Summary

Executive summary

As the global economy recovers from its worst economic slump since the 1930s, any investment decision will hinge critically on the evolution of the dollar. In the medium to long term, the extra-sized US fiscal stimulus will provide downward pressure to the dollar. At the same time, fiscal solidarity among Eurozone countries points to higher liquidity and sophistication in the euro financial market. We believe that such a process should be bumpy and that it may take some time for investors to find and trust an alternative to the dollar. The link between the US twin deficits and the dollar -- which has held in the long run -- unfortunately has barely worked in periods when dollar-denominated assets have dominated, as shown in this paper. Should the huge fiscal measures generate stronger economic growth -- as both investors and we believe -- we foresee international capital flows remaining anchored to the United States and its assets in the short term.

Over the next few months, this trend will offset any concern over the huge imbalances that the US economy faces today. If we buy this as a valid ‘per-se’ narrative, we are even more confident in considering that other countries will implement similar expansionary policies to support the post-Covid-19 economic recovery. At least this year, we believe that investors should focus on growth rather than on the means implemented by each country to achieve that goal. The twin deficit issue remains relevant on a longer-term perspective, but other factors will dominate on a shorter horizon.

An interesting comparison could be drawn with 2018, when the US fiscal position deteriorated sharply in response to Trump’s 2017 tax cut, but the dollar diverged considerably from what the long-term relationship should have entailed. Indeed, the dollar stayed upbeat, benefitting from strong US growth, which was stronger than most other countries. We believe that this could be the case in 2021 as well. This time, medium- and short-term forces are misaligned, suggesting a challenging environment for the dollar:

- In the medium term, the huge liquidity injections and the deteriorating US fiscal position remain strong headwinds for the dollar, pointing to some depreciation and possibly even a sell-off, based on eroded investor confidence. Large-scale capital outflows might take place at that stage.

- In the short term, the fiscal boost is building a US growth premium versus the rest of the world, suggesting that international capital inflows should stay anchored to dollar-denominated assets. In the short term, we expect this effect to prevail and offset any concern about US imbalances. This should keep the dollar in the 1.16-1.18 range at end-2021. Such a trend should be bumpy though, as any consolidation in US rates could cause the dollar to weaken somewhat.

Medium- to long-term trends

1. Downward pressure from fiscal and trade deficits

Covid-19 triggered a sharp global economic slump in 2020, due to containment measures applied across countries, to varying degrees, and which generally entailed business closures, event cancellations, travel restrictions and work-from-home policies. However, central banks and governments were quicker and bolder in their action than in the past. Such combined monetary and fiscal stimulus proved enough to restore confidence in financial markets and rein in any major refinancing risks, smoothing the usual dynamics of the credit cycle (following a quick and sharp widening of credit spreads early in the crisis, that narrowed back quickly). Those synchronised and combined efforts paid off. Today, global growth is set to rebound strongly, with an accelerating trend that is proving stronger than any other recovery of the past few decades, in the United States above all. Such a strategy has delivered on the expected results, but they came at a cost:

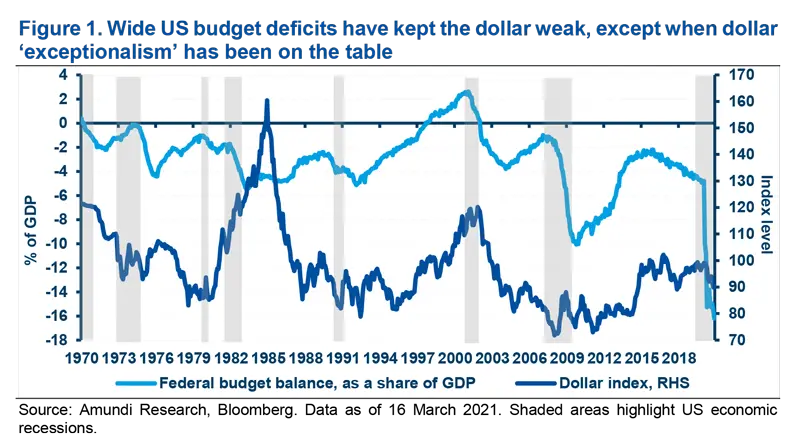

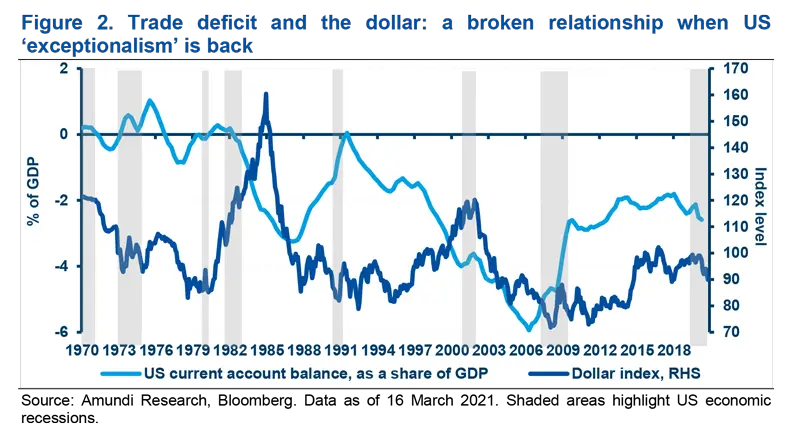

- The already poor US fiscal position has deteriorated. The budget deficit-to-GDP ratio currently stands at its highest level since the early 1970s. Such deterioration has come alongside a widening US trade deficit, raising concerns over a possible ‘hard landing’ for the dollar. ‘Twin deficits’ are at play -- the large federal budget deficit combined with the trade deficit -- and have always been one of the main challenges to dollar stability. In fact, the major risk associated with large and persistent twin deficits is a possible drastic reduction in the net capital flows that those deficits would require (“The huge and growing international trade and current account imbalances… represent the single greatest threat to the continued prosperity and stability of the United States and World Economies”, Bergsten 2007).

Today, global growth is set to rebound strongly, with an accelerating trend that is proving stronger than any other recovery of the past few decades, in the United States above all.

The stronger growth profile that the twin deficits could generate suggests a lack of alternatives to the US economy, which may continue to attract the required level of investments.

- Unsustainable deficits might erode investor confidence and trigger large-scale capital flights, as incentives to keep underwriting such imbalances fall drastically. Today, the US administration – and, more generally, worldwide fiscal authorities – is less worried about the fiscal burden and is acting as if ‘deficits do not matter, now’. Such an approach is reminiscent of the G.W. Bush era. These deficits are needed to prevent any collapse of the real economy and are essential boosters to spur economic growth over the next few years. The stronger growth profile that such twin deficits could generate suggests a lack of alternatives to the US economy, which may continue to attract the required level of investments. This is the ‘exceptionalism’ of US assets.

2. Valuations also point to dollar depreciation, though with less of a potential correction

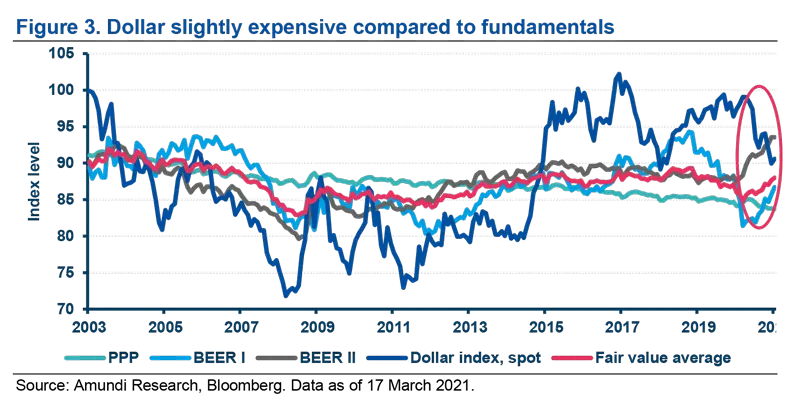

Twin deficits should entail a large dollar sell-off, but, looking at fundamentals, we envisage some mild depreciation only. This is because foreign exchanges reflect relative imbalances. Our medium-term valuation framework currently assesses the dollar as being slightly expensive with respect to the average of our fair value estimates. Purchasing Power Parity (PPP) is the most widely adopted framework. However, its relevance has decreased over time, as the sensitivity of exchange rates to relative-price dynamics has more than halved since the Great Financial Crisis (GFC). Therefore, our fair valuation framework identifies additional factors to identify medium- to long-run trends. Based on Clark and MacDonald1, we built three different behavioural equilibrium exchange rate (BEER) models, which -- in addition to price dynamics -- we leverage on:

- interest rates;

- terms of trade;

- productivity;

- fiscal spending; and

- trade openness.

Our medium-term valuation framework currently assesses the dollar as being slightly expensive compared to the average of our fair value estimates.

PPP is the most powerful driver, while the combined contribution from BEER models accounts for almost 50% of the final weighted estimates. Based on such a framework, we confirm our 2020 view that the dollar is trading above its long-term valuation. PPP points to the largest correction, while the deterioration in US public finances and the drop in the ten-year interest rate differential appear to be priced in following the 2020 developments. By looking at the US fiscal and trade imbalances, one may argue that the dollar depreciation has just started. However, we believe that our long-term dollar view has simply found cyclical catalysts in 2020, but the average fair valuation has not deteriorated much. Generally, currencies reflect relative imbalances and the growth and productivity collapse experienced by most other countries is offsetting the deteriorating US fiscal position.

On average, the dollar index is about 3-4% overvalued compared to its average fair value. However, its adjustment speed may have peaked in 2020 and could be slower this year. Despite the poor management of the pandemic, the second half of 2020 has proved how resilient the US economy can be. In addition, the recently passed $1.9tn fiscal package, together with a possible infrastructure plan, could give an additional boost to US growth that may result in a persistent deviation to what fundamentals imply.

We believe that our long-term dollar view has simply found cyclical catalysts in 2020, but the average fair valuation has not deteriorated much compared with last year.

Short-term trends

1. The US growth and interest rates advantage should prevent a mean reversion to fundamentals

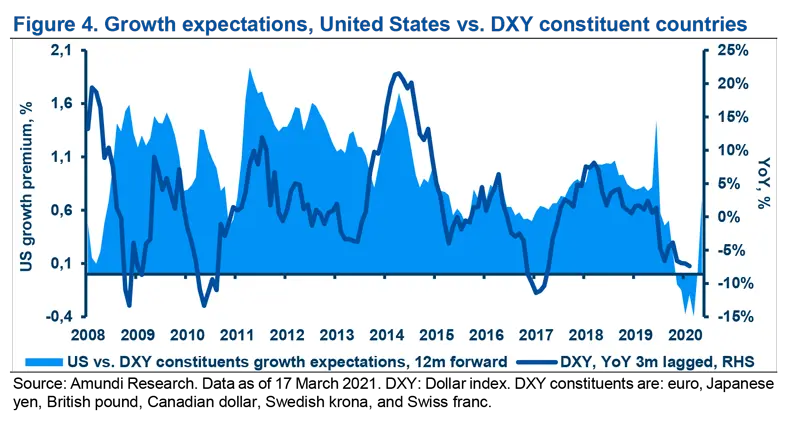

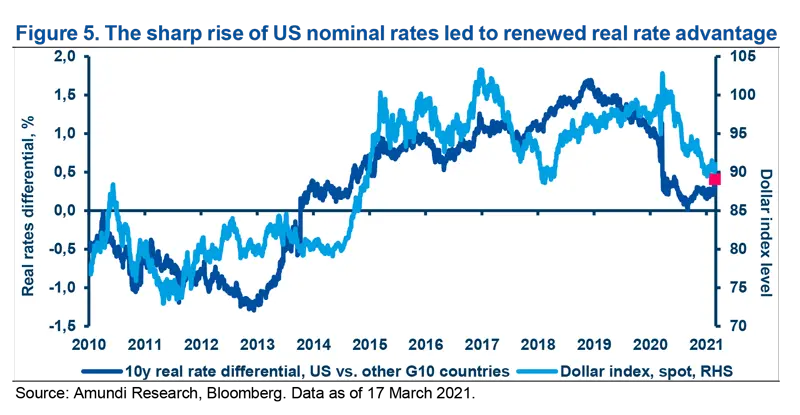

The persistent deviations of the dollar from its fundamentals recorded over the past few years may sound an alarm bell. The relative over-performance of US assets and the high hedging costs were the main reasons supporting the dollar premium against its fair valuations. In June 2020, Covid-19 shifted such balance overseas, allowing a repositioning to more underowned and dislocated assets. At that time, the dollar had lost two of its main cyclical drivers that featured in the recent past. Firstly, its growth premium compared to other G10 countries collapsed in the first half of 2020. Secondly, the Federal Reserve (Fed) removed the dollar rates advantage almost completely, which had made the greenback a profitable investment opportunity on top of being a defensive play. The Fed’s policy shift to an average inflation targeting (AIT) regime signaled in September 2020 has led to rising inflation expectations and added further pressure on real rates. This has reinforced investor confidence in a sharp and abrupt dollar sell-off.

Relative growth expectations have started to move in support of the US, which is now expected to lead the global economic recovery.

Since then, the picture has changed substantially. Unlike in June 2020, when the financial industry was fascinated by the potential structural fallout of the Next Generation EU plan for EU economies, markets have realised how strong the US economic rebound has been compared to other G10 economies. Consequently, relative growth expectations have started to move in support of the US, which is now expected to lead the global economic recovery. Our current expectations foresee US nominal GDP growth at 10% this year, well above consensus estimates.

The relative over-performance of US assets and the high hedging costs were the main reasons supporting the dollar premium against its fair valuation.

As history often repeats itself, it is interesting to draw a comparison with 2018 as current conditions are lining up to allow another dollar bull run. At that time -- and despite the dollar overvaluation being even more noticeable than today -- the dollar benefitted from what we deem the best combination of factors for any currency market:

- Fiscal loosening, enabled by the Trump administration’s tax cuts, boosted US growth and corporate margins; and

- Monetary tightening, as the Fed was normalising policy rates, added carry to US fixed income.

Both factors encouraged investor demand of dollar-denominated assets, regardless of its valuation. Today, growth is accelerating, while the Fed is highlighting its willingness to keep rates unchanged through 2023 despite upgrades to its economic outlook. It needs to persuade market participants that the monetary policy stance will stay accommodative in order to anchor market expectations. Meanwhile, the recovery should gain traction. Since Q4 2020, the Fed has welcomed the rise on the long end of the curve, both nominal and real, consistently with the progresses in economic activity and in the vaccine rollout campaign, which were difficult to imagine only a few months ago. We believe the Fed should keep a ‘wait and see’ approach, carefully managing any communication on forward guidance. However, investors should stand ready to face any communication change should data confirm what expectations are pointing to today. Market participants may test the Fed’s commitment to keep rates at historically low levels and will try to anticipate any possible rhetoric shift. As such, interest rate patterns – for both real rates and inflation breakevens – will determine dollar trends, possibly triggering dollar accumulation. Therefore, we believe it is worth taking a deep dive into the US rates framework in order to frame the dollar profile and highlight potential triggers to dollar stockpiling.

2. Dollar to remain weak against commodity-related currencies, but strengthen against low yielders

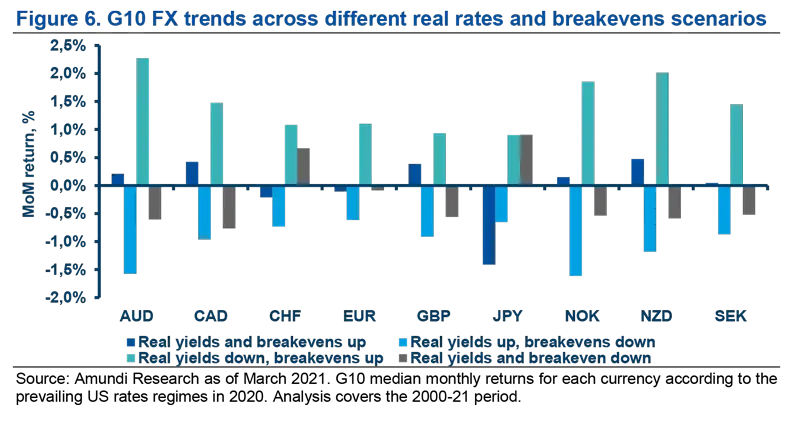

As the Fed is anchoring the short end of the yield curve, any improvement in growth and inflation dynamics should translate into higher nominal and real rates at the long end of the curve, suggesting the ‘exceptionalism’ of dollar-denominated assets is back. As such, US rates dynamics are back in the spotlight. Let us focus on US ten-year real yields and inflation breakevens. We analyse all possible US real yield and breakeven combinations and the resulting four regimes:

- Falling real yields and rising breakevens;

- Rising real yields and rising breakevens;

- Rising real yields and falling breakevens; and

- Falling real yields and falling breakevens.

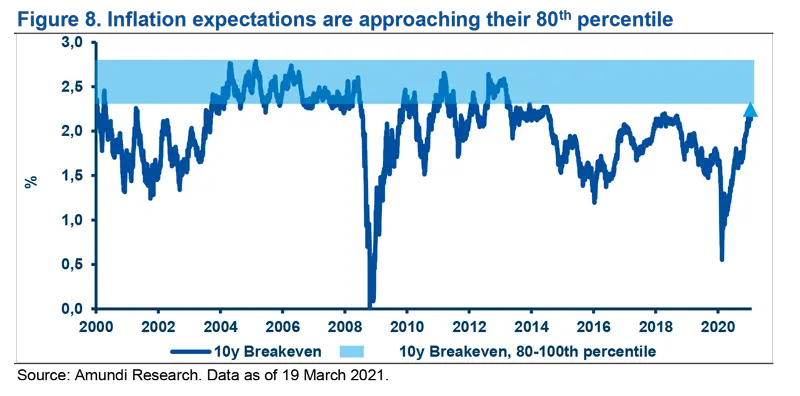

In 2020, rising US breakevens and falling US real rates caused a persistent dollar sell-off, which was consistent with historical evidence. Those conditions need to be back to restart such a depreciating trend, but we believe they are unlikely to materialise in 2021.

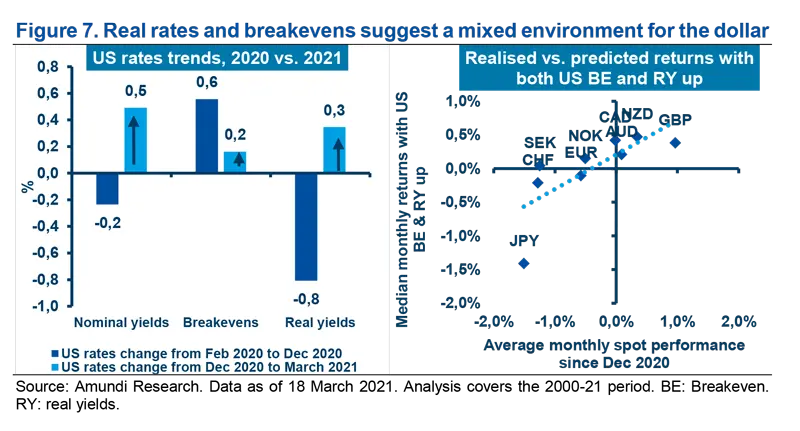

According to our analysis, the dollar tends to sell-off when real rates fall and breakevens rise (green bars on figure 6), while it shows a mixed tendency when both real rates and breakevens rise (our current base scenario, blue bars). Finally, it appreciates against the entire G10 universe when real rates rise but breakevens fall (light blue bars). In 2020, rising US breakevens and falling US real rates caused a persistent dollar sell-off, which was consistent with historical evidence. Those conditions are needed to restart such a broad-based depreciating trend, but we believe they are unlikely to materialise in 2021. Today:

- Nominal rates remain well below their pre-pandemic level and we expect them to rise.

- Inflation expectations (i.e., breakevens) have repriced significantly since May 2020; we see some consolidation risk as we approach the second half of this year.

Under such circumstances, a regime of rising breakevens and falling real rates is unlikely to be experienced again in the short term. 2020 has mostly been distinguished by rising US breakevens and falling real rates. Against such a backdrop the dollar sold-off strongly against the entire G10 spectrum. Today, to see a continuation of such a trend, we would need to be back on that regime. However, it appears unlikely, as nominal rates have further room to go and breakevens have repriced meaningfully. Looking at those periods in 2020 when breakevens were rising and real yields were falling (namely, April-August and October-December), empirical evidence confirmed our results: the dollar depreciated strongly across the entire G10 spectrum, with commodity currencies outperforming strongly.

This year, we see both breakevens and real rates rising, thanks to US growth proving stronger than anticipated and the Fed’s average inflation targeting framework. In 2021, the dollar will face a mixed and challenging environment: it will be weak against higher yielders and commodity currencies, but stronger against the lowest yielders, mainly the safe havens such as the Swiss franc and the Japanese yen.

In 2021, the dollar will face a mixed and challenging environment: it will be weak against higher yielders and commodity currencies, but stronger against the lowest yielders.

As shown in figure 7, US ten-year real yields and breakevens have started rising together since early 2021 and year-to-date monthly FX performance has been consistent with the median returns experienced when both breakevens and real yields rise. The sharp depreciation experienced by the Swiss franc and the Japanese yen is due to their high sensitivity to rising US rates.

Investment implications

The current environment is suitable for a barbell position: investors should favour commodity currencies and be cautious on low-yielder currencies. This should be maintained for as long as breakevens revert.

We are not there yet, but this is the key risk in the FX market, in our view. We expect inflation to grind higher from Q2. However, such a move is expected to be temporary on the back of the strong base effect from Q2 2020. Markets will stay focused on the Fed’s new inflation targeting framework, which should keep inflation expectations on the rise. On the other hand, the market may anticipate any consolidation in inflationary pressures.

This could be a regime where US breakevens start to stabilise or move lower, adding pressure on real rates, even with a limited increase in nominal rates as the Fed may stay active at the long end of the curve. In such an environment, the dollar should strengthen against the entire G10 FX spectrum. Indeed, the rise in real rates will no longer be seen ‘for good reasons’ that investors are willing to tolerate.

Conclusions and key risks

It is key to distinguish short- from medium-to-long-term dynamics. The huge liquidity injections -- money supply has increased by over 25% compared to its pre-pandemic level and could grow further in light of the $1.9tn stimulus package -- and the deteriorating US fiscal position are strong headwinds for the dollar. In the medium term, those factors could entail a strong dollar sell-off, as they may erode investor confidence and induce large-scale capital outflows from the US.

However, in the short term, the fiscal boost is translating into stronger US growth compared to the rest of the world, suggesting international capital flows will remain anchored to dollar-denominated assets. We expect this to offset any concern regarding US imbalances. We expect low-yielding currencies – namely the Swiss franc and the Japanese yen – to be weak against the dollar, while commodity-related currencies may outperform the dollar for the time being and reverse such a trend as soon as inflation expectations stabilise. At that point, investors should consider an increase to their dollar exposure against the entire G10 spectrum. As with every analysis, there are many potential pitfalls behind our assessment; these are the key risks:

- Possible disappointment on the US growth front, with the Fed easing policy further and US rates drifting lower;

- Other economies rebounding faster than expected and the US versus RoW GDP gap narrowing;

- Overshooting inflation expectations and real rates being lower than anticipated; and

- Any violent correction in confidence and US capital outflows.

Definitions

- Barbell: The barbell strategy is an investment concept that suggests that the best way to strike a balance between reward and risk is to invest in the two extremes of high risk and no risk assets while avoiding middle-of-the-road choices.

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- Breakeven inflation: Breakeven inflation is the difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: The carry of an asset is the return obtained from holding it.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always moves in the opposite direction) through to 0 (absolutely independent) to 1 (always moves in the same direction).

- Curve steepening: A steepening yield curve may be the result of long-term interest rates rising more than short-term interest rates or short-term rates dropping more than long-term rates.

- Default rate: The share of issuers that failed to make interest or principal payments in the prior 12 months. Default rate based on BofA indices. Universe consists of issuers in the corresponding index 12 months prior to the date of default. Indices considered for corporate market are ICE BofA.

- FX: FX markets refer to the foreign exchange markets where participants are able to buy and sell currencies.

- Spread: The difference between two prices or interest rates.

________________________________________

1 Clark P., MacDonald R., “Exchange rates and economic fundamentals: A methodological comparison of BEERs and FEERs”, IMF, 1998. Clark P., MacDonald R., “Filtering the BEER: A permanent and transitory decomposition”, IMF, 2000.