Summary

Key takeaways

- Companies in the engagement pool demonstrated mixed awareness around biodiversity but all were very interested in having a dedicated dialogue with us on the topic, even those that were the less advanced.

- The degree of commitment to biodiversity was not necessarily linked to the magnitude of company’s exposure to natural capital. We noticed significant weaknesses in dealing with biodiversity for companies having the most direct and specific impact on nature (e.g. pharmaceutical residues in the environment).

- While some biodiversity concerns may already be incorporated into the ESG strategies of corporates, the chemicals and pharmaceuticals sectors still have a long way to go in terms of integrating these elements into a more comprehensive biodiversity strategy.

This paper is the concluding section of a thematic paper series on biodiversity, resulting from the discussions we had during meetings dedicated to biodiversity engagement with various companies in the pharmaceuticals and chemicals sectors1.

This dialogue followed a framework based on ten questions structured around:

- biodiversity strategy and governance,

- biodiversity related impacts, dependencies, risks and opportunities, and

- biodiversity metrics, targets and reporting.

Overall Observations

Companies within the chemicals and pharmaceuticals sectors may have quite different level and type of exposure to biodiversity depending on the nature of their business. Biodiversity challenges are not the same when producing medicines or industrial gas, or for a flavor and fragrance company or a plastic manufacturer. Likewise, biodiversity impacts and dependencies are more or less direct and manageable depending on the business.

Yet, the chemicals and pharmaceuticals sectors have a lot in common when it comes to biodiversity as their impacts, dependencies, risks, and opportunities are diffused across the value chain:

- Upstream through the supply chain: most drugs (by volume) are chemically synthetized, or require chemicals at some point in the production process;

- Within operations through chemical leakages or inadequate pollution control notably at the manufacturing site;

- Through product use (e.g. forever chemical leaking into nature; active pharmaceutical ingredient excretion, etc.)

- Further downstream, via poor management of products’ end of life (e.g. poor handling of final product waste, plastic pollution).

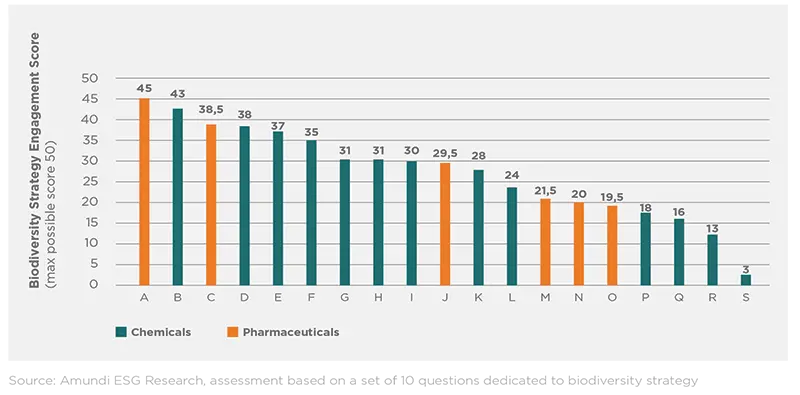

Companies in our engagement pool demonstrated mixed awareness around the topic of biodiversity (as illustrated in Figure 1). Only a few of them had actually discussed biodiversity at the top management level, or initiated any type of work to evaluate risks, impacts, dependencies and opportunities. All companies in our sample were nevertheless interested in discussing biodiversity with us. Even the companies less advanced on the topic were keen to engage dialogue and learn about biodiversity. Corporates were notably interested in better understanding our investor needs and how we consider they could deal with the issue and better address biodiversity loss.

Figure 1: Biodiversity Strategy Engagement Score

Interestingly, the degree of commitment to biodiversity was not necessarily linked to the magnitude of company’s exposure to natural capital. Some companies had very limited biodiversity strategies relative to their highly negative impact on nature. Conversely, a couple of companies with only limited direct impact on natural capital had embedded biodiversity as a core feature of their ESG strategy and were devoting significant resources to initiatives and research on the topic. For instance, it is on the issue where the pharmaceuticals industry has the most direct and specific connection to biodiversity, i.e. on pharmaceutical residues in the environment, that we found the most weakness in dealing with biodiversity.

A majority of companies admitted they were struggling against the challenge biodiversity represents due to the complexity in understanding all facets of biodiversity, and the lack of tools and resources dedicated to assessing their connection to nature. Some companies did not even understand how they could directly be exposed to biodiversity. In addition to this lack of expertize, companies were also citing insufficient bandwidth and biodiversity not being identified as a top priority as justifications for their lack of commitment to biodiversity.

All companies were nevertheless tackling adjacent topics without necessarily making the link to biodiversity. A good illustration of a biodiversity loss driver addressed by companies is climate change, to which several companies admitted they were dedicating a majority of their sustainability resources. We cannot agree more on the importance of climate change, but its strong relation to biodiversity should not be ignored.

Biodiversity strategy and governance

We discussed biodiversity strategy and governance with companies, notably with the aim to better assess to what extent biodiversity is a specific subject at the board level, as well as the degree to which the company has formalized its biodiversity strategy. We noticed that while biodiversity topics were expected to be increasingly present at the board’s agenda, the discussion remained largely focused on climate change. We noticed significant efforts on biodiversity-related topics but rarely on an overarching strategy.

- Chemicals: With the exception of one company at the early stage of its sustainability journey, the companies we met had launched initiatives aiming at limiting their negative impacts on biodiversity. These initiatives were nevertheless often swamped in numerous sustainability projects with various purposes, or implemented through environmental management systems. The companies had rarely developed an overarching biodiversity strategy but were focusing on partial drivers of biodiversity loss, specific activities or business units, or locations. For example, they may have dedicated significant resources to addressing deforestation caused by palm oil, even though this issue represented limited impact at company level compared to other significant drivers of land use change caused by the company. Only very few companies formalized a biodiversity dedicated policy and committed to specific targets such as enhancing biodiversity on a specific area, improving soil health or being land or nature positive by 2030 for example.

- Pharmaceuticals: Two companies within our sample demonstrated best practice by approaching biodiversity holistically. Despite having relatively low direct exposure to biodiversity, they consider they cannot fulfill their core mission of contributing to the world’s population good health without addressing biodiversity, as they see the link between a healthy and biodiverse environment and good human health. They also both perceived the social dimension of biodiversity as certain indigenous population cannot survive without the rich biodiversity surrounding them. The most advanced of these two companies had developed several targets around biodiversity and set an ambitious goal to become net positive on nature by 2030. A third company in our panel was also developing specific initiatives around biodiversity but focusing essentially on its non-pharmaceuticals business with strong exposure to biodiversity. Its efforts towards biodiversity were neither holistic nor sufficient with regard to the potential harm it may cause. The other companies we engaged with did not discuss biodiversity at board level, only address adjacent environmental topics, primarily climate, or were taking environmental initiatives, which they did not directly connect to biodiversity.

We cannot discount the efforts most companies were making on topics related to biodiversity such as climate, water, waste management and pollution. These are valid efforts but we encouraged companies to connect these efforts to an overarching biodiversity strategy, such as only a few companies we engaged with were able to do.

Biodiversity related impacts, dependencies, risks and opportunities

We asked companies about the extent to which they identify and manage impacts, dependencies, risks, and opportunities linked to biodiversity. We noticed that biodiversity risk management was still a field to be developed for most companies.

The most advanced companies considered their impacts and tried to assess their dependencies on biodiversity, notably through their supply chain. For instance, one company calculated the land used for corn or palm. It also mentioned different indicators it could use, such as an ecosystem vitality index, biodiversity and habitat index or species protection index. The same company also cited several risks related to biodiversity loss: loss of capital attractiveness and higher capital cost since investors are more concerned with biodiversity issues, penalties or increasing cost to comply with the regulation, the potential disruption of its raw material supply chain, and the loss of market share due to customers growing concerns about products harming nature.

Aside from a few instances, companies in our panel did not evaluate impact and dependencies, nor risk and opportunities, related to biodiversity. However, most of them were conducting assessment on adjacent topics, such as climate change, and some were taking some initiatives to reduce their negative impacts.

Table 1: Examples of impacts, dependencies, risks and opportunities provided by companies during our engagements

Climate change:

- GHG intensive production processes or gas release in the atmosphere.

Pollution:

Air, soil and water pollution throughout the value chain:

- Raw material sourcing,

- Production (such as air and water pollution from chemical plants),

- Products use (like eco-toxic product release such as from pesticides spreading or fertilizer runoff),

- End of Life (such as physical pollution from plastic through packaging notably or due to the poor disposal of chemical based drugs - i.e. flushing them down the toilet - or drugs that do not fully degrade in the body and that end up in water and soil). Land and Habitat degradation:

- Large footprint of chemical sites,

- Eutrophication of area from pollution.

Resource consumption:

- Water intensive production,

- Overexploitation of bio based materials.

Provisioning services:

Many production processes are water intensive and largely depend on water provision. Companies are also dependent on various provisioning services such as raw materials from Nature (wood pulp for packaging, palm oil, sugar to produce ethanol, plants for active ingredients). While active ingredients from nature are now often chemically synthesized, and that amounts used are relatively small for pharmaceuticals, it may differ for chemicals such as for plant-based materials for flavor and fragrance for instance.

Regulating services:

Several chemical companies are directly or indirectly dependent on regulating services such as soil fertility or pollination.

Physical risks:

Changes in weather patterns leading to watershed degradation and water scarcity. Disruption of the raw material sourcing.

Transition risks:

- Regulation and litigations: Regulatory pressure to decarbonize. Emerging regulation on biodiversity. While patient health and safety always comes first, drug approval processes are increasingly demanding regarding the environmental impact assessment of drugs post use.

- Sales/market: Customers and investors are paying more attention to the impact of nature and biodiversity.

- Reputation: Growing public awareness on the impacts of specific products on environment (such as impacts to pollinators, of plastic pollution, forever chemicals, etc.).

Bio based chemicals can enable companies to explore more sustainable practices and provide clients with eco-friendly alternatives including bio based agri-products or recycled products.

Opportunities to offer alternatives to animal proteins.

Green chemistry helps reducing waste, toxicity, and pollution across the value chain. It can also be cost efficient by optimizing resources consumption

(such as with chemical recycling).

Commercial opportunities outside of pharma business companies: including greener and safer agricultural products, specialty chemicals for active ingredients (like sunscreen that minimize harm to corals), proteins for biosynthetic meat.

Overall, we noticed that most companies were managing biodiversity-related topics without realizing it and without connecting the dots holistically to biodiversity. Examples of assessment and management included:

- Measuring and managing carbon emission and setting target to reduce them, including encouraging their suppliers to adopt the same strategy.

- Making inventories of raw material supplies and assessing their dependency on nature. Some companies mentioned palm oil being used in tiny quantities and ethanol, with possibilities for alternative sources.

- Measuring the local footprint of their plants and buildings, and protecting their local environment notably when its biodiversity is more fragile.

- Measuring and controlling pollution risks at the production site (water discharge), including at their supplier’s level.

- Conducting life cycle analysis of their key products.

- Monitoring and managing packaging, with initiatives to reduce the use of virgin plastic and packaging size. Yet, several companies mentioned that packaging represented a tiny part of their operations.

- Looking for greener production processes (adoption of “green chemical principles” in drug synthesis) or greener alternative to their products (e.g. microbial pesticides instead of agro-chemical products).

- Attempting to control the risk of pollution from product use and disposal (e.g. drugs, fertilizers, pesticides). This encompasses several initiatives, including: collaborative work, education on how to properly dispose unused drugs, R&D on drug degradation in the body and the impact of excreted residue on nature, developing alternative to current products with a safer impact on the environment, etc.

- Managing forestry projects or other nature-related projects (such as watersheds) in order to both account these projects as carbon offsets, but also as part as what they considered being their ultimate goal to protect nature and the local populations that depend on this nature to survive. Companies specifically mentioned afforestation projects with careful reintroduction of local species in partnership with local people who depend on local biodiversity. Some of these companies also are signatories of the LEAF (Lowering Emissions by Accelerating Forest finance) Coalition, which aims at halting deforestation by financing large-scale tropical forest protection.

Biodiversity metrics, targets and reporting

This part of the dialogue we had with companies focused on how they were measuring and assessing biodiversity, how they were measuring their performance and the metrics they might use for targets and reporting as well as the extent to which they were working collectively to address related difficulties.

Some of the interviewed companies mentioned were using the IBAT tool (Integrated Biodiversity Assessment Tool) to get a sense of where they were, to better understand where they operated, notably if they operated in or near protected areas, in high-risk sites. Several companies told us they were monitoring if their production sites were located in or near protected areas, mapping their sites with IUCN (International Union for Conservation of Nature) or the Ramsar conservation areas. This is something they have to do when responding to the GRI biodiversity dedicated indicator (GRI 304), for instance. Some companies used UN World Heritage Sites (WHS) list to map their operations with protected areas and areas of high biodiversity value, with some of them following the GRI 304 indicator and providing related disclosure. Some companies were also developing more innovative options, based on blockchain for instance, to improve the traceability of raw materials and offering sourcing analysis. We lastly discussed with companies part of the TNFD consultation, or following associated developments closely, or considering setting science based targets for nature.

Table 2: Noteworthy collaborative initiatives and tools cited by companies during our interviews

Built on the momentum of the Science Based Targets initiative, SBTN’s purpose is to responds to the demand for more methods, guidance and tools to set science-based targets for the whole Earth system.

The Taskforce on Nature-related Financial Disclosures (TNFD) has developed a set of disclosure recommendations and guidance for organizations to report and act on evolving nature-related dependencies, impacts, risks and opportunities.

The Rainforest Alliance is an international non-profit organization working at the intersection of business, agriculture, and forests to make responsible business the new normal. We are building an alliance to protect forests, improve the livelihoods of farmers and forest communities, promote their human rights, and help them mitigate and adapt to the climate crisis.

The LEAF Coalition is a public private partnership bringing together forest governments, the private sector, donor governments, Indigenous Peoples and local communities and civil society. It aims to raise and deploy the finance needed to tackle tropical deforestation.

GPBB is a network of multiple national and regional initiatives, all working towards greater business engagement on biodiversity-related issues. It aims at linking these various initiatives so that they can share information and good practices, and cooperate on common projects with a view to mainstreaming biodiversity concerns into businesses. The Global Partnership gets also involved in select COP mandated projects.

The PSCI brings together more than 70 biopharmaceutical companies to define, establish, and promote responsible supply chain practices, human rights, environmental sustainability, and responsible business for the whole of the global pharmaceutical and healthcare supply chain.

The SVI is an industry membership forum for companies committed to work on sustainable production in the vanilla industry. It aims to promote the long-term stable supply of high quality, natural vanilla, produced in a socially, environmentally and economically sustainable way, benefitting all partners along the value chain.

OP2B is an international cross-sectorial, action-oriented business coalition on biodiversity with a specific focus on agriculture. Its actions are focused around three pillars: scaling up regenerative agricultural practices; boosting cultivated biodiversity and diets through product portfolios; and eliminating deforestation / enhancing the management, restoration and protection high-value natural ecosystems.

UNEP-WCMC specializes in collaborating with partners to apply the best-available knowledge, data, and digital innovations for effective policy and practice across public and private sectors for the benefit of people and nature. Its team consists of around 200 experts. From nature scientists, economists and ecological modelers, to policy analysts and business sustainability professionals. Their focus is on delivering positive outcome for nature through global partnerships with leaders form various sectors, including business, government, non-governmental organizations, and research bodies, with the aim of strengthening the protection, restoration, and sustainable use of nature on a global scale.

ENCORE is a free, online tool that helps organizations explore their exposure to nature-related risk and take the first steps to understand their dependencies and impacts on nature. The ENCORE tool is maintained and continuously improved by Global Canopy, UNEP FI, and UNEP-WCMC.

IBAT is a subscription-based service providing biodiversity data in an integrated fashion, helping users to assess biodiversity related risk. In particular, IBAT updates and maintains three of the world’s most authoritative global datasets: the World Database on Protected Areas, the World Database of Key Biodiversity Areas, and the IUCN Red List of Threatened Species. IBAT was developed and is maintained by the IBAT Alliance: Birdlife International, Conservation International, IUCN and UN Environment World Conservation Monitoring Centre.

Case Study 1: in the Chemicals sector

Q: What was one company in your engagement study that you want to highlight? What are they doing on biodiversity currently?

A: We had constructive discussions with Croda that showed, like many others, a great willingness to dialogue on biodiversity topics. We particularly appreciate the company’s target to be Land Positive by 2030, and that the topic is overseen by the Executive Committee. We also like Croda’s science-based approach, its efforts to assess its footprint and notably on biodiversity, as well as the company’s comfort to present the limits of its work.

Q: What was particularly interesting about Croda?

A: While the target is to be land positive in almost ten years, when starting to measure its land footprint, the company noticed that it is almost already land positive in fact. Croda indeed considers its products, downstream, help saving land and that most of its impact results from its Scope 3 upstream. As an asset light company the company’s operations impacts are minimal compared to the supply chain.

Q: Any recommendations for improved practices?

A: We emphasized the company of our awareness of the complexity of biodiversity and encouraged Croda to continue working on this issue with a "best effort" approach. The company’s representatives lastly mentioned the two key areas they are working on in order to address the best they can: biodiversity and nature, as well as social and inequality issues. We encouraged Croda to foster effort on these two areas, which are of focus for Amundi also. This case study was based on our 2021 engagement, Croda nevertheless announced in 2022 its aspiration to become Nature Positive by 2030. In addition to its Land Positive Commitment, the company works to be Net Nature Positive through an increased focus on preserving and restoring natural ecosystems in its supply chains, minimizing the water impact of its operations and helping accelerate sustainable and regenerative agriculture.

Case Study 2: in the Pharmaceuticals sector

Q: What was one company in your engagement study that you want to highlight? What are they doing on biodiversity currently?

A: GSK stood out as having the most advanced and articulated approach to biodiversity. They address biodiversity holistically across all businesses and from the top as well as from the bottom. They adhere to growing scientific evidence that climate change and biodiversity degradation are interconnected and both affect human health; therefore as a company with a core mission to protect and improve people’s health, they also have to protect and restore the planet’s health (i.e. biodiversity).

Q: What was particularly interesting about GSK?

A: GSK set a goal to have a net positive impact on nature by 2030, which is unique in the pharmaceutical industry and quite unusual across any sector. This looks very ambitious and possibly aspirational for the time being. However, this has the merit to set the group into action, force them into taking initiatives, testing new approaches, and seriously looking at biodiversity from all angles: impact, opportunities, dependency and risks. In addition, to make this aspirational goal more concrete, they have subdivided their biodiversity approach into sub-targets (such as deforestation-free sourcing, zero operational waste, elimination of single-use plastic, or reduction in the impact of packaging). Their commitment to biodiversity also comes through participating in initiatives aiming at developing standard guidance on impact measurement (SBTN, UNEP-WCMC) and risk management and financial disclosure (TNFD).

Q: Any recommendations for improved practices?

A: We would recommend GSK to better communicate on its initial assessment of impact and dependency. We also recommend a stronger focus (including reporting and setting targets) on its management of pharmaceutical ingredient in the environment (PIE), which the primary specific impact the pharmaceutical industry has on biodiversity. Lastly, GSK could elaborate more on the competitive advantage it will gain by leading in the management of biodiversity.

Table 3: Recommendations and best practices

Strategy and governance

Have a biodiversity dedicated strategy, with overarching and specific targets

Connect the dot between adjacent topics and include them in the biodiversity strategy

Oversee biodiversity at board level

Commit to biodiversity protection dedicated statements

Biodiversity (incl. protection and restoration) as a core part of the ESG strategy

Aspirational ambition to be nature positive by 2030 by taking into account the main adjacent topics

Impact, dependencies, risks, and opportunities

Assess and systematically analyze the impact on nature of the company’s activities across the whole value chain, including supply, own operation, and downstream up to product use and end of life

Develop biodiversity information systems and monitor footprint measurement through increased traceability tools Increase the focus on the assessment and management of industry-specific indirect impacts (such as pollution from forever chemicals or active chemical & pharmaceutical ingredients)

Develop supply chain mapping tools to ensure traceability (and allow targets setting such as for supply chain certification)

Develop and switch to eco-friendly products and solutions

Collaborate with third parties (NGOs, academic research, industry peers) to develop best practices, and with local stakeholders to facilitate integration of local specificities

Encourage public-private partnerships in managing specific impacts (such as active pharmaceutical ingredients or forever chemicals)

Monitoring of production sites located in or near protected areas using mapping sites such as IUCN Key Biodiversity Areas or the UNESCO World Heritage sites Land footprint measurement detailed per purchased commodity

Collaboration with academic research to develop company-specific biodiversity assessment tools

Assessment of interactions with biodiversity in the supply chain (e.g. sourcing analysis and mapping of raw materials)

Pollution risk management throughout the supply chain

Eco-design of products (by adopting green chemical principles) and processes (circularity)

Natural site management including afforestation in partnership with local population

Assessment of biodiversity dependencies such as ecosystem services and notably through the supply chain (supported here also by traceability capacities to map sourcing)

Systematic analysis of natural resources being used upstream directly or indirectly.

Measurement is done in volume of commodity (or processed commodity) used.

Assessment of potential risk of water scarcity at local manufacturing site

Partnership with local NGOs and farmers

Metrics, targets and reporting

Provide detailed reporting information through a dedicated framework

Disclose the identified direct and indirect business impact and dependencies on biodiversity and related services

Develop KPIs allowing the monitoring of biodiversity loss drivers and set related targets

Participate in industry initiatives aiming at harmonizing reporting frameworks

Set overarching targets encompassing adjacent topics

Using IBAT to provide the share of production sites located in or near biodiversity sensitive areas (mapping their sites with WHS, IUCN or Ramsar conservation areas), such as to fill in GRI 304

Disclosure of the share of certified sustainable sourcing according to recognized labels such as RSPO (Roundtable on Sustainable Palm Oil), ASD (Action for Sustainable Derivatives), FSC (Forest Stewardship Council) or PEFC (Programme for the

Endorsement of Forest Certification)

Active participation in TNFD development

Target to be nature positive by 2030

Conclusion

The chemicals and pharmaceuticals sectors have a wide range of impacts disseminated across the value chain as well as varying biodiversity impacts, dependencies, risks and opportunities, likewise the wide range of products and services they offer. At the same time, the companies we engaged with demonstrated mixed results on their consideration of biodiversity.

As illustrated by the high variability of results, we noticed strong heterogeneity between companies in terms of awareness and management of biodiversity. Companies were often tackling biodiversity related topics but without connecting the dots to biodiversity in order to form an articulated strategy. While they may incorporate some biodiversity concerns into their ESG strategies, there remains a long way to go for companies to integrate these elements into a more comprehensive biodiversity strategy.

The responses to our engagement were nevertheless very positive, with most companies willing to better assess and manage biodiversity issues, as well as better understand investors’ expectations. As the topic continues to grow in awareness, we can hope to see great momentum on action.

Sources:

1 This report was written based on engagements that took place in 2021 and 2022.