Summary

The Role of Investors

In order to better integrate biodiversity considerations into portfolio construction, first there is a need to better understand how companies impact and depend on biodiversity. Companies must provide dedicated information in order for investors to better consider biodiversity related risks and opportunities in their investment decisions. Biodiversity disclosure will help drive capital allocation from biodiversity harming activities to those limiting negative impacts or even providing solutions. It will also contribute to the assessment of physical and transition risks in investment portfolios.

While biodiversity is quite possibly one of the most complex ESG subjects in existence, it underpins the entire environmental pillar and has strong connections to the social pillar. Key biodiversity linked elements such as climate, water, pollution, and resource use need to be properly accounted for as a foundational element of corporate environmental strategy.

There are significant hurdles to effectively account for biodiversity such as challenges around data measurement and a lack of clear standards and guidelines for reporting. However, this complexity is not an excuse for inaction.

Work on the topic is moving fast and there are many steps companies can take to prepare for new developments and guidelines.

| Finance for Biodiversity Pledge: an unprecedented coalition aimed at reverse nature loss in this decade |

|---|

|

As a financial institution, Amundi recognizes the need to protect biodiversity and reverse nature loss in this decade. As such, in 2021 Amundi joined the Finance for Biodiversity Pledge, a unprecedented coalition of 103 signatories representing over €14.7 trillion in AUM across 19 countries. The pledge is a commitment of financial institutions to protect and restore biodiversity through their finance activities and investments. |

The Role of Engagement

Engagement is a common tool that investors use to push companies to adopt better practices.

It may include encouraging standardised and transparent reporting on material ESG topics. However, for emerging topics (such as biodiversity), awareness of best practice is often limited. Engagement for these emerging themes also has a unique value in that it provides investors with a bird’s eye perspective on what are current best practices. It also provides guidance on what will be the future best practice.

Thus, engagement on emerging topics has two key aims: first, to raise awareness of these topics, which may be insufficiently addressed or understood; second, to disseminate awareness (and expectations of) best practice. This provides companies with concrete feedback and hopefully boosts momentum of action.

Amundi Launched a Major Engagement on Biodiversity in 2021

As part of our contribution to the need to act, Amundi launched in 2021 a formal engagement around biodiversity. Overall, companies demonstrate relatively limited awareness or still insufficient management action, for those already addressing the topic. For this reason, we call this topic an “Emerging Thematic” meaning the aim of year 1 for this engagement was to simply establish a baseline for current practices, while identifying existing and emerging best practices.

An Engagement with 56 Companies, Across 8 Sectors and 18 Countries

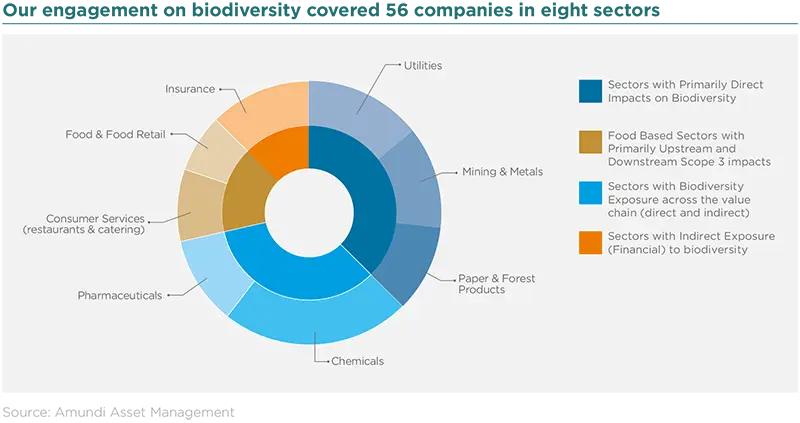

Amundi reached out to over 67 companies and conducted 56 engagement calls on biodiversity. Our Engagement covered 8 different sectors. We organized these sectors into four categories:

Areas of Focus for Amundi’s Biodiversity Engagement

We assessed companies’ current management of biodiversity and assigned them a score based on the following three categories:

- Strategy from the top: extent to which biodiversity is a specific subject at the board level and degree to which the company has formalized its biodiversity strategy

- Identification and management of biodiversity linked exposure: extent to which the company has identified, and is managing biodiversity linked impacts, risks, dependencies and opportunities

- Metrics, Targets, and Reporting: how a company is currently measuring and assessing biodiversity risks and impacts and the extent to which the company is working collectively to address reporting difficulties

For more information on our methodology, including the engagement questions, please see appendix 1 in the PDF version.

Overview of Engagement – Quantitative results

Overall scores by sector are summarized in the graphic below2.

Our key takeaways from the Quantitative Results

– Within most sectors, we observed a high variability in performance reflecting strong heterogeneity between companies in terms of awareness and management of biodiversity.

– Comparing performance between “macro-sectors” provides limited insight, as these macro-sectors are not comparable in terms of their exposure to biodiversity (both how the sectors impact and depend on biodiversity).

- The food sector also had somewhat high average scores, demonstrating some efforts to address biodiversity, but - considering the severity of the risk linked to food - much more work is needed.

- Sectors with direct exposure to biodiversity (mining, utilities, and forestry) overall presented the highest average score, meaning most companies have already made substantial efforts to address the topic, though there remains room for improvement.

- In sectors with relatively low, varying, or uncertain exposure to biodiversity, such as pharmaceuticals, some companies are actively working on the subject as expressed by their very high score. In pharmaceuticals, the leaders make a connection between strong natural capital and good human health. In the insurance sector, the leading companies already anticipate the potential significant financial risks associated with biodiversity loss.

Key conclusions from our engagement campaign

Based on the results of each sector, we collected some general conclusions on the engagement overall.

Investor engagement and dialogue with corporates on biodiversity still quite new

Many companies in this study mentioned that we were the first investor wanting to discuss the topic with them. This is understandable considering the recent awareness around the issue and complexity of the topic. This also demonstrates the real need for investors to begin engaging in more depth and at a greater scale. With investor groups such as the Finance for Biodiversity Pledge as well as emerging regulation, investor interest is likely to increase significantly.

Significant efforts on biodiversity linked topics, but limited ability to connect them to an overarching strategy

While biodiversity as a holistic topic is still quite new, we cannot discount the efforts most companies were making on adjacent topics such as climate (all sectors) and (depending on sectors) pollution, water, plastic, packaging, food waste, or deforestation. These are all valid efforts to address the issue, but we encourage companies to connect these efforts to a centralized biodiversity strategy. Indeed, only a handful of companies in our sample were able to do so. This will better enable companies to understand how they both impact and rely on biodiversity. Furthermore, it will them identify any major gaps within their current programs and policies.

Assessment of exposure is a challenge and a roadblock to insightful reporting

Most companies were saying that they were struggling to properly assess exposure across all dimensions (beyond climate and water). It is true that exposure is ultimately unique to a business and its particular operations, but there are already available tools (for instance ENCORE) that can help guide companies towards priority areas. Effectively measuring impact can appear to be an insurmountable task, but many companies are beginning to develop tailor-made solutions to face these challenges head on. Thus, we encourage companies to not be afraid to work collectively and test new solutions, making improvements along the way.

Is 2030 the new 2050?

We observed a lot of language about being “biodiversity positive” or having “net zero biodiversity loss” by 2030. This timeline is linked to the Convention on Biological Diversity’s Global Biodiversity Framework announced in 20213. For now, these ambitions appear more aspirational than truly tangible and quantifiable. For example, how can a company be net zero on Biodiversity loss by 2030 and only net zero on carbon emissions by 2050? Also, how do you accurately measure this? Regardless of these valid questions, we support the 2030 ambitions because they represent a major step in the right direction to develop appropriate companywide strategies and targets. However, we recommend both a top down ambition to help mobilize resources and priorities across the whole company, as well as bottom up priorities and targets that adequately address specific areas of operation.

Collectively progressing to address biodiversity loss

There are clearly major gaps to address biodiversity loss. These gaps include understanding limits to data availability and a lack of standards in measurement techniques. However, there are a wide variety of initiatives working to address these issues, including TNFD4 and SBTN5 among others. While many companies were aware of them, companies with stronger scores were more actively involved in pilot projects and working groups to help collaboratively develop much needed guidelines and resources. Biodiversity cannot be solved by one company alone. We encourage companies to not just passively follow, but become actively involved with these collaborative initiatives to not only contribute to but also stay on top of new developments.

Companies hide behind the complexity of the topic, but there is work to be done now!

Many companies were hiding behind the complexity of the topic to justify limited assessment and reporting on biodiversity.

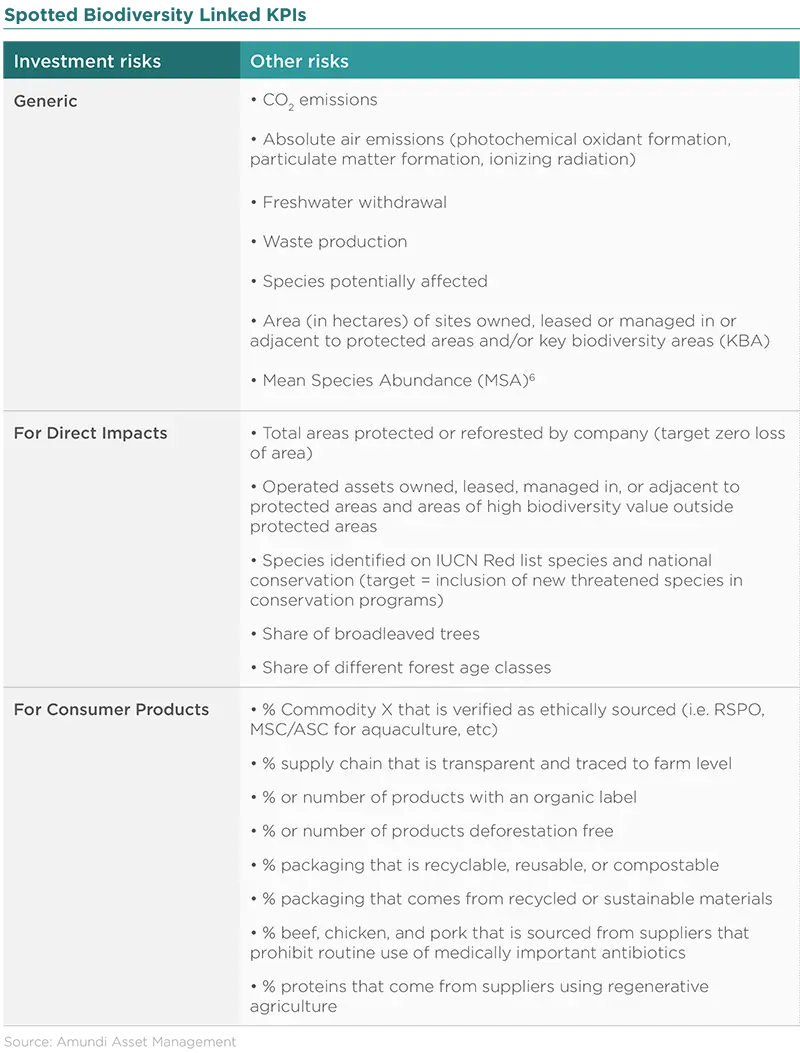

Admittedly, we are never likely to find a perfect, all-encompassing KPI to assess biodiversity effectively. This does not mean companies should shy away from trying and reporting more transparently on their processes while collaborating with peers to find feasible solutions both in the short and long term. We encourage companies to become more transparent about how they assess their impacts at an operational and commodity specific level and identify common areas that can support an overarching strategy. We also encourage companies to actively experiment with existing assessment tools such as IBAT (Integrated Biodiversity Assessment Tool) and ENCORE (a broad sector mapping of impacts and dependencies) and work with peers to test out new ideas and solutions.

Are Companies Ready to Start Measuring and Reporting on Biodiversity in all Dimensions?

Even with the onset of regulation and reporting standards, companies are still in the early stages of even identifying their own unique link to nature in terms of risks, impacts, dependencies, and opportunities. Our key observations broadly across all sector were as follows.

Dependencies

Understanding how a company depends on nature (and the associated risks to the business) was more nascent. Some companies have begun to articulate these elements of biodiversity but only a select few in any formal manner. For dependencies, material benefits that are outputs from nature (such as fresh water, fruits, seafood, or timber) are a bit more obvious, but little was formally done regarding the ecosystem services that enable nature to produce these outputs in sufficient quantities. Only a small handful of companies had any specific reporting on the ecosystem services essential for business continuity.

| Amundi’s Key Recommendations for Companies Overall |

|---|

|

Below is a summary of our key recommendations that can be applied to practically all companies and sectors. Find inspiration in best-practices and even go beyond

|

Summaries and Conclusions at a Macro Sector Level

Sectors with Primarily Direct Impacts on Biodiversity

Utilities, mining & metals, and paper & forest products were sectors with primarily direct impacts as the majority of their operations happen on owned or directly managed assets.

Overall these sectors showed a strong understanding of the complexities of biodiversity and were well on their way to figuring out how to measure their impact through available tools, dedicated teams, collaborative groups, partnerships with universities, as well as other third parties including NGOs. For these sectors, there is a strong link between biodiversity and short term financial materiality. The business models have a clear impact on the local environment and surrounding communities. Thus, business operations would not be able to continue if they did not address their impacts to local biodiversity.

Overall, biodiversity is discussed at the board level for these three sectors, but is largely assimilated into adjacent environmental topics or the sustainability strategy overall. Companies demonstrating the strongest performance indicated that biodiversity was a specific topic with board oversight on progress towards biodiversity linked KPIs. Overall however, what remained lacking was the need for a specific biodiversity strategy that addressed the linkages to other key environmental topics that can drive biodiversity loss (i.e. pollution, climate change, habitat destruction, consumption of natural resources, etc).

A majority of the companies had some sort of qualified ambition to have “Net Zero Biodiversity Loss” or to be “Nature Positive”. Some companies even set time bound 2030 commitments to protect biodiversity (in line with the Convention of Biological Diversity’s first draft of the new Global Biodiversity Framework). While understandably it still remains unclear on how these companies will measure and report on these ambitions, we support it as a first step and hope to see greater granularity as data measurement improves.

These sectors have a strong understanding of their impacts, but reporting around biodiversity related risks, dependencies, and opportunities is a little more nascent. Often risks/opportunities are described as in the risks to nature or “opportunities to protect nature loss”, but the business angle on how inaction on biodiversity could impact the company was overall quite lacking.

All of these sectors are similar in that they have a relatively clear idea of where in the world their operations primarily impact biodiversity. Where those similarities stop is regarding the current type of reporting to measure impact and progress towards biodiversity goals. This is understandable considering the vast nature of the topic and the fact that for biodiversity there is no one easy indicator like CO2 for climate. Despite this, it is clear there is a long way to go to develop commonly held metrics both within sectors and between sectors. GRI 304 on biodiversity does provide a basic level of guidance, but we encourage companies to work together within their sectors to develop a list of relevant metrics that are comparable and understood.

Food Based Sectors with both Upstream and Downstream Exposure

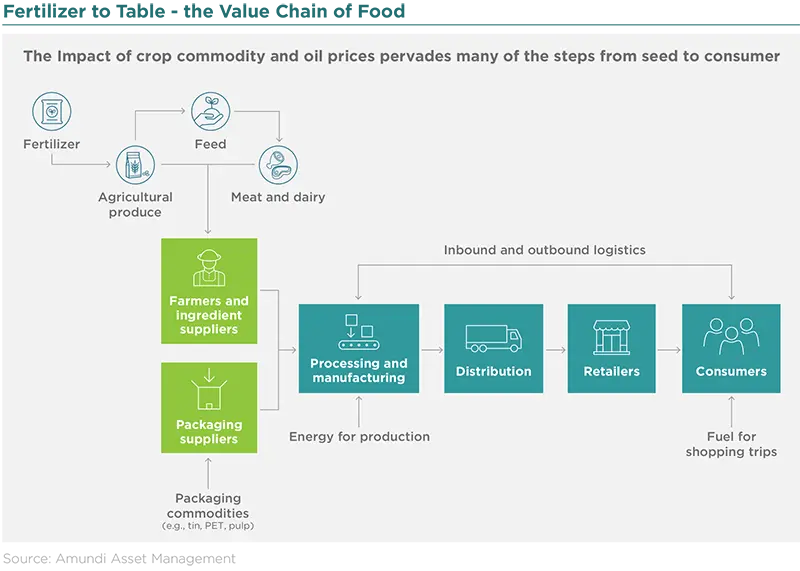

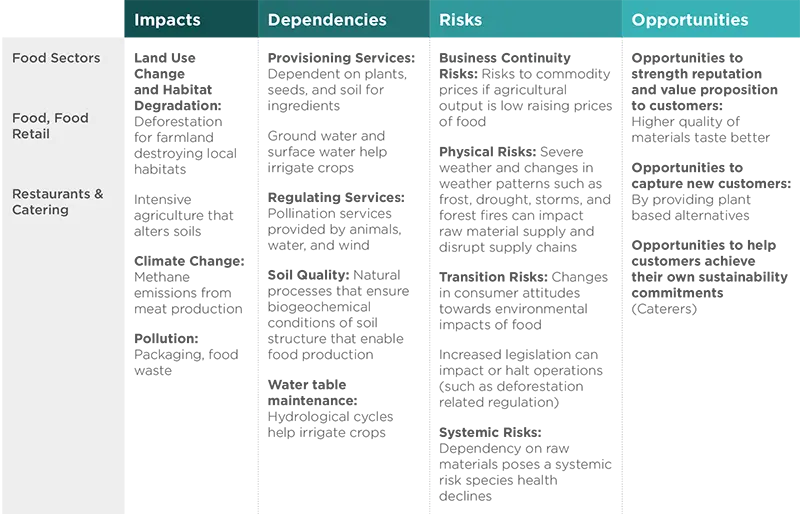

The global food sector is frequently cited as the sector primarily driving biodiversity loss globally7. While the sector heavily exacerbates biodiversity loss,8 it is also heavily dependent on biodiversity and faces significant associated risks. In the food sector, the impacts to biodiversity are often indirect, primarily through the sourcing of raw materials, making the topic difficult to manage and measure in part due to the sheer scale of global supply chains.

Overall, most companies in our study were in the early days of addressing the topic of biodiversity as a specific strategic topic, with some companies having almost no awareness of the subject altogether. However, they did demonstrate some awareness and action through commodity specific strategies (i.e. coffee, cattle, palm oil, etc.) or specific impact drivers (such as deforestation, climate change, and packaging). Consequently, biodiversity at the board level is often addressed through these other issues, but not as specific strategic topic that requires board oversight. The one exception was for European companies who performed better likely due to existing pressure from French Regulation (see appendix 3 in the PDF version for more details).

Commodity or activity focused efforts are a great start, but they can leave gaps in their strategies. Mapping supply chains and addressing biodiversity impacts is arguably a huge undertaking for a single commodity, let alone an entire menu of ingredients; however, inaction on other commodities remains a major risk for companies.

On opportunities, companies within the food sector need to more clearly evaluate the business opportunities associated with addressing biodiversity loss. While there will be costs to address the impacts of global food supply chains, there are also business opportunities in the transition. There is a growing consumer focus on the environmental impacts of food (such as demands for organic products and plant based alternatives). It is estimated that the market for plant based foods could be worth more than $162 billion by 2030, making up over 7% of the total global protein market. If food companies better develop their biodiversity strategies, they may be able to react more quickly to growing consumer interest around environmental preservation and animal protein alternatives.

As a guideline for companies, using information from our engagement dialogue and the ENCORE tool, we compiled a list of impacts, dependencies, risks, opportunities for each sector. Table meant for illustrative purposes only, specific items can vary per company based on their specific business operations

Metrics and targets for the sector are often linked to sourcing targets for specific commodities such as % commodity X ethically sourced or that supports deforestation free supply chains. Some companies have time bound targets to eliminate deforestation in supply chains which we support. For example, one company had a deforestation free supply chain commitment by 2030 in line with the CBD’s Global Biodiversity Framework. However, details on how they verify that their supply chains remain deforestation free remains vague. The companies do work with well-respected third parties to verify their claims. However, there remains a disconnect between company statements on being deforestation free and third party reports on the deforestation that is actually occurring. More KPIs and transparency are thus needed to understand how companies are managing these commitments.

Collaboration

Collaborative initiatives within the food sector play an important role by helping to amplify individual company action while enabling companies to collectively discuss the issues with other stakeholders. In particular, this helps companies take action at an ecosystem level or to take location specific actions on key biodiversity topics (plan globally, act locally).9 Common commitments and standards such as being “deforestation free” also helps level the playing field and move the needle on key biodiversity topics.

Unfortunately, the theory of collaboration is sometimes better than the reality. Collaborative initiatives in the food sector have faced numerous controversies and claims on greenwashing. For example, RSPO for palm oil has been accused of failing to adequately audit members to ensure they are not breaking the RSPO standards and failing to penalize companies who broke the rules.

Regardless, the complexity of biodiversity linked issues means there is no easy fix and collaboration is a great first step to address biodiversity issues in global supply chains. However, expectations from investors are growing to for companies to demonstrate how the collective initiative is having a tangible impact on the topic as well as how the membership is furthering a company’s own sustainability objectives.

Sectors with Biodiversity Exposure Diffused Across the Value Chain

Overall, responses to our engagement for the chemical and pharmaceutical sectors were positive with most companies in our sample willing to understand how to better address biodiversity loss. Key takeaways from this engagement with these two sectors are as follows:

The chemical and pharmaceutical sectors demonstrate mixed awareness around the topic of biodiversity. Only a few companies within our sample had actually discussed biodiversity at the top management level, or initiated any type of work to evaluate risks, impacts, dependencies and opportunities.

A majority of companies admitted that they were struggling against the challenge this topic represents: lack of assessment tools, complexity in understanding all aspects of biodiversity and how they are inter-related and connected to the company. Some companies, notably in the pharmaceuticals sector, did not even understand how they could be directly exposed to biodiversity. Yet, all companies we interviewed are effectively tackling adjacent topics without realizing their relation to natural capital, or without connecting the dots to form an articulated biodiversity strategy. Regarding adjacent topics, most companies are dedicating a majority of their sustainability resources to climate change, with several companies admitting a lack bandwidth or expertise to consider other sustainability issues. We could not agree more on the importance of climate change, but we consider that the biodiversity angle of this topic should not be ignored. At least, we expect companies to work on evaluating risks, impacts, dependencies and opportunities related to Nature.

Finally, interestingly, the degree of commitment to biodiversity is not always linked to the magnitude a company’s exposure to natural capital. In our sample, some companies didn’t have strong enough biodiversity strategies relative to their highly negative impact on nature. Conversely, a couple of companies with only limited direct impact on natural capital had embedded biodiversity as a core feature of their ESG strategy and were devoting significant resources to initiatives and research on the topic.

Sectors with Indirect (Financial) Exposure to Biodiversity

Based on our work in the insurance sector, the financial sector is rather mixed in terms of their management of biodiversity. Some companies take the protection of ecosystems very seriously, and have announced a specific strategy and/or devoted significant resources to initiatives and research. By contrast, others appear unfamiliar with the subject and how it relates to the insurance industry specifically. This means that for some companies, biodiversity is an important point of strategic attention, while others have little to no prioritization of the topic at board level and lack significant top down oversight. Most of the insurers have started to indirectly take biodiversity risks and impacts into account through its strong links with climate change, but not through a direct assessment of the risks and impacts.

There is a long way to go to precisely price biodiversity into risk management processes. However, a specific nature-related risk, the risk of a pandemic, has now been integrated into risk management by the industry. Insurers have either excluded this risk from their policies (travel, business interruption, workers compensation insurance), or the inclusion of pandemic risk has led to higher premium rates. Companies with the strongest practices have identified biodiversity as a(n emerging) risk. They have also implemented biodiversity-related sector policies (on forestry, pulp & paper, palm oil, hydroelectric dams, thermal coal, oil & gas), which we consider to be the first major step when adopting a meaningful biodiversity strategy.

It has to be said that a few players within the sector are quite advanced in terms of measuring biodiversity-related risk exposure. We see the work of some of the leading companies as particularly innovative. However, these companies remain an exception in the industry. Of course, it remains difficult to quantitatively measure financial companies’ impacts, as there is no ‘simple’ KPI. Indeed, it is easier for financial companies to identify the drivers that negatively impact biodiversity (CO2 emissions, toxic waste, pollution intensity) and to look at what the company can do in that respect.

When taking into account biodiversity into operations, the industry generally starts with the investment portfolio, before moving on to the underwriting activities. We also note that the industry‘s primary focus on biodiversity is a risk approach, more than an approach of impact, dependencies or opportunities. The nature of the industry as a risk manager and risk carrier explains this tendency.

General awareness on the role of biodiversity for the insurance sector is still low. Having said that, several insurers are taking the lead through the application of biodiversity-related sector exclusion policies, the active participation or leadership in collaborative initiatives, the spending of major resources to the subject or through the development of financial products that mitigate or adapt to biodiversity-related risks.

Conclusion: The Time to Act is Now

In conclusion, our initial year of engagement has demonstrated urgent need for investors to engage on the topic of biodiversity. This will help drive the speed of action to halt biodiversity loss by 2030 and put it on a pathway to recovery by 2050 (in line with the Convention of Biological Diversity’s Post-2020 Global Biodiversity Framework). Through engagement dialogue, investors have a unique visibility into best practices and can thus use engagement as a tool to disseminate this information and further drive positive change.

The additional parts of this report are meant to provide unique insight and guidance for sectors and companies so they can better address the urgent problem of biodiversity loss. The time to act is now!

For more insights

This article is part of the series “Biodiversity: it’s time to Protect our Only Home”. To learn more about this theme, please click below on the following article.