Summary

- Former US President Donald Trump was indicted by a Manhattan grand jury on 31 March, a move that has polarised US public opinion. In the near term, the indictment has improved Trump’s standing among the Republican base, however further charges in upcoming cases could inject some uncertainty into the Republican nomination.

- In the case of a Biden – Trump rematch, while the contours of the race may not change dramatically and it will likely be another close election, independents are expected to be the key group deciding the outcome of the 2024 election. The Trump indictment is unlikely to be a major factor when it comes to lifting the US debt ceiling. We expect an eventual agreement to lift the debt ceiling as Republicans would not want to be seen as being responsible for a US government default.

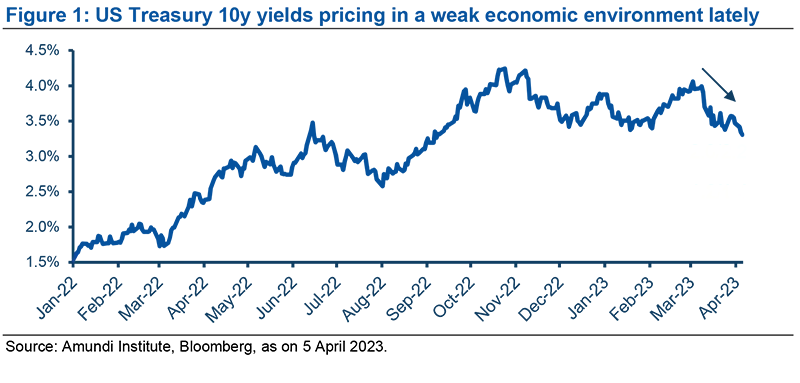

- UST 10-year yields have started pricing in a recession recently, underlining the case for duration in these turbulent times. We remain slightly constructive on duration with an active stance. On credit, we see the tightening of financial conditions to be a negative for spreads, especially for the weaker, highly-leveraged segments of the market. We maintain our overall cautious stance, with a preference for high-quality corporate credit.

What could the implication of Trump’s arrest be for US politics?

The US political environment is highly polarised on Trump’s indictment, with some seeing this as being politically motivated.

Donald Trump was indicted on 31 March by a Manhattan grand jury on charges of hush money payments and falsifying business records, making him the first former President to be indicted in US history. He has pled not guilty to 34 counts related to business fraud. The courtroom battle is likely to be a long drawn-out process that could take place during the midst of the 2024 presidential election and is likely to have implications for US politics.

- The political environment is highly polarised, with the electorate evenly divided between Democrats and Republicans. A CNN poll (conducted on 31 March-1 April) found that 94% of Democrats approve of the decision to indict Trump, whereas 79% of Republicans disapproved. Significantly, 62% of independents also approve of the decision to indict Trump. The poll also indicated that 76% of Americans think politics played a role in the decision to indict Trump and 52% said politics played a major role.

- The Republican base is rallying around Donald Trump. Trump has seen his lead over Florida Governor Ron DeSantis rise from 13% to 26% since the announcement of the indictment1. These are still early days, but the indictment is likely to strengthen Trump’s case for the Republican nomination in the short term. According to political betting site Predictit, Trump is favoured over his number two rival DeSantis by 45% versus 36% as of 5 April.

How could this indictment affect the 2024 Presidential elections?

More indictments against Trump could create concern among Republicans over the strength of Trump’s appeal for next year’s Presidential elections.

With respect to a general election contest between Biden-Trump, the former has seen a small bump higher versus Trump. Trump had a small lead in February but now trails President Biden by 1%. More importantly, it is the independents that have the highest disapproval ratings for Trump. While the contours of the race may not change dramatically, and it is likely the election will be a close one, the independents could tilt the race against Trump. According to market expectations, Biden is favoured to win re-election by 55-45% as of 5 April.2

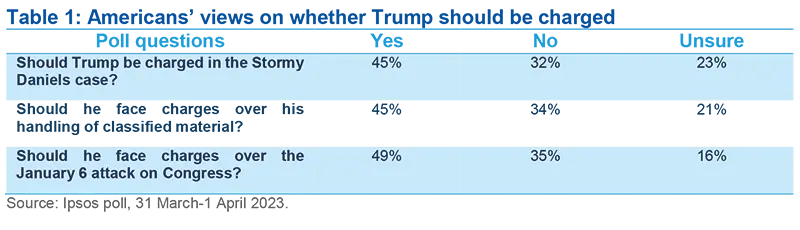

What is likely to inject the most volatility and uncertainty into Trump’s run for the Republican nomination are the three other cases against Trump currently underway. Table 1 below shows US public opinion on the different cases against the former President.

There is a significant probability that if there are further indictments against Trump, the Republican electorate could become concerned that he may be a weak general election candidate. This could lead Republican voters to make a pragmatic decision to support a Trump-like candidate, such as Florida Governor Ron DeSantis, whose image is not tarnished by scandals.

Do you see this weighing on the US debt ceiling?

We are likely to see a very contentious and divisive debate over the lifting of the US debt ceiling. The Trump indictment will not help the already tense relations between Democrats and Republicans in Congress but should not be a decisive factor in the eventual lifting of the debt ceiling. Market volatility and the negative fallout from a potential default, where Republicans could be blamed, should lead to a last-minute agreement to raise the debt ceiling.

Do you see any increase in the political risk premium for US assets?

Legal proceedings against Trump are not likely to be the deciding factor on lifting the US debt ceiling.

Markets have begun to price in the prospect of spending cuts which could imply a degree of rising expectations for a debt ceiling deal. We also have to consider the difficulty President Biden will have running for re-election during a potential US recession (which is now our central scenario for the second half of 2023). This is likely to negatively impact Biden’s chances for re-election. And should Trump be the candidate of choice, could further increase political risk in the US moving ahead.

For the time being, the US 10-year yield has been falling as the market prices in some concerns over a recession and a Federal Reserve that may be close to the end of its tightening cycle. For the moment, this suggests little political risk premium in yields.

1 Source: RealClearPolitics poll of polls.

2 Source: political betting site PredictIt as of 5 April 2023.