Ride the policy noise and shifts

A rewiring of the global economy is forcing investors and policymakers to proceed with caution. Unpredictable policymaking is unhelpful for the economy and triggering big market swings. But there are hopeful signs too. Major economies have so far proved resilient. Also, while the US administration’s priorities were tariffs and security, planned tax cuts and deregulation may mitigate trade levies’ impact on growth.

In Europe, Germany’s fiscal shift was a gamechanger. And there is a political consensus that the continent must act to ensure its international clout matches its economic heft. Meanwhile, the European Central Bank has more leeway than the Federal Reserve to support growth. Still, European actions must match the rhetoric. Moreover, not all countries can boost spending given investors are increasingly sensitive to rising global fiscal burdens.

Portfolio allocation is also becoming more complicated as familiar relationships between asset prices break down. Enhancing portfolios’ resilience is therefore paramount. Hedging to reduce currency risks and focusing on long-term themes will also help. Turbulence may be a feature of markets for a while as the new geoeconomic order takes shape. But the uncertainty and policy noise are creating opportunities that are already evident.

Despite unpredictable policymaking, business resilience, and the reorganisation of global trade and financial systems, the expected rate cuts from central banks will create opportunities in global equities. We are focusing on themes such as European defence spending, US deregulation, corporate governance reform in Japan, and the ‘Make in India’ initiative.

Investment Themes and sequence for H2 2025

Investment Themes and sequence for H2 2025

Government bond markets are being rattled by the threat of higher debt and rising inflation fears, keeping volatility high. Investors are likely to demand greater compensation for long-dated bonds, making yields appealing. The name of the game will be diversifying away from the US and into European and emerging market bonds.

Key convictions for H2 2025

Key convictions for H2 2025

We expect US real GDP growth to slow from nearly 3% in 2023–24 to 1.6% in 2025, largely due to weakened private demand. Higher tariffs will raise prices, dampening consumer sentiment and spending, while uncertainty will weigh on investment. Although fiscal measures and deregulation may provide some relief, the impact is likely to be limited, with average tariffs around 15% (as per our base case) leading to economic losses and a temporary resurgence in inflation. Amid the growth slowdown, the Fed is expected to cut rates three times in H2.

We are now in a more contentious geopolitical environment, with the US administration contributing to rising tensions through tariffs and reduced commitments to European security. This could further unify Europe, with leaders recognising the benefits of collective negotiation as they seek to diversify trading partners through new trade agreements. The US–China relationship is set to deteriorate further, though both nations will seek to avoid escalation. In this environment, diversification away from US assets is set to continue, favouring European assets in particular.

Despite the sub-par growth outlook, we do not anticipate an earnings recession, as businesses show resilience. This, coupled with the Fed's anticipated rate cuts, supports a mildly constructive asset allocation with inflation protection. We favour global equities with a focus on valuations and pricing power, along with commodities, gold, and hedges against growth and inflation risks stemming from a world of geopolitical uncertainty. Infrastructure investments can offer stable cash flows. Currency diversification will be crucial amid shifting correlations between the USD, equities, and bonds.

Investors will demand a higher premium for US Treasuries, amid uncertainty on trade policies, rising public debt, and substantial bond supply. In developed markets, long-term yields will remain under pressure. Central Banks cutting rates will continue to support short-dated bonds, driving yield curve steepening. Investors will seek diversification across markets, favouring Europe and EM debt. Continue to play quality credit, with a preference for euro investment grade (financial and subordinated credit).

Equities may generate low single-digit returns in the second half, but rotations will continue. Europe’s appeal is likely to become a structural theme, favouring also small- and mid-caps, where valuations remain highly attractive. Globally, sector selection will be key. We favour domestic and service-orientated sectors to reduce the risk from tariffs, with a focus on themes such as US deregulation, European defence and infrastructure, and the ongoing Tokyo Stock Exchange reform, which is generating a more investor-friendly environment.

Emerging market equities will be favoured in H2 2025, driven by recovering macro momentum and stabilising inflation. As US exceptionalism fades, India and ASEAN are emerging as key beneficiaries of the global supply chain rerouting. India's ‘Make in India’ initiative is attracting multinational corporations, particularly in defence and IT. With a focus on domestically-orientated sectors, these markets are not just manufacturing hubs but dynamic growth engines, poised to capitalise on structural shifts and expanding consumer bases.

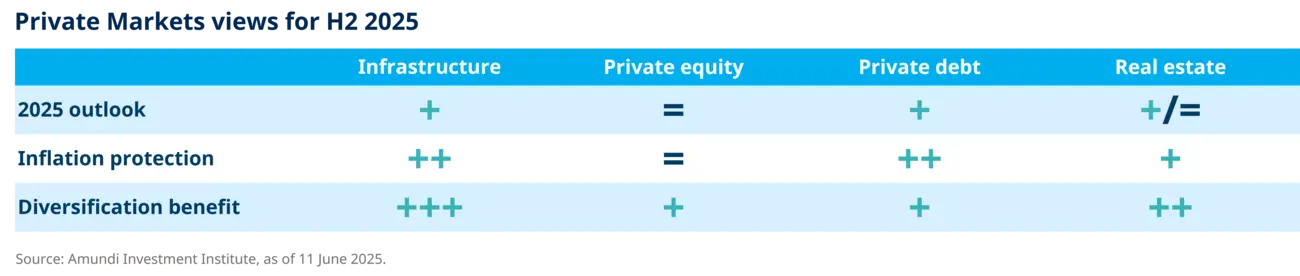

Extra selectivity is required given the surge of capital being invested in these segments. Overall, a challenging geo-economic backdrop will boost diversification through private assets, benefitting resilient domestic stories. Private debt and infrastructure are expected to remain the most attractive. Private debt may benefit from strong direct lending and fundraising, while infrastructure will attract investors seeking inflation protection.

Upcoming reforms and investment plans aimed at achieving strategic autonomy are transforming Europe into an increasingly attractive destination for investors, supported by a stronger euro. Equity valuations are relatively appealing, especially among small caps; government bonds may benefit from a favourable growth and inflation mix; and credit supply and demand appear balanced, with the financial sector expected to outperform.

Asset Class Views

Asset Class Views

We favour a mildly risk-on allocation designed to withstand an inflationary regime with downside risks, considering expensive market valuations. This involves a well-diversified equity approach with a focus on valuations, pricing power, and margins to identify areas able to withstand inflationary pressures, alongside tactical duration management.

In credit, we favour quality, especially in Europe, where the risk/return profile is compelling, while we remain cautious in High Yield. Gold is considered a key portfolio stabiliser in case of hyperinflation while FX will also play an increasingly relevant role, as changing correlation patterns in the USD will call for higher currency diversification and hedging.

Editors

|

|

| ||

Claudia BERTINO | Laura FIOROT | Swaha PATTANAIK |

Get more insights

|

|

| ||

India and EM are winners of the rerouting shift | Private diversification still attractive | "The Great Diversification" is underway | ||

| Read the article | Read the article | Read the article |