Summary

As one of the main contributor in terms of waste and in terms of CO2 emissions, the construction sectors is well aware of the necessity to reinvent itself. Besides, the sector faces strict legislations at the EU level and more specifically in France. However, the sector struggles to review its whole business-model with Circular Economy lenses while the solutions are only at an embryonic stage and that the waste issue is not yet solved. Implementing a Circular Economy requires a complete change of culture of all actors and partnerships within the construction sectors, its suppliers, its clients and the State are key to make it real.

The regulatory pressure is increasingly heavy for the sector at EU and national levels

The construction sectors uses a vast amount of resources and accounts for 30% to 50% of all extracted material. Besides, it is responsible for over 35% of the EU’s total waste generation while the overall rate of recovery of building waste varies from 48% to 64%1 . This rate varies greatly depending on the activity: 60 to 80% for demolition, 10 to 30% for rehabilitation, 40% to 60% for new construction.

In order to reach a sustainable development and be climate neutral by 2050, the EU has defined a new strategy in 2020, the European Green Deal. This new strategy is based on policies that strongly promote the implementation of a Circular Economy, especially the New Circular Action Plan (CEAR) and the European taxonomy.

In the CEAR, the construction sectors have been identified specifically as one of the seven priority sectors with the highest potential for Circular Economy2 as greater material efficiency could save 80% of the 5-12% of GHG emissions due to the construction sectors.

The CEAR wants to promote circularity principles throughout the lifecycle of buildings by:

- Improving the sustainability performance of construction products (revision of the Construction Product Regulation and possible introduction of recycled content requirement);

- Improving durability and adaptability through building design and digital logbooks;

- Integrating life cycle assessment in public procurement and maybe including carbon reduction targets;

- Revising material recovery targets in EU for construction and demolition waste;

- Promoting initiatives to reduce soil sealing and use of excavated soils.

| WHAT IS THE RENOVATION WAVE? | ||

|---|---|---|

|

The Renovation wave is part of the Green Deal, which sets the objective of climate-neutrality by 2050 at EU level. Though responsible for over 35% of greenhouse gas emissions (GHG), only 1% of buildings is renovated each year. Consequently, a much faster rate of renovation is needed. In consideration of these figures, the European Commission published its Renovation Wave Strategy, in 2020, aiming at improving renovation rates by 2030 through renovating 35 million buildings and creating up to 160 000 additional green jobs in the construction sectors. The EU has defined 3 priorities:

The communication is a far-reaching document, adopting a comprehensive approach to building renovation, outlining a wide range of policies, measures, and tools to overcome barriers and mobilize all actors. |

In view of the regulations set up in the EU, the built environment industry has no other option than to implement circularity at a higher speed to meet EU rules and expectations.

It is two other European regulations and their follow-up amendments that are geared towards construction sectors: the Waste Framework and the Landfill Directives. The Circular Economy subject was mainly taken through the waste angle in the early 2000’s as waste is a key issue for the sector and highly contributing to the CO2 emissions. Indeed, in 2019, CO2 emissions increased to 9.95 GtCO2, 38% of which accounted for the building and construction sectors. The International Energy Agency (IEA) has estimated that direct building CO2 emissions need to fall by 50% by 2030 equating 6% per year in order to reach net-zero3.

As France wants to become a leader in Sustainability, it is also targeting the buildings and construction sectors through its latest law “Anti-waste law for a Circular Economy”, adopted in 20204. Thus starting from January 2023 at the latest “polluter-pays system” (pps) will be put in place and will be applied to construction products and materials whether for households or professionals.

The changes brought are of consequence for the construction sectors notably the polluter-pays system. Below the changes brought by the Anti-waste law5 to the waste issue and the polluter-pays system:

This regulation is strongly affecting the way the sector approaches the implementation of a Circular Economy by giving a high priority to the waste treatment to the detriment of the other pillars. We will see in the following section how the sector is moving towards a more Circular Economy. We have engaged with seven companies, all Europeans, in the first year of this 3-year to last engagement: three in the construction & engineering sector, four in the construction materials sector and one in the building products sector.

As a foreword, it must be outlined that the construction industry is a fragmented one hence our use of the terminology construction sectors throughout this document. The companies with whom we spoke belonged to one of the three sectors composing the industry in connection to materials and their use:

- The building products sector: glass, insulation…

- The construction materials sector: cement, concrete, aggregates…

- The construction & engineering sector: buildings, infrastructures projects…

For the sake of simplification, the first two sectors will be considered as providers of products and materials to the latter listed in view of constructing buildings or infrastructures.

The construction sectors is struggling to reinvent itself to implement a circular business-model

Circular Economy can be considered as a new concept and as all new concept, it needs time to be fully implemented. If many companies consider that the subject of implementing a Circular Economy is covered, we still see several obstacles to a full implementation.

Circular Economy is not yet “fully grasped” by the top management and by the Board. Indeed, less than two companies out of seven admit that this subject was discussed at Board level in the previous years. The Circular Economy topic is very often embedded in the Corporate Social Responsibility Strategy and considered as a sub-part of it and not handled as a specific matter. Thus, though Circular Economy appears in most materiality matrixes, it is not recorded as high priority. In the best case, a Board member is in charge of Sustainability and consequently of Circular Economy.

When a subject is not overseen by the top management, it makes it difficult to implement it globally.

Besides, Circular Economy is not something that can be added or taken out. Integrating Circular Economy in a company strategy implies to completely rethink-model every single step of the process: design, manufacturing, selling, end of life and consumer ownership. This can hardly be done by adding a new offer on top of the old ones.

This missing overview by top management level is also true amongst business lines and employees as training on Circular Economy does not seem to be part of the industry regimen. Only two companies out of seven have mentioned they have specific trainings on the subject. However, none of them has a training strategy on this subject or was able to report key indicators performance (i.e.: number of employees trained, number of hours, etc).

At least two other reasons can be mentioned to explain the difficulty to implement a Circular Economy in the construction sectors: the need for a complete change of culture and the heavy financial investments that are required to do so. As said earlier, implementing Circular Economy means to review the whole business model and consequently can be seen as taking risks by the top management who might prefer to keep doing what has been working for years rather than anticipating. Besides, switching to a Circular Economy also implies to invest very importantly in Research & Development and to bet on new products and/or new consumers that are still embryonic as of today.

We do understand the obstacles to the implementation of a Circular Economy. However, we strongly believe that actors that understand the challenges we will face over the next decades in terms of climate change and limitations of access to new materials and start anticipating their answer from today will be the winners tomorrow. The efforts that the other actors will need to implement in order to face these challenges if they start later on will be harder and they will need to do them in a shorter amount of time.

For doing so, companies need to take Circular Economy out of the Sustainability strategy to make it a pillar of the overall business strategy. Companies need to define what Circular Economy means for every single step of their process: extraction of raw materials, manufacturing of primary products, production, use, end of life, re-use, recycling, etc. They also need to define ambitions, quantitative targets, deadlines and KPIs in order to be able to follow the rightful implementation. In this process, training is key: if employees or managers are not convinced by the necessity and the usefulness of switching from a linear to a circular model, the new circular model will fail to be implemented.

Waste management is a major focal point over other pillars of Circular Economy because of legislation

Legislations on waste all over the world, and more specifically in Europe, started at the end of the 20th century, that is to say way before the concept of Circular Economy was popular. This explains why sometimes the Circular Economy is reduced to waste treatment while it is way more than just that and why companies focus on this issue particularly.

Indeed, companies want to meet legislations first and start by giving a regulatory answer on waste before turning the table over to implement a Circular Economy, which requires rethinking the whole business-model.

This is confirmed by our engagement as all companies have implemented processes to comply with the law but also KPIs on waste while the other pillars of a Circular Economy are left behind. As an example, one of the companies we have engaged with is in the top 5 actors of the waste treatment globally. This shows how the waste treatment is key for the sector but is also a good example of how companies can make their business-model change when they want to integrate better a pillar of Circular Economy.

However, even on this subject, we see that progress can be made, especially on recyclability and reuse of materials. The construction sectors take care of their waste with extensive use of landfill, which is no longer considered as enough, as shown by the Anti-waste law adopted by France lastly. This law requires the sector to be better structured by implementing an Extended Producer Responsibility and by asking them to better recycle and improving the quantity of recycled content integrated into new products. Indeed, even though recyclability and reuse are keys for the industry, they are mainly applied to new materials or products and are mostly linked to material scarcity.

Likewise, circular designs are mostly applied to new range of products or materials and concern only a very small part of the products offer.

We do understand that waste is a key priority for the sector because of legislation. However, we do believe that as the legislation is getting stricter and Circular Economy is becoming a must have, companies need to review their whole process from the beginning, that is to say from the design. This implies to invest more in eco-design and in R&D in order to improve the recyclability of the products and ensure that recycled content can be integrated in a bigger proportion. The design phase is key, including in terms of waste treatment and recyclability: if the company puts on the market products the waste sector does not know how to recycle or how to disassembly, the company will pay an increased tax as the Extended Producer Responsibility is put in place. As of today, we strongly believe that building design (also called deconstruction) cannot be uncorrelated from the disassembly phase.

In order to improve the circularity of the construction sectors, we first encourage companies to proceed to a lifecycle analysis (LCA) for their key products, representing a high percentage of their revenue. A LCA allows to highlight where the highest impacts of the products are and then to find solutions to reduce these impacts. Besides, a LCA can also show that using recycled content can decrease the environmental impacts of the product significantly and play a role in accepting to integrate more recycled content into new products.

We also encourage companies to promote digitalization and follow the EU Building Information Modelling (BIM) guidelines6. BIM or the digital mock-up of a building allows simulation to be made on the supply of materials and the waste they will generate and then make trade-offs. BIM offers a global vision of a project impact on the environment and as such the means to optimize them. RIM - or Resource Information Modeling – assesses the materials used depending on their capacity to be recycled or reused. It also offers data traceability that can be updated throughout the equipment life. With a detailed database of a building components and quantities, it becomes possible to anticipate deconstruction, associated costs as well as the possibilities of recycling and reusing channels to activate.

We encourage companies to think from the design phase about deconstruction rather than demolition. Deconstruction requires to be planned way in advance so that materials than can be reused are identified and rightfully taken out and put in an upgrade process so that they can be either recycled or reused directly for another project. Demolition does not imply any requirement of the sort as it consists in razing a building with no intention to increase the waste sorting. These new business-models can only emerge from the ground with the partnership of suppliers and clients.

Partnerships are being established but they need to go faster and deeper

We think that companies have a key role to play and are at the crossroads of many actors: regulators, suppliers and clients and consequently can influence them positively.

All companies are involved to some degree in on-going legislation and discuss regulations with officials regarding sustainability and the Circular Economy. For some companies, regulations are viewed as potential business opportunities.

Collaboration is key to all the companies we spoke to. Indeed, all the companies in the panel do take part to collaborative initiatives whether sector-focused or cross-sectors ones aimed at innovation and promotion of Circular Economy. These initiatives can be local or international such as WBCSD, World Green Building Council, GCCA or Sekoya7 , a cross-sector French carbon and climate platform bringing together major groups, SMEs and start-ups to propose low-carbon technical solutions around various themes including Circular Economy. If companies are part of working-groups on sustainability, none of them is fully dedicated to the Circular Economy theme. The subject is always a sub-part of a wider subject. This could change in the next few years because of the increasing and more stringent legislation.

We encourage companies from a common sector to team up so that they can better define what a Circular Economy means for their activities and speak with a common voice with regard to clients and customers, think of how the change can be implemented operationally, share their best practices and the obstacles they face, building up tools that can be used, etc. One good example of working-groups that is working quite well on another thematic is the Responsible Minerals Initiative8, initiative that was born due to the increasing issue and legislation, first in the USA and then in Europe, to structure the actions of companies. This initiative gave birth in 2018 to a Conflict Minerals Reporting Template (CMRT), which is free, standardized reporting template that facilitates the transfer of information through the supply chain regarding the mineral country of origin and the smelters and refiners being used. The template also helps new smelters to undergo an audit via the RMI’s Responsible Minerals Assurance Process. A similar working-group proposing a think tank and delivering tools could hugely help the subject to be better taken into account by companies.

We also encourage partnerships with suppliers on circularity, as they are not the norm amongst most of the companies we engaged with despite being essential to achieving a Circular Economy throughout their value chain. Indeed to fully integrate circularity as a business model and make it work, it has to be disseminated within the ecosystem wherein the companies evolve.

Educating clients is also an important step as many companies we engaged with face customers’ reluctance when it comes to use recycled or reusable materials over new ones. This kind of reluctance is a hurdle for an efficient implementation of Circular Economy. All companies stated that customers – other than institutional ones - in their majority choose new materials over recycled or reused ones though companies indicate promoting recycled materials. We consider that companies can help moving the lines by explaining their R&D process, the tests they realize to ensure the same level of quality and safety with products integrating recycled content as with the virgin ones and play the game of transparency with their clients.

| JAPAN, THE NEXT EXAMPLE TO BE FOLLOWED IN TERMS OF ECOLOGICAL CITIES? | ||

|---|---|---|

|

Circularity is not a new concept for Japan as we find the idea of it in the Japanese term “mottaina”, which could be translated as “waste not, want not”. While Japan is already known for its high recycling rate, the Circular Economy concept has grown steadily in the last few years. For example, Japan hosted the World Circular Economic Forum in Yokohama in 2018 and launched its Regional and Circular Ecological Sphere policy later on (R-CES). This policy aims to reduce the environmental footprint of cities, at every stage: from the construction of building to the recycling of household waste. R-CES aims to organize communities and space so that both material and carbon are transported in a way that minimizes waste depending on the industry or resource in question. For durable goods, like cement, they can be transported on a long distance so that they can be well recycled while for degradable goods, like food, they need to remain in a small area. By planning these scales, cities can organize themselves to minimize carbon emissions and improve the local economy. Japan is a good example of how cities can be rethought and redesigned but additional elements need to be added so that the redesign is complete, such as mobility and how to better renovate buildings to reuse or recycle most of it. |

Conclusion

This first year of engagement proves that the construction sectors have come a long way but progress still needs to be made. Carrying out circularity for most companies mean significant changes to their business models as well as specific and significant investments. Companies will need to better understand the concept of Circular Economy and how it applies to their activities, especially with the increasing legislation in Europe. They will need to review their business-models, to train their staff and their suppliers and clients so that the switch is unanimous and implemented by all. As many other sectors facing Circular Economy, construction companies will need to innovate and to go further than business as usual if they want to be identified as the winners for tomorrow.

This is particularly true for construction as its impacts will not stop rising considering the growing pace of urbanization: the UN World Urbanization Prospects estimates that by 2050 68% of the world’s population will leave in urban areas – an increase from 54% in 20169. By 2050, the OECD10 projects GHG emissions to increase by 50% primarily due to a 70% growth in energy-related CO2 emissions.

We have sent our feedbacks to the companies and gave to each of them specific guidelines and recommendations we would like to see launched in the next few years. We will follow carefully the fate of these recommendations in the next two years, duration of our engagement.

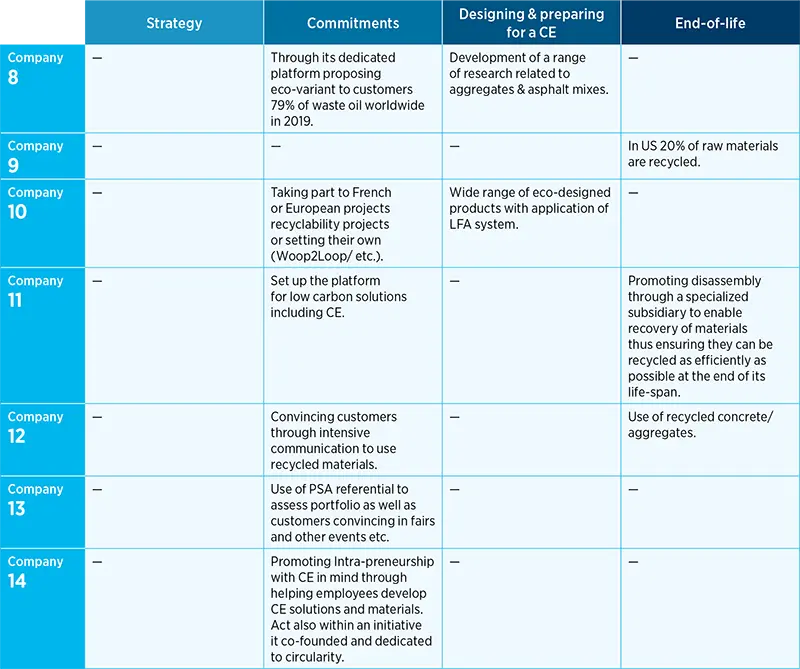

Table of best practices

The construction sectors

_______________

1. Déchets du bâtiment | Ministère de la Transition écologique (ecologie.gouv.fr)

2. Circular economy action plan (europa.eu)

3. Building sector emissions hit record high, but low-carbon pandemic recovery can help transform sector – UN report (unep.org)

4. loi anti-gaspillage économie circulaire | Ministère de la Transition écologique (ecologie.gouv.fr)

5. INSIDE_The anti-waste law in the daily lives of the French people (ecologie.gouv.fr)

6. EU BIM Task Group

7. Plateforme Carbone & Climat (sekoyacarboneclimat.com)

8. Responsible Minerals Initiative

9. Urbanization - Our World in Data

10. OECD Environmental Outlook to 2050: The Consequences of Inaction - Key Facts and Figures - OECD