Introduction

Covid-19 is a ‘once in a hundred years’ cataclysmic event. Superlatives that do it justice are hard to find.

The emotional, physical and economic pain it has inflicted is the worst in living memory. After the most precipitous economic destruction, it is hard to know whether the global economy will snap back to its pre-crisis path or suffer permanent scars.

Such a calamity can never truly be resolved until many of the fundamentals of our social and economic lives have been repaired. After all, history shows that humanity has always emerged from tumultuous upheavals mostly the stronger for it, but not without heavy cost. Thus, investors are left to grapple with four big unknowns: how long successive lockdowns of 2020 will last, how long national economies will take to recover, whether their productive base will emerge intact, and what the successful business models will be when the worst is over?

The pandemic has caused unusual tremors, with demand, supply and finance at their epicentre. With radical uncertainty, the normal business cycle dynamics have been sidelined. Governments and their central banks have duly embarked on a ‘whatever it takes’ wartime-type response to save lives and protect livelihoods, sparking a dramatic policy revolution in real time, reacting as specific needs have arisen. It marks the passing of an ancien régime . As history shows, such upheavals accelerate deep-rooted existing trends while also unleashing new secular forces via innovation.

Their long-term impacts on financial markets are hard to spot at the time; by their very nature, they only become evident in hindsight. Investors are thus left to decide whether the current volatility in asset prices is a buying opportunity or the halfway stage in a prolonged bear market.

Hence, our 2020 annual Amundi–CREATE survey aims to shed light on how pension plans worldwide are responding as the world economy struggles to recover from what is the economic equivalent of a massive cardiac arrest.

Taking a 3–5 year forward view, the survey aims to obtain their views on three core issues:

• what shifts are likely in the current macro financial regime in response to the unorthodox policy response?

• how will these shifts affect the way investing is done in future?

• what will be the key changes in pension plans’ asset allocation?

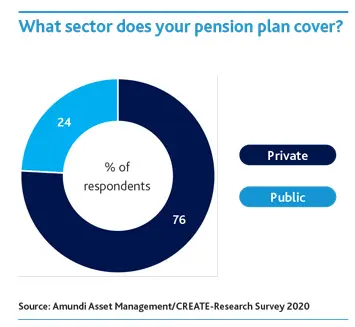

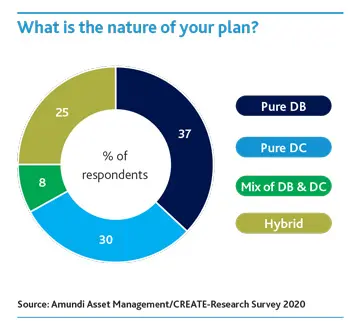

The survey is based on 158 respondents from 17 pension markets, collectively managing €1.96 trillion of assets. Their background details are given in Figure 1.0. The survey was followed up by structured interviews with 30 senior decision makers in the respondent organisations. The survey provided the breadth, the interviews the insights.

The rest of this section provides the survey highlights, their three key findings and their seven associated themes. The times they are a-changing.

The times they are a-changing.

Bod Dylan

|

|