Summary

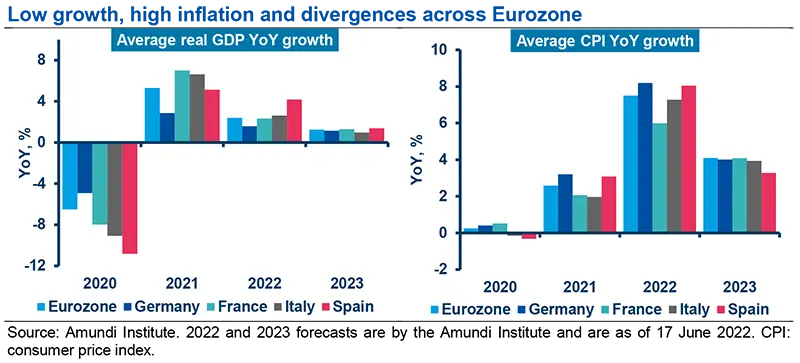

§ The global background and the Italian macroeconomic snapshot: The rising risk of stagflation is resulting in a slashing of growth estimates and an increase in revisions to inflation simultaneously. The growth outlook for Italy has been revised down on tighter financing conditions and monetary policy normalization, coupled with the energy crisis in Europe and global value chain bottlenecks. Thus, GDP growth in Italy has been revised downwards to 2.6% for 2022, slowing to 1% for 2023, while the Eurozone is expected to grow by 2.4% in 2022 but slow to 1.3% in 2023. Inflation projections have been revised up on a higher oil price scenario and stronger and broader-based realised inflation: we forecast inflation average 7.3% and 7.5% in Italy and the Eurozone in 2022, respectively, while we expect moderations for 2023, averaging 3.9% in Italy and 4.1% in the Eurozone.

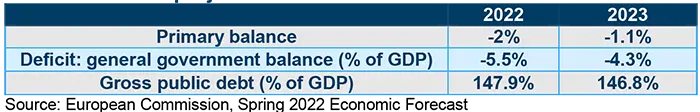

§ Italy’s public finances and the trajectory of Italian debt: The debt/GDP ratio rose to 150% in 2021, impacted by the shock of the Covid-19 pandemic. But we observe a somewhat stronger decline in the ratio for any given level of rates and fiscal discipline vs the past.] However, Italy continues to be exposed to sustained and persistent shifts in the yield curve, and on a mid-term horizon, when the bulk of NGEU spending will be over, improvement in potential growth will be the key to debt sustainability.

§ Investment implications: BTP technicals look supportive, together with more attractive relative value in terms of carry, but short-term volatility will persist as the market focus will remain on the next announcement from the ECB and to what extent the new backstop will be perceived as effective.

Macroeconomic scenario and economic perspectives

Amid the cost of living crisis, ongoing since last autumn, Italy saw unexpected resilience in Q1 as the initial GDP growth estimate of -0.2% was revised up to 0.1% QoQ. However, there was no good news on domestic demand: a 0.8% QoQ contraction in household consumption does not bode well for the future, as consumer confidence declined further during Q2. Thanks to the fiscal incentives and likely NGEU –related optimism, the rise in investment was substantial so far, with a 3.9% QoQ jump, driven by a surge in construction of buildings (+5.4% QoQ) and an increase in machinery and equipment investments (+4.3% QoQ). Gross fixed capital formation contributed a whopping 0.8% to quarterly GDP growth while final consumption expenditure subtracted more than 0.4%. Inventory changes were flat. Net exports made a negative contribution as imports (4.3% QoQ) were stronger than exports (3.5% QoQ).

Looking ahead, the cost-of-living crisis will continue to squeeze real disposable income in the coming quarters and we expect consumption to remain weak in the middle of 2022. Conversely, it is encouraging to see that that the expansion in investment activity appears to be continuing. We expect to see a contraction in Q2 and possibly another weak reading for the autumn/winter season, provided there is no energy rationing. The services sector should remain well supported in Q3, thanks to the re-opening effect and tourism-related inflows.

The “strong” annual expected GDP growth for 2022 will simply be an optic effect, though, thanks to the 2021 carry-over, while the GDP dynamic will be flattish in terms of levels.

The sustainability of Italian public debt and the deficit

Recent developments in yields point to risks of a rising cost of debt, to such an extent that the weighted average yield of Italian debt has increased recently after 10Y bond yields crossed the 4% level (the highest level since 2013), a persistent shift in this direction would put Italy to a situation of returning faster to maintaining primary surpluses to manage debt sustainability over the medium/long term.

EU Commission projections:

So far, inflation has helped the fiscal deficit to close faster (thanks to stronger tax receipts, rising with inflation), creating room for the government to provide more support to the economy without having to issue more debt than programmed EUR 28bn of additional stimulus measures so far this year, keeping the deficit target at 5.6% of GDP.

Yet, as imported inflation will also impact the expenditures side (higher costs for public investments; public sector wages and social benefits catching up with inflation), in a rising rates environment (higher interest payments), further consolidation will be needed to move the debt/GDP ratio on to a sustainably downward trajectory. One of the main market risks going forward which could cast doubts on the ability to commit to fiscal discipline is elections in mid-2023.

In the near term, GDP may be sustained by NGEU so that in a context of still-high inflation and possibly above-trend growth, debt may remain on a stable to slightly downward sloping trajectory. Issues to watch include the dynamics of expected interest spending. Post 2025-26, when the bulk of NGEU spending will be over, improvement in potential growth will be the key to debt sustainability, together with a controlled fiscal path.

Headline inflation is expected to decline from 7.3% in 2022 towards 3.9% in 2023, but the speed of deceleration remains uncertain and energy is a key risk.

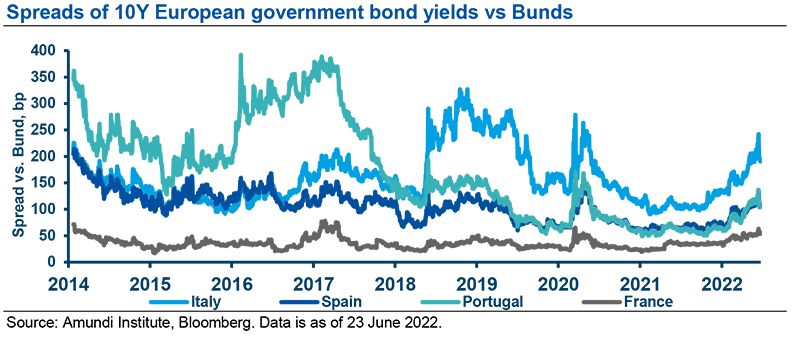

The ECB’s role in containing market fragmentation

The European Central Bank is playing a decisive role in containing spread-widening between peripheral bonds and core euro bonds. In this respect, on 15 June, just six days after its official policy meeting, the ECB held an ad-hoc meeting to discuss the widening in eurozone bond yield spreads and the increase in borrowing costs. The Governing Council decided two key measures moving forward:

- In order to preserve the functioning of the monetary policy transmission, the ECB decided to implement flexibility in reinvesting redemptions coming due in the PEPP portfolio.

- The Governing Council also decided to accelerate the completion of the design of a new anti-fragmentation instrument.

The news was well received by the market, resulting in significant tightening of peripheral spreads, especially for Italy, as well as the euro moving higher vs the US dollar.

Debt may stay on a stable to slightly downward trajectory. But, Italy remains exposed to sustained and persistent shifts in the yield curve and therefore needs to keep a balanced fiscal approach on the radar screen.

In our view, there are pros and cons for Italian debt in the current enviorment, and all in all, we hold a neutral position currently.

On the positive side:

- An ad-hoc ECB emergency meeting indicated that a 250bps spread on 10Y Italian bonds-German Bunds is a pain threshold as far as the transmission mechanism of monetary policy is concerned and the ECB is ready to intervene in order to reduce fragmentation risk.

- High inflation and high nominal growth reduce the real cost of debt and the average nominal cost of funding is still low.

- Implementation of NGEU funds will continue to be a positive growth driver.

On the negative side:

- The anti-fragmentation tool pre-announced by the ECB has high political risk and in the end might fall short of expectations in terms of size and implementation. So, visibility is still low.

- Volatility remains high and the ECB is very hawkish, so the environment remains difficult for carry trades.

More visibility on the ECB and especially on planned 'anti-fragmentation' instruments could help to reduce volatility.

Investment implications and the view on BTPs

A look at the technical aspects for BTPs

BTPs’ technicals look overall supportive, as Italy has made stronger progress than other EMU countries in funding for this year, with 80% of net issuance already placed as of mid-May. Also in terms of the ECB’s role for this year, QE absorbed roughly 50% of Italian yearly projected net issuance in Q1 (mainly thanks to remaining PEPP), leaving private investors to absorb a limited amount in H2. Finally, Treasury liquidity buffers are high by historical standards, at close to EUR 80bn in May, ample vs the remaining net issuance to be delivered in H2. In terms of “stock effect”, the ECB will continue to play a role in reinvesting its holdings, with redemptions in its portfolio representing roughly 20% of overall redemption volumes for Italian debt this year. Finally, as foreign investors reduced their weights to low levels by historical standards, current positioning already reflects a more cautios approach in the new, more challenging environment.

The technicals look supportive for Italy, together with more attractive relative value in terms of carry, but the short-term focus on spread drivers will remain concerning the next announcement from the ECB.

The view on the drivers

Year to date, Italian debt has increasingly been driven by sharp repricing of expected ECB rates – until no material commitment to an anti-fragmentation tool was finally announced at the 15 June ad hoc ECB meeting. Given the sudden and significant widening of peripheral spreads, together with the objective to avoid a further sharp move, the recent meeting probably signalled a pain threshold for the ECB. No details have been released on how this tool could work – we hope to gain more clarity in July. However, the ECB recognised that PEPP reinvestments alone would not be effective in fighting fragmentation, especially for their very gradual deployment through time.

We expect that until more clarity becomes available regarding the tool, the commitment shown by the ECB may contain spreads and keep alive the previous pre-9 June meeting spread range levels, a level to which Italy’s spreads have returned. The effectiveness and credibility of the combination of the new tool and PEPP reinvestments will then prove the main driver of capping spreads given a still-challenging environment in terms of inflation surprises and weaker growth.

In conclusion, the technicals look supportive for Italy, together with more attractive relative value in terms of carry, but the short-term focus on spread drivers will remain concerning the next announcement from the ECB, as will the extent to which the new backstop will be perceived as effective.

Definitions

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- NGEU related-funds: Next Generation EU is a European Union (EU) economic recovery package to support the EU member states to recover from the COVID-19 pandemic.

- PEPP: Pandemic emergency purchase programme.

- Spread: The difference between two prices or interest rates.

- Volatility: A statistical measure