Summary

We expect rotations within equity markets to benefit Europe and we continue to stay positive on Japan.

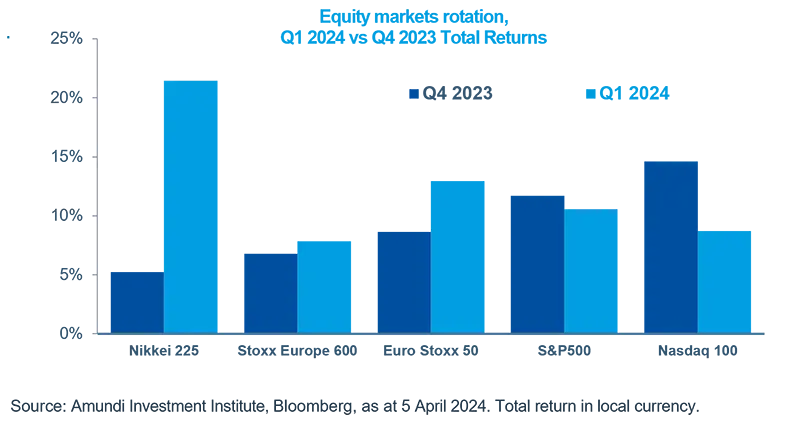

- In a strong start to the year, equity markets showed signs of rotation in favour of Europe and Japan.

- European equities may benefit from appealing valuations, while Japan from the domestic investor demand.

- During the week, tensions in the Middle East pushed oil to the highest level since October.

In 2024, the equity rally has weakened in the tech heavy Nasdaq Index which was the leader last year, now in favour of other regions. Large cap companies in the Eurozone and Japan posted double digit returns in Q1.

Moving forward, we think there could be a continuation of the broadening of the participants in the rally, which so far has been concentrated around few names. In particular, the fact that the expected slowdown will not end up in a recession could benefit some European cyclical and value stocks. We also continue to be positive on Japan amid resilient earnings and the revamp of the NISA* program that should support domestic demand.

*NISA is the Nippon Individual Savings Accoung tax-free stock investment program.

Actionable ideas

- Go global in the search for potential equity opportunities

After the strong US dominance in 2023, the equity rally is moving global, with countries like Japan expected to continue to perform. - Look at European equity in the search for value

European equities could see a broadening of the rally. In particular value cyclical stocks could benefit from a stabilising economic outlook.

This week at a glance

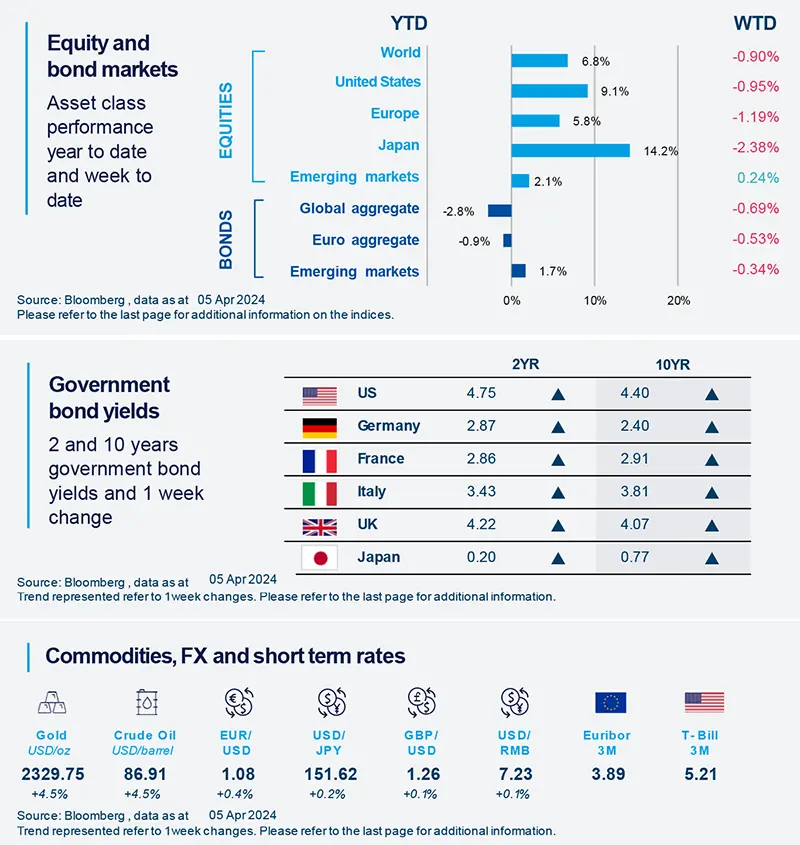

During the week, US bond yields touched their highest levels since the start of the year after better than expected economic data in the US. Equities were negative amid increasing geopolitical tensions in the Middle East, which also pushed oil prices to the highest since October.

Amundi Investment Institute Macro Focus

Americas

March US ISM manufacturing surprises on the upside, printing the highest level since September 2022.

The upside move in the US manufacturing index was helped by gains in particular in production, new orders and inventories. Despite some improvements, the employment sub-index continues to signal declining demand for workers. The price component rose to 55.8 from 52.5, firmly on increasing territory after remaining below 50 (expansion threshold) for the majority of 2023.

Europe

Eurozone inflation remains moderate but services inflation continues to be sticky.

Eurozone inflation eased more than expected by consensus in March, mainly due to the slowdown in food and energy prices, but also from moderation in core inflation. However, services inflation print remained unchanged for the fifth consecutive month at 4% YoY. France posted the biggest downward surprise in inflation (2.4% YoY from 3.2% in February).

Asia

Tokyo inflation slows.

Tokyo new core CPI (ex. fresh food and energy) came in at 2.9% YoY in March, the first below 3% reading since 2023. The March Tokyo print confirms the dis-inflationary direction of our forecasts. We expect national new core CPI to break below critical thresholds of 3% and 2%, in Q2 and Q3 respectively. These levels are not high enough to propel more hikes from the Bank of Japan.

Key Dates

|

9 Apr Japan Consumer Confidence, |

10 Apr |

11 Apr ECB Monetary Policy Committee, China CPI Inflation, US PPI |