Lula netted a goal in Egypt at COP27 in the fight against climate change. However, it was an own-goal on the spending front that unsettled the markets and threw doubt on expectations of a prudently populist policy direction. We still believe Lula’s policies will be of a centre-left nature, with the help of the markets, though risks have risen.

Exactly one week after China’s Xi Jinping became the country’s three-term president, Luiz Inácio Lula da Silva (Lula) was elected as the head of the Brazilian state for the third time himself. Unlike in China, the presidential election in the Latin America’s BRIC representative was contested very closely. As expected, Lula defeated the sitting president 51-49% on average, but by the narrowest of margins (1.7pp) in the country’s elections history.

Lula’s victory also marked the region’s record books. All four presidential contests (Peru, Chile, Colombia, and now Brazil) over the past 18 months have been won by leftist candidates. However, the political pendulum has not exactly shifted leftward in Brazil, and there are signs it is shifting in the other direction in the rest of the region, as well, as Chileans overwhelmingly rejected the leftist new Constitution, for instance. This supports the view that the region voted against the establishment, rather than for the left. In Brazil, while the incumbent lost the presidential race, Bolsonarismo is alive and well. Candidates supported by Bolsonaro won half of the gubernatorial races, including in three of the most populous states, and plenty of seats in both chambers of Congress – Bolsonaro’s party is bigger even in representation than Lula’s Partido dos Trabalhadores (PT). In fact, Congress is now leaning centre-right and serving a role of checks and balances.

Lula is aware of fiscal, economic, and financial constraints, but is equally fixated on his ESG agenda that is not fully comparable with the country’s macrostability objectives.

Given the highly polarised race, it should have come as no surprise that emotions took over early on, despite Lula’s calling for unity and nearly all political actors recognising the election results. After staying on the side-lines for a couple of days, Bolsonaro eventually ‘conceded’ and overall surprised on the upside, behaving, rather than instigating. While disruptive, the protests did not turn out as disorderly, prolonged, and economically damaging as the trucker strikes of 2018 or those seen throughout the rest of the region more recently.

The transition process was handed over to a well-respected Vice-President Geraldo Alckmin, but the formation of the economic team to a far less orthodox PT’s Aloizio Mercadante. With no finance minister in place yet – Lula will fill the key position only in the coming weeks – the transition team took a far more ambitious and confrontational stance on creating extra budgetary room to meet and fit PT’s immediate campaign promises. The constitutional amendment (PEC) proposed to take the entire Bolsa Familia 2.0 out of the spending cap, which, together with other addons, amounts to around 2% of GDP per year and lasts for four years, the entire presidential term. The markets expected a much smaller waiver in size (slightly more than 1% of GDP) and duration (one year), not one that is equivalent in total expenditure to the entire pension reform savings over a period of a decade. That is as much of an own-goal as it gets in any football VAR analysis.

However, the signalling since the proposal was revealed has been more constructive. Most recently, alternative PECs have surfaced of a much more prudent nature in both duration and size, but we doubt that such a big watering-down is realistic. Lula also stressed fiscal responsibility was important though without checking all of the markets’ boxes. This is a good change in momentum for once.

The recent events highlight the mutually exclusive cross-currents at play in Brazil. While markets are laser-focused on the fiscal story’s remaining anchored, Lula’s PT is crystal-clear about wanting to spend more freely. Lula himself is pragmatic and not much of a leftist ideology like Dilma Rousseff, as he wants to rule by wider consensus, also because of the lack of clear social and political support, unlike in the past. He is aware of fiscal, economic, and financial constraints, but Lula is equally fixated on his ESG agenda that is not fully comparable with country’s macro-stability objectives. This looks like a conundrum.

We stick to the view that Lula will be a pragmatic populist despite actions as of late that have been more populist than pragmatic. Markets will need to act as a football arbiter, via the centre-right leaning congress, though the latter is only a necessary, but not sufficient, condition, and refrains from repricing the real like it was a World Cup winner. Otherwise, the backstop is not binding and Lula’s policy stance might start resembling Gustavo Petro’s rather than Gabriel Boric’s. The risks of a less benign outlook have risen also in light of Lula’s confrontational towards the markets comments.

Lula will be a pragmatic populist despite actions as of late that have been more populist than pragmatic.

Away from home, the news has been far more encouraging. At COP27 in Egypt, Lula proclaimed Brazil was back in the fight against climate change and deforestation. He also wants to create a special ministry for indigenous people and hold COP30 in Brazil/ the Amazon. This news highlights Lula’s strong ESG credentials, as fully expected by investors.

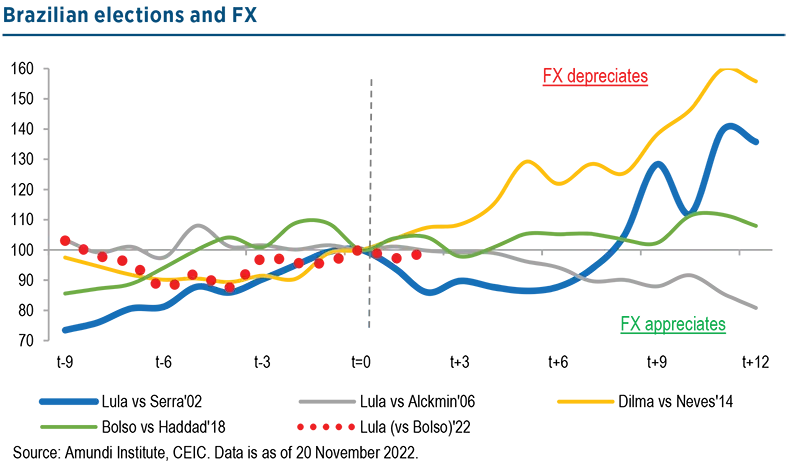

The chart below shows a study of the Brazilian real’s behaviour throughout an election cycle, with FX dynamics from six months before until 12 months after the election. It shows how the real – like financial markets – is undecided about whether Lula’s administration will be more similar to Dilma’s or to his own administration from 2003. In the first occurrence, an insufficient risk premium is now discounted by the currency, while there is plenty of room to appreciate if the latter prevails.

At COP27 in Egypt, Lula proclaimed Brazil was back in the fight against climate change and deforestation.