Summary

Despite experiencing volatility in Q3 2024, markets demonstrated resilience with largely positive returns. The decrease in liability discounting rates in Q3 compensated these good performances, and funding ratios have been mostly stable over the period, still at comfortable levels.

Market review: Resilience despite some volatile periods

The third quarter of 2024 was characterised by a generally positive performance across most asset classes, with both equities and bonds delivering robust returns despite a volatility spike in August. Between June and October, the MSCI World Equity Index rose by +4.3% in net USD terms, with US equities leading the charge. The S&P 500 gained +5.9% in Q3, reaching an all-time high in mid-October before a sell-off at the end of the month. This upward momentum was supported by strong corporate earnings, particularly in the financial sector, which exceeded market expectations.

In the bond markets, the evolution of long-term interest rates played a crucial role in shaping market dynamics. Throughout Q3, US Treasury yields for long-term bonds experienced a significant decline, with the 10-year yield falling from 4.40% at the end of June to 3.78% by the end of September. This decline was largely driven by the Federal Reserve's decision to cut rates by 50 basis points in September, signaling a more accommodative monetary policy stance in response to weakening economic indicators. However, in October, stronger-than-expected economic data led to a reassessment of future rate cuts, with the 10-year yield rising to approximately 4.3% by the end of the month. This shift reflected growing concerns about inflation and the potential for a more aggressive monetary policy stance moving forward.

In the Eurozone, the European Central Bank (ECB) maintained a cautious approach to monetary policy, with the 10-year German Bund yield experiencing a similar trend. The yield fell from 2.6% end of June to around 2.1% by the end of September, but saw upward pressure in October as inflationary concerns resurfaced, leading to a rise in yields to 2.4%. The Euro experienced mixed performance against the US Dollar, strengthening by 3.9% in Q3 but facing pressure in October as the dollar rebounded.

In the UK, the Bank of England (BoE) cut its key interest rate by 25bps to 5.00% in August, marking its first reduction since the pandemic began. The yield on the 10-year UK Gilt also saw a slight decline (-20bps in Q3), reflecting the broader trend in long-term rates. However, as economic data improved, the yield began to rise in October, with a +45bps increase for the 10-year Gilt reflecting market expectations of a more resilient economy. The GBP weakened against the USD in Q3 but showed resilience in October, gaining 3.7% as the market adjusted to the reduced likelihood of rapid rate cuts.

Inflation and economic indicators played a crucial role in shaping market sentiment throughout the quarter. In the US, the Consumer Price Index (CPI) slowed to 2.5% in August, with core inflation at 3.2%. The labour market showed signs of strength, with unemployment at 4.1% in September. Following the election of Donald Trump, market dynamics may shift as investors assess the implications of his policies on fiscal and monetary strategies.

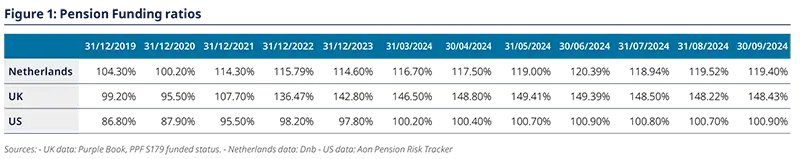

Low impact on pension funding ratios

As Figure 1 shows, these markets movements had a limited impact on pension funding ratios in the third quarter: On one hand, decreasing interest rates had a negative impact though the increased liabilities valuations, but good equity performance mostly compensated for these adverse conditions. All in all, funding ratios slightly decreased in Europe (-1%) and remained unchanged in the US during Q3. From end-September to mid-November, the rebound in interest rates, especially in the US due to Trump’s election, combined with rather positive equity markets have positively impacted pension funding.

The average situation of DB plans is still very positive. Currently, it seems that most plans will be able to pay their current pensioners rights with little or no additional contributions. Additionally, if we also consider the current shift from defined benefits to a defined contribution framework, future pension accruals (i.e. services cost) are on a downward trend. Indicators tend to show that the sustainability of the DB system is on course financially.

Lack of standardised pension adequacy measures for DC Schemes

But these funding indicators only address part of the retirement system. We still lack international standardised and commonly accepted indicators for defined contribution plans. In the DC universe, risks are supported by the members. Thus, the major issue is the level of pension they will be able to secure at retirement. Will it be enough to ensure good living standards? The “pension adequacy” concept refers to this issue. The measure of expected replacement ratio can be a good indicator: For example, by considering all pillars of the pension system, what monthly pension can be secured at retirement as a proportion of final salary?

But we face several hurdles to derive a synthetic pension adequacy measure: As an illustration, DC pensions are individualised, and aggregation can hide huge discrepancies within a population. Secondly, the calculation of the expected pot at retirement heavily depends on investment choices and capital market assumptions, which can vary significantly from one provider to another. In addition, the adequacy concept can differ from one country to another depending on the relative importance of the first, second and third pillars.

Many tools have been developed by providers to simulate the individual outcomes of DC plans. The UK government started the pension dashboard program, to provide each individual a centralised, but personal portal2. Meanwhile, Dutch pensions are facing the reverse problem, namely the translation of defined benefits to a current lump sum in the context of their pension reform3. Also, many studies have been performed concerning this pension adequacy issue in the aggregate countrywide populations4, mostly for the current retirement age cohort (see Figure 2). But a reactive and standard measure like for DB pension funding ratios has yet to be developed for DC.

2. See https://www.pensionsdashboardsprogramme.org.uk/

3. See Amundi Pension Funds Letter 18 for context on this reform

4. See European Union 2024 pension adequacy report for example

Read more