Summary

Tariffs and fiscal policy, the moment of truth

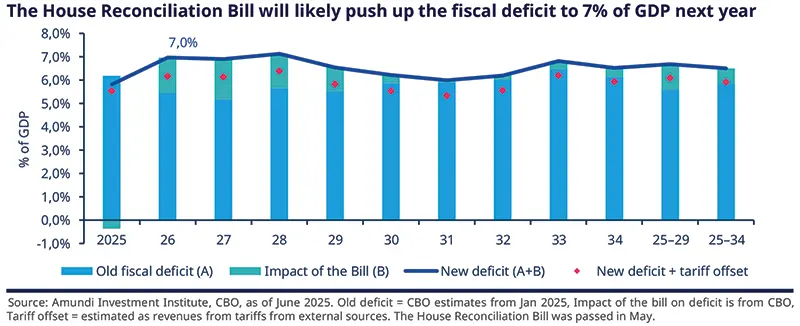

Mounting concerns over large US fiscal deficits, along with consumers’ inflation expectations and the escalating conflict in the Middle East, have started moving the markets. The issues around fiscal sustainability were further aggravated by President Trump’s Big Beautiful Bill, the renewed interest in fiscal expansion in Europe (including German borrowing plans), and Japanese debt auctions. Long-end bond yields rose in response, but equities showed some resilience.

Looking ahead, we could see some signs of weakness. Barring an escalation of the Israel-Iran conflict, markets will now focus on fiscal risks and tariffs. The big question is whether the allure of US assets is diminished by the fiscal issues, the challenge to the status quo by the US administration’s policies, and how that could affect US assets.

We could very well see these old patterns changing in the future, but it is a long-term trend, not something that will happen within a short time frame. For now, trust in US institutions and their credibility remains intact – it may be questioned at various stages though. From an economic perspective, we see the following main themes playing out:

We see economic activity decelerating in the US, with this year growth projections unchanged at 1.6%. Economic activity will be volatile due to net trade and consumption weakness. In the euro zone, we see credit growth and a continuation of improvement in the manufacturing sector. The defence and infrastructure push is likely to have positive effects on growth from 2026. The main question is how this will be financed.

The traditional safe haven stature of the USD will be challenged in an era of rising deficit and debt

The impact of US tariffs on underlying inflation will be gradual. The tariffs’ impact on US inflation has been muted, and we haven’t seen higher consumer prices so far. But we are monitoring whether these are passed on to consumers and what impact they could have on corporate margins if companies are unable to pass on the costs. In the eurozone, the inflationary backdrop is slightly different, and inflation seems on track for deceleration.

International trade negotiations will get increasingly difficult. The latest round of US-China talks in London indicated that China will remain a tough negotiator. Erratic trade policies may affect the appeal of US assets. Although section 899 (which we have always believed was a negotiation tactic) of the Big Beautiful Bill has now been scrapped, such provisions tend to increase uncertainty and volatility in the markets.

We upgraded growth projections for some EM such as Brazil (2025), Mexico (2025), and India (2025 and 2026). In China, some recent data has been benign for example on retail sales. However, we would like to see a more sustained trend to convince us to upgrade our growth expectations. A boost to durable goods consumption from government subsidies should be supportive, but once the effect fades, this would weigh on growth. We stick to our projection of 4.3% for this year.

To summarise, we remain marginally positive on risk assets, with increased valuation discipline. Growth-inflation mix is less of a headwind, and we do not see a corporate earnings recession. But fiscal direction and the potential economic impact of uncertainty on tariffs and of geopolitical conflicts point to high volatility.

| Amundi Investment Institute: central banks and the dollar |

Fed in a wait and see mode, unsurprisingly. We confirm our projections of three Fed rate cuts this year. Economic growth will likely remain below potential and credit and liquidity conditions in the market are also good. However, price hikes due to import tariffs in the US and a sustained surge in oil prices (not our base case) due to the geopolitical tensions in the Middle East might reinforce inflationary pressures. For the ECB and the BoE, we maintain our view of two cuts each this year. For the Bank of Japan, inflation and volatility in yields are major issues. Nonetheless, real yields in the country are still low. Thus, we expect the bank to hike rates once in October this year, and after that, terminal rates should reach 0.75%.* The dollar is coming under pressure from questions over superiority of US growth, and high US government debt (and deficit). Because of the changing correlations between the dollar and US equities, the currency is not acting as well as a diversifier as it was in the past. Despite all that, near-term consolidation in the dollar is possible for example as a result of stress coming from global conflicts. Hence importantly, any shift away from the greenback is a multi-year trend. We expect the EUR/USD to reach 1.20 by around Q2 next year. |

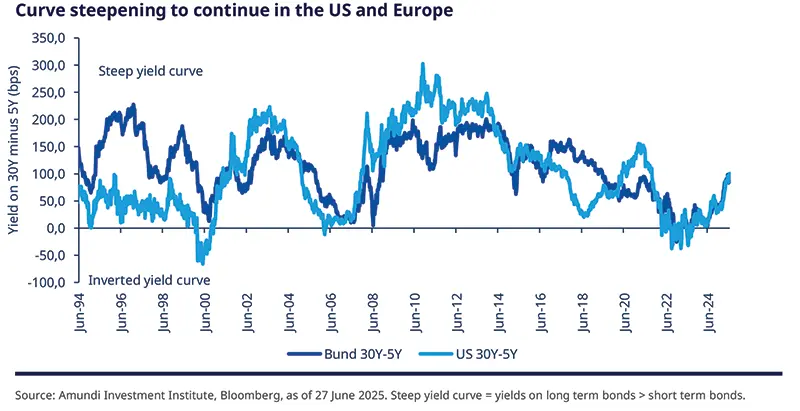

Debt piling up and deficits rising are common features across the US, Europe and Japan. This will have consequences for the long end of the yield curve, which is likely to come under pressure.

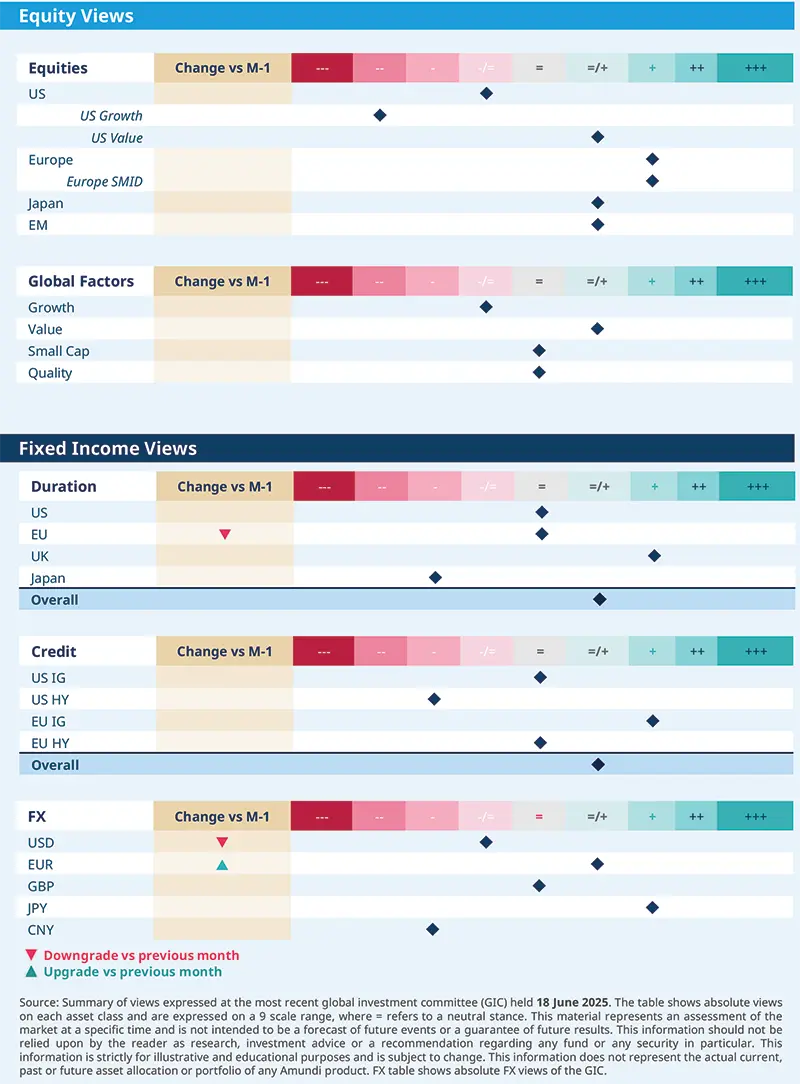

In line with our economic backdrop discussed earlier, we outline our main investment convictions below:

Debt and fiscal worries are rising, but curve steepening opportunities persist in fixed income. In an overall flexible stance, we moved to neutral on EU. Carry is attractive in corporate credit, but we acknowledge the bifurcation between high and low rated companies and large and smaller ones. We stay positive on investment grade, particularly through EU banks.

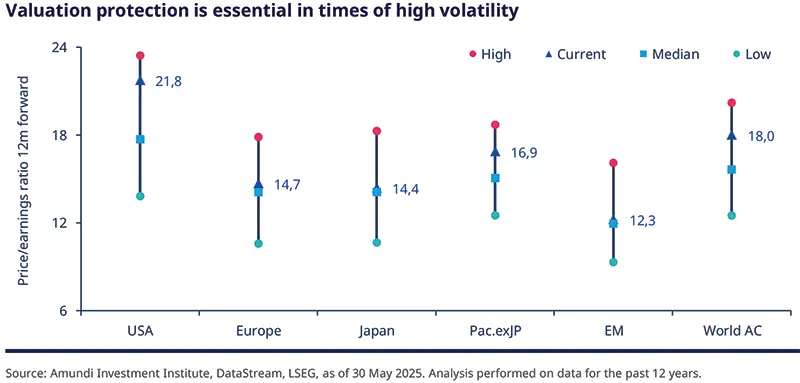

Equities in US have been resilient, ignoring negative scenarios. Valuations have risen to rich levels, whereas those in Europe and Japan are close to their averages. As we enter into H2, the important point is to see which businesses are able to pass on the costs to consumers and preserve margins. Hence, valuations and quality both will become important.

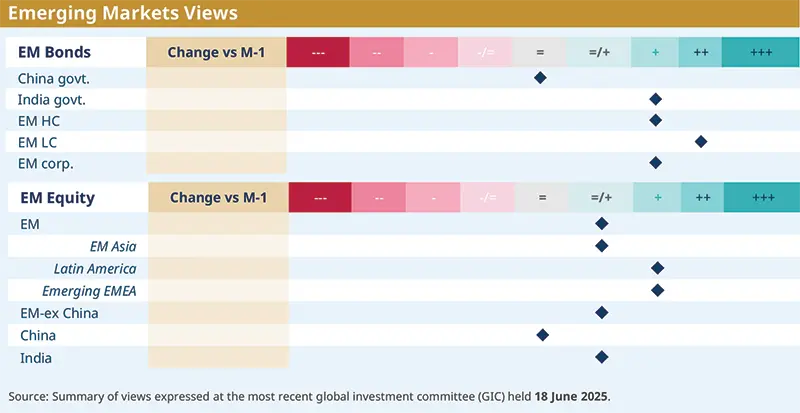

Emerging market at a time of strong growth and a weakening dollar. Volatility from international trade may be tackled by exploring domestic ideas. China presents a nuanced case where recent domestic data has been strong, but we stay neutral on equities, waiting for sustained improvement. For now, we explore other parts of Asia, LatAm and emerging Europe for equities and credit.

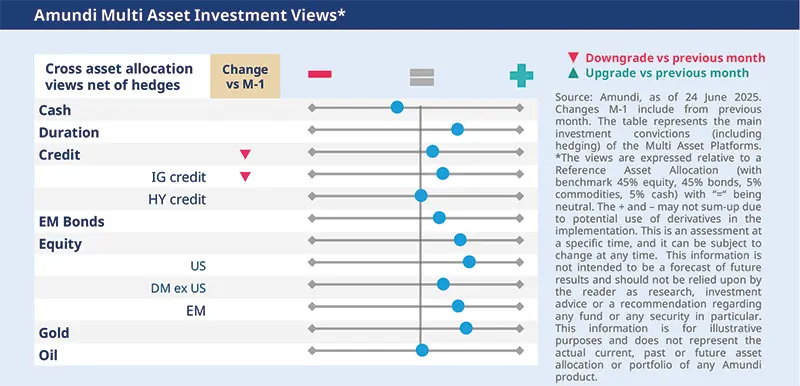

In multi asset, we do not expect a recession in the US, and Europe, Japan and the EM world also show reasonable growth. But risks such as excess valuations, inflation resurgence, fiscal deficit and geopolitics remain. We rebalanced our stance slightly in duration and stay positive on risk but are doing so with more safeguards.

Changing correlations between asset classes is a time to question the historical playbook, particularly in light of high equity valuations.

FIXED INCOME

Curve steepeners are the way forward

Amaury D’ORSAY |

Inflation is easing in developed markets, though tariff effects are still unfolding. Meanwhile, high government debt and spending bills risk pushing yields higher. For instance, the Big Beautiful Bill is feeding concerns over bond vigilantes, particularly at the very long end of the yield curve.

In this fluid environment, we maintain an overall positive and agile duration stance and see curve steepening opportunities in the US and Europe. But regional and tactical nuances require flexibility across the spectrum. Fundamentals in corporate credit are strong, but some deterioration is possible on the low-quality side if growth disappoints. We favour names with strong capital buffers, and less affected by changes to the economic cycle.

We stay positive on duration, with an eye on curves across geographies.

We moved to neutral on EU, but are positive on peripherals. On UK gilts, our stance is positive amid weak labour markets. We see curve steepening in EU on the 5Y-30Y side, and on 2Y-10Y in the UK.

Japanese inflation dynamics differ from the rest of the world. We stay cautious on government bonds there.

From a global perspective, we prefer EU IG and are neutral on UK and US. In US IG yields are decent, but valuations expensive. Overall, it is important to focus on quality and liquidity, which could dry in case of extreme stress.

In EU IG, we are positive on banks as they are relatively shielded from the tariff uncertainty. We also like medium term maturities. But we are cautious on industrials, capital goods.

We downgraded the USD. There are lot of uncertainties with respect to US fiscal and tax policies that could affect the dollar’s allure. Although global players are still exposed to the currency, long term risks point to a dollar downside.

We upgraded the EUR slightly as it should benefit from any diversification away from the USD, and potential asset allocation towards Europe.

EQUITIES

Prioritise valuations and quality

Barry GLAVIN |

Equities have been resilient so far this year, with Europe outperforming the US, as the full impact of tariff policies has yet to be felt. Corporate forward guidance indicate that the impact of tariffs is still not clear. While some companies with pricing power will be able to raise prices once the impact of tariffs are felt, other will not. This differentiation will be crucial in deciding the impact on margins.

In addition, we think, European market performance so far has not been broad based. Looking ahead, this might change, and the rally could broaden, depending on forward earnings guidance, economic developments, and tariff-related newsflow. Our focus remains on identifying those names through a bottom-up analysis that could withstand these vulnerabilities.

Through a balanced approach, we explore areas offering valuation protection and relative insulation from international trade tensions. Such opportunities exist in European and Japanese small and mid-caps, and in the UK.

In US, where we are cautious overall, we see certain opportunities in defensive and quality industrial sectors. But we tend to avoid areas of high concentration risk, aiming to maximise selection and idiosyncratic opportunities.

Although Japanese equities have been affected by yen appreciation, valuations in the country are attractive. We prefer playing interest rate normalisation through banks and insurance.

In Europe, we are constructive on defensive consumer staples, healthcare stocks, and quality industrials sectors. We also like core European banks due to their strong balance sheets. However, we are cautious on the technology sector.

Following the strong performance of industrials and financials, we think there are select opportunities to benefit from these movements.

Globally, equity markets have been much more volatile, especially in the US. Thus, we are positive on the low-volatility style for the near term. We also like high dividend sectors that may potentially enhance total shareholder returns.

EMERGING MARKETS

Domestic resilience amid global volatility

| Yerlan SYZDYKOV Global Head of Emerging Markets |

The long-term (but non-linear) shift away from the dollar and robust EM-DM growth differential paint a constructive picture for emerging market assets. However, at the moment, the uncertainty surrounding President Trump’s next policy moves and their impact on trade negotiations and foreign policy is high – whether relating to conflict in the middle east, and trade with countries such as China, India.

In China, recent data has been benign and the country seems to have used its leverage (rare earth exports) in negotiations with the US. But the picture is clouded by weakness in the housing sector and lack of structural reforms. Overall, we are exploring domestic opportunities that are uncorrelated with the global cycle, with a strong selection bias.

We are constructive on local currency and hard currency debt and on corporate credit. In particular, continued central bank easing should boost LC debt, and we like Mexico, Peru, Colombia. Additionally, we have raised our views on Hungary and South Africa, where real yields are high.

HC sovereign new issuance remains light when compared with DM credit, lending technical support to the former. Against this backdrop, we expect sovereign credit spreads to remain resilient despite ongoing macro volatility and trade/tariffs news flows.

Neutral on China. Issues such as excess capacity and weakness in housing market persist. But the détente on tariffs is positive, and valuations are also attractive. We expect some normalisation in exports and consumption growth in the second half, which could potentially draw the market’s attention to the economy’s domestic weak spots – deflationary pressures and housing market.

We are optimistic on India and are monitoring any progress on a trade deal with the US.

At a sector level, we like consumer staples, communication services and real estate.

| Main convictions from Asia |

Market resilience tested by rising geopolitical uncertainty. Asian markets continued to perform in the run-up to and after US-China trade talks. Limited macroeconomic impacts of tariffs so far, coupled with central banks’ easing, added support to investors’ sentiment. However, the recent escalation of conflict in the Middle East is putting that market resilience to the test. We are monitoring multiple channels of potential spillover effects to Asia via higher oil prices, geopolitical uncertainties and possible supply-chain disruption.

|

Multi-asset

Stay risk-on, disciplined through hedges

Francesco SANDRINI | John O’TOOLE Head of Multi-Asset Investment Solutions |

“We turned more positive on US 5Y keeping in mind that the longer end of the curve is at risk from high debt.”

Macro conditions, liquidity and growth are reasonably supportive of risk assets. Corporate earnings prospects are also decent, but H2 would test whether companies are able to pass on the higher costs to consumers. This, coupled with high valuations in risk assets and geopolitical uncertainties, could lead to some consolidation but not an outright-sustained recapitulation. We maintain our positive view on risk assets, and believe investors should consider reinforcing hedges.

Equities have shown resilience in the face of ambiguous tariff policies and geopolitical tensions. We realise that valuations are becoming expensive, particularly in the US, but there are factors such as earnings growth, decent economic activity that keep us constructive overall including on the US mid caps, Eurozone and the UK. We also see a need for better protections in the US. In EM, our stance is positive through China and particularly on the technology sector.

We are positive on duration but made slight adjustments. We upgraded views on US 5Y, in line with our expectations that the Fed will cut rates by more than what’s priced in by the markets. The long end of the US curve could come under pressure from higher deficits. At the same time, we closed our constructive view on EU 5Y, but stay positive through 10Y that should gain from concerns over global growth. We are also optimistic on UK 10Y, on Italian BTPs, but are cautious on Japan. In credit, we reduced our positive stance on EU IG amid uncertainty over US-EU trade negotiations. This asset class still offers the best value in DM credit. We are also positive on EM spreads.

Uncertainties and high valuations in US equities underpin our view to enhance hedges in this segment, and maintaining protections in Europe. In FX, we are cautious on the dollar but recognise this to be a consensus view and hence now see a need to hedge this. Finally, precious metals such as gold safeguard and complement our overall risk-on stance.

VIEWS

Amundi views by asset classes

Definitions & Abbreviations

Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.