Summary

Introduction

An inopportune toxic confluence of three unrelated forces has badly undermined the finances of employer-sponsored defined benefit pension plans, in which employers bear most of the risks involved in providing decent retirement pensions to their employees.

The first is ageing demographics: ever larger cohorts of post-war Baby Boomers have entered their golden years since the start of the last decade.

The second is regulation. Across all the key pension markets, pension plans have been enjoined to prepare for their End Game: showing how they intend to meet their fast-maturing pension obligations.

The third is interest rates. These have been falling under the central bank quantitative easing programmes that followed the Global Financial Crisis of 2008. They have reduced funding ratios by inflating the present value of plan liabilities and also hit the interest income used to fund regular pay-outs.

The latest round of zero-bound rates – accompanying an unprecedented fiscal stimulus worth 25% of global GDP to fight the Covid-19 crisis in 2020 – has made a bad situation worse for most DB plans worldwide. They went into the crisis with their finances in far worse shape than they were in the 2008 crisis. Now they are caught in a Catch-22 situation: they can’t afford to take risks with persistent deficits in a maturing plan; nor can they cut deficits without doing so.

Accordingly, our 2021 annual Amundi–CREATE pension survey aims to find out how DB plans are juggling with conflicting priorities at a time when asset values are trading at nosebleed levels that are far removed from reality.

As part of their response, pension plans have been raising allocations to environmental, social and governance investing in search of decent risk-adjusted returns since the 2015 Paris Agreement. Indeed, many have also adopted net zero goals. The UN’s COP26 in 2021 may well mark another turning point.

Taking a three-year view, therefore, the survey pursued four lines of enquiry:

- Which macro shifts are likely in the post-pandemic global economy?

- How are the dynamics of the End Game being played out and what challenges are being addressed?

- Why has cash flow driven investing (CDI) dominated asset allocation?

- What outcomes have thus far been delivered by ESG investing and what are the expectations post-COP26?

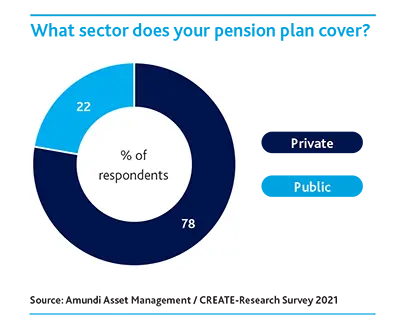

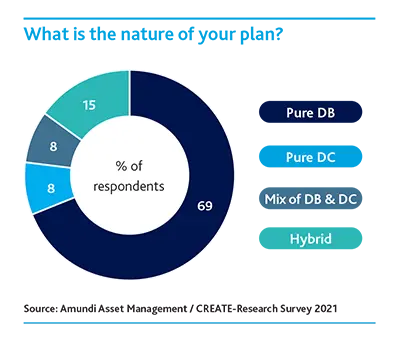

The survey involved 152 pension plans with a collective AuM of €2.1 trillion in 17 pension markets. Their background features are given in Figure 1.0. Thirty of them were also involved in structured post-survey interviews, so as to add the necessary depth, colour and nuance to the survey results.

The rest of this section presents survey highlights, our four key findings and the nine themes that underpin them.

|

|