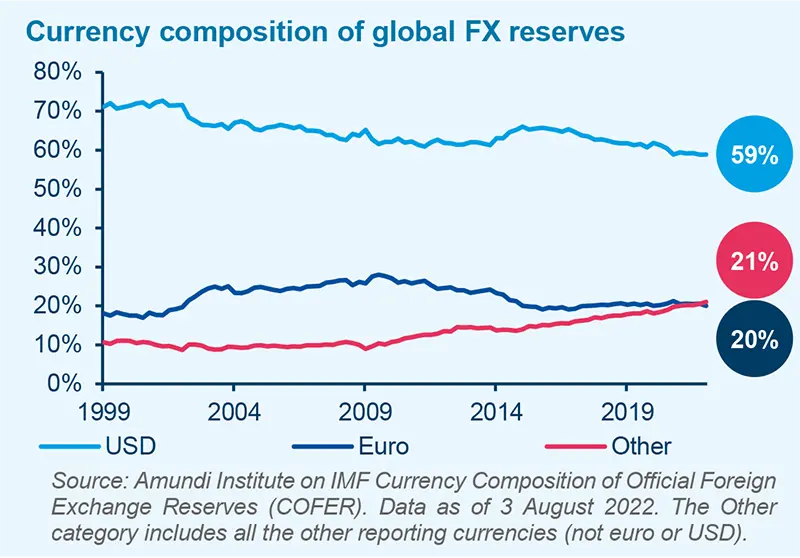

- The USD has gradually depreciated against some Asian currencies, but not against major DM currencies. It has also lost some ground as an international reserve, but less so as a trade currency, and its weighting has even increased in other aspects (for example, in the denomination of international bonds).

- No alternative currency has proved sufficiently credible. For its part, the euro has failed to enhance its global status, particularly due to the fragmented nature of euro sovereign bonds and capital markets. Another key reason has been the outsized euro current account surplus, implying lower exports of the domestic currency.

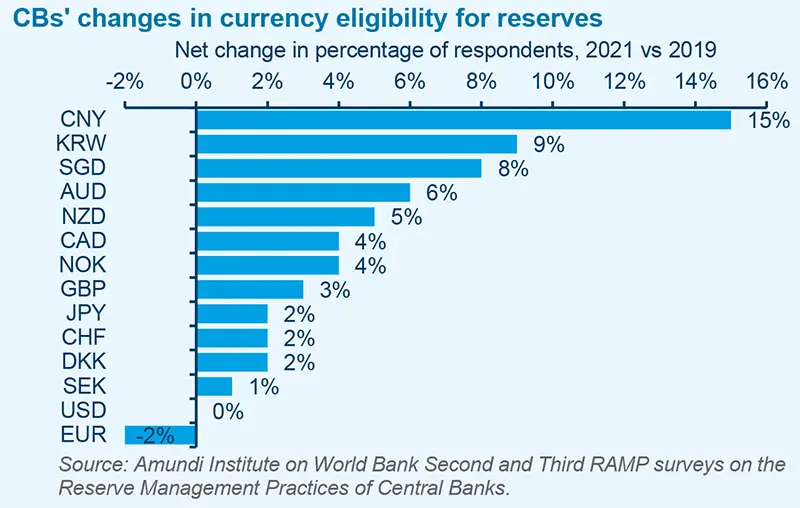

- While the renminbi, starting from very low levels, has made strides in most regards, its global role has remained comparatively small considering China’s weight in global GDP. Capital controls and, to some extent, doubts concerning the rule of law, have no doubt hindered its development.

This regime is now reaching its limits, and many of the narratives underpinning the USD’s central role are being questioned:

- First, the new inflationary regime may challenge the belief that the USD and US Treasuries are truly ‘safe’ assets, by raising the issue of real yields. Reserve managers, who so far have been holding USD primarily to fulfil a liquidity mandate, may open their eyes to this ‘Keynesian’ price to pay in terms of value erosion.

- Additionally, against a backdrop of deglobalisation, holding USD for trade or to manage exchange rates may gradually be seen as a less stringent need. In terms of narratives, the aforementioned ‘public good’ provided by the USD-centric system may seem less valuable. Rising concerns regarding inequality and sovereignty, and to some extent the climate topic, are widely seen as better addressed at the domestic and regional levels.

- Moreover, the recent ‘weaponisation’ of Western currency-denominated FX reserves against the backdrop of the Russia-Ukraine conflict may be seen as a wake-up call by EM central banks, showing that these reserves may become geopolitical hostages.

THE IMMEDIATE NEW CHALLENGES

From energy-driven inflation to currency misalignments

The current spike in inflation, largely driven by energy, is altering some traditional patterns of current account imbalances, generating stress and misalignments in the global currency order. The USD has been more resilient, while the EUR and JPY have been more exposed. In the case of the EUR/USD cross, it should be noted that the energy shock caused Germany to post a monthly current account deficit (in May 2022) for the first time since 1991.

The impact is also very visible for the JPY. Rising energy costs are driving down the country’s current account. At the same time, monetary policy divergences are increasing, as the Bank of Japan is sticking to its yield curve control policy. These combined effects have taken the country’s real effective exchange rate to its lowest level in the last 50 years. Therefore, Japan is left with little room to maintain its role as a long-time major buyer of foreign assets: a potentially disruptive change in the global bond and energy markets’ equilibria.

The JPY’s depreciation also poses a major dilemma for China. The rise in the CNY/JPY parity contributed to raising China’s real effective exchange rate (REER) to its highest level since 1994. When similar levels were reached in 2015-16, a depreciation ensued. However, it is not certain that China will pursue this road today. It could send a problematic signal for capital flows and the country’s long-term objectives of bolstering the renminbi’s international status and making its economy more domestically-oriented. It is more likely that, within the trade-off between different objectives, China will adopt a more ‘Wicksellian’ attitude and accept some of the pain inherent in the appreciation of its currency (similarly to a pre-euro Germany) or limit itself to targeted CNY/JPY interventions.

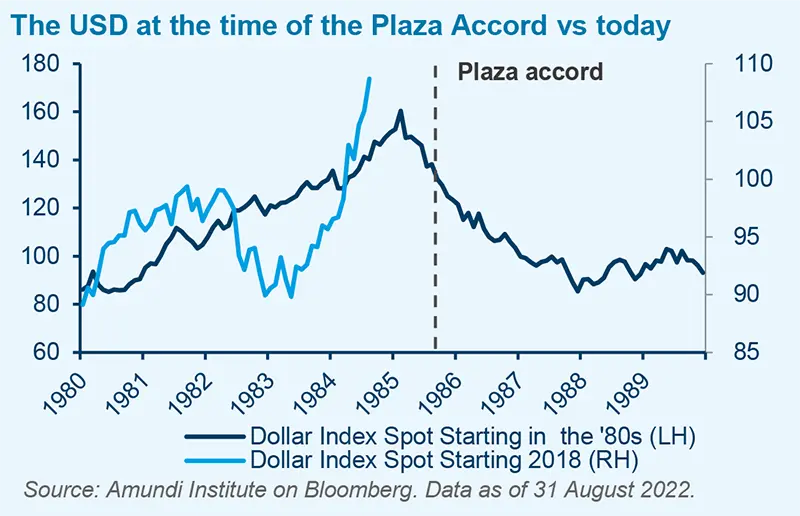

What remains to be seen is whether, and how, countries will respond to this new episode of ‘great de-anchoring’. A cooperative approach could mean large countries take the road back to a Plaza like agreement1. The low EUR and JPY are proving to be damaging to their respective economies while many sectors in the US may be penalised by a strong USD. The most likely outcome of such an agreement would therefore be coordinated interventions in the same direction as in 1985 (JPY and EUR appreciation, USD depreciation). While China was obviously absent from the Plaza Accord, today it may also welcome a slightly less strong USD, making it easier for the renminbi to bolster its international status.

A competitive approach, on the other hand, would imply countries are headed for a ‘reverse currency war’. In the context of imported, energy-led inflation, a weaker currency exacerbates the downside. Therefore, instead of competing for depreciation (as in usual ‘currency wars’), countries could try to appreciate their currencies in a potentially zero- or negative-sum game, according to a ‘currencies cannot all be strong’ (instead of ‘weak’) principle.

TOWARDS A RESHAPING OF FINANCIAL GLOBALISATION

Shifting patterns of capital flows

Over the medium to long term, the dynamics of capital flows could be changing for good, mirroring structural changes in current account imbalances. A new exchange rate regime should emerge as part of this new equilibrium. China and Japan, so far the two largest ‘liquidity pumps’ (at least in terms of US Treasuries purchases), could be the main pieces to change. In fact, due to its changing economic structure, China may not be a current account surplus country for much longer and therefore may no longer be in a position to amass reserves. Similarly, Japan is likely to gradually re-internalise its savings to meet domestic requirements, including public debt financing. Which countries could step up to fill this ‘liquidity pump’ duty is not obvious. However, this is a zero-sum game: reduced surpluses in some countries must be offset by a lower deficit (or larger surplus) in others.

The euro area is likely to retain a large current account surplus, despite today’s cyclical fall. Unless the energy crisis does not abate at all, or unless Europe suddenly initiates massive internal investments, the region benefits from the strength of its manufacturing-oriented members. Energy-exporting nations could be the ones accumulating more financial assets, especially if energy prices remain structurally higher. The same is true for other export-oriented EM countries.

Nevertheless, it is unlikely that China’s shoes can be filled entirely. Global current account imbalances are likely to shrink, meaning there will be less cross-country recycling of savings. For countries running large negative basic balances (starting with the US), this could signify painful upside pressure on real rates and downside pressure on currencies and asset prices.

Over and above the lower accumulation of FX reserves, the very structure of reserves will be revisited; value will increasingly take precedence over liquidity. Reserve managers are likely to look for greater diversification both in terms of geopolitical exposure and relative to different countries’ trade structures and inflationary risks. This means a shift away from US Treasuries towards other currencies, gold, private financial assets, real assets and potentially even ‘exotic’ newcomers like cryptocurrencies. Reserve managers could also be driven towards more active FX strategies which, in an inflationary world characterised by diminished real returns, could become a larger contributor to portfolio performance.

THE LONG TERM FX REGIME IS AT A CROSSROADS

A two-bloc system versus a continuation of the USD-centric system

Longer-term, the emergence of a two-bloc trade system centred on the US and China seems like a plausible scenario. Each bloc would use the currency of its dominant country as its anchor and recycle current account imbalances internally. Trade across each bloc would remain significant but would not lead to massive capital flows or reserves accumulation, absent a large cross-bloc current account imbalance. Due to its geopolitical importance, energy may be a key factor accelerating the emergence of the two-bloc system, as each bloc may seek to price energy in its anchor currency.

Europe (and presumably Japan) would remain peripheral but related to the US bloc. A number of large EM countries, such as Brazil, India and Indonesia, may once again establish a non-aligned group. Some may even attempt to trade under a (potentially deflationary) gold-based system. Other oil exporters, notably Middle-Eastern producers and Russia, will likely keep accumulating USD or renminbi reserves since energy would be priced in both.

A major question concerns the lengths China would have to go to in order for the renminbi to become the Eastern hemisphere’s anchor. It would certainly require major steps in terms of freeing capital flows, which may imply somewhat lower internal political control. Moreover, as mentioned previously, China would be required to pursue relatively tight ‘Wicksellian’ policies in order to inspire trust, favour capital inflows and bolster the development of its internal financial markets. Simultaneously, other countries would need to accept some degree of subordination to China’s monetary policy.

In any case, achieving a complete two-bloc FX system is likely to take years, if not decades. It is also unlikely that the two blocs would be perfectly symmetrical in their functioning. Important differences in intra-bloc current account imbalances, capital flows and reserve accumulation patterns, intra-bloc exchange rate systems and the extent of the anchor currency’s influence are likely to persist. Additionally, an East-Asian bloc dominated by China and the renminbi does not currently match the existing geopolitical alliances in the region: a potential impediment to its formation. Moreover, while the renminbi’s status is likely to increase over time, there are also scenarios where the USD’s domination could persist and even extend further.

- One reason could be that globalisation persists, contrary to current beliefs. In particular, the deglobalisation of trade in goods could be more than offset by an increased globalisation of services. The incumbent USD anchor would therefore remain the easiest numeraire to organise new, globalised services value chains.

- A related reason could be technological developments in the monetary sphere where the USD has a significant head start. Notably, USD-based private digital stablecoins are growing rapidly, being used globally and could be vectors for further dollarisation in the fintech and e-commerce spaces. To what extent China and the euro area will be able to compete with their own (public or private) digital currencies is very uncertain today.

- Finally, China hitting a major bump on its path to growth or running into political stability problems would leave the world with few alternatives to the USD.

INVESTMENT IMPLICATIONS

This changing FX environment carries risks but also opportunities for investors.

- In the short-term, investors should be wary of further riding the large waves generated by the ongoing energy and inflation crises. As we have tried to show, countries may intervene to resolve some of the misalignments that have formed. Regardless of whether these attempts take a cooperative or competitive shape, they may cause sharp market reversals.

- A longer-term question relates to the opportunity of holding the renminbi as a rising alternative to the USD. Time horizons matter a lot here. To support the status of its currency, China will need to provide a growing amount of renminbi and renminbi-dominated assets for the rest of the world to hold. This initial liquidity effect may exert downward pressure on the currency (similarly to what happened in the euro’s early days). However, assuming the renminbi does eventually become the anchor currency of a regional trade bloc, or a vessel for diversification, it should benefit from these new roles.

- More generally, the benefits of currency diversification should increase, in response to the inflationary environment and the desynchronisation of monetary policies and economic cycles, which should reduce the co-movement of global risk.

- Active FX strategies may become growing contributors to portfolio performance. In addition to the desynchronisation of monetary policies, FX reserve managers’ changing attitudes and shifts in the balance of payments equilibria may accentuate FX volatility. Reserve managers will need to pay more attention to currencies’ remuneration or appreciation prospects and may no longer wish to hold some currencies in large quantities, should rates fall or the prospects of depreciation increase. Together with focusing on the flows that need to be absorbed, investors should therefore also focus more on stocks of reserves.

- Finally, investors should bear in mind that a reason for the shrinking of current account mismatches and cross-border capital flows will be public policies to reinternalise savings. They will need to identify the asset classes that will benefit from this reinternalisation, typically starting with those sectors that are targeted by publicly sponsored investment plans.