Summary

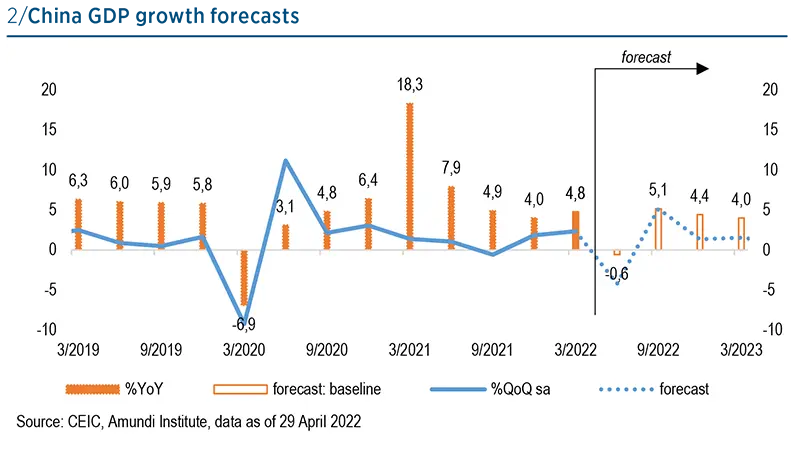

The extended lockdown in Shanghai and other cities have shattered market confidence, sending Chinese equity market down again over the month. Taking into account the damage of the zero-Covid policy to the Chinese economy, we expect a recession in Q2 and full-year growth to undershoot the government target by a wide margin (Amundi forecast 3.5% versus the 5.5% official target).

Nevertheless, a simple extrapolation of Shanghai’s case would be wrong. Despite the fact that one fourth to one third of the economy is under various levels of restrictions, activities outside of Shanghai have started to recover since early April, heralding an adjustment of policy execution and a gradual reopening in May/June.

More importantly, hesitation on broad policy easing has decreased. The Central Financial and Economic Committee on 26 April called for comprehensive infrastructure construction, laying the ground for a rebound in sentiment. Three days later, the Politburo reassured markets by reiterating its annual economic targets and calling for an end to regulatory crackdowns on the platform economy.

The Growth puzzle – how much should we discount on the downside?

GDP growth came in firmer than we expected at 4.8% YoY in Q1, defying strong negative base effects. A closer look at the numbers reveals an increased statistical discrepancy between official and alternative data, especially on industrial and housing sides. In our view, the upbeat print is likely to overstate actual economic growth.

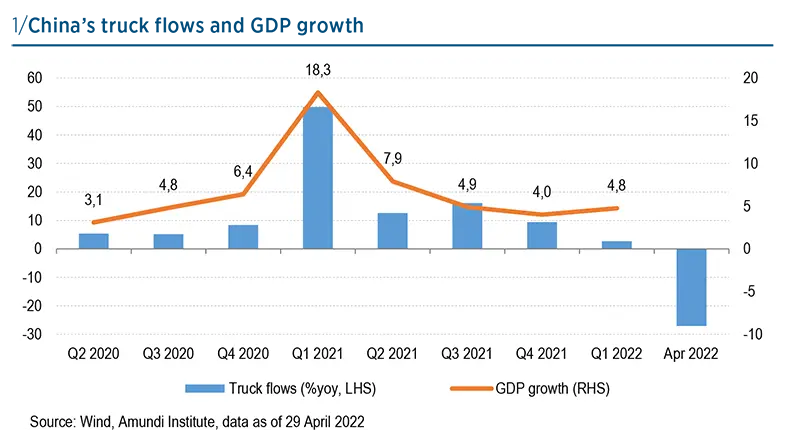

In Q2, the extended lockdown in Shanghai and expanded restrictions into other regions will send China into a transitory recession. The evidence is telling. National freight traffic – an indicator that tracks China’s growth closely – was down by 27% YoY in April (Chart 1). Shanghai and Jilin have shown that the economic cost of zero-Covid policy is high and will only get higher with more transmissible variants, as a city needs to bring mobility down more for an Omicron outbreak than for a non-Omicron outbreak.

Using truck flow data, academic economists Chen et al., 2022 have estimated that a one-month full-scale lockdown in Shanghai, Beijing and Shenzhen will reduce national GDP by 4%, 3.6% and 2.8%, respectively. Now, Shanghai’s full-scale lockdown has stretched over a month into early May, and the Ministry of Transport predicts a 60% YoY decline of national travel during the Labour Day Golden Week. Even though the lockdown economy (e.g., medical equipment production and online shopping) may thrive again, a recession is inevitable in Q2 in our view, assuming a cautious reopening in May and June (see Chart 2 for forecast details).

Nonetheless, we cannot rule out upside surprises to our forecasts. For one, the statistical smoothing will lead us to catch up with the official numbers in the coming quarter. Just in the last week of April, a PBoC official called for securing growth above 5% in Q2, signifying the importance of achieving the fullyear growth target. Another meaningful source of upside surprise is infrastructure investment, which could go beyond our forecast range and land above 10% for the full year.

The upbeat Q1 GDP growth print is likely to overstate actual economic growth

The Covid puzzle – how long will the zero-Covid policy last?

The zero-Covid policy remains the major catalyst to our growth outlook, and poor execution could thwart other stimulus efforts. The April Politburo meeting stated clearly its intention of sticking to a dynamic zero-Covid approach. With a busy political schedule ahead, including local leadership reshuffles in 17 provinces in Q2 and the Politburo/Central Committee elections in November, we expect officials to adhere to the zero-Covid policy throughout the year. However, it would be wrong to simply extrapolate Shanghai’s hit to other cities. At the execution level, adjustment is underway to accommodate logistics demand, for instance a streamlined application process for truck drivers to get their health passes. As a result, we have observed a steady recovery of activities outside of Shanghai and at the national level, paving the way for an economic recovery in May/June and Q3.

The policy puzzle – will policymakers under-deliver?

Markets have been disappointed by the follow-through of policy promises, in particular monetary easing. In fact, the PBoC disappointed again in April in keeping its policy rates unchanged for the fourth straight month and cutting the RRR less than expected. That said, interbank liquidity conditions have loosened further, with front-end rates plunging. Meanwhile, the PBoC has turned its focus to transmission, guiding banks to extend loans and relax their lending requirements. With mounting downward pressures on growth, we do see the need for additional rate cuts and expect another 10bp rate cut in coming months.

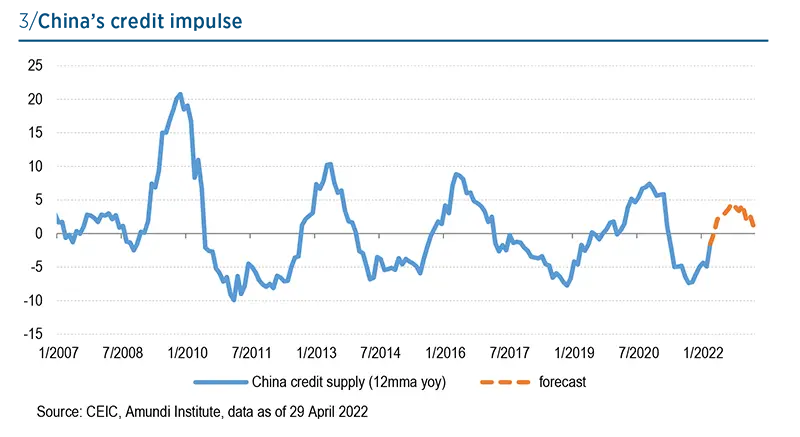

Although the PBoC is behind the curve in the traditional monetary easing space, its window guidance appears to be working. Credit growth has regained its lost ground, picking up again in March. We expect the credit impulse to turn positive in April and to continue to climb higher throughout September (Chart 3).

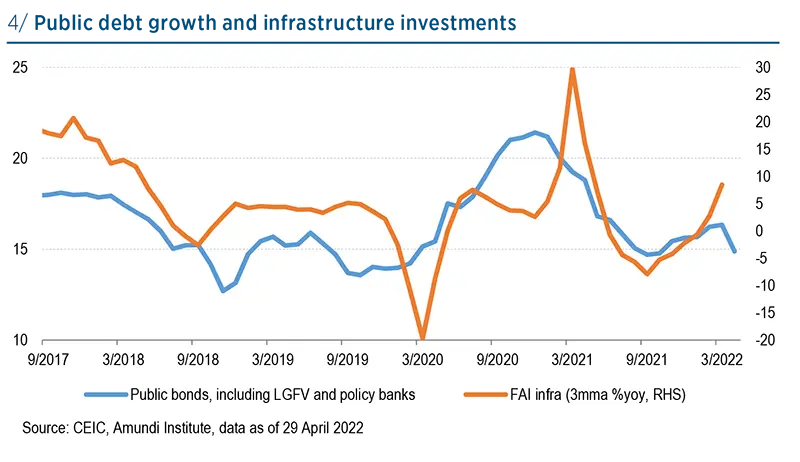

We expect the credit impulse to turn positive in April and to continue to climb higher throughout September

On the other hand, fiscal stimulus has come more in the form of tax and fee cuts, which probably explains the expectation gap between markets and policymakers. In addition, as public debt growth has accelerated, infrastructure spending is also likely to strengthen. Infrastructure investment growth is now heading to a higher range of 5-10% in 2022, compared with our previous forecast of 0-5%. This will be supported by the relaxation of infrastructure project quality requirements and public bond issuance. Cash handouts or subsidies to consumers, if any, would be positive surprises to our forecasts..

Following the April Politburo meeting, we are likely to see a quicker follow-through of policy supports. These supports, albeit addressing major market concerns directly, will not be enough to cancel out the damage from Covid restrictions. But since the downside of Chinese growth becomes visible to us, we believe policies will only be looser instead of tighter, underpinning a recovery in sentiment.

Following the April Politburo meeting, we are likely to see a quicker follow-through of policy supports