Summary

Executive summary

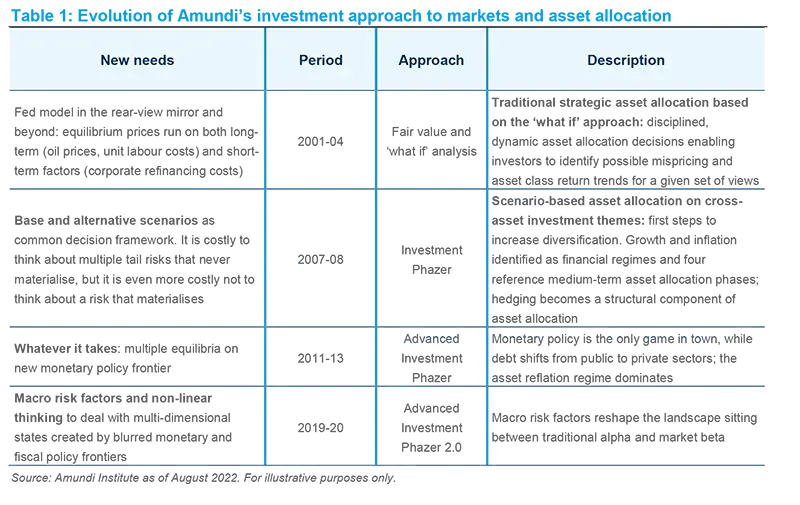

Economic cycles have been a crucial driver for financial markets, making regime-based dynamic asset allocation (DAA) a common practice in supporting optimal portfolio construction. Changes in key economic indicators, monetary policy trends and the evolution of financial leverage have proven a reliable guide in identifying business cycle phases. The new economic paradigm, triggered by the 2008 Great Financial Crisis (GFC), overcame the traditional bidimensional approach, which leveraged on growth and inflation for the definition of economic phases. In a post-GFC world of ever-growing debt, the role of monetary policy was so strong and persistent that it became one of the primary drivers of asset class returns and correlation.

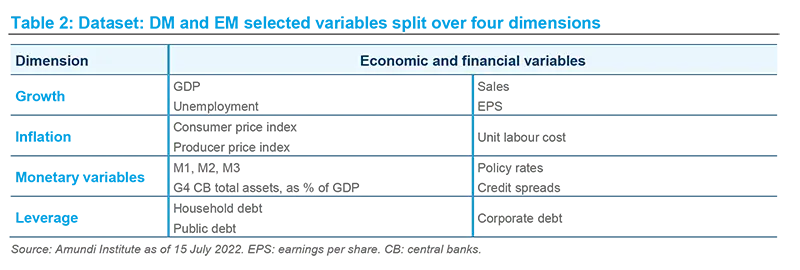

Taking advantage of its multi-year experience in cross asset modelling, Amundi Institute leverages artificial intelligence for its investment approach, in order to tackle complex and fast-evolving financial markets. The Institute developed an innovative tool called the Advanced Investment Phazer (AIP), which embraces the complexity and multi-dimensions of regime determination. It encompasses an extensive range of global variables, aimed at building the optimal portfolio allocation with the potential for outperformance and drawdown minimisation via the diversification of trade bets. Regimes are identified by a clustering algorithm applied to a comprehensive set of macro-financial variables split over four dimensions: growth, inflation, monetary policy and financial leverage.

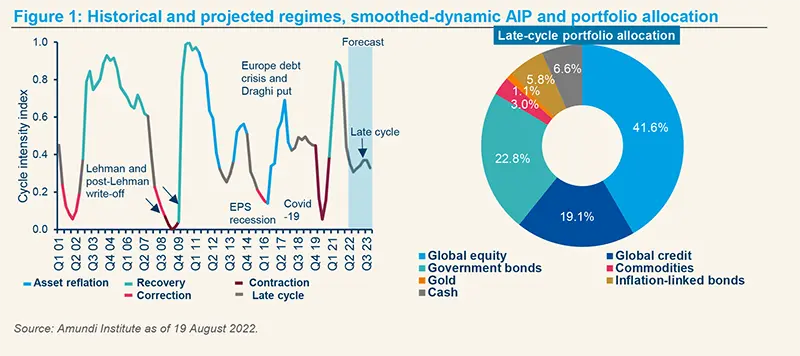

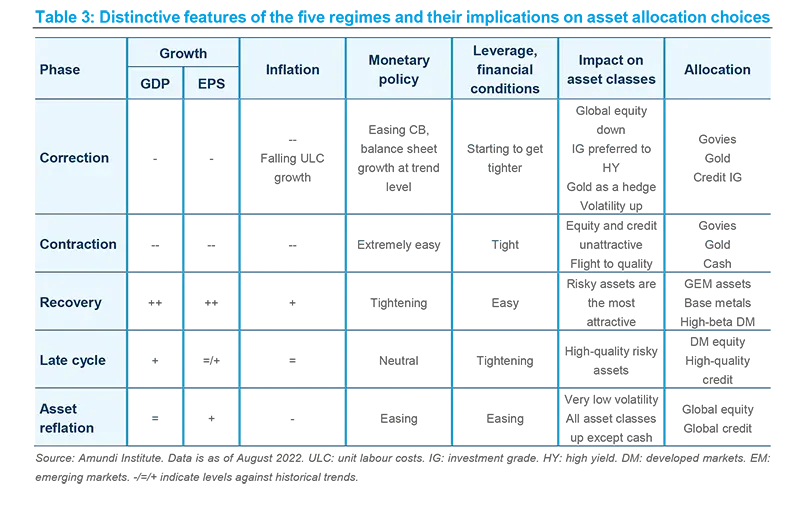

There are five phases – Correction, Contraction, Recovery, Late cycle and Asset reflation – each featuring reference values for the aforementioned macro-financial measures. The distance between an array of forecasts for our factors and each regime’s thresholds will determine the likelihood of each phase in the future (i.e., the smaller the difference, the higher the probability). The resulting optimal portfolio allocation will hinge on the probability distribution of the regimes over the forecasting horizon and the returns that asset classes have delivered historically in each phase.

For instance, according to the AIP, the economic Recovery regime in place from Q4 2020 to Q4 2021 was replaced by a Late Cycle regime in H1 2022. Throughout this Late cycle phase, asset allocation has been tilted towards high-quality risky assets, partly offsetting the pro-beta stance that dominated in 2021. In H2 2022, a Late cycle regime will be as likely as a Correction regime, stemming from the fallout of the expected economic recession in the Eurozone and the United Kingdom. As such, the asset allocation stance needs to become more defensive, with higher exposure to government bonds and gold. In 2023, as the global economy is expected to slow below trend levels, a Correction regime will stand side by side with a Late cycle regime, suggesting focus should remain on defensive assets (see figure 1).

Economic cycles and financial markets

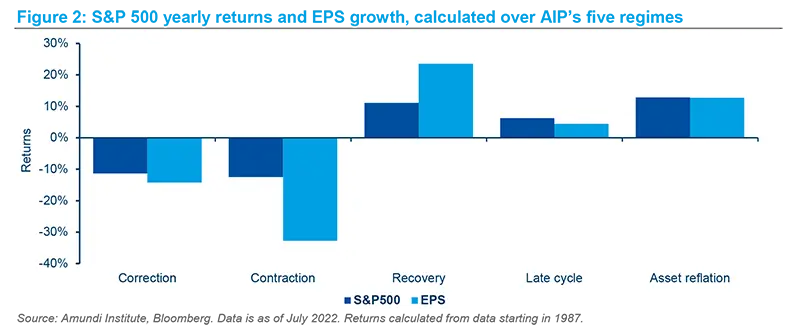

Business cycles and economic fluctuations have historically been the principle drivers of profit patterns and asset class returns. Strong evidence of the co-movement between economic and financial variables can be verified empirically by looking back at history through the lenses of macroeconomic data, policy shifts and geopolitical events. Although every business cycle is different, economic fluctuations have tended to follow similar patterns: cyclical regularities repeat themselves for GDP growth, inflation, monetary policy, yield curves and risky assets, albeit with different magnitudes and length. Consequently, over the medium term, the performance of the main asset classes tends to exhibit recurring patterns according to the state of the economic cycle. Looking at the average yearly returns of US stocks during different regimes, it is clear that it is crucial to discriminate among regimes when dealing with asset allocation choices (see figure 2).

The definition of regimes is not straightforward and the selection of the most suitable macro-financial variables is crucial, as investment implications depend critically on the accuracy of such analysis. Traditionally, growth and inflation patterns have extensively been used to define what is typically a four-state model. The comparison of realised (or expected) prints of these two factors against their long-term averages defines whether an economy is in an early, mid or late cycle, or in a recession. The resulting asset allocation should then be based on the likelihood of each asset class out/underperforming in any given phase. This bidimensional framework has proven valid for an extensive period of time and has been the backbone of Amundi’s first regime-based model, the Investment Phazer in 2007-08 (see table 1). In a post-GFC world of ever-growing debt, the role of monetary policy was so strong and persistent that it became one of the primary drivers of asset class returns and correlation.

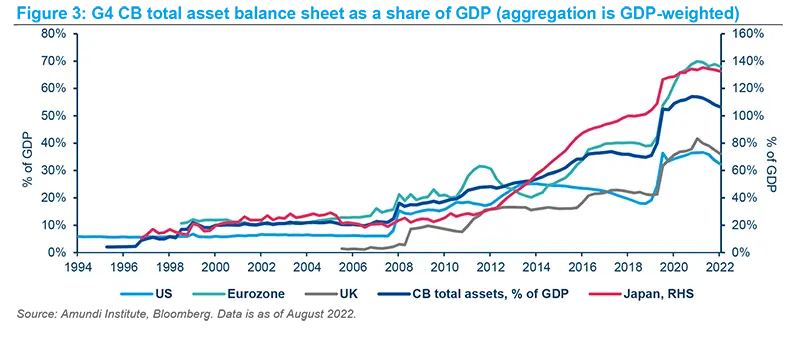

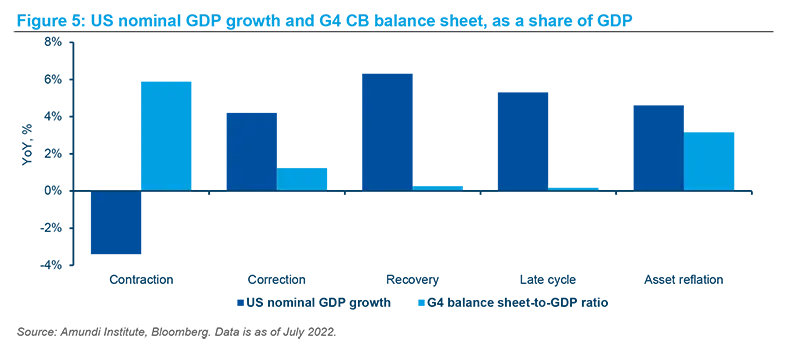

G4 central banks (CB) have supported economies through both traditional (i.e., rate cuts) and unconventional tools (i.e., asset purchases), resulting in lower nominal and real rates, while fostering the market appetite for risk assets. The use of unconventional tools has been the most striking: the aggregated G4 CB total asset balance sheet on GDP rose from around 10% before the GFC to 55% currently and expanded almost every year, except for 2017-18 when the Federal Reserve (Fed) carried out its balance sheet runoff.

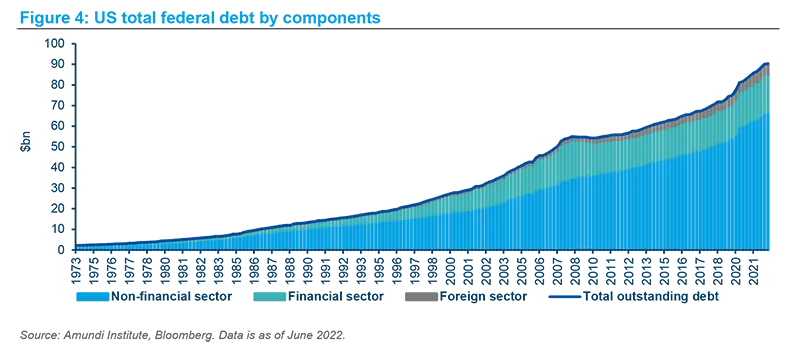

The quantitative easing (QE) programmes pursued by several CB following the GFC introduced a structural change in the macro-financial environment that cannot be ignored, as it is critically helpful in explaining and framing some inconsistencies in asset class behaviour. Actually, the equity bull market, which took place over the past ten years in a low-growth and low-inflation environment, would not otherwise fit into any ‘conventional’ regime. Other than boosting market appetite for risk assets, easy monetary conditions also depressed real rates and favoured the creation of debt (see figure 4). Financial leverage also comes into play in our regime-based asset allocation model, as an additional factor that features the economic landscape, especially since the GFC.

Methodology

In an effort to overcome the faults of a traditional bi-dimensional approach to the definition of regimes, we have opted for a multi-dimension one. We selected a large number of variables – from both developed and emerging economies – belonging to four main groups: growth, inflation, monetary policy and leverage.

The inclusion of the last two dimensions is what differentiates Amundi’s AIP from the more common regime-based approaches. In doing so, multiple key drivers are taken into account: corporate profits cycles, credit cycles, inflation cycles, monetary policy cycles. The variables are then processed by a clustering algorithm, whereby similar items are grouped in the form of ‘clusters’. The five clusters resulting from the analysis become AIP’s five phases, each one characterised by specific features, quantified in a vector of reference values. Once these phases are defined, their likelihood to materialise in the future is calculated by looking at the distance of each variable’s forecast – produced by Amundi Institute – from the cluster’s reference value. The analysis has been based on US data only, starting from 1880, and extended to include other developed and emerging economies from 1988.

While endorsing the validity of the typical four stages of the economic cycle, the use of clustering allows for the identification of an additional regime, called Asset reflation, where central bank intervention plays a crucial role in determining asset returns. This phase can explain what has occurred on several occasions over the past ten years, that is, the economy growing at trend on average, while inflation proves to be stubbornly below target despite expanding central bank balance sheets.

From an investment standpoint, monetary policy intervention supported financial asset returns and contained market volatility, despite no extra boost from growth. The relevance of the asset reflation phase is merited not only in accurately describing the economic cycle per se, but also in helping to better explain asset class performances, which otherwise would not be fully justifiable in the standard framework. As such, for asset allocation purposes, it is crucial to identify macro-financial phases and not just pure macroeconomic data.

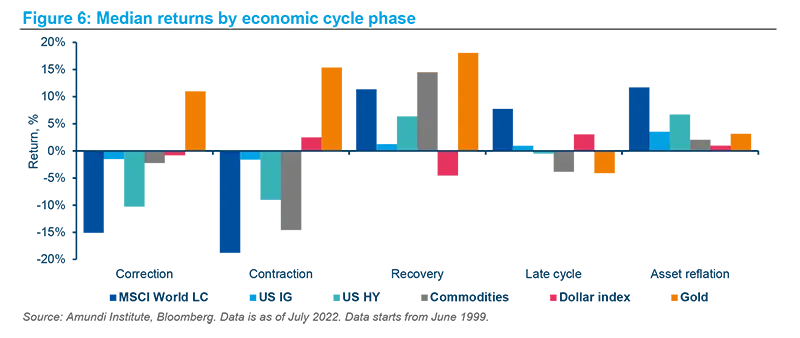

Each regime requires a specific asset allocation, which hinges on the estimated impact that the various cycle stages have on financial instruments. In the Asset reflation regime, most asset classes deliver positive returns thanks to the monetary policy support that is a feature of this phase. On the other hand, Contraction is detrimental for the majority of assets, except for the US dollar and gold, which benefit from their safe-haven statuses. Although the Contraction phase tends to be less frequent, timing its identification is key because of its impact in terms of negative returns. Recovery, Late cycle, and Correction are the most common regimes in a conventional economic cycle. In terms of returns, they tend to perform in the middle between Correction and Asset reflation.

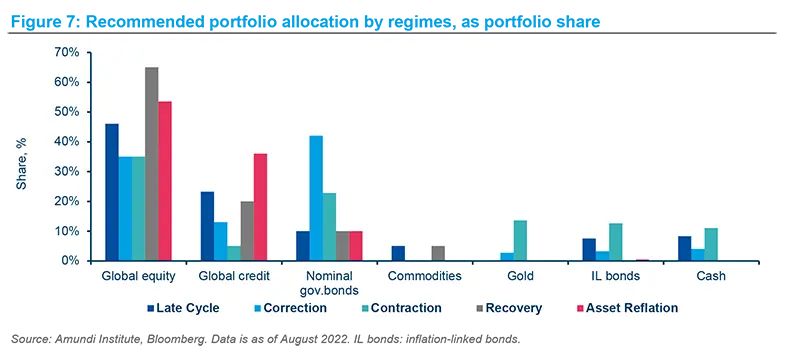

Our approach aims to provide a framework for asset allocation choices by taking advantage of those positions that are expected to outperform under prevailing economic and financial conditions. In each of the five AIP regimes, we optimise each asset class’s weight in a balanced portfolio, according to their expected returns. The outcome is an asset allocation that hinges on the economic regime, as shown in figure 7.

The final allocation weighting is not fully reliant on what the most likely phase would require, rather we implement a weighting scheme that reflects the whole spectrum of the AIP probability distribution for the time horizon under consideration. Such an approach aims to deliver a dynamic, cycle-based asset allocation with the potential to outperform and minimise the portfolio’s drawdowns thanks to higher diversification.

Box 1: Where do we stand?

Over the next 12-18 months, major global economies are expected to experience a growth slowdown. Macroeconomic activity, which was already forecast to decelerate to a more sustainable pace after the exceptional activity rebound in 2021, was substantially hit by geopolitical events in Ukraine. The onset of the Russia-Ukraine war, with its serious repercussion on energy supply and costs, and the return to a strict zeroCovid-19 policy in China throughout H1 2022, exacerbated the ongoing pandemic-related supply constraints and bottlenecks, driving inflation data to new record highs. Such an additional wave of price pickup, particularly in the food and energy components, contributed to deteriorating sentiment and caused a further squeeze in real incomes and worsening the prospects for profit margins.

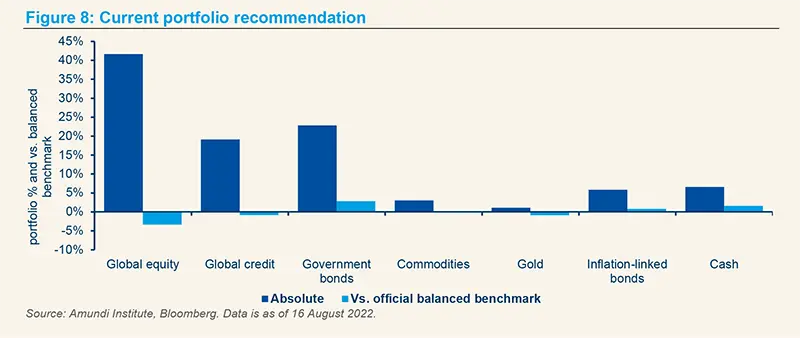

Against such a backdrop, over the past quarter, global growth has been constantly downgraded, amid strong upward inflation revisions. Currently, real global GDP is expected to grow at 3.2% in 2022 and 2.7% in 2023 (yearly averages), slowing substantially from 6.2% in 2021. Global inflation is forecasted at 8.1% in 2022 and 5.2% in 2023, up dramatically from 3.9% in 2022. Such a stark acceleration in price dynamics has fuelled expectations that monetary policy will become much tighter over the next 12-18 months, in an effort to restore price stability and prevent long-term inflation expectations from de-anchoring. A tightening of financial conditions will be the main transmission channel of CBs’ restrictive stance, with an overall softening in the current pace of economic activity due to the second round effect on the economy from less monetary policy accommodation. The expected deterioration of the macro-financial outlook is reflected in the shift of the probability distribution among AIP’s regimes. Year to date the business cycle has experienced Late cycle conditions, taking over from 2021’s Recovery phase, as GDP growth slows down relative to last year, monetary policy gets tighter and financial conditions are less supportive. In Q2 2022 resilient companies’ fundamentals (i.e., profits and sales) prevented the cycle from deteriorating into a Correction regime as companies managed to pass through higher production costs to the final consumers who absorbed this without an impact on revenues. Looking at the second half of 2022, a Late cycle regime is as likely as a Correction regime (both having a 35% probability). However, risks are skewed to the downside as the aggregate probability of contractionary phases (i.e., Correction and Contraction) is expected to increase to 40% (from 20% in H1 2022). The business cycle is indeed set for further deterioration during the rest of the year as a sustained profits rebound is very unlikely to materialise. The aforementioned deterioration in the macro backdrop should drive the top line lower due to low, below trend real growth and decelerating inflation, while higher rates and labour cost should drag margins.

Asset allocation-wise, the probabilities of the central scenario in combination with tail risks confirm the need to keep a defensive stance, with moderate beta and higher quality for the rest of 2022. As a Correction regime is confirmed as the second most likely regime, we reiterate an increased focus on defensive assets (government bonds and gold) throughout 2023 as well.

Conclusion

Over the next decade, investors will face a challenging economic juncture, as the mix of monetary and fiscal policy deployed during the Covid-19 crisis will have to be managed carefully while being unwound. The outcome will weigh starkly on global financial market dynamics. Amundi Institute’s Advanced Investment Phazer aims to provide a compass for medium-term top-down asset allocation, based on economic regime analysis. The tool provides a 12-to-36-month forward-looking, optimal portfolio allocation, based on the likelihood of the five economic cycle regimes over the investment horizon. These probabilities are determined by extracting information from a wide set of variables, spanning from macroeconomic to monetary policy and financial leverage. Recovery and Asset reflation are the most risk-friendly regimes, where equities experience the strongest performance. The Late cycle regime, the phase that economic cycles tend to follow afterwards, is less supportive for risky assets, as monetary policy tightening usually takes place at this stage. Finally, Correction and Contraction regimes occur when the economy is deteriorating or in recession, respectively, and markets take a much more defensive stance, withdrawing from equity and allocating to safehaven assets (i.e., govies and gold).

For its nature and methodology of construction, AIP is used to build Amundi’s medium-term capital market assumptions (both public and private). It also serves as the main scenario for cross asset allocation in Amundi’s Multi Asset alpha platform and for the quarterly asset allocation recommendations for Amundi’s Multi Asset investment process. It is also calibrated for stress tests and alternative scenario simulations for retail and institutional client needs.