Summary

Introduction

ESG (environmental, social, and governance) investing has been making news headlines recently. With the rising adoption of ESG worldwide, regulatory scrutiny has started to intensify. The focus of this attention has been the assessment of what is effectively the integration of ESG principles into the traditional investment process versus what can sometimes appear to be the mere labelling of investment products as ESG with minimal effort to incorporate ESG aspects – a marketing push put in place to address fast growing investor demand.

The matter is not an easy one, as ESG is continuously evolving. In fact, as the process of ESG integration progresses throughout the entire investment value chain, the so-called traditional and ESG worlds and organisations are converging. What was once the remit of ESG analysts separated from that of the fundamental ones, now is not. With the convergence of these two worlds, various set ups are emerging and walls of the past are continuing to fall as ESG and fundamental valuation models and terms are becoming unified.

Among the key reasons why this convergence is taking place, is the fact that the previously perceived trade-off between ESG and performance is outdated. ESG is no longer seen as detrimental, but at the very least neutral or even complementary to the classical portfolio metrics of risk and return, therefore driving the case for the inclusion of ESG into fundamental assessments.

ESG integration in portfolio construction (risk and return)

In the process of integrating ESG into risk and return metrics, risk reduction has been the first pillar. Initially, ESG was seen as a pool of risk factors, poorly remunerated with the probability that some of these risks would materialise in the future increasingly seen as likely enough to take action in the portfolio. Carbon was under the spotlight first as this was where data initially became available amid the publication of the Greenhouse Gas (GHG) protocol in 2001. The demand for carbon-related investment strategies consequently gained momentum, thanks also to the rising push from coalitions and legislation, which drove a positive feedback loop between rising carbon risk adoption and its increasing impact on prices. Other risks in the ESG pool will arguably go on the same journey. It could be the case that some social risks will be increasingly in focus on the road to building a more sustainable and inclusive growth model after the Covid-19 crisis. Being able to identify these could be distinctive and provide a competitive edge for investors.

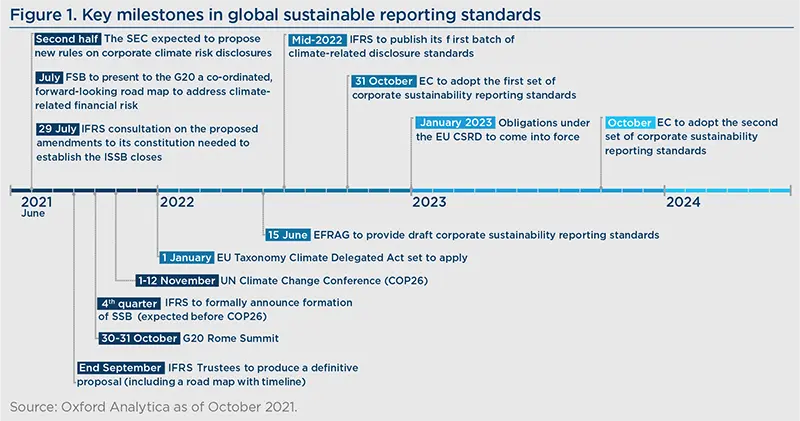

Regarding returns, the opportunity to integrate ESG considerations in generating excess return (alpha) has been the second pillar in the ESG investor journey. The potential to generate alpha lies in the possible areas of inefficiency. Inefficiencies arise when market prices do not integrate fully all relevant information, which it is often the case when it comes to ESG dynamics. Data is one of the key elements in the price discovery process that could lead to market inefficiencies. In the ESG world, the availability of data and the lack of standard accounting measures (if we exclude carbon with the GHG protocol) are two challenges leading to market inefficiencies. A lack of regulation has also been an area of inefficiency for a long time, although this has started to improve with the introduction of the Non-Financial Reporting Directive (NFDR) in Europe. The wave of regulation will intensify in the coming years and will continue to push for an alignment of ESG standards and practices.

Data availability, inefficiencies, and alpha opportunities

In our view, investors have a window of opportunity in front of them, as increasing data disclosures will create alpha opportunities arising from the gradual closing of existing information inefficiencies. This will arise alongside the convergence of fundamental and ESG investing. This may also help uncover whether the risk factors embedded in ESG investing are unique and idiosyncratic or whether they can be readily proxied by traditional risk factors.

In particular, many dimensions of ESG are likely to evolve around quality as a factor – which is already present in traditional analysis – further confirming the convergence between ESG and fundamental metrics. How fast this convergence between ESG and fundamental worlds occurs will depend on the evolution of ESG demand. The function that determines ESG demand is not easy to forecast as it is unstable and not linear, as with investor preferences. ESG demand not only depends on investor appetite (flows) for some or all ESG elements, but it is also driven by the overall ESG ecosystem which comprises multiple forces such as regulatory change, coalitions, and legislation.

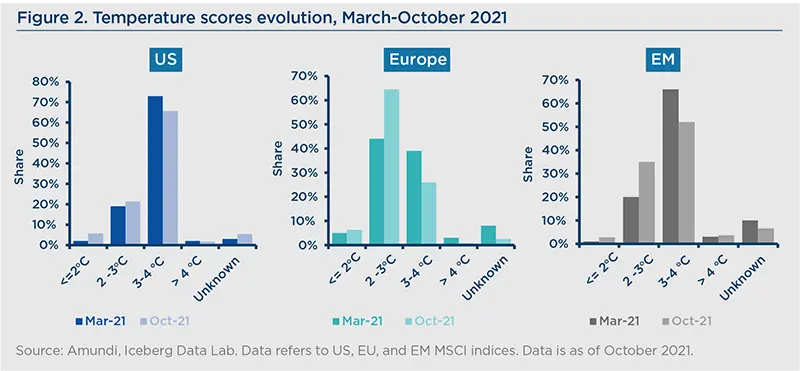

The net-zero emissions initiative is one of the most recent examples of an ESG ecosystem in motion, highlighting the theme for investors and further raising the impact of other climate change-related ESG factors on prices. At the same time, it provides an example of data evolution. Temperature scores are emerging as a complementary tool to other existing climate-oriented metrics for investors wanting to create net-zero aligned portfolios. With rising interest on temperature scores and an increasing push towards net zero, company’s temperature score profile is starting to improve quickly, especially in emerging markets.

Nevertheless, the task of creating a netzero portfolio is not an easy one, as very few companies worldwide meet the target, there are still strong data inconsistencies among providers and no standard approach to creating a portfolio with a net zero objective. This provides a fertile ground for alpha generation as investors may leverage all available ESG data and fundamental bottom-up assessments to try to determine a forward-looking view of a company’s net-zero trajectory.

While this data inconsistency persists, investors will be able to exploit these inefficiencies, but the room of opportunity may not last forever. Let us imagine there is a unique average global portfolio. As long as there is a sustained increase in demand for ESG assets and strategies, this demand will exert a price effect on the market, driving inefficiencies and risk premia down and prices up. This will continue with the rise in ESG demand and increase in ESG regulation, until a tipping point (equilibrium) has been reached when ESG and traditional investing are so interlinked that the ESG standalone definition will cease to be distinctive. This will happen when an ESG efficient frontier will be touched and no additional gains in terms of risk-return can be exploited from additional ESG input. In fact, only a few elements of ESG will remain unconnected, as most of them will already be integrated in the fundamental assessment. When this occurs, the pure ESG component will start to be less relevant (as only a few remaining marginal aspects will not be integrated into the fundamental framework) and its impact will fade in the market. Yet, this process may take a long time and may not prove to be a straightforward journey.

ESG adoption and the opportunities for investors

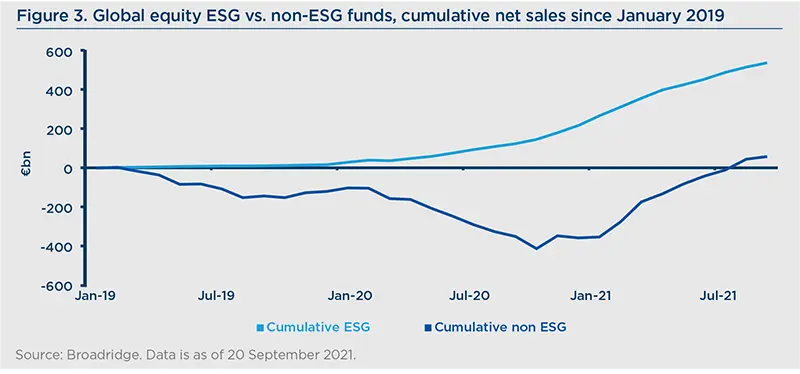

In terms of the penetration of ESG investing, ESG adoption seems well advanced in the institutional market, especially Europe, but it remains far from complete at a global level, with the United States just starting to close the gap. As a result, global flows into ESG funds have been above € 530bn from January 2019 to September 2021, compared with a meagre €56bn for non ESG funds. Meanwhile, the retail end of the market has just recently woken up to ESG and there is room for penetration to rise.

This means that we are far from reaching a tipping point on ESG adoption. The fact that research has not yet been able to isolate a pure ESG component from other fundamental elements does not imply that there is no value left in ESG, but it suggests that ESG investing is nuanced and multifaceted and in constant evolution. To deal with this dynamic world, we need more research, not less. This is the time to invest further into ESG, as the battle for data has just begun. There is a long way to go for the ESG landscape to emerge fully and significant investment will be required.

On the road to 100% ESG adoption, there are still opportunities to be played:

- The best-in-class approach (based on the selection of the best companies by their ESG rating within their sector) is already being well exploited by investors. It is time to embrace a focus on the trajectory of improvements in terms of ESG. With progression on the data and reporting front, some of the previous inefficiencies are disappearing, but what will remain crucial is a dynamic assessment of the ESG path for each company. We believe that detecting the dynamics of ESG ratings matters critically in the value creation process. Through engagement and favouring companies on a virtuous path, ESG can become a tool forcing change that is increasingly intertwined with the fundamental assessments of each company. This approach will drive further the integration of ESG and fundamental analysis that will become the key to generating alpha going forward.

- At a global level, we will see the emergence of global ESG themes driven by powerful narratives built in the market and society that will provide opportunities, until they become completely saturated. As mentioned previously, the net-zero emissions initiative is one of them. The focus on tackling inequality is likely to be the next one as this is a key focus of governments during this recovery phase. Some blended themes combining environmental and social aspects could also emerge, such as the just transition theme to tackle climate change in an equitable way. This is of particular concern for emerging countries, but it is also coming to the fore in developed markets at the time when skyrocketing energy prices are disproportionally affecting already disadvantaged people.

- On emerging markets and small cap companies, there continues to be strong inefficiencies amid a lack of data, both in the traditional and the ESG world. This is where there is a strong potential for alpha generation from additional ESG adoption as there is ample space for ESG improvement. In emerging markets, there are also specific themes that are not present in the developed world, such as the theme of base education, access to clean water, or even corporate governance, which are all still lagging behind. Yet, ESG in emerging markets comes with a significant cost in terms of deeper analysis, data collection, and engagement. The universe is also wide, as the possibility of engagement on ESG topics is not limited to corporations, but also with governments and supranationals.

The future economic, environmental, and social developments will lead us down the path of increasing ESG adoption. This is a dynamic process made up of fulfilling prophecies and feedback loops between narratives, markets and wider society. In this respect, ESG should not be considered a top-down force that fuels the misallocation of capital and price distortions. On the contrary, the evolution of ESG data and dynamics are crucial to unveiling already existing market inefficiencies that need market forces to reduce them. The time to push further on ESG is now, and additional regulation on this front should be seen as a further lever to drive positive momentum in the ESG journey