Summary

Macroeconomic focus

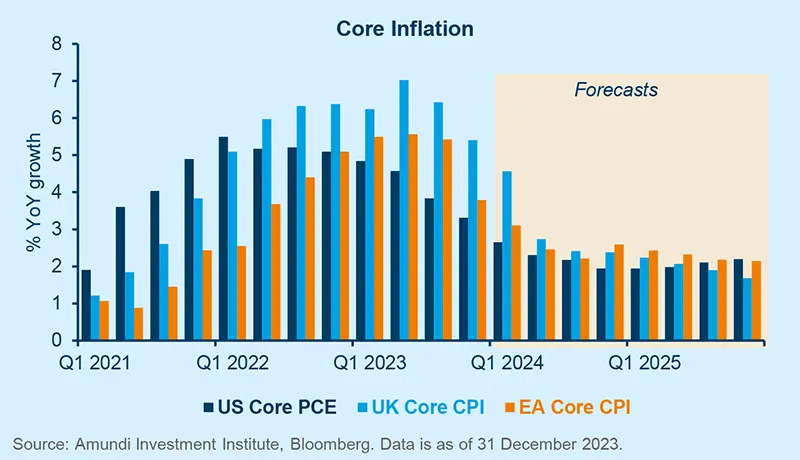

Core services remain pivotal to the disinflationary process

The easiest part of the disinflationary trend is past, we now need to see moderation in the labour market to keep inflation around target.

Recent Q4 2023 inflation data in the Euro Area, UK and US, on net have surprised on the downside, with year-over-year (YoY) rates of headline inflation now standing at 2.9%, 3.9%, 3.4% respectively, prompting expectations of a faster than expected reversion to target.

A rapid disinflationary trend, more dramatic in headline than in core, has been at work across Developed Markets (DM), helped by very favourable base effects on energy prices which are now set to progressively fade and become less prominent, if not marginally adverse. The expiry of the special measures implemented by national governments, particularly in Europe, to reduce the impact of the energy shock back in 2022 may temporarily lift the energy contribution to headline inflation and add to nearterm volatility. Thus, while the general disinflationary process is poised to continue (we expect goods prices to continue falling in 2024), we also believe that the “easier part” of the disinflationary process is past and that the path to bring core inflation back to target will require a substantial moderation in demand and growth. Though core CPI remains above target in all three regions – US (3.9%), UK (5.1%) and Euro Area (3.4%) – macroeconomic policy settings, especially monetary policy, are sufficiently restrictive to deliver this growth slowdown.

Normalised supply chains, expected sub-par economic growth and a shift in domestic demand from goods to services point to a continued price moderation across core goods in 2024, as part of a global phenomenon which should similarly impact the US, UK and Euro Area.

For core service prices, though, the dynamics remain more complex: while economic growth has been moderating progressively, demand for services remains resilient, supported by ongoing healthy wage growth, thus keeping pricing power and price levels elevated in the service sector. As such, we think that a significant moderation in labour market tightness and wage dynamics will be key to keeping inflation stable once it is around central bank target levels. The weak growth we expect for 2024 should help on this front.

Emerging markets

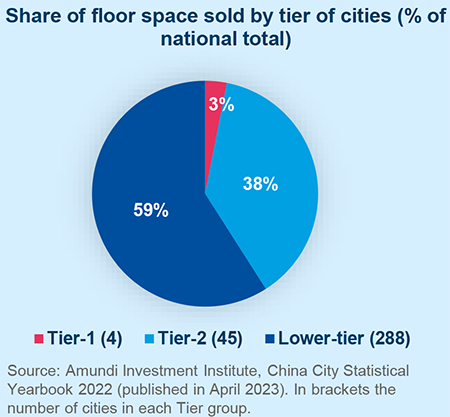

China: Housing turnaround ahead?

No sign of the Chinese real estate market correction halting.

The recent decision by Beijing and Shanghai to ease their stringent house purchase restrictions has rejuvenated hopes for a more stable Chinese housing market in 2024. However, it's worth noting that the effects of these policy changes are likely to be constrained. Tier-1 cities, including Beijing and Shanghai, account for just 3% of the national floor space sold, meanwhile, an increasing number of households are selling their homes on the secondary market.

We expect additional price falls, particularly in the large cities that have thus far avoided significant price corrections. The Chinese real estate market is expected to continue its correction in 2024, characterised by a combination of price and volume adjustments.

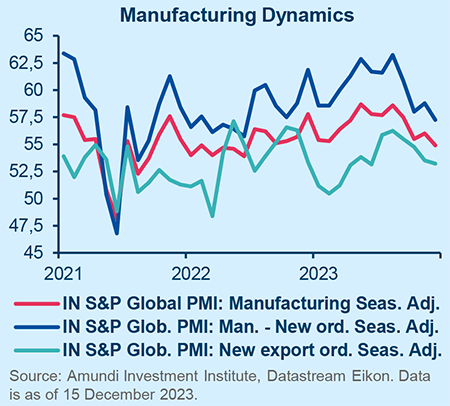

India: Easing activity in December

No fiscal slippage despite more pre-elections measures being announced.

Broad industrial and manufacturing indicators still outline robust economic momentum early in the quarter, despite December’s PMI softening across the board (54.9 from 56). Domestic demand leads external demand with new orders at 57.3 and export orders at 53.2. Food prices, the most erratic and relevant component, drove overall inflation up to 5.6% YoY in November from 4.9% YoY, by contributing 3.7%. The December Inflation reading is expected to reach 6% YoY.

November fiscal data confirm a picture that remains sound with Financial Development at around 51% of the FY24 (Fiscal Year) Budget 8 months into the fiscal year. A very mild diversion towards less productive expenditure is on its way. Q2 FY24 CAD (Current Account Deficit) has reduced to 1.0% of GDP from 1.7%: buoyant services exports are partially offsetting weak goods exports.

Macroeconomic snapshot

After a strong Q3 performance, we expect the US economy to progressively weaken driven by moderating domestic demand impacted by tighter credit conditions. While Q4 23 posted moderate growth, we still expect a more marked deceleration in H1 24. In the meantime, inflation will gradually decelerate thanks to weakening services inflation, which has so far remained sticky.

After the weak Q3 print, feeble PMIs provide evidence that the Eurozone economy is already in a phase of lacklustre growth, driven by the deterioration of financial conditions, demand and business confidence. Weaker global growth and less supportive fiscal policy will ensure growth remains weak for the next few quarters. Inflation will progressively slow towards target, although this will be faster for headline inflation than for core.

We have revised our projections for the UK slightly lower as we see domestic demand slowing, the labour market deteriorating and capex spending remaining weak, due to tight monetary policy, a weak external environment and ongoing elevated inflation. The fiscal side may provide some modest support. Inflation is expected to moderate going forward, moving closer to target around year-end 2024.

Japan’s Q4 data reaffirms our view of a bumpy and above-trend recovery. While goods consumption data surprised on the downside, consumer sentiment improved further towards the year-end. Industrial production proved more resilient than expected, expanding in Oct-Nov despite a contraction in exports and imports.

In Poland, inflation is gradually declining. Headline inflation decreased to 6.3% YoY in December from 6.6% in November, albeit remaining well above the central bank’s target range of 2.5% +/-1%. We expect the Narodowy Bank Polski (NBP) to remain on hold for the time being. In terms of economic activity, the December manufacturing PMI declined slightly from 48.7 in November to 47.4, while the PMI was slightly up over the quarter. New orders, on the other hand, dropped for 22 consecutive months and export orders also declined.

South Africa’s headline inflation came in at 5.5% YoY in November down from 5.9% in October, while core inflation edged up to 4.5% YoY in November from 4.4% in October. Our headline inflation forecast for 2024 is 5.1% (6% in 2023). We expect the SARB to start the easing cycle this quarter bringing the policy rate to 7.75% from 8.25% by the end of Q1 2024.

Economic momentum in Mexico is firm but starting to show signs of an overheated economy in need of a break. Services saw a 0.5% decline in October, reinforcing our H2-visibly-softerthan-H1 story for next year. Meanwhile, disinflation is benefiting from slowing core goods but services inflation remains sticky. After dovish turn in November, and arguably lining up a cut in Q124, Banxico sounded more cautious in December suggesting a cut in Q1 is not a given.

Brazil’s GDP continues to slow by design – high policy rates – and barely expanded in Q3 (0.1%), while the Banco Central do Brasil (BCB)’s economic activity proxy just contracted at the start of Q4/November. Inflation continued to improve – annual IPCA slowed to 4.7% YoY in November. The BCB maintained its 50bps easing pace in December (4th cut to 11.75%) and its forward guidance pointed to the pace remaining unchanged in light of fiscal concerns.

Central Bank Watch

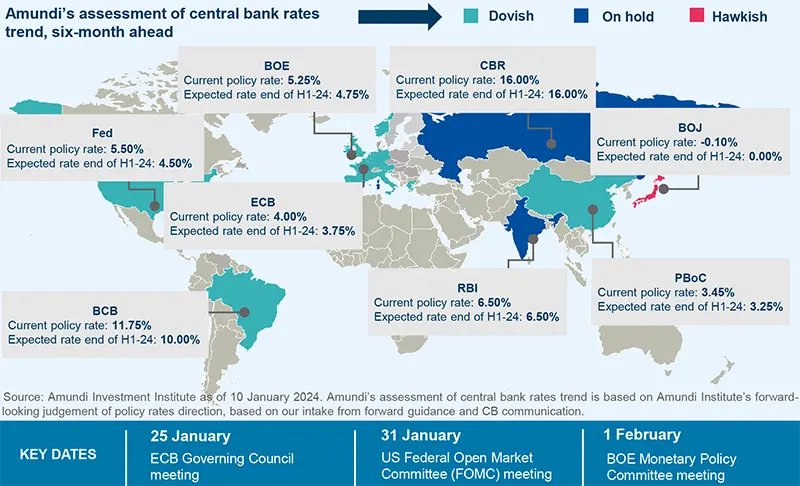

More and more CBs approaching the pivot

Developed markets

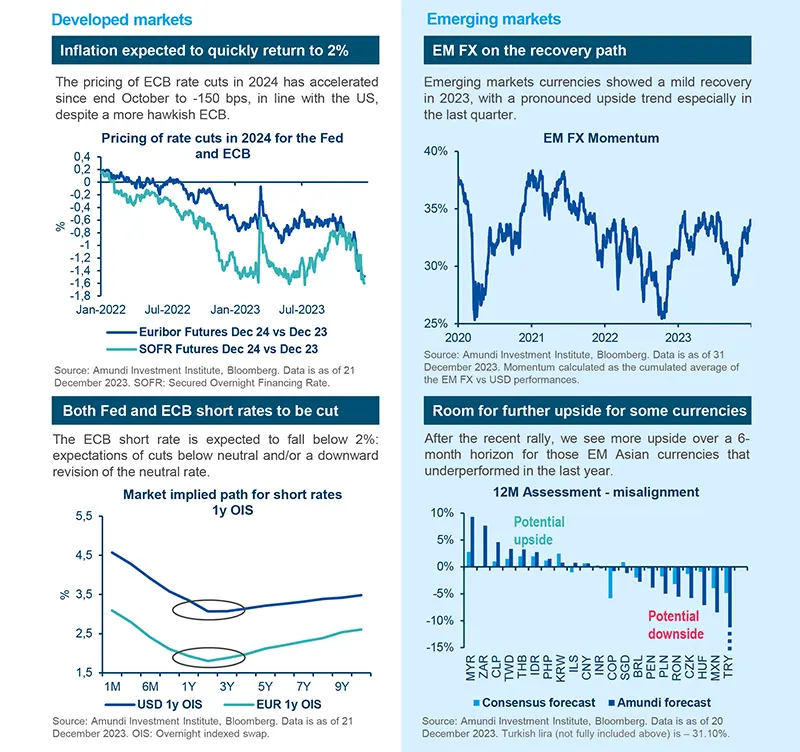

The Fed meeting was a clear “pivot” towards easier monetary policy. The “Higher for longer” narrative is over.

The Fed does not want to restrict the economy longer than necessary. FOMC (Federal Open Market Committee) members are now strongly attentive to the impact of higher rates on growth. The Fed is now back to the point where both mandates (price stability and maximum sustainable employment) are important.

Despite recent positive developments, Christine Lagarde said the ECB shouldn’t lower its guard as inflation tumbles. She admitted that “we did not discuss a rate cut at all”. The ECB expects an uptick in inflation over the coming months. Wages are the biggest factor. The ECB remains particularly concerned about wage development in the context of falling productivity.

The divergence between the Fed and the ECB is particularly notable given the Eurozone's recent weaker economic performance and more rapid disinflation compared to the US.

Meanwhile, the BoE maintains a cautious stance, showing no indication of deviating from its 'higherfor-longer' policy.

Emerging markets

During December, global financial conditions remained benign in terms of core rates and the USD, allowing EM Central Banks to continue their easing cycle and using their own domestic economic conditions as the main driver of monetary policy conduct. In December, BanRep in Colombia and CNB in the Czech Republic joined the group of Central Banks already in an easing cycle, starting gradually (-25bps each). With Inflation still around 10%, BanRep in Colombia took its policy rates to 13%, in line with the consensus. On the back of a more pronounced disinflationary trend, we expect BanRep to deliver larger cuts in 2024 (over 400bp). With the disinflationary path resuming in November, CNB started its easing cycle (policy rates at 6.75%) against our expectations for a start in early 2024. We confirm our expectation of policy rates at 4% by the end of 2024. On an opposite path and with a more idiosyncratic narrative, the Central Bank of the Republic of Turkey hiked again, moderating the pace (+250bps to 42.5%). The end of the hiking cycle is near (after 3400bps of hiking) and the terminal rate should be at 45%.

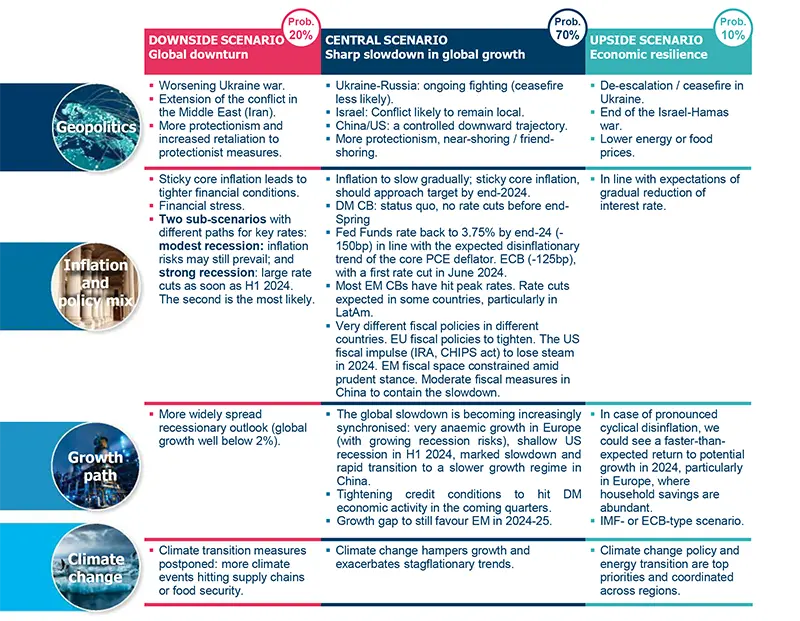

Geopolitics

2024 a year of bigger downside risks

2024 will seem like 2023 with even higher risks – rather than be like 2018.

For those wanting a binary assessment of risk: our base case (around 60%+) across the board is that the big geopolitical hotspots should not boil over next year. However, it is important to note that 2024 will seem like 2023 with even higher risks (rather than be like 2018). This means we will likely see downside surprises given the amount of risk in the system and the appetite by some powers to exploit vulnerabilities to weaken the US and its allies. We have revised up the downside risks to many of our geopolitical scenarios for this year. In many instances, this risk is as high as 40%, meaning it is best to be prepared and think through the implications of what could occur should such a risk play out.

In Israel, while the base case that the conflict stays ‘local’ remains, current developments are a reminder that the risk of broader regional escalation remains acute. While Iran is unlikely to directly involve itself, there is a growing likelihood that Israel may decide to strike Iran.

With regard to relations between China and Taiwan: we expect a more China-hawkish government to be in place after the January election, so tensions with China will likely rise. Even if the more China-friendly opposition wins, while relations between Taiwan and China would improve, they would likely deteriorate between the US and Taiwan and therefore between the US and China.

For Russia/Ukraine, continued fighting is the most likely scenario for most of 2024, with Russia likely going on an offensive ahead of the US elections.

Policy

Eurozone: mind public debt divergences

Most countries will have very little fiscal room for manoeuvre to absorb new shocks.

Fiscal consolidation is essential. Persistent upward pressure on spending and higher interest charges are complicating governments' tasks. The 2024 budgets allow for a reduction in public deficits, thanks to the removal of temporary measures and an expected return to growth. But official GDP growth forecasts are too optimistic.

The debt of certain countries (France, Italy and Belgium) will hardly stabilise. This means that ambitious countercyclical fiscal policies are a thing of the past.

In Germany, the debt-brake rule imposes a form of fiscal consolidation that is difficult to reconcile with Germany's structural weaknesses and risks being counterproductive in a period of recession. This consolidation is likely to harm potential growth, particularly if investment plans are scaled back.

In France, the savings made by cutting energy-related supportive measures are offset by increased spending in other priority areas. The government expects the deficit to return to 3% of GDP, but not before 2027.

In Italy, the debt burden continues to hamper the fiscal outlook. Reductions in public spending are limited to a gradual reduction of the temporary spending related to Covid and the energy crisis. This reduction is likely to be offset by an increase in debt servicing. Rather than raising taxes, the government plans to stimulate growth through a €250bn national stimulus programme.

In short, the Eurozone lacks ambition. This could come at a high price.

Scenarios and Risks

Central and alternative scenarios

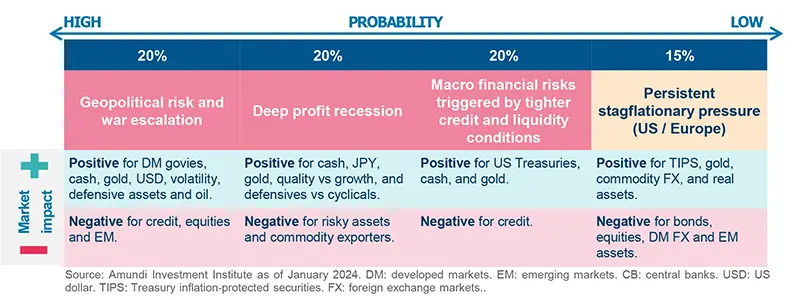

Risks to central scenario

Amundi Investment Institute Models

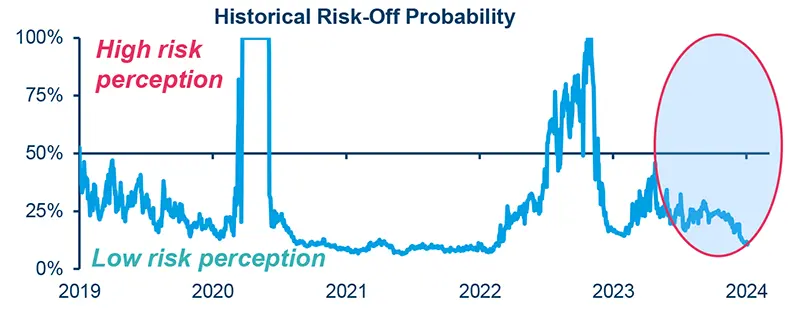

Cross Asset Sentinels Threshold (CAST)

Financial conditions can influence markets’ risk perception and ultimately inform asset allocation decisions.

What is the model about?

- The rationale: CAST is Amundi Investment Institute’s (AII) model to assess the extent to which financial conditions pass through to corporate fundamentals and valuations. As market risk perception tends to be correlated with financial conditions, a deterioration in the latter would point to an increasingly defensive asset allocation.

- Model setup: CAST consists of five selected sentinels, which aim to generate the probability of markets being in risk-off mode. An alert threshold is estimated for each sentinel and represents the level beyond which the sentinel has historically flagged an episode of elevated market stress and heightened risk aversion. Indeed, thresholds can be seen as signposts of excessive market complacency for investors and signal a possible turning point for risky assets.

- Model output: as the sentinels move towards their threshold levels, market risk perception increases and the probability of a risk-off phase rises exponentially if such a level is exceeded.

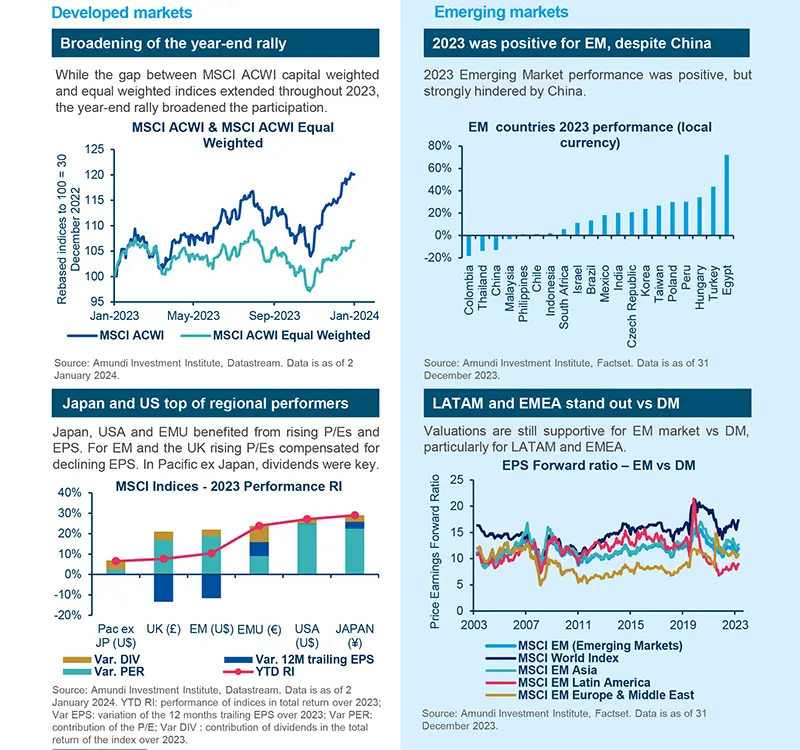

Infographic - Markets in charts

Equities in charts

2023 turn out to have been a positive year for equities as a whole.

2023 was positive for EM, despite China’s performance.

Bonds in charts

The strength of demand and the labour market will play a crucial role in setting the path of the monetary policy.

The risk-on mood has benefitted EM currencies in the last month.

Commodities

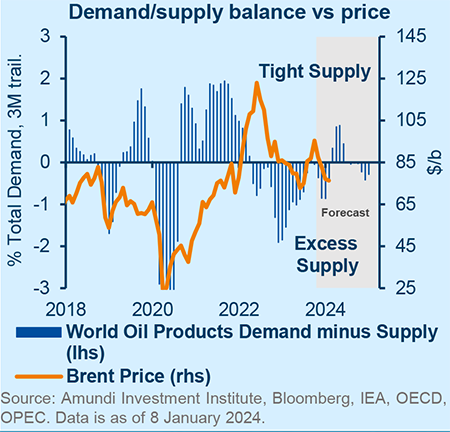

Modest oil upside still ahead

US supply and lower Opec credibility have capped prices.

Higher non-Opec supply and a loosening of Opec+ discipline were key caps for oil prices. US output surprised on the upside in 2023, thanks to improved drilling techniques while tapping into the reserves of wells near completion. The well inventory now needs to be rebuilt and the price incentive for shale producers is less attractive, which would limit future surprises from US output. Also, OPEC+ is yet to deliver on its recent cut commitments, even though compliance on quotas will be harder to achieve.

Geopolitics has also not been supportive. Houthi rebel attacks in the Red Sea are more of a global trade issue than an oil supply risk. Yet, an escalation can’t be ruled out. Demand would remain stable amid relatively resilient world growth. With modest market tightness in sight, and with oil both cheap and under-owned, we see Brent drifting towards $85/b.

Currencies

The fall of the USD and the “early cycle signal”

The rapid USD catch-up to its fair valuation seems premature and caution is needed.

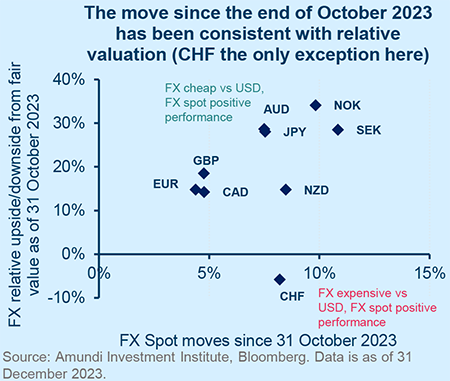

The USD sold off aggressively in Q4 2023, with no exceptions across G10. While the negative December USD seasonality certainly played a role, the main drivers of the move were a combination of weak US economic data and a dovish Fed meeting in December. The FX reaction seems consistent with the positive performance of both bonds and stocks during that time, yet we feel the rapid USD catch-up to its fair valuation seems premature and implies caution when chasing the market from here.

Historically, the USD mean reverts to fair value when a new cycle starts and growth expectations bottom out, but these conditions are far from being met. As the market is no longer long USD and seasonality is less of a headwind in Q1, we struggle to identify imminent catalysts for further USD weakness in the short term.