Summary

European Securitisations have recently attracted attention, with 2024 to date seeing record volumes of issuance since the Great Financial Crisis1. European regulators have also shown strong support through several recent reports (from Noyer, Letta and Draghi), which have led to a public consultation from the European Commission. We review the opportunities and the associated risk of European securitisations for pension funds.

Definition

Securitisations are defined by two main features in European regulation2:

1. Use of collateral

Payments to investors are provided by one or several assets. The vast majority of securitisations rely on pools of loans to households or corporates.

2. Subordination of the liabilities

The liabilities of European securitisation vehicles are distributed among different notes, or “tranches”, reflecting the priority of cashflow allocation, i.e., the subordination of tranches.

1. €112.9bn year-to-date publicly placed securitisations as of end of September 2024. Source AFME Securitisation Data Snapshot Q3 2024.

2. See article 2 of European regulation EU 2017/2402.

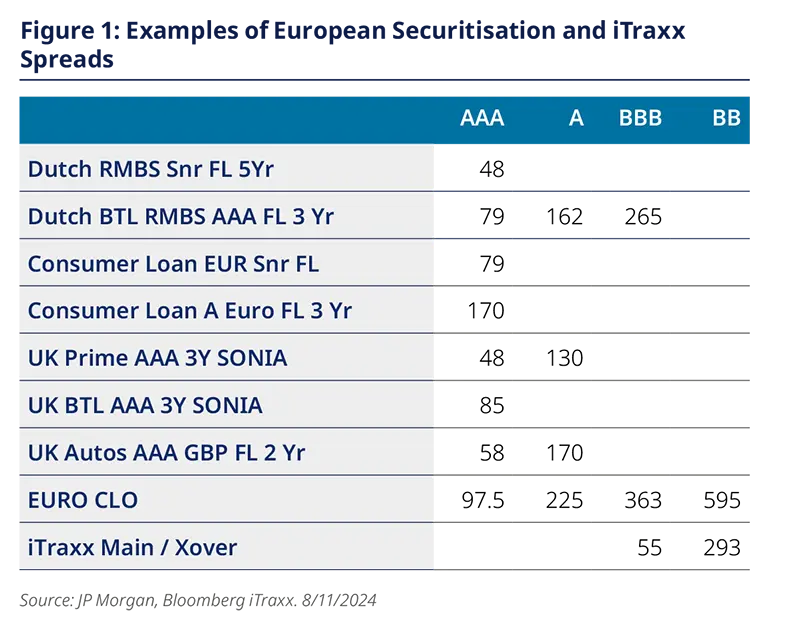

Returns

Unlike in the US, most European securitisations pay floating coupons, linked to a 3-month or 1-month index. Due to the low interest rate duration, their main sensitivity relates to credit. Securitisation credit spreads are significantly wider than those of corporates with similar ratings.

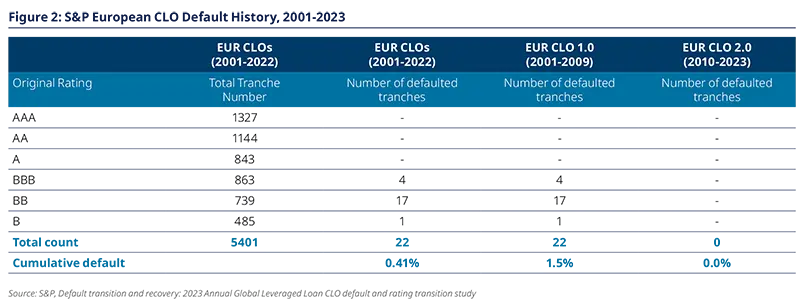

Default Risk

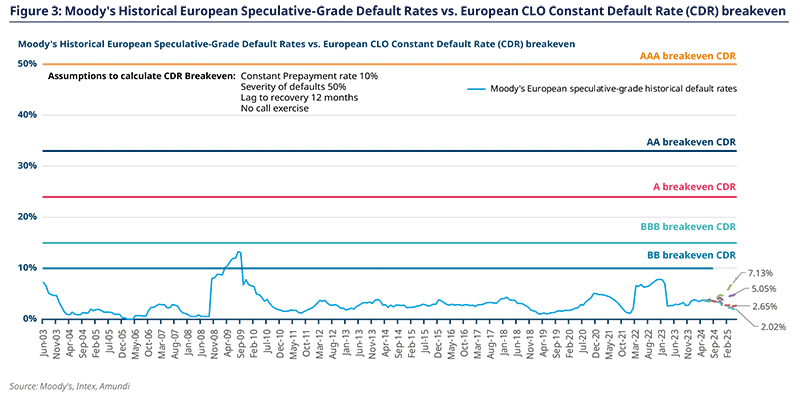

Contrary to market efficiency theory, wide European securitisation spreads are not consistent with their actual default rates, which have been historically much smaller, including during the 2008 Crisis. For example, for collateralised loan obligations (CLOs), it is important to distinguish between structures issued before and after the GFC. Both have demonstrated high robustness, with no defaults for structures issued since 2010 (Figure 2).

Securitisation Premium

Three main reasons explain this significant excess spread relatively to expected loss:

1. Uncertain cashflow timing

Borrowers of the underlying loans, especially mortgages, or sponsors, notably for CLOs and Commercial Mortgage-Backed Securities (CMBS), have the right to repay the loan principal before its maturity. This timing repayment uncertainty may put off investors with fixed maturity constraints (e.g., Target Maturity Funds…). This uncertainty is mitigated by several factors. For example, CLOs and CMBS maturities are limited by provisions restricting non-call and re-investment periods and by the maturities of the underlying loans.

The floating rate nature of the coupon also means price impacts are linked to the potential spread change. Prepayment risk and the consequential reinvestment risk, occurs during significant spread tightening. The opportunity cost of this (possible) situation has to be balanced with the (certain) benefit of the initial investment in high-spread securitisations. The wide spreads of CLOs allow a cushion to be progressively built against this risk that has proved effective in recent volatile periods. Conversely, the extension risk is limited by the medium-term maturities of most of the underlying loans (excluding residential mortgages): typically, less than 7 years for consumer, auto and leveraged loans.

2. Due diligence constraints from securitisation regulations

Not all investors are able to analyse securitisation structures, especially the varying cashflows allocation rules (waterfall). Even for the most senior tranches of high-quality securitisations, detailed pre-trade analysis and on-going monitoring are mandatory under the European and UK regulations. This may deter investors if they are reluctant to dedicate sufficient resources. For institutional investors, the regulatory burden of pre-trade due diligence and on-going monitoring can be managed by delegating these responsibilities3.

3. Punitive prudential treatment

Following the subprime crisis, European and UK regulations have been significantly tightened, especially around capital charges and the liquidity treatment of securitisations for banks. These costs de facto exclude most European insurers from the non-senior, non-STS or long-dated tranches.

For institutions that are not submitted to the Solvency 2 standard approach, like pension funds, the exclusion of competitors can be an advantage.

3. See article 5.5 of the European Securitisation Regulation.

Our expectations for securitisations

Although past data demonstrate the historical robustness of securitisations, we expect future returns to be linked to the fundamental performance of the underlying loans.

Three main borrower types exist in this context:

- Households: for Residential mortgage-backed securities (RMBS), consumer loans and credit cards, most auto loans

- Corporates: for CLOs, trade receivables and whole loans securitisations

- Commercial Real estate funds: for CMBS

- Household loan defaults are highly correlated with unemployment. In both the UK and continental Europe, unemployment figures are at historical lows and we expect persisting labour markets tensions will shield Europe from a surge in unemployment in 2025.

- Leveraged loans are used in CLOs and are often issued by medium-size corporates with a high-yield profile, typically B-rated and often belonging to non-cyclical sectors.

Post-crisis CLOs, (CLO 2.0), benefit from improved structural features. Investment grade and BB tranches are designed to withstand extreme default rates. The breakeven Constant Default Rate for the BB tranches typically stands at 10%, meaning the rate has to be on average above this threshold for the remaining life of the tranche for it to incur a loss.

Due to their spreads and their ability to sustain default rates of the same magnitude as during the GFC, IG tranches of CLOs are currently our favoured type of securitisation.

3. CMBS and whole loan securitisations

We are cautious on both CMBS and whole business securitisations as they rely on specific risk factors which can make refinancing and default risk difficult to assess due to:

- Asset price cyclicity

- Sectoral changes that may affect specific assets

- Concentration of risk focused on a specific business or properties, e.g. commercial real estate currently suffers from adverse conditions, complicating the refinancing of high LTV loans.

Risk / Return gain in a diversified credit portfolio

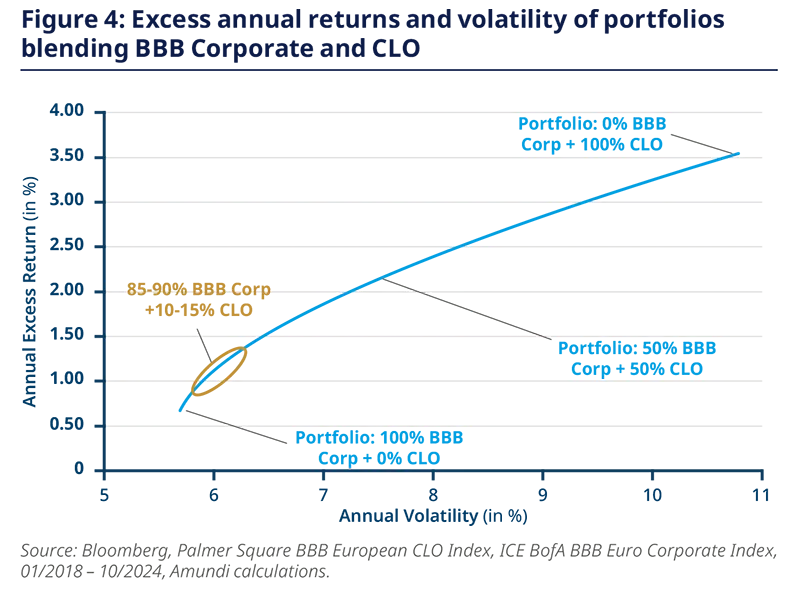

Securitisations can significantly improve the performance of a credit portfolio, especially through including CLOs that benefit from the largest securitisation spreads. Figure 4 demonstrates how European CLOs and BBB corporates may be used in a portfolio. A 15%/85% split of CLOs to BBB corporates has potential to optimise risk/return up to this proportion, as additional excess return is obtained with a limited increase in volatility of the portfolio

Liquidity

The market size of European securitisations, although smaller than the US, is important, totaling €538bn of placed issuances, of which €245bn are CLOs4.

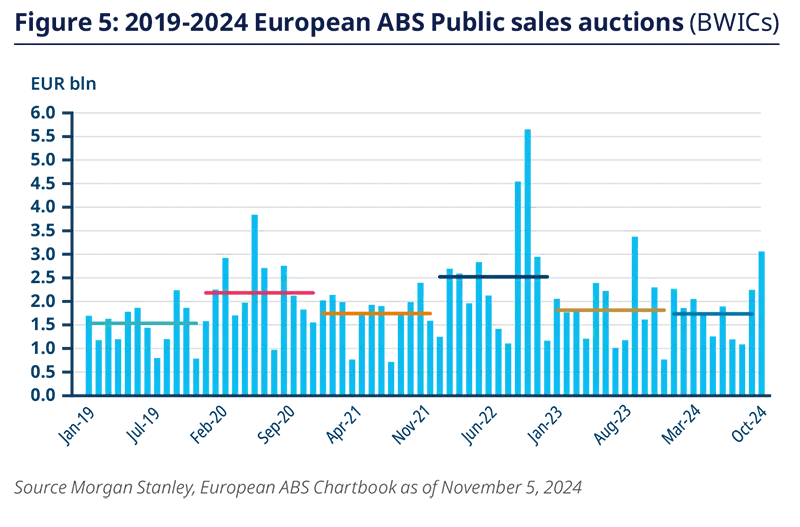

Even if some market participants may prefer to hold securitisations long-term, others often implement active management. This allows for opportunistic purchases, especially when sellers are in need of liquidity, as demonstrated during the UK mini-budget crisis.

In October 2022, trading activity recorded its highest levels, estimated to be in excess of €20bn over a few weeks, almost half executed through public auctions (BWICs for Bid Wanted in Competition).

Although prices were impacted by the exceptional surge in paper, constrained sellers were able to obtain liquidity. This extreme liquidity stress test of the European securitisation market has demonstrated both the existence and the reasonable cost of such immediate liquidity.

4. Source Morgan Stanley, European ABS Chartbook as of November 5, 2024

ESG assessment

As securitisations rely on specific assets for collateral, ESG assessment can be relatively transparent. For example, for an auto loan securitisation, the ESG score of a pool can be assessed using the CO2 emissions of the financed cars, or a proxy like the motor type compared to the whole market.

Similarly, the Energy Performance Certificate of the financed properties can be used to assess the mortgage’s environmental value. The European Green Bond framework can also be used to recognize the value of securitisations with a green use of proceeds commitment from the seller of the loans.

Unfortunately, not all these data are public and they must be gathered by the portfolio manager to ensure fair comparison.

Business Case

Implementing a dedicated CLO fund for a pension fund

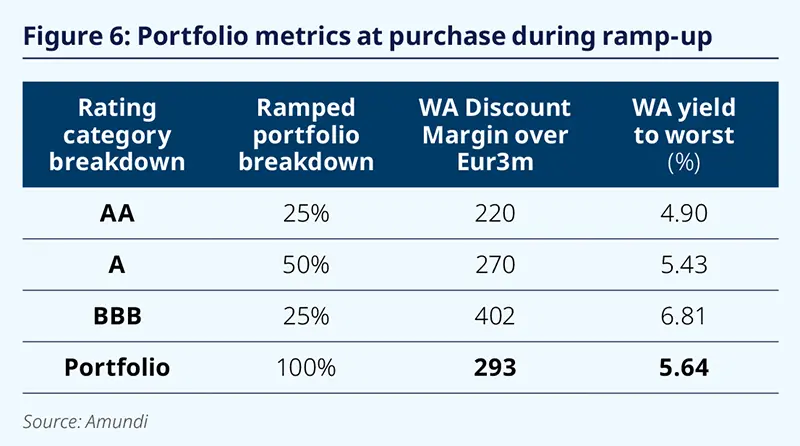

In order to capture the CLO spread premium, one of our pension funds clients made the decision to invest in a dedicated fund in December 2023. To limit the volatility of the fund and maintain a high-grade average rating, the investments are focused on AA to BBB rated tranches with a maximum of 25% of BBB tranches.

The portfolio was fully invested within a few months using both primary and secondary markets, with a dominant share (63%) for the former given the long investment horizon of the client.

The portfolio is diversified across country and sector, reflecting the structural diversification of CLOs across the European leveraged loan market.

Client benefits

- Diversification: Historical 1-year return correlation of 0.46 between BBB corporates and CLOs5

- Robust credit position with very low idiosyncratic risk (No expected loss even in a GFC-like stress on IG rated tranches)

- Capture of additional returns across traditional FI market with an annualized IRR since inception of 7.9%6

5. 1-year correlation of ICE BofA BBB corporate index with Palmer Square European CLO indices reflecting the rating structure of the portfolio as of end of October 2024. Source Bloomberg.

6. Amundi calculation.

Read more