Summary

Introduction

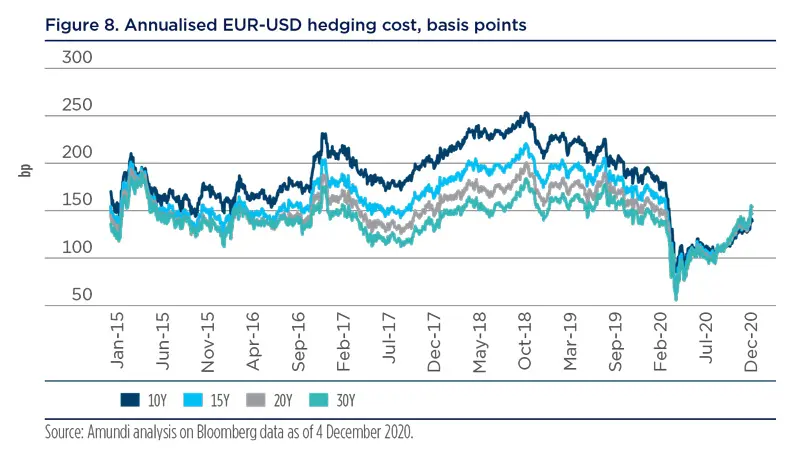

In the hunt for yield, some years ago European investors started to allocate part of their credit exposure to dollar assets. However, many of them put a stop to this diversification due to high hedging costs. In the context of the Covid-19 outbreak, the Fed cut rates to post-Lehman lows. Consequently, euro and dollar interest rates converged significantly, reducing hedging costs and making a case for broadening the investment universe from a European to a global base more attractive.

This approach is reinforced by the fact that -- in a ‘lower-for-longer’ interest-rate scenario -- European investors have been increasing the euro credit share of their investments, in some cases leading to credit-risk limit saturations on major European issuers. Against this backdrop, the dollar corporate market offers European investors attractive diversification opportunities in terms of issuers, since 80% of US domestic issuers have never issued in euros, as well as across sectors and maturities.

In addition, the dollar investment grade (IG) credit market can be considered to offer an interesting entry point from an ESG (Environmental, Social and Governance) perspective. A recent in-house study showed that ESG investing has been a source of outperformance in euro IG bonds since 2014. Today, we see evidence of a delay in integrating the ESG approach in the US credit market, offering potential opportunities. This paper concerns core investing for institutional clients geared toward long-term portfolios with limited turnover. We analyze the complementary features of the dollar and euro IG credit markets, present the benefits of widening the investment universe to include the dollar credit market, and explore the methods of implementing such a strategy. Finally, we focus on Solvency II and accounting implications for European insurers.

Three main benefits of combining dollar and euro IG credit markets

Diversification

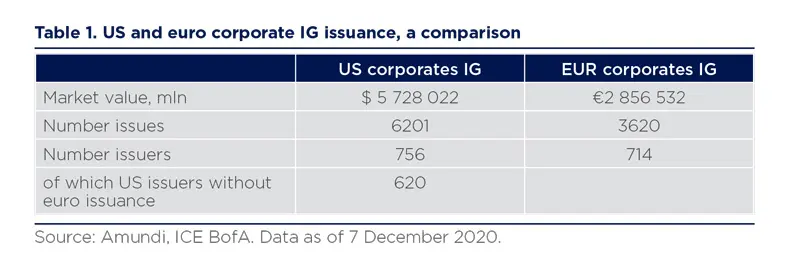

Access to new names

The dollar IG credit universe accounts for over 700 US-domiciled issuers, of which about 600 have never issued in euros. Therefore, investing in the dollar corporate-bond market will offer to European investors exposure to completely new names. In terms of market value, the size of the US investment universe is double that of Europe (see table 1).

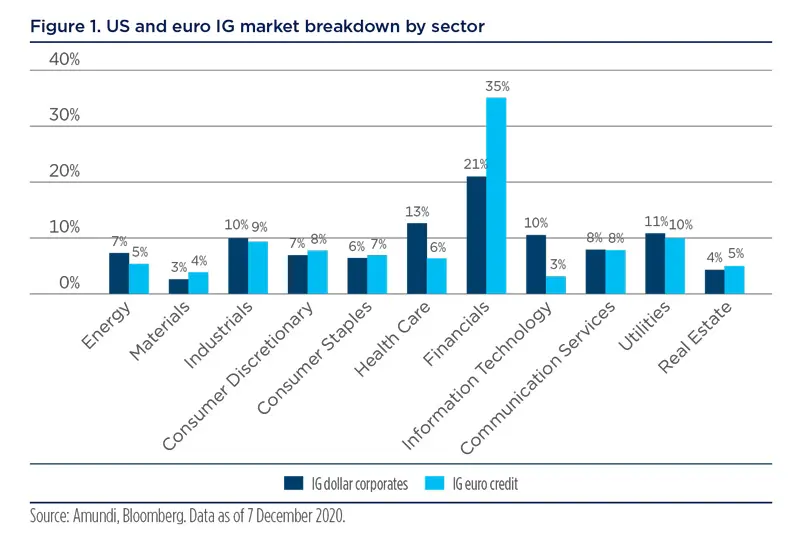

Access to different sectors vs. the euro IG credit universe

Dollar credit markets feature a relatively more important industrial segment due to the higher weights of the energy and technology sectors at the expense of financial institutions. As the US and Eurozone economic cycles may not be synchronised, so the US and euro credit markets can follow different cycles. This can offer additional opportunities, for example in US energy and technology, even if a strict credit framework remains key for investing in challenging sectors.

Dollar credit markets feature a relatively

more important industrial segment due

to the higher weights of the energy and technology

sectors at the expense of financial institutions.

Access to a diversified set of longer-maturity bonds

Longer-dated bonds (ten-year and above) account for 39% of the dollar universe vs. 10% in the euro universe, offering European investors diversified accessible exposure to longer maturities. This can be an additional benefit in a context where low long-term rates have generated additional hedging needs from ALM-driven investors looking to lengthen duration on their investments.

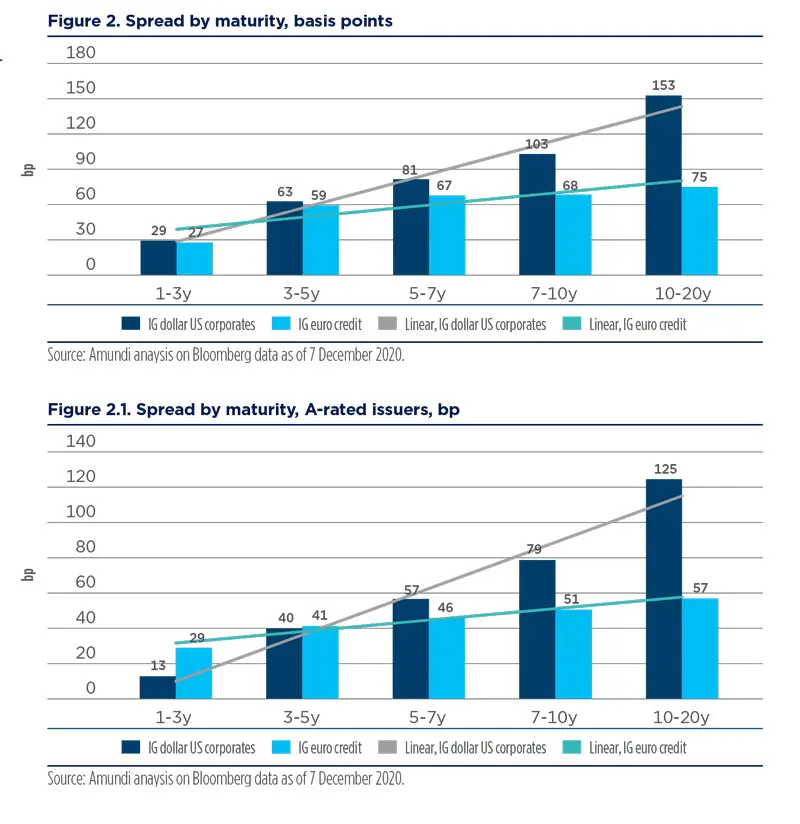

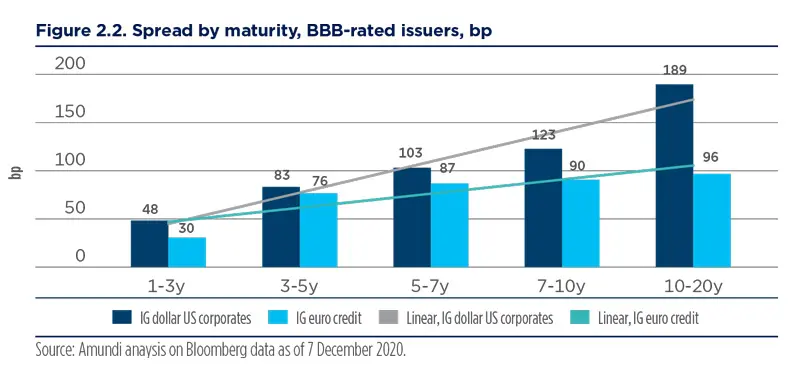

Yield pick-up

The credit curves of US domestic issuers are steep comparative to those of euro issuers, offering attractive spread pick-up on intermediate- and long-dated maturities. The steepness is observed within every rating category. This is good news for investors seeking to add credit exposure on longer maturities for yield or ALM reasons.

The credit curves of US domestic issuers are

steep comparative to those of euro issuers,

offering attractive spread pick-up on

intermediate- and long dated maturities.

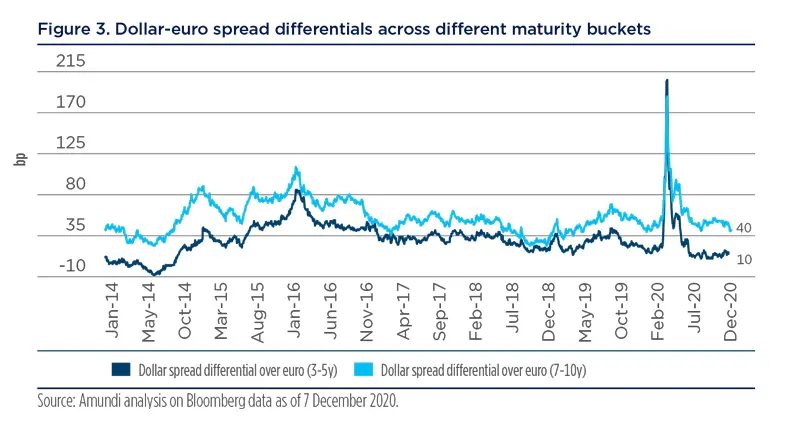

Dynamic allocation within the global credit framework

Within the global credit framework, dynamic allocations for regional exposure can be an important performance driver. The recent relative behaviour of dollar and euro spreads is a good example. With the Covid-19 outbreak hitting the United States later than Europe, dollar credit spreads widened to unprecedented levels. The dollar-euro spread differential soared to 200 bp across all maturities. The differential decreased significantly following the Fed and ECB announcements on their respective corporate bond purchase programmes, and to a varying to extent across maturity buckets. We observed huge dollar vs. euro spread tightening for short-dated bonds, while longer-dated bonds still offer an attractive pick-up over the euro. This distortion can be explained by differences in central bank easing measures. The Fed corporate purchase programme is limited to five-year maturity bonds, while the ECB purchases up to thirty-year bonds. Interestingly, the Fed’s purchases in the US corporate-bonds market were not significant compared with the ECB’s purchases, but the Fed’s communication was strong enough to put spreads under pressure, while longer-maturity dollar spreads remained better positioned than euro spreads.

Within the global credit framework, dynamic allocations

for regional exposure can be an important performance driver.

Selectivity will be key

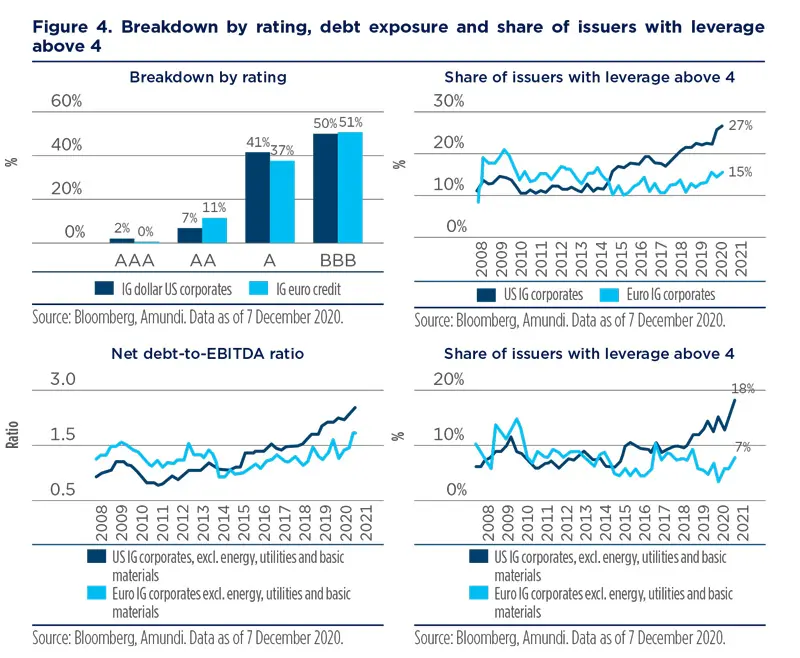

While the rating split is similar in the two markets (see figure 4, breakdown by rating), it will be key to take a closer look at fundamentals, as we have seen a continuous increase in leverage across the US IG universe. As a consequence, the share of US issuers with leverage above 4 increased to 27% vs. 15% for European companies. Excluding the most leveraged sectors, such as energy, basic materials and utilities, this figure stands at 18% for US companies and 7% for European names.

Investing in US IG credit can offer both

diversity and yield pickups compared with euro

IG, but approaching this properly will require an

in-depth credit analysis so as to exploit relative

value opportunities across the markets.

To sum up, investing in US IG credit can offer both diversity and yield pick-ups compared with euro IG, but approaching this properly will require an in-depth credit analysis so as to exploit relative-value opportunities across the markets.

Currency hedging: how to implement it

When venturing into the US credit universe, most -- if not all -- European investors are happy to take fixed income risk but not currency risk. Investigating and assessing hedging strategies is thus essential, with two types of hedging strategy commonly considered.

When venturing into the US credit universe,

most -- if not all -- European investors are happy

to take fixed income risk but not currency risk.

Investigating and assessing hedging strategies is thus essential.

Hedging through short-term forwards

Under this approach, hedging involves selling dollars on a forward basis. Short-term forward contracts (up to twelve months) are entered into the system and rolled until bond maturity. Two variables affect the forward exchange rate:

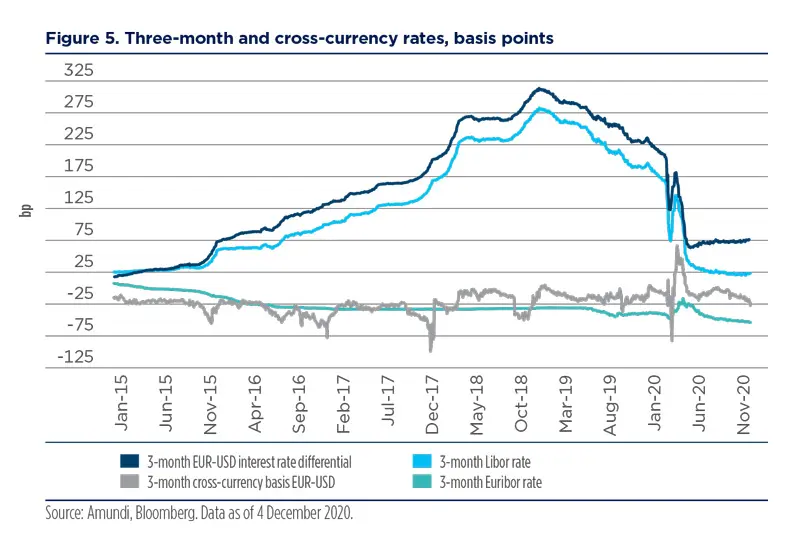

- The short-term interest-rate differential between the two currencies. Considering stable euro rates, higher money-market dollar yields result in depreciation of the forward dollar exchange rate to the euro, meaning higher USD-EUR forward rates than the rolled spot rate, depleting the return on this strategy.

- The short-term cross-currency basis, representing the cost of accessing dollar liquidity against the euro. In the event of strong demand for a particular currency, investors are willing to pay much higher prices than implied by the interest-rate differential. This was the case in 2008, when European banks were short of dollar liquidity, or in 2012, during the Eurozone sovereign debt crisis, due to high risk aversion toward European banks.

Based on a combination of these two components, we can obtain the overall hedging cost.

Hedging long-maturity bonds with short-term

forwards will lead to uncertainty about

overall hedging costs over the life of a bond.

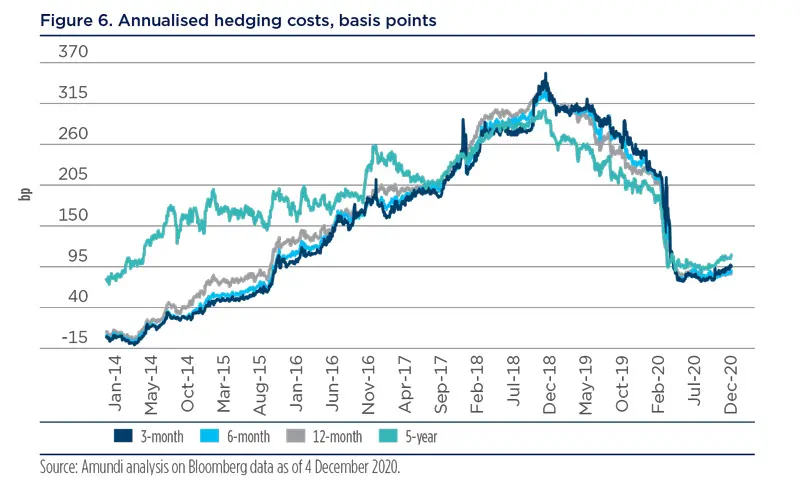

Hedging long-maturity bonds with short-term forwards will lead to uncertainty about overall hedging costs over the life of a bond. For example, in 2014, investing in ten-year dollar-denominated corporate bonds while hedging through short-term forwards was attractive, as hedging costs were low. However, these rose above 3% in late 2018, with hedging costs weighed on the long-term investment return.

Short-term hedging costs have fallen significantly since last March following the Fed’s Covid-related rate cuts. Since then, they have been stabilising at around 90-100 bp, with limited potential for a rebound (except in the event of traditional year-end volatility). The Fed’s members put the Fed funds rate at zero through the end of 2023. Moreover, their new forward guidance will allow inflation overshoot for some time without any rate increase to reach maximum employment. This should limit even more any potential short-term hedging cost increase.

Investors should keep in mind that hedging via short-term forwards provide the hedge of the currency risk only. They will continue to be exposed to dollar long-term interest rates.

Hedging through cross-currency swaps at maturity

Hedging via cross-currency swaps will allow both currency and interest-rate risk hedging up to bond maturity. As with the rolling of short-term forwards, hedging costs can be split into different components:

- Long-term interest rate differential. Investors switch from the dollar swap curve to the euro curve while maintaining the credit spread of the issuer.

- Cross-currency basis. The relative cost of access to dollar liquidity against the euro remains relevant for long-term maturities, and could weigh on final euro return. For example, under current market conditions, the cross-currency basis is less detrimental vs. historical standards. It could appeal investors looking for exposure to 20/30-year maturity bonds to be hedged until maturity via cross-currency swaps.

- A technical adjustment linked to available market instruments. Euro liquidity is offered on a six-month rolling basis compared with the three-month rolling basis for dollar liquidity.

Combined, these three components allow us to measure hedging cost.

Such approach is well suited to long-term portfolios. As a further consequence, irrespective of the hedging framework actually used when implementing dollar fixed income hedging, getting ready to execute hedging via cross-currency swaps at maturity would allow to establish a fair comparison and benefit from relative mispricings between the dollar and euro markets.

Example: an European energy group

Let us consider a dollar-denominated bond, with a 4.25% coupon, maturing on 9 May 2029. The bond’s spread/dollar swap is 115 bp. It will be compared with euro-denominated bonds with a 3.63% coupon maturing on 29 January 2029. Its spread/ euro swap will be 45 bp. In this example, the dollar-denominated bond swapped in euros will offer a spread of 95 bp. The initial 115-bp spread is negatively affected by the basis cost. However, this spread is wider than the euro-denominated bond’s 45-bp spread, offering a 50-bp pick-up.

Opportunities such as these evolve over time and depend on many factors (primary market premium, investor risk aversion towards non-domestic names, levels of cross currency basis). Therefore, detecting this type of spread differential requires constant monitoring of the credit markets in both currencies, as well as historical analysis. Finally, investors will need to take into account that both hedging strategies, -- short term roll and ‘at maturity’ -- will require some collateral to be posted or received under the derivative contract applied.

To sum up, investors should consider the following factors when choosing a hedging strategy:

- Market levels of hedging costs;

- Risk appetite;

- Collateral needs; and

- Other liquidity constraints.

Conclusion: why should European investors combine euro and dollar IG credit?

The Covid-19 crisis has reinforced a ‘low-for-longer’ interest-rate scenario, with central banks anchoring accommodative policies for a more significant duration. Under this scenario, both diversification and the hunt for yield will be paramount, and need to be taken into account. Some investors have remained within their domestic markets due to the prohibitive costs of currency hedging. These costs remain a drag today, even though they have improved considerably. Since, in the current market environment, every basis point of additional yield is very valuable, we think widening the investment universe to include dollar IG assets is worth (re)considering.

First and foremost, this is a strong diversification opportunity and is relevant today because, in this low-interest-rate environment, European investors have already upped their exposure to European corporate issuers and are close to issuer limits on certain names.

The dollar IG credit market can offer European investors exposure to completely new names, as 80% of US domestic issuers have never issued in euros. The same holds true at sector level, as underlying dynamics – size, growth, consumer culture, regulatory framework – can be very different in the two areas. In addition, the steepness of the credit curve could offer good opportunities to those investors willing to exploit dollar long-dated bonds to reduce the duration gap. However, it’s crucial to combine a long maturity strategy such as this with high selectivity of issuers, in particular because US corporates entered the Covid-19 crisis more leveraged than their European peers.

Secondly, investors could detect and exploit any mispricing opportunity between the two markets. Cross-currency swap calculations will allow investors to build a sound relative-value framework. This framework could prove useful for sourcing assets and issuers in the most rewarding currency, so as to benefit from specific market disparities. In addition, the hedging strategy itself can be a source of added value. As such, both short- and long-term hedging costs have to be monitored closely, as they evolve over time.

Finally, choice and execution will be key in order to implement this global strategy within a large investment universe and with relative-value comparisons. Any selection should be supported by strong fundamental analysis. As a consequence, we recommend two approaches to reap the strategy’s benefits:

- Establish a proper proprietary framework to analyse issuers and permit reactivity in terms of execution.

- Team up with an investment manager that will monitor both the euro and dollar credit markets -- this could be extended to other developed credit markets – on a continuous basis, and select and trade the best opportunities that emerge in every currency, while at the same time integrating client guidelines.

Choice and execution will be key in order to

implement this global strategy within a large

investment universe and with relative value

comparisons.

Any selection should be supported by strong

fundamental analysis.

Annex. Solvency II and accounting considerations for insurance companies when investing in the dollar credit market

Solvency Capital Requirements present a series of specific market risks at the asset-class level. Investments in dollar-denominated corporate bonds will involve currency risk and credit risk – depending on credit quality and on the bond’s modified spread duration, as well as interest-rate risk -- upward and downward movements interest-rate movements will apply to the valuation of both assets and liabilities valuation --and concentration risk.

Currency risk

The first market risk that investors will be facing when diversifying into dollar denominated bonds is currency risk. The Solvency II Directive (2009/138/EC) set a specific and deterrent (25%) solvency capital charge applicable in the event of currency mismatches between insurance companies’ assets and liabilities. Unless the insurance company already has liabilities in dollars, this may discourage it from profiting from this type of opportunity, and is why the forex-hedging strategies described in the previous section should be put in place and monitored through time.

Taking apart Solvency II considerations, from a financial point of view, when maintaining an un-hedged position, the company needs to be right on its directional view, as FX volatility can easily wipe away excess return earned. In practice, most insurers usually choose to fully hedge their currency exposure.

Credit spread risk

Forex is not the only component of the Solvency Capital Requirements involved in the Market Risk module. The Credit Spread risk sub-module doesn’t take into account the nationality of the issuer or bond currency. It is based on the Credit Spread Duration of the bond and on its Credit Quality Step (CQS), which is the second-best rating of External Credit Assessment Institutions (ECAI, as well as the main rating agencies). If only one rating is available, this rating should be used.

Consequently, one can argue that an arbitrage in the credit space, favouring dollar- to euro-denominated bonds with the same CQS and with the same spread duration, is neutral from a SCR Spread point of view. However, considering that we need to freeze some capital when buying a credit bond, it is of the utmost importance to optimise its spread, as the spread net of cost of capital, depending mainly on the return on equity assumption, can result in a much lower and sometimes negative spread. This is why widening the credit investment universe to dollar bonds is a positive move, with many opportunities potentially arising from this market.

Interest-rate risk

Comparing dollar-denominated credit investments with euro-equivalent bonds is less straightforward from an interest-rate risk perspective.

First, the shocks to the dollar and euro risk-free curves aren’t the same. Even if a standard formula is subject to a material revision, since current methodology understates downward interest-rate risk, (see “A more restrictive capital requirement for insurers in 2019?” Amundi), the principal of proportional shocks applies. Consequently, as rates on the dollar are higher than rates on the euro, dollar-asset shocks can be more painful.

Second, it is not possible to hedge euro liabilities with dollar assets following the standard formula, as this model allows for no benefit from the correlation between interest curves in dollars and euros. All currency interest curves are shocked in the same direction at the same time, and a negative change in net asset value less best estimate liabilities in one currency may not be cleared with a positive change in another currency.

Bear in mind that, under the Solvency II regime, the interest-rate part of the Market SCR is calculated by applying a shock per currency to the difference between liabilities and assets. If assets are longer than liabilities, the shock will translate into a rate increase (S_up). If liabilities are longer than assets, the opposite applies.

Let us look at the generally standard situation of life insurance companies – where liability maturities exceed those of assets -- doing their business in euros, where the interest-rate portion of the Market SCR is calculated applying an interest-rate decline on both assets and liabilities in euros (‘S_down’). In this case, investing into a dollar-denominated bond would have the following effects:

- It would not contribute to reducing the euro interest-rate portion of the market SCR as the dollar bond would not contribute to the euro duration of the assets (S_down unchanged in euros).

- The dollar bond position would contribute to the dollar interest-rate portion of market SCR (S_up in dollar) as the insurance company does not have dollar denominated liabilities.

Concentration risk

If the portfolio is too concentrated on some specific group issuers, an additional capital charge may arise, depending on issuer credit quality (i.e., BBB-rated names with a weight exceeding 1.5%). In this event, diversification into US market can be considered in order to reduce this risk and, consequently, the Solvency capital requirement.

Volatility and matching adjustments

On the liability side, the risk-free rate curve is generally used as the discount curve, regardless of the structure of the assets, though insurers can also use a slightly different curve (provided certain conditions are met) using either a volatility adjustment (VA) or matching adjustment (MA) optionality.

VA and MA are part of the ‘long-term guarantee’ package that aims to limit the short term market volatility impact on the own funds of long-term institutional investors when these are insurance companies. These approaches consist of applying an add-on spread to the risk free curve used to discount the liabilities. Both adjustments of the discount rate curve will have a positive and direct impact on available capital (improving the SCR ratio’s numerator).

The difference between the two options is that the add-on is provided by the EIOPA in the case of the VA, depending on country and currency, but is directly linked to the insurer’s portfolio structure for the MA. Thus, by increasing available capital as each yield pick-up in the dollar credit market lowers the valuation of liabilities, MA offers greater benefits than VA for insurers in terms of Solvency II ratio. Eligibility criteria are stricter for MA, and not all insurers have recourse to it.